Yang expects streaming music to have a compound annual growth rate of 10% (down from the previous estimate of 11%).

That’s mainly because of the team’s lower assumptions for revenue from ads and emerging platforms, and the shift to subscription revenue from emerging markets.

The team expects monetization to improve amid price increases, premium plans for super fans, new payment models for artists, and the monetization of generative AI models.

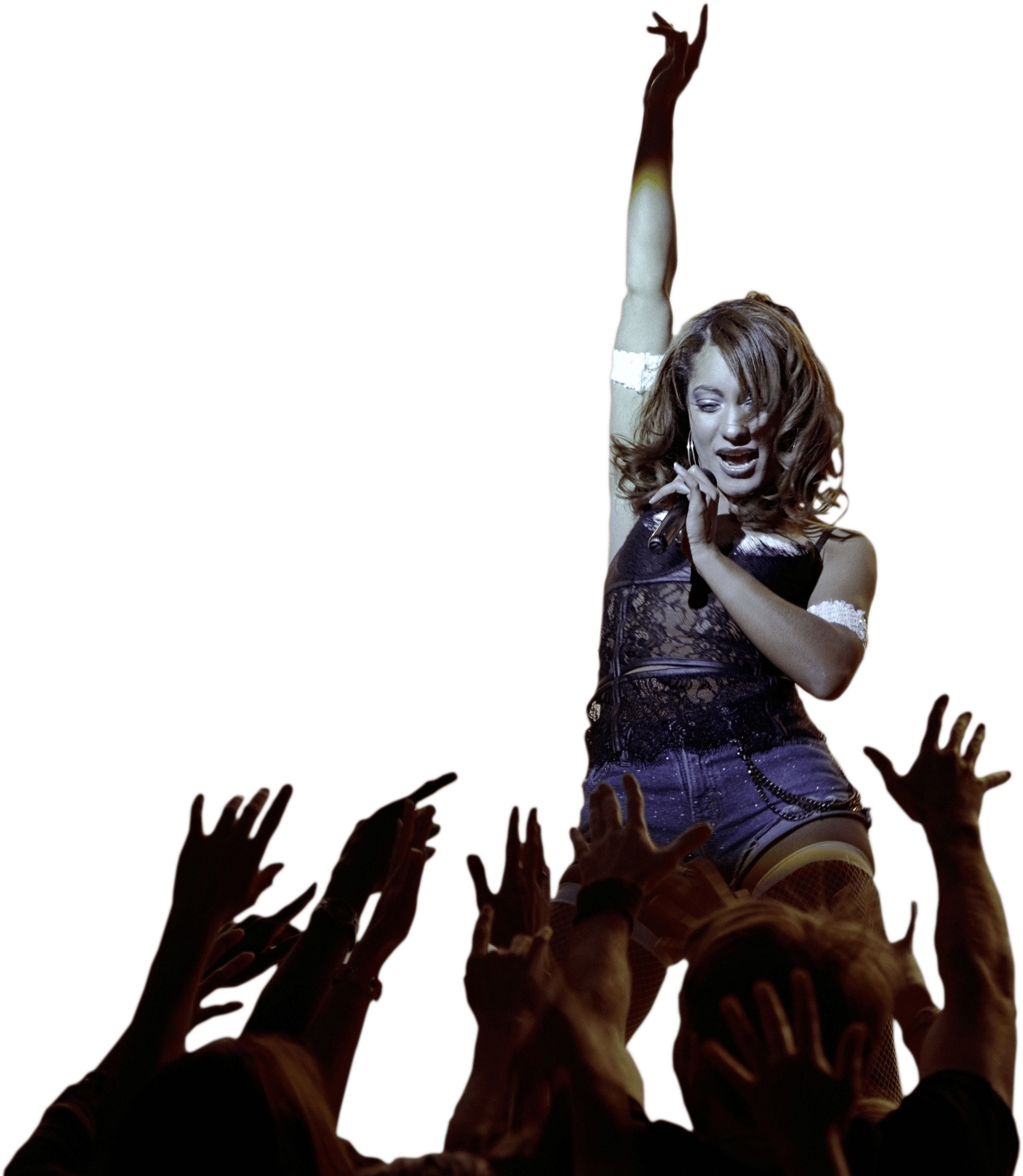

