RESULTS OF OPERATIONS

Goldman Sachs is a global investment banking and securities firm that

provides a wide range of services worldwide to a substantial and diversified

client base.

Our activities are divided into three principal business lines:

- Investment Banking, which includes financial advisory services and

underwriting;

- Trading and Principal Investments, which includes fixed income, currency

and commodities ("FICC"), equities and principal investments (principal

investments reflect primarily our investments in our merchant banking

funds); and

- Asset Management and Securities Services, which includes asset

management, securities services and commissions.

When we use the terms "Goldman Sachs", "we" and "our", we mean, prior

to the principal incorporation transactions that are described under "Certain

Relationships and Related Transactions — Incorporation and Related

Transactions — Incorporation Transactions", The Goldman Sachs Group, L.P., a

Delaware limited partnership, and its consolidated subsidiaries and, after the

incorporation transactions, The Goldman Sachs Group, Inc., a Delaware

corporation, and its consolidated subsidiaries.

Economic and market conditions can significantly affect our

performance. For a number of years leading up to the second half of 1998, we

operated in a generally favorable macroeconomic environment characterized by low

inflation, low interest rates and strong equity markets in the United States and

many international markets. This favorable economic environment provided a

positive climate for our investment banking activities, as well as for our

customer-driven and proprietary trading activities. Economic conditions were

also favorable for wealth creation which contributed positively to growth in our

asset management businesses.

From mid-August to mid-October 1998, the Russian economic crisis, the

turmoil in Asian and Latin American emerging markets and the resulting move to

higher credit quality fixed income securities by many investors led to

substantial declines in global financial markets. Investors broadly sold

credit-sensitive products, such as corporate and high-yield debt, and bought

higher-rated instruments, such as U.S. Treasury securities, which caused credit

spreads to widen dramatically. This market turmoil also caused a widespread

decline in global equity markets.

As a major dealer in fixed income securities, Goldman Sachs maintains

substantial inventories of corporate and high-yield debt. Goldman Sachs

regularly seeks to hedge the interest rate risk on these positions through,

among other strategies, short positions in U.S. Treasury securities. In the

second half of 1998, we suffered losses from both the decline in the prices of

corporate and high-yield debt instruments that we owned and the increase in the prices of the U.S.

Treasury securities in which we had short positions.

This market turmoil also led to trading losses in our fixed income

relative value trading positions. Relative value trading positions are intended

to profit from a perceived temporary dislocation in the relationship between the

values of different financial instruments. From mid-August to mid-October 1998,

the components of these relative value positions moved in directions that we did

not anticipate and the volatilities of some of our positions increased to three

times prior levels. When Goldman Sachs and other market participants with

similar positions simultaneously sought to reduce positions and exposures, this

caused a substantial reduction in market liquidity and a continuing decline in

prices.

In the second half of 1998, we also experienced losses in equity

arbitrage and in the value of a number of merchant banking investments.

Later in the fourth quarter of 1998, market conditions improved as the

U.S. Federal Reserve cut interest rates, the International Monetary Fund

finalized a credit agreement with Brazil and a consortium of 14 financial

institutions, including Goldman Sachs, recapitalized Long-Term Capital

Portfolio, L.P. For a further discussion of Long-Term Capital Portfolio, L.P.,

see "— Liquidity — The Balance Sheet" below.

Our earnings in the second half of 1998 were adversely affected by

market conditions from mid-August to mid-October. In this difficult business

environment, Trading and Principal Investments recorded net revenues of $464

million in the third quarter of 1998 and net revenues of negative $663 million

in the fourth quarter of 1998. As a result, Trading and Principal Investments

did not make a significant contribution to pre-tax earnings in 1998.

In the first quarter of 1999, we operated in a generally favorable

macroeconomic environment characterized by low inflation and low interest rates.

Global financial markets recovered from the turbulent conditions of the second

half of 1998, leading to narrowing credit spreads and an increase in mergers and

acquisitions and other corporate activity.

The macroeconomic environment in the first quarter of 1999 was

particularly favorable in the United States, where inflationary pressures were

minimal and interest rates were left unchanged by the U.S. Federal Reserve.

Economic growth in Europe was sluggish despite a simultaneous cut in interest

rates by 11 European central banks in December and the successful establishment

of the European Economic and Monetary Union in January. Markets in Asia and

Latin America were generally characterized by continuing economic and financial

difficulties, particularly in Japan and Brazil. In a number of Asian emerging

markets, however, economic and market conditions stabilized in the first quarter

of 1999.

Management believes that the best measure by which to assess Goldman

Sachs' historical profitability is pre-tax earnings because, as a partnership,

we generally have not been subject to U.S. federal or state income taxes. See

"— Provision for Taxes" below and Note 2 to the audited consolidated

financial statements for a further discussion of our provision for taxes.

Since historically we have operated as a partnership, payments to our

profit participating limited partners have been accounted for as distributions

of partners' capital rather than as compensation expense. As a result, our

compensation and benefits expense has not reflected any payments for services

rendered by managing directors who were profit participating limited partners

and has therefore understated the expected operating costs to be incurred by us

after the offerings. As a

corporation, we will include these payments to managing directors who were

profit participating limited partners in compensation and benefits expense, as

discussed under "Pro Forma Consolidated Financial Information". See

"Management — The Partner Compensation Plan" for a further discussion of the

plan to be adopted for the purpose of compensating our managing directors who

were profit participating limited partners.

Moreover, in connection with the offerings, we will record the effect

of the following non-recurring items in the second quarter of 1999:

- the award of the restricted stock units to employees based on a

formula;

- the initial irrevocable contribution of shares of common stock to the

defined contribution plan;

- the recognition of net tax assets; and

- the contribution to the Goldman Sachs Fund, a charitable foundation.

We also expect to record additional expense in the second quarter of 1999

equal to (i) 50% of the estimated compensation and benefits of the managing

directors who were profit participating limited partners in 1999 based on the

annualized results for the first half of 1999 offset by (ii) the effect of

issuing restricted stock units to employees, in lieu of cash compensation, for

which future service is required as a condition to the delivery of the

underlying shares of common stock. In accordance with Accounting Principles

Board Opinion No. 25, these restricted stock units will be recorded as

compensation expense over the four-year vesting period following the date of

grant.

As a result, we expect to record a substantial pre-tax loss in the

second quarter of 1999. See "Risk Factors — We Expect to Record a Substantial

Pre-Tax Loss in the Second Quarter of Fiscal 1999".

The composition of our historical net revenues has varied over time as

financial markets and the scope of our operations have changed. The composition

of net revenues can also vary over the shorter term due to fluctuations in

economic and market conditions. As a result, period-to-period comparisons may

not be meaningful. See "Risk Factors" for a discussion of factors that could

affect our future performance.

Overview

The following table sets forth our net revenues and pre-tax

earnings:

(in millions)

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| Net revenues | $6,129 | $7,447 | $8,520 | $2,472 | $2,995 |

| Pre-tax earnings | 2,606 | 3,014 | 2,921 | 1,022 | 1,188 |

February 1999 versus February 1998. Our net revenues were $2.99

billion in the three-month period ended February 1999, an increase of 21%

compared to the same period in 1998. Net revenue growth was strong in Investment

Banking, which increased 42%,

primarily due to higher market levels of mergers and acquisitions and

underwriting activity. Net revenues in Trading and Principal Investments

increased 15% as higher net revenues in FICC and equities more than offset a

reduction in principal investments. Net revenues in Asset Management and

Securities Services increased 12% due to increased assets under management and

higher customer balances in securities services. Pre-tax earnings increased 16%

to $1.19 billion for the period.

1998 versus 1997. Our net revenues were $8.52 billion in 1998,

an increase of 14% compared to 1997. Net revenue growth was strong in Investment

Banking, which increased 30%, due to higher levels of mergers and acquisitions

activity, and in Asset Management and Securities Services, which increased 43%,

due to increased commissions, higher customer balances in securities services

and increased assets under management. Net revenues in Trading and Principal

Investments decreased 19% compared to the prior year, due primarily to a 30%

reduction of net revenues in FICC. Pre-tax earnings in 1998 were $2.92 billion

compared to $3.01 billion in the prior year.

1997 versus 1996. Our net revenues were $7.45 billion in 1997,

an increase of 22% compared to 1996. Net revenue growth was strong in Asset

Management and Securities Services, which increased 46%, due to increased

commissions and asset management fees and higher assets under management and

customer balances in securities services. Net revenues in Investment Banking

increased 22% due to increased levels of mergers and acquisitions and debt

underwriting activity. Net revenues in Trading and Principal Investments

increased 9% over the prior year, due to higher net revenues in FICC and

principal investments. Pre-tax earnings were $3.01 billion in 1997, an increase

of 16% over the prior year.

The following table sets forth the net revenues of our principal

business lines:

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| Investment Banking | $2,113 | $2,587 | $3,368 | $ 633 | $ 902 |

| Trading and Principal Investments | 2,693 | 2,926 | 2,379 | 1,182 | 1,357 |

| Asset Management and Securities Services | 1,323 |

1,934 |

2,773 |

657 |

736 |

| Total net revenues | $6,129 |

$7,447 |

$8,520 |

$2,472 |

$2,995 |

Net revenues in our principal business lines represent total revenues

less allocations of interest expense to specific securities, commodities and

other positions in relation to the level of financing incurred by each position.

Interest expense is allocated to Trading and Principal Investments and the

securities services component of Asset Management and Securities Services. Net

revenues may not be indicative of the relative profitability of any principal

business line.

Investment Banking

Goldman Sachs provides a broad range of investment banking services to

a diverse group of corporations, financial institutions, governments and

individuals. Our investment banking activities are divided into two

categories:

- Financial Advisory. Financial advisory includes advisory

assignments with respect to mergers and acquisitions, divestitures,

corporate defense activities, restructurings and spin-offs; and

- Underwriting. Underwriting includes public offerings and private placements of equity and debt securities.

The following table sets forth the net revenues of our Investment

Banking business:

(in millions)

| Year Ended November

|

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| Financial advisory | $ 931 | $1,184 | $1,774 | $363 | $522 |

| Underwriting | 1,182 |

1,403 |

1,594 |

270 |

380 |

| Total Investment Banking | $2,113 |

$2,587 |

$3,368 |

$633 |

$902 |

February 1999 versus February 1998. The Investment Banking business

achieved net revenues of $902 million in the three-month period ended February

1999, an increase of 42% compared to the same period in 1998. Net revenue growth

was strong in both financial advisory and underwriting, particularly in the

communications, media and entertainment, healthcare and financial institutions

groups. Our Investment Banking business was particularly strong in Europe and

the United States.

Financial advisory revenues increased 44% compared to the same period

in 1998, primarily due to higher market levels of mergers and acquisitions

activity as the trend toward consolidation continued in various industries.

Underwriting revenues increased 41%, primarily due to increased levels of equity

underwriting activity in Europe.

1998 versus 1997. The Investment Banking business achieved net

revenues of $3.37 billion in 1998, an increase of 30% compared to 1997. Net

revenue growth was strong in financial advisory and, to a lesser extent, in

underwriting as Goldman Sachs' global presence and strong client base enabled it

to capitalize on higher levels of activity in many industry groups, including

communications, media and entertainment, financial institutions, general

industrials and retail. Net revenue growth in our Investment Banking business

was strong in all major regions in 1998 compared to the prior year.

Financial advisory revenues increased 50% compared to 1997 due to

increased revenues from mergers and acquisitions advisory assignments, which

principally resulted from consolidation within various industries

and generally favorable U.S. and European stock markets. Despite a substantial

decrease in the number of industry-wide underwriting transactions in August and

September of 1998, underwriting revenues increased 14% for the year, primarily

due to increased revenues from equity and high-yield corporate debt underwriting

activities.

1997 versus 1996. The Investment Banking business achieved net

revenues of $2.59 billion in 1997, an increase of 22% compared to 1996. Net

revenue growth was strong in both financial advisory and underwriting,

particularly in the financial institutions, general industrials and real estate

groups.

Financial advisory revenues increased 27% compared to 1996 primarily

due to increased revenues from mergers and acquisitions activity in the market

as a whole. Underwriting revenues increased 19% primarily due to increased

revenues from investment grade and high-yield debt underwriting, which resulted

from lower interest rates. Revenues from equity underwriting activities

increased modestly over 1996 levels.

Trading and Principal Investments

Our Trading and Principal Investments business facilitates customer

transactions and takes proprietary positions through market-making in and

trading of fixed income and equity products, currencies, commodities, and swaps

and other derivatives. The Trading and Principal Investments business includes

the following:

- FICC. We make markets in and trade fixed income products, currencies and commodities, structure and enter into a wide variety of derivative transactions and engage in proprietary trading and arbitrage activities;

- Equities. We make markets in and trade equities and equity-related products, structure and enter into equity derivative transactions and engage in proprietary trading and equity arbitrage; and

- Principal Investments. Principal investments primarily represents net revenues from our investments in our merchant banking funds.

Net revenues from principal investments do not include management fees

and the increased share of the income and gains from our merchant banking funds

to which Goldman Sachs is entitled when the return on investments exceeds

certain threshold returns to fund investors. These management fees and increased

shares of income and gains are included in the net revenues of Asset Management

and Securities Services.

Substantially all of our inventory is marked-to-market daily and,

therefore, its value and our net revenues are subject to fluctuations based on

market movements. In addition, net revenues derived from our principal

investments in privately held concerns and in real estate may fluctuate

significantly depending on the revaluation or sale of these investments in any

given period.

The following table sets forth the net revenues of our Trading and

Principal Investments business:

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| FICC | $1,749 | $2,055 | $1,438 | $ 741 | $ 876 |

| Equities | 730 | 573 | 795 | 365 | 455 |

| Principal investments | 214 |

298 |

146 |

76 |

26 |

| Total Trading and Principal Investments | $2,693 |

$2,926 |

$2,379 |

$1,182 |

$1,357 |

February 1999 versus February 1998.The Trading and Principal

Investments business achieved net revenues of $1.36 billion in the three-month

period ended February 1999, an increase of 15% compared to the same period in

1998. Strong performances in FICC and equities more than offset a net revenue

reduction in principal investments.

Net revenues in FICC increased 18% compared to the same period in 1998,

primarily due to higher net revenues from market-making and trading of

currencies, corporate bonds and mortgage-backed securities, partially offset by

lower net revenues from fixed income derivatives.

Net revenues in equities increased 25% compared to the same period in

1998, primarily due to increased market-making net revenues resulting from

strong over-the-counter transaction volume in Europe and the United States.

Net revenues from principal investments decreased 66%, due to lower

gains on the disposition of investments and a reduction in net revenues related

to the mark-to-market of our principal investments.

1998 versus 1997. Net revenues in Trading and Principal

Investments were $2.38 billion in 1998, a decrease of 19% compared to 1997. This

decrease in net revenues was concentrated in the second half of the year. See

"— Business Environment" above for a discussion of the losses suffered in

Trading and Principal Investments in the second half of 1998. For the full year,

significant net revenue reductions in FICC and principal investments were

partially offset by increased net revenues in equities.

Net revenues in FICC decreased 30% compared to 1997 due to an

extraordinarily difficult environment in the second half of 1998. The net

revenue reduction in FICC was concentrated in fixed income arbitrage and

high-yield debt trading, which experienced losses in 1998 due to a reduction in

liquidity and widening credit spreads in the second half of the year. An

increase in net revenues from market-making and trading in fixed income

derivatives, currencies and commodities partially offset this decline.

Net revenues in equities increased 39% compared to 1997 as higher net

revenues in derivatives and European shares were partially offset by losses in

equity arbitrage. The derivatives business generated significantly higher net

revenues due, in part, to strong customer demand for over-the-counter products,

particularly in Europe. Net revenues from European shares increased as Goldman

Sachs benefited from generally favorable equity markets and increased customer

demand. The equity arbitrage losses were due principally to the underperformance

of various equity positions versus their benchmark hedges, to widening of

spreads in a variety of relative value trades and to lower prices for

event-oriented securities resulting from a reduction in announced mergers and

acquisitions and other corporate activity in the second half of 1998.

Net revenues from principal investments declined 51% compared to 1997

as investments in certain publicly held companies decreased in value during the

second half of 1998. This decrease was partially offset by an increase in gains

on the disposition of investments compared to the prior year.

1997 versus 1996. The Trading and Principal Investments business

achieved net revenues of $2.93 billion in 1997, an increase of 9% compared to

1996. Strong performances in FICC and principal investments more than offset a

net revenue reduction in equities.

Net revenues in FICC increased 17% compared to 1996 due principally to

higher net revenues from market-making and trading in currencies, fixed income

derivatives and commodities. Fixed income arbitrage activities also contributed

to net revenue growth in FICC. Net revenues from market-making in and trading of

emerging market debt securities and corporate bonds declined in 1997 compared to

1996.

Net revenues in equities decreased 22% in 1997 compared to 1996 due

principally to reductions in net revenues from derivatives and convertibles

resulting from volatility in the global equity markets in October and November

1997 and declining asset values in Japan in late November 1997. This reduction

was partially offset by increased net revenues from higher customer trading

volume in certain European over-the-counter markets.

Net revenues from principal investments increased 39% in 1997 compared

to 1996, as certain companies in which we invested through our merchant banking

funds completed initial public offerings and our positions in other publicly

held companies increased in value.

Asset Management and Securities Services

Asset Management and Securities Services is comprised of the

following:

- Asset Management. Asset management generates management fees by

providing investment advisory services to a diverse and rapidly growing

client base of institutions and individuals;

- Securities Services. Securities services includes prime

brokerage, financing services and securities lending and our matched

book businesses, all of which generate revenue primarily in the form of

fees or interest rate spreads; and

- Commissions. Commission-based businesses include agency transactions for clients on major stock and futures exchanges. Revenues from the increased share of the income and gains derived from our merchant banking funds are also included in commissions.

The following table sets forth the net revenues of our Asset Management

and Securities Services business:

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| Asset management | $ 242 | $ 458 | $ 675 | $139 | $202 |

| Securities services | 354 | 487 | 730 | 170 | 207 |

| Commissions | 727 |

989 |

1,368 |

348 |

327 |

| Total Asset Management and Securities Services | $1,323 |

$1,934 |

$2,773 |

$657 |

$736 |

Goldman Sachs' assets under supervision are comprised of assets under

management and other client assets. Assets under management typically generate

fees based on a percentage of their value and include our mutual funds, separate

accounts managed for institutional and individual investors, our merchant

banking funds and other alternative investment funds. Other client assets are

comprised of assets in brokerage accounts of primarily high net worth

individuals, on which we earn commissions. The following table sets forth our

assets under supervision:

| Three Months Ended | |||||

|---|---|---|---|---|---|

| Year Ended November |

February |

||||

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| Assets under management | $ 94,599 | $135,929 | $194,821 | $151,189 | $206,380 |

| Other client assets | 76,892 |

102,033 |

142,018 |

114,928 |

163,315 |

| Total assets under supervision | $171,491 |

$237,962 |

$336,839 |

$266,117 |

$369,695 |

February 1999 versus February 1998. The Asset Management and

Securities Services business achieved net revenues of $736 million in the

three-month period ended February 1999, an increase of 12% compared to

the same period in 1998. Strong performances in asset management and securities

services more than offset a net revenue reduction in commissions.

Asset management revenues increased 45% compared to the same period in

1998, primarily reflecting a 43% increase in average assets under management. In

the 1999 period, approximately half of the increase in assets under management

was attributable to net asset inflows, with the balance reflecting market

appreciation. Net revenues from securities services increased 22% during the

period, primarily due to growth in our securities borrowing and lending

businesses. Commission revenues decreased 6%, as an increase in equity

commissions was more than offset by a reduction in revenues from the increased

share of income and gains from our merchant banking funds compared to a

particularly strong period in the prior year.

1998 versus 1997. The Asset Management and Securities Services

business achieved net revenues of $2.77 billion in 1998, an increase of 43%

compared to 1997. All major components of the business line exhibited strong net

revenue growth.

Asset management revenues increased 47% during this period, reflecting

a 41% increase in average assets under management over 1997. In 1998,

approximately 80% of the increase in assets under management was attributable to

net asset inflows, with the remaining 20% reflecting market appreciation. Net

revenues from securities services increased 50%, primarily due to growth in our

securities borrowing and lending businesses. Commission revenues increased 38%

as generally strong and highly volatile equity markets resulted in increased

transaction volumes in listed equity securities. Revenues from the increased

share of income and gains from our merchant banking funds also contributed

significantly to the increase in commission revenues.

1997 versus 1996. The Asset Management and Securities Services

business achieved net revenues of $1.93 billion in 1997, an increase of 46%

compared to 1996. All major components of the business line exhibited strong net

revenue growth.

Asset management revenues increased 89% during this period, reflecting

a 73% increase in average assets under management due to strong net asset

inflows, market appreciation and assets added through the acquisitions of

Liberty Investment Management in January 1997 and Commodities Corporation in

June 1997. Net revenue growth in securities services was 38%, principally

reflecting growth in our securities borrowing and lending businesses. Commission

revenues increased 36% as customer trading volumes increased significantly on

many of the world's principal stock exchanges, including those in the United

States where industry-wide volumes increased substantially in the third and

fourth quarters of 1997. Revenues from the increased share of income and gains

from our merchant banking funds also contributed significantly to the increase

in commission revenues.

Operating Expenses

In recent years, our operating expenses have increased as a result of

numerous factors, including higher levels of compensation, expansion of our

asset management business, increased worldwide activities, greater levels of

business complexity and additional systems and consulting costs relating to

various technology initiatives.

Since we have historically operated in partnership form, payments to

our profit participating limited partners have been accounted for as

distributions of partners' capital rather than as compensation expense. As a

result, our compensation and benefits expense has not reflected any payments for

services rendered by our managing directors who were profit participating

limited partners. Accordingly, our historical compensation and benefits, the

principal component of our operating expenses, will increase significantly after

the offerings since, as a corporation, we will

include these payments to our managing directors who were profit participating

limited partners in compensation and benefits expense.

We expect to record additional expense in the second quarter of 1999

equal to (i) 50% of the estimated compensation and benefits of the managing

directors who were profit participating limited partners in 1999 based on the

annualized results for the first half of 1999 offset by (ii) the effect of

issuing restricted stock units to employees, in lieu of cash compensation, for

which future service is required as a condition to the delivery of the

underlying shares of common stock. In accordance with Accounting Principles

Board Opinion No. 25, these restricted stock units will be recorded as

compensation expense over the four-year vesting period following the date of

grant. In addition, we expect to record non-cash compensation expense related to

the amortization of the restricted stock units awarded to employees on a

discretionary basis over the five-year period following the consummation of the

offerings. The non-cash expense related to these restricted stock units is a

fixed amount that is not dependent on our operating results in any given period.

See "Pro Forma Consolidated Financial Information" for a further discussion of

these items.

The following table sets forth our operating expenses and number of

employees:

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| (unaudited) | |||||

| Compensation and benefits | $2,421 | $ 3,097 | $ 3,838 | $ 1,100 | $ 1,275 |

| Brokerage, clearing and exchange fees | 278 | 357 | 424 | 93 | 111 |

| Market development | 137 | 206 | 287 | 54 | 77 |

| Communications and technology | 173 | 208 | 265 | 58 | 78 |

| Depreciation and amortization | 172 | 178 | 242 | 42 | 97 |

| Occupancy | 154 | 168 | 207 | 44 | 78 |

| Professional services and other | 188 |

219 |

336 |

59 |

91 |

| Total operating expenses | $3,523 |

$ 4,433 |

$ 5,599 |

$ 1,450 |

$ 1,807 |

| Employees at period end(1) | 8,977 | 10,622 | 13,033 | 10,899 | 12,878 |

(1) Excludes employees of Goldman Sachs' two property management

subsidiaries, The Archon Group, L.P. and Archon Group (France)

S.C.A. Substantially all of the costs of these employees are

reimbursed to Goldman Sachs by the real estate investment funds

to which the two companies provide property management services.

In addition, as of February 1999, we had approximately 3,400

temporary staff and consultants. For more detailed information

regarding our employees, see "Business — Employees".

February 1999 versus February 1998. Operating expenses were $1.81

billion in the three-month period ended February 1999, an increase of 25% over

the same period in 1998, primarily due to increased compensation and benefits

and higher other operating expenses due to, among other things, Goldman Sachs'

increased worldwide activities.

Compensation and benefits decreased as a percentage of net revenues to

43% from 44% in the same period in 1998. Employment levels increased 18%

compared to the same period in 1998, with particularly strong growth in

investment banking and asset management. Expenses associated with our temporary

staff and consultants were $98 million for the three-month period ended February

1999, an increase of 55%, reflecting preparations for the Year 2000 and greater

levels of business activity.

Brokerage, clearing and exchange fees increased 19%, primarily due to

higher transaction volumes in fixed income derivatives and futures contracts.

Market development expenses increased 43% and professional services and other

expenses increased 54%, due to higher levels of business activity.

Communications and technology expenses increased 34%, reflecting higher

telecommunications and market data costs associated with higher employment

levels and additional spending on technology initiatives. Depreciation and

amortization increased significantly due to certain fixed asset write-offs and

to capital expenditures on telecommunications and technology-related equipment

and leasehold improvements in support of Goldman Sachs' increased worldwide

activities. Occupancy expenses increased 77%, reflecting additional office space

needed to accommodate higher employment levels.

1998 versus 1997. Operating expenses were $5.60 billion in 1998,

an increase of 26% over 1997, primarily due to increased compensation and

benefits expense.

Compensation and benefits increased as a percentage of net revenues to

45% from 42% in 1997, principally as a result of increases in employment levels

and in expenses associated with temporary staff and consultants. Employment

levels increased 23% during the year, with particularly strong growth in asset

management. Expenses associated with our temporary staff and consultants were

$330 million in 1998, an increase of 85% compared to 1997, reflecting greater

business activity, Goldman Sachs' global expansion and consulting costs

associated with various technology initiatives, including preparations for the

Year 2000 and the establishment of the European Economic and Monetary Union.

Brokerage, clearing and exchange fees increased 19%, primarily due to

higher transaction volumes in European and U.S. equities and futures contracts.

Market development expenses increased 39% and professional services and other

expenses increased 53%, due to higher levels of business activity and Goldman

Sachs' global expansion. Communications and technology expenses increased 27%,

reflecting higher telecommunications and market data costs associated with

higher employment levels and additional spending on technology initiatives.

Depreciation and amortization increased 36%, principally due to capital

expenditures on telecommunications and technology-related equipment and

leasehold improvements. Occupancy expenses increased 23%, reflecting additional

office space needed to accommodate higher employment levels.

1997 versus 1996. Operating expenses were $4.43 billion in 1997,

an increase of 26% over 1996, primarily due to increased compensation and

benefits expense.

Compensation and benefits increased as a percentage of net revenues to

42% from 40% in 1996. This increase primarily reflected higher compensation due

to higher profit levels and an 18% increase in employment

levels across Goldman Sachs due to higher levels of market activity and our

global expansion into new businesses and markets. Expenses associated with our

temporary staff and consultants also contributed to the increase in compensation

and benefits as a percentage of net revenues. These expenses were $178 million

in 1997, an increase of 55% compared to 1996, reflecting greater business

activity, Goldman Sachs' global expansion and consulting costs associated with

various technology initiatives.

Brokerage, clearing and exchange fees increased 28%, primarily due to

higher transaction volumes in global equities, derivatives and currencies.

Market development expenses increased 50% and professional services and other

expenses increased 16%, due to higher levels of business activity and Goldman

Sachs' global expansion. Communications and technology expenses increased 20%,

reflecting higher telecommunications and market data costs associated with

higher employment levels and additional spending on technology initiatives.

Depreciation and amortization increased 3%. Occupancy expenses increased 9%,

reflecting additional office space needed to accommodate higher employment

levels.

Provision for Taxes

The Goldman Sachs Group, L.P., as a partnership, generally has not been

subject to U.S. federal and state income taxes. The earnings of The Goldman

Sachs Group, L.P. and certain of its subsidiaries have been subject to the 4%

New York City unincorporated business tax. In addition, certain of our non-U.S.

subsidiaries have been subject to income taxes in their local jurisdictions. The

amount of our provision for income and unincorporated business taxes has varied

significantly from year to year depending on the mix of earnings among our

subsidiaries. For information on the pro forma effective tax rate of Goldman

Sachs under corporate form, see "Pro Forma Consolidated Financial

Information".

Geographic Data

For a summary of the total revenues, net revenues, pre-tax earnings and

identifiable assets of Goldman Sachs by geographic region, see Note 9 to the

audited consolidated financial statements.

Our cash flows are primarily related to the operating and financing

activities undertaken in connection with our trading and market-making

transactions.

Year Ended November 1998

Cash and cash equivalents increased to $2.84 billion in 1998. Cash of

$62 million was provided by operating activities. Cash of $656 million was used

for investing activities, primarily for leasehold improvements and the purchase

of telecommunications and technology-related equipment and certain financial

instruments. Financing activities provided $2.10 billion of cash, reflecting an

increase in the net issuance of long-term and short-term borrowings, partially

offset by a decrease in net repurchase agreements, distributions to partners,

cash outflows related to partners' capital allocated for income taxes and

potential withdrawals and the termination of our profit participation plans. See

Note 8 to the audited consolidated financial statements for a discussion of the

termination of the profit participation plans.

Year Ended November 1997

Cash and cash equivalents decreased to $1.33 billion in 1997. Operating

activities provided cash of $70 million. Cash of $693 million was used for

investing activities, primarily for the purchase of certain financial

instruments and technology-related equipment. Cash of $258 million was used for

financing activities, principally due to a decrease in net repurchase

agreements, distributions to partners and cash outflows related to partners'

capital allocated for income taxes and potential withdrawals, partially offset

by the net issuance of long-term and short-term borrowings.

Year Ended November 1996

Cash and cash equivalents increased to $2.21 billion in 1996. Cash of

$14.63 billion was used for operating activities, primarily to fund higher net

trading assets due to increased levels of business activity. Cash of $218

million was used for investing activities, primarily for the purchase of

technology-related equipment and leasehold improvements. Financing activities

provided $16.10 billion of cash, reflecting an increase in net repurchase

agreements and the net issuance of long-term borrowings, partially offset by

distributions to partners and cash outflows related to partners' capital

allocated for income taxes and potential withdrawals.

Management Oversight of Liquidity

Management believes that one of the most important issues for a company

in the financial services sector is access to liquidity. Accordingly, Goldman

Sachs has established a comprehensive structure to oversee its liquidity and

funding policies.

The Finance Committee has responsibility for establishing and assuring

compliance with our asset and liability management policies and has oversight

responsibility for managing liquidity risk, the size and composition of our

balance sheet and our credit ratings. See "— Risk Management — Risk

Management Structure" below for a further description of the committees that

participate in our risk management process. The Finance Committee meets monthly,

and more often when necessary, to evaluate our liquidity position and funding

requirements.

Our Treasury Department manages the capital structure, funding,

liquidity and relationships with creditors and rating agencies on a global

basis. The Treasury Department works jointly with our global funding desk in

managing our borrowings. The global funding desk is primarily responsible for

our transactional short-term funding activity.

Liquidity Policies

In order to maintain an appropriate level of liquidity, management has

implemented several liquidity policies as outlined below.

Diversification of Funding Sources and Liquidity

Planning. Goldman Sachs maintains diversified funding sources with both

banks and non-bank lenders globally. Management believes that Goldman Sachs'

relationships with its lenders are critical to its liquidity. We maintain close

contact with our primary lenders to keep them advised of significant

developments that affect us.

Goldman Sachs also has access to diversified funding sources with over

800 creditors, including banks, insurance companies, mutual funds, bank trust

departments and other asset managers. We monitor our creditors to maintain broad

and diversified credit, and no single creditor represented more than 5% of our

uncollateralized funding sources as of November 1998. Uncollateralized funding

sources principally include our short-term and long-term borrowings and letters

of credit.

We access liquidity in a variety of markets in the United States as

well as in Europe and Asia. In addition, we make extensive use of the repurchase

agreement market and have raised debt in the private placement, the SEC's Rule

144A and the commercial paper markets, as well as through Eurobonds, money

broker loans, commodity-based

financings, letters of credit and promissory notes. After the offerings and

subject to market conditions, we intend to raise additional funds in the public

debt securities market, including through an anticipated $1 billion offering of

long-term debt securities and an anticipated €1 billion offering of long-term

debt securities payable in euros. We seek to structure our liabilities to avoid

significant amounts of debt coming due on any one day or during any single week

or year. In addition, we maintain and update annually a liquidity crisis plan

that provides guidance in the event of a liquidity crisis. The annual update of

this plan is reviewed and approved by our Finance Committee.

Asset Liquidity. Goldman Sachs maintains a highly liquid balance

sheet. Many of our assets are readily funded in the repurchase agreement

markets, which generally have proven to be a consistent source of funding, even

in periods of market stress. Substantially all of our inventory turns over

rapidly and is marked-to-market daily. We maintain long-term borrowings and

partners' capital substantially in excess of our less liquid assets.

Dynamic Liquidity Management. Goldman Sachs seeks to manage the

composition of its asset base and the maturity profile of its funding to ensure

that it can liquidate its assets prior to its liabilities coming due, even in

times of liquidity stress. We have traditionally been able to fund our liquidity

needs through collateralized funding, such as repurchase transactions and

securities lending, as well as short-term and long-term borrowings and partners'

capital. To further evaluate the adequacy of our liquidity management policies

and guidelines, we perform weekly "stress funding" simulations of disruptions to

our access to unsecured credit.

Excess Liquidity. In addition to maintaining a highly liquid

balance sheet and a significant portion of longer-term liabilities to assure

liquidity even during adverse conditions, we seek to maintain a liquidity

cushion that consists principally of unencumbered U.S. government and agency

obligations to ensure the availability of immediate liquidity. This pool of

highly liquid assets averaged $14.17 billion during 1998 and $12.54 billion

during 1997.

Liquidity Ratio Maintenance. It is Goldman Sachs' policy to

further manage its liquidity by maintaining a "liquidity ratio" of at least

100%. This ratio measures the relationship between the loan value of our

unencumbered assets and our short-term unsecured liabilities. The maintenance of

this liquidity ratio is intended to ensure that we could fund our positions on a

fully secured basis in the event that we were unable to replace our unsecured

debt maturing within one year. Under this policy, we seek to maintain

unencumbered assets in an amount that, if pledged or sold, would provide the

funds necessary to replace unsecured obligations that are scheduled to mature

(or where holders have the option to redeem) within the coming year.

Intercompany Funding. Most of the liquidity of Goldman Sachs is

raised by The Goldman Sachs Group, L.P., which then lends the necessary funds to

its subsidiaries and affiliates. We carefully manage our intercompany exposure

by generally requiring intercompany loans to have maturities equal to or shorter

than the maturities of the aggregate borrowings of The Goldman Sachs Group, L.P.

This policy ensures that the subsidiaries' obligations to The Goldman Sachs

Group, L.P. will generally mature in advance of The Goldman Sachs Group, L.P.'s

third-party long-term borrowings. In addition, many of the advances made to our

subsidiaries and affiliates are secured by marketable securities or other liquid

collateral. We generally fund our equity investments in subsidiaries with

partners' capital.

The Balance Sheet

Goldman Sachs maintains a highly liquid balance sheet that fluctuates

significantly between financial statement dates. In the fourth

quarter of 1998, we temporarily decreased our total assets to reduce risk and

increase liquidity in response to difficult conditions in the global financial

markets.

Our total assets were $230.62 billion as of February 1999 and $217.38

billion as of November 1998.

Our balance sheet size as of February 1999 and November 1998 increased

by $8.99 billion and $11.64 billion, respectively, due to the adoption of the

provisions of Statement of Financial Accounting Standards No. 125 that were

deferred by Statement of Financial Accounting Standards No. 127. For a

discussion of Statement of Financial Accounting Standards Nos. 125 and 127, see

"— Accounting Developments" below and Note 2 to the audited consolidated

financial statements.

As of February 1999 and November 1998, we held approximately $999

million and $1.04 billion, respectively, in high-yield debt securities and $1.39

billion and $1.49 billion, respectively, in bank loans, all of which are valued

on a mark-to-market basis. These assets may be relatively illiquid during times

of market stress. We seek to diversify our holdings of these assets by industry

and by geographic location.

As of February 1999 and November 1998, we held approximately $1.04

billion and $1.17 billion, respectively, of emerging market securities, and $103

million and $109 million, respectively, in emerging market loans, all of which

are valued on a mark-to-market basis. Of the $1.14 billion and $1.28 billion in

emerging market securities and loans, as of February 1999 and November 1998,

respectively, approximately $778 million and $968 million were sovereign

obligations, many of which are collateralized as to principal at stated

maturity.

In September 1998, a consortium of 14 banks and brokerage firms,

including Goldman Sachs, made an equity investment in Long-Term Capital

Portfolio, L.P., a major market participant. The objectives of this investment

were to provide sufficient capital to permit Long-Term Capital Portfolio, L.P.

to continue active management of its positions and, over time, to reduce risk

exposures and leverage, to return capital to the participants in the consortium

and ultimately to realize the potential value of the portfolio. We invested $300

million in Long-Term Capital Portfolio, L.P.

Credit Ratings

Goldman Sachs relies upon the debt capital markets to fund a

significant portion of its day-to-day operations. The cost and availability of

debt financing is influenced by our credit ratings. Credit ratings are also

important to us when competing in certain markets and when seeking to engage in

longer-term transactions, including over-the-counter derivatives. A reduction in

our credit ratings could increase our borrowing costs and limit our access to

the capital markets. This, in turn, could reduce our earnings and adversely

affect our liquidity.

The following table sets forth our credit ratings as of November

1998:

| Short-term debt |

Long-term debt |

|

|---|---|---|

| Moody's Investors Service, Inc | P-1 | A1 |

| Standard & Poor's Ratings Services(1) | A-1+ | A+ |

| Fitch IBCA, Inc . | F1+ | AA— |

| CBRS Inc . | A-1 (High) |

A+ |

(1) On September 25, 1998, Standard & Poor's Ratings

Services affirmed Goldman Sachs' credit ratings but

revised its outlook to "negative". On April 16, 1999,

Standard & Poor's Ratings Services revised its outlook

to "stable".

Long-Term Debt

As of November 1998, our consolidated long-term borrowings were $19.91

billion. Substantially all of these borrowings were unsecured and consisted

principally of senior borrowings with maturities extending to 2024. The weighted

average maturity of our long-term borrowings as of November 1998 was

approximately four years. Substantially all of our long-term borrowings are

swapped into U.S. dollar obligations with short-term floating rates of interest

in order to minimize our exposure to interest rates and foreign exchange

movements. See Note 5 to the audited consolidated financial statements for

further information regarding our long-term borrowings.

Many of our principal subsidiaries are subject to extensive regulation

in the United States and elsewhere. Goldman, Sachs & Co., a registered U.S.

broker-dealer, is regulated by the SEC, the Commodity Futures Trading

Commission, the Chicago Board of Trade, the NYSE and the NASD. Goldman Sachs

International, a registered United Kingdom broker-dealer, is subject to

regulation by the Securities and Futures Authority Limited and the Financial

Services Authority. Goldman Sachs (Japan) Ltd., a Tokyo-based broker-dealer, is

subject to regulation by the Japanese Ministry of Finance, the Financial

Supervisory Agency, the Tokyo Stock Exchange, the Tokyo International Financial

Futures Exchange and the Japan Securities Dealers Association. Several other

subsidiaries of Goldman Sachs are regulated by securities, investment advisory,

banking and other regulators and authorities around the world. Compliance with

the rules of these regulators may prevent us from receiving distributions,

advances or repayment of liabilities from these subsidiaries. See Note 8 to the

audited consolidated financial statements and Note 5 to the unaudited condensed

consolidated financial statements for further information regarding our

regulated subsidiaries.

Goldman Sachs has a comprehensive risk management process to monitor,

evaluate and manage the principal risks assumed in conducting its activities.

These risks include market, credit, liquidity, operational, legal and

reputational exposures.

Risk Management Structure

Goldman Sachs seeks to monitor and control its risk exposure through a

variety of separate but complementary financial, credit, operational and legal

reporting systems. We believe that we have effective procedures for evaluating

and managing the market, credit and other risks to which we are exposed.

Nonetheless, the effectiveness of our policies and procedures for managing risk

exposure can never be completely or accurately predicted or fully assured. For

example, unexpectedly large or rapid movements or disruptions in one or more

markets or other unforeseen developments can have a material adverse effect on

our results of operations and financial condition. The consequences of these

developments can include losses due to adverse changes in inventory values,

decreases in the liquidity of trading positions, higher volatility in our

earnings, increases in our credit risk to customers and counterparties and

increases in general systemic risk. See "Risk Factors — Market Fluctuations

Could Adversely Affect Our Businesses in Many

Ways" for a discussion of the effect that market fluctuations can have on our

businesses.

Goldman Sachs has established risk control procedures at several levels

throughout the organization. Trading desk managers have the first line of

responsibility for managing risk within prescribed limits. These managers have

in-depth knowledge of the primary sources of risk in their individual markets

and the instruments available to hedge our exposures. In addition, a number of

committees described in the following table are responsible for establishing

trading limits, monitoring adherence to these limits and for general oversight

of our risk management process.

| Committee |

Function |

| Management Committee | All risk control functions ultimately report to the Management Committee.

Through both direct and delegated authority, the Management Committee approves

all of Goldman Sachs':

|

|

|

|

| Risk Committees | The Firmwide Risk Committee:

The FICC Risk Committee sets market risk limits for individual business units and sets issuer-specific net inventory position limits. The Equities Risk Committee sets market risk limits for individual business units that consist of gross and net inventory position limits and, for equity derivatives, limits based on market move scenario analysis. The Asset Management Control Oversight Committee and Asset Management Risk Committee oversee various operational, credit, pricing and business practices issues. |

|

|

|

| Global Compliance and Control Committee | The Global Compliance and Control Committee provides oversight of our compliance and control functions, including internal audit, reviews our legal, reputational, operational and control risks, and periodically reviews the activities of existing businesses. |

|

|

|

| Commitments Committee | The Commitments Committee approves:

The Commitments Committee has delegated to the Credit Department the authority to approve underwriting commitments for investment grade debt and certain other products. |

|

|

|

| Credit Policy Committee | The Credit Policy Committee establishes and reviews broad credit policies and parameters that are implemented by the Credit Department. |

|

|

|

| Finance Committee | The Finance Committee is responsible for oversight of our capital, liquidity and funding needs and for setting certain inventory position limits. |

|

|

|

Segregation of duties and management oversight are fundamental elements

of our risk management process. Accordingly, departments that are independent of

the revenue producing units, such as the Firmwide Risk, Credit, Controllers,

Global Operations, Central Compliance, Management Controls and Legal

Departments, in part perform risk management functions, which include

monitoring, analyzing and evaluating risk.

Market Risk

The potential for changes in the market value of our trading positions

is referred to as "market risk". Our trading positions result from underwriting,

market-making and proprietary trading activities.

The broadly defined categories of market risk include exposures to

interest rates, currency rates, equity prices and commodity prices.

- Interest rate risks primarily result from exposures to changes in the

level, slope and curvature of the yield curve, the volatility of

interest rates, mortgage prepayment speeds and credit spreads.

- Currency rate risks result from exposures to changes in spot prices,

forward prices and volatilities of currency rates.

- Equity price risks result from exposures to changes in prices and

volatilities of individual equities, equity baskets and equity

indices.

- Commodity price risks result from exposures to changes in spot prices,

forward prices and volatilities of commodities, such as electricity,

natural gas, crude oil, petroleum products and precious and base

metals.

In addition to applying business judgment, senior management uses a

number of quantitative tools to manage our exposure to market risk. These tools

include:

- risk limits based on a summary measure of market risk exposure referred

to as Value-at-Risk or "VaR";

- risk limits based on a scenario analysis that measures the potential

effect of a significant widening of credit spreads on our trading net

revenues;

- inventory position limits for selected business units and country

exposures; and

- scenario analyses which measure the potential effect on our trading net

revenues of abnormal market movements.

VaR. VaR is the potential loss in value of Goldman Sachs'

trading positions due to adverse movements in markets over a defined time

horizon with a specified confidence level.

For the VaR numbers reported below, a one-day time horizon and a 95%

confidence level were used. This means that there is a one in 20 chance that

daily trading net revenues will fall below the expected daily trading net

revenues by an amount at least as large as the reported VaR. Thus, shortfalls

from expected trading net revenues on a single trading day greater than the

reported

VaR would be anticipated to occur, on average, about once a month. Shortfalls on

a single day can exceed reported VaR by significant amounts. Shortfalls can also

accumulate over a longer time horizon such as a number of consecutive trading

days. For a discussion of the limitations of our risk measures, see "Risk

Factors — Our Risk Management Policies and Procedures May Leave Us Exposed to

Unidentified or Unanticipated Risk".

The VaR numbers below are shown separately for interest rate, currency,

equity and commodity products, as well as for our overall trading positions.

These VaR numbers include the underlying product positions and related

hedges, which may include positions in other product areas. For example, the

hedge of a foreign exchange forward may include an interest rate futures

position and the hedge of a long corporate bond position may include a short

position in the related equity.

VaR Methodology, Assumptions and Limitations. The modeling

of the risk characteristics of our trading positions involves a number of

assumptions and approximations. While management believes that these assumptions

and approximations are reasonable, there is no uniform industry methodology for

estimating VaR, and different assumptions and/or approximations could produce

materially different VaR estimates.

We use historical data to estimate our VaR and, to better reflect asset

volatilities and correlations, these historical data are weighted to give

greater importance to more recent observations. Given its reliance on historical

data, VaR is most effective in estimating risk exposures in markets in which

there are no sudden fundamental changes or shifts in market conditions. An

inherent limitation of VaR is that past changes in market risk factors, even

when weighted toward more recent observations, may not produce accurate

predictions of future market risk. For example, the asset volatilities to which

we were exposed in the second half of 1998 were substantially larger than those

reflected in the historical data used during that time period to estimate our

VaR. Moreover, VaR calculated for a one-day time horizon does not fully capture

the market risk of positions that cannot be liquidated or offset with hedges

within one day.

VaR also should be evaluated in light of the methodology's other

limitations. For example, when calculating the VaR numbers shown below, we

assume that asset returns are normally distributed. Non-linear risk exposures on

options and the potentially mitigating impact of intra-day changes in related

hedges would likely produce non-normal asset returns. Different distributional

assumptions could produce a materially different VaR.

The following table sets forth our daily VaR for substantially all of

our trading positions:

(in millions)

| Risk Categories |

As of November

1998 |

|---|---|

| Interest rates | $ 27.3 |

| Currency rates | 9.0 |

| Equity prices | 25.3 |

| Commodity prices | 7.0 |

| Diversification effect(1) | (25.7) |

| Firmwide | $ 42.9 |

(1) Equals the difference between firmwide daily VaR and the sum of the

daily VaRs for the four risk categories. This effect arises because

the four market risk categories are not perfectly correlated.

The daily VaR for substantially all of our trading positions as of

February 1999 was not materially different from our daily VaR as of November

1998.

For a discussion of what our daily VaR would have been as of November

1998 had we used our volatility and correlation data as of May 29, 1998, see

"Business — Trading and Principal Investments — Trading Risk

Management — Risk Reduction".

Non-Trading Risk

The market risk associated with our non-trading financial instruments,

including investments in our merchant banking funds, is measured using a

sensitivity analysis that estimates the potential reduction in our net revenues

associated with hypothetical market movements. As of February 1999 and November

1998, non-trading market risk was not material.

Recent Enhancements to Risk Management

While VaR continues to be a core tool in our risk management process, management has increased its emphasis on the supplemental measures described below:

- Credit Spread Limits. In addition to VaR, the Firmwide Risk

Committee now sets market risk limits based on a scenario analysis of

widening credit spreads similar to those experienced in the second half

of 1998; and

- Scenario Analyses. Management is using scenario analyses that

reflect more extreme market conditions, such as large increases in

market volatility as well as substantial and sustained adverse movements

in the volatility and correlation of our relative value positions.

Valuation of Trading Inventory

Substantially all of our inventory positions are marked-to-market on a

daily basis and changes are recorded in net revenues. The individual business

units are responsible for pricing the positions they manage. The Controllers

Department, in conjunction with the Firmwide Risk Department, regularly performs

pricing reviews.

Trading Net Revenues Distribution

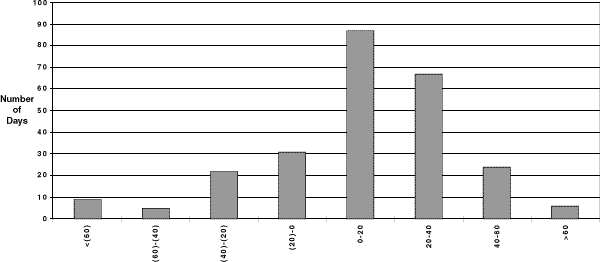

The following chart sets forth the frequency distribution for

substantially all of our daily trading net revenues for the year ended November

1998:

Credit Risk

Credit risk represents the loss that we would incur if a counterparty

or issuer of securities or other instruments we hold fails to perform its

contractual obligations to us. To reduce our credit exposures, we seek to enter

into netting agreements with counterparties that permit us to offset receivables

and payables with such counterparties. We do not take into account any such

agreements when calculating credit risk, however, unless management believes a

legal right of setoff exists under an enforceable master netting agreement.

For most businesses, counterparty credit limits are established by the

Credit Department, which is independent of the revenue-producing departments,

based on guidelines set by the Firmwide Risk and Credit Policy Committees. Our

global credit management systems monitor current and potential credit exposure

to individual counterparties and on an aggregate basis to counterparties and

their affiliates. The systems also provide management with information regarding

overall credit risk by product, industry sector, country and region.

Risk Limits

Business unit risk limits are established by the risk committees and

may be further segmented by the business unit managers to individual trading

desks.

Market risk limits are monitored on a daily basis by the Firmwide Risk

Department and are reviewed regularly by the appropriate risk committee. Limit

violations are reported to the appropriate risk committee and the appropriate

business unit managers.

Inventory position limits are monitored by the Controllers Department

and position limit violations are reported to the appropriate business unit

managers and the Finance Committee. When inventory position limits are used to

monitor market risk, they are also monitored by the Firmwide Risk Department and

violations are reported to the appropriate risk committee.

Derivative Contracts

Derivative contracts are financial instruments, such as futures,

forwards, swaps or option contracts, that derive their value from underlying

assets, indices, reference rates or a combination of these factors. Derivative

instruments may be entered into by Goldman Sachs in privately negotiated

contracts, which are often referred to as over-the-counter derivatives, or they

may be listed and traded on an exchange.

Most of our derivative transactions are entered into for trading

purposes. We use derivatives in our trading activities to facilitate customer

transactions, to take proprietary positions and as a means of risk management.

We also enter into non-trading derivative contracts to manage the interest rate

and currency exposure on our long-term borrowings.

Derivatives are used in many of our businesses, and we believe that the

associated market risk can only be understood relative to the underlying assets

or risks being hedged, or as part of a broader trading strategy. Accordingly,

the market risk of derivative positions is managed with all of our other

non-derivative risk.

Derivative contracts are reported on a net-by-counterparty basis on our

consolidated statements of financial condition where management believes a legal

right of setoff exists

under an enforceable master netting agreement.

For an over-the-counter derivative, our credit exposure is directly

with our counterparty and continues until the maturity or termination of such

contract.

The following table sets forth the distribution, by credit rating, of

substantially all of our exposure with respect to over-the-counter derivatives

as of November 1998, after taking into consideration the effect of netting

agreements. The categories shown reflect our internally determined public rating

agency equivalents.

| Credit Rating Equivalent |

Amount |

Percentage |

|---|---|---|

| AAA/Aaa | $ 2,170 | 12% |

| AA/Aa2 | 5,571 | 30 |

| A/A2 | 4,876 | 26 |

| BBB/Baa2 | 3,133 | 17 |

| BB/Ba2 or lower | 1,970 | 11 |

| Unrated(1) | 730 |

4 |

| $18,450 |

100% |

(1) In lieu of making an individual assessment of such counterparties'

credit, we make a determination that the collateral held in respect

of such obligations is sufficient to cover our exposure. In making

this determination, we take into account various factors, including

legal uncertainties and market volatility.

As of November 1998, we held approximately $2.97 billion in collateral

against these over-the-counter derivative exposures. This collateral consists

predominantly of cash and U.S. government and agency securities and is usually

received by us under agreements entitling us to require additional collateral

upon specified increases in exposure or the occurrence of negative credit

events.

In addition to obtaining collateral and seeking netting agreements, we

attempt to mitigate default risk on derivatives by entering into agreements that

enable us to terminate or reset the terms of transactions after specified time

periods or upon the occurrence of credit-related events, and by seeking third-party guarantees of the obligations of some counterparties.

Derivatives transactions may also involve the legal risk that they are

not authorized or appropriate for a counterparty, that documentation has not

been properly executed or that executed agreements may not be enforceable

against the counterparty. We attempt to minimize these risks by obtaining advice

of counsel on the enforceability of agreements as well as on the authority of a

counterparty to effect the derivative transaction.

Operational and Year 2000 Risks

Operational Risk. Goldman Sachs may face reputational damage,

financial loss or regulatory risk in the event of an operational failure or

error. A systems failure or failure to

enter a trade properly into our records may result in an inability to settle

transactions in a timely manner or a breach of regulatory requirements.

Settlement errors or delays may cause losses due to damages owed to

counterparties or movements in prices. These operational and systems risks may

arise in connection with our own systems or as a result of the failure of an

agent acting on our behalf.

The Global Operations Department is responsible for establishing,

maintaining and approving policies and controls with respect to the accurate

inputting and processing of transactions, clearance and settlement of

transactions, the custody of securities and other instruments and the detection

and prevention of employee errors or improper or fraudulent activities. Its

personnel work closely with the Information Technology Department in creating

systems to enable appropriate supervision and management of its policies. The

Global Operations Department is also responsible, together with other areas of

Goldman Sachs, including the Legal and Compliance Departments, for ensuring

compliance with applicable regulations with respect to the clearance and

settlement of transactions and the margining of positions. The Network

Management Department oversees our relationships with our clearance and

settlement agents, regularly reviews agents' performance and meets with these

agents to review operational issues.

Year 2000 Readiness Disclosure. Goldman Sachs has determined

that it will be required to modify or replace portions of its information

technology systems, both hardware and software, and its non-information

technology systems so that they will properly recognize and utilize dates beyond

December 31, 1999. We presently believe that with modifications to existing

software, conversions to new software and replacement of some hardware, the Year

2000 issue will be satisfactorily resolved in our own systems worldwide.

However, if such modifications and conversions are not made or are not completed

on a timely basis, the Year 2000 issue would have a material adverse effect on

Goldman Sachs. Moreover, even if these changes are successful, failure of third

parties to which we are financially or operationally linked to address their own

Year 2000 problems would also have a material adverse effect on Goldman Sachs.

For a description of the Year 2000 issue and some of the related risks,

including possible problems that could arise, see "Risk Factors — Our

Computer Systems and Those of Third Parties May Not Achieve Year 2000

Readiness — Year 2000 Readiness Disclosure".

Recognizing the broad scope and complexity of the Year 2000 problem, we

have established a Year 2000 Oversight Committee to promote awareness and ensure

the active participation of senior management. This Committee, together with

numerous sub-committees chaired by senior managers throughout Goldman Sachs and

our Global Year 2000 Project Office, is responsible for planning, managing and

monitoring our Year 2000 efforts on a global basis. Our Management Controls

Department assesses the scope and sufficiency of our Year 2000 program and

verifies that the principal aspects of our Year 2000 program are being

implemented according to plan.

Our Year 2000 plans are based on a five-phase approach, which includes

awareness; inventory, assessment and planning; remediation; testing; and

implementation. The awareness phase (in which we defined the scope and

components of the problem, our methodology and approach and obtained senior

management support and funding) was completed in September 1997. We also

completed the inventory, assessment and planning phase for our systems in

September 1997. By the end of March 1999, we completed the remediation, testing

and implementation phases for 99% of our mission-critical systems, and we plan

to complete these three phases for the remaining 1% by the end of June 1999. In

March 1999, we completed the first cycle of our internal integration testing

with respect to critical securities and transaction flows. This cycle, which

related to U.S. products, was completed successfully with no material problem.

The remaining cycle, which

will relate primarily to non-U.S. products, is to be completed in June 1999.

This testing is intended to validate that our systems can successfully perform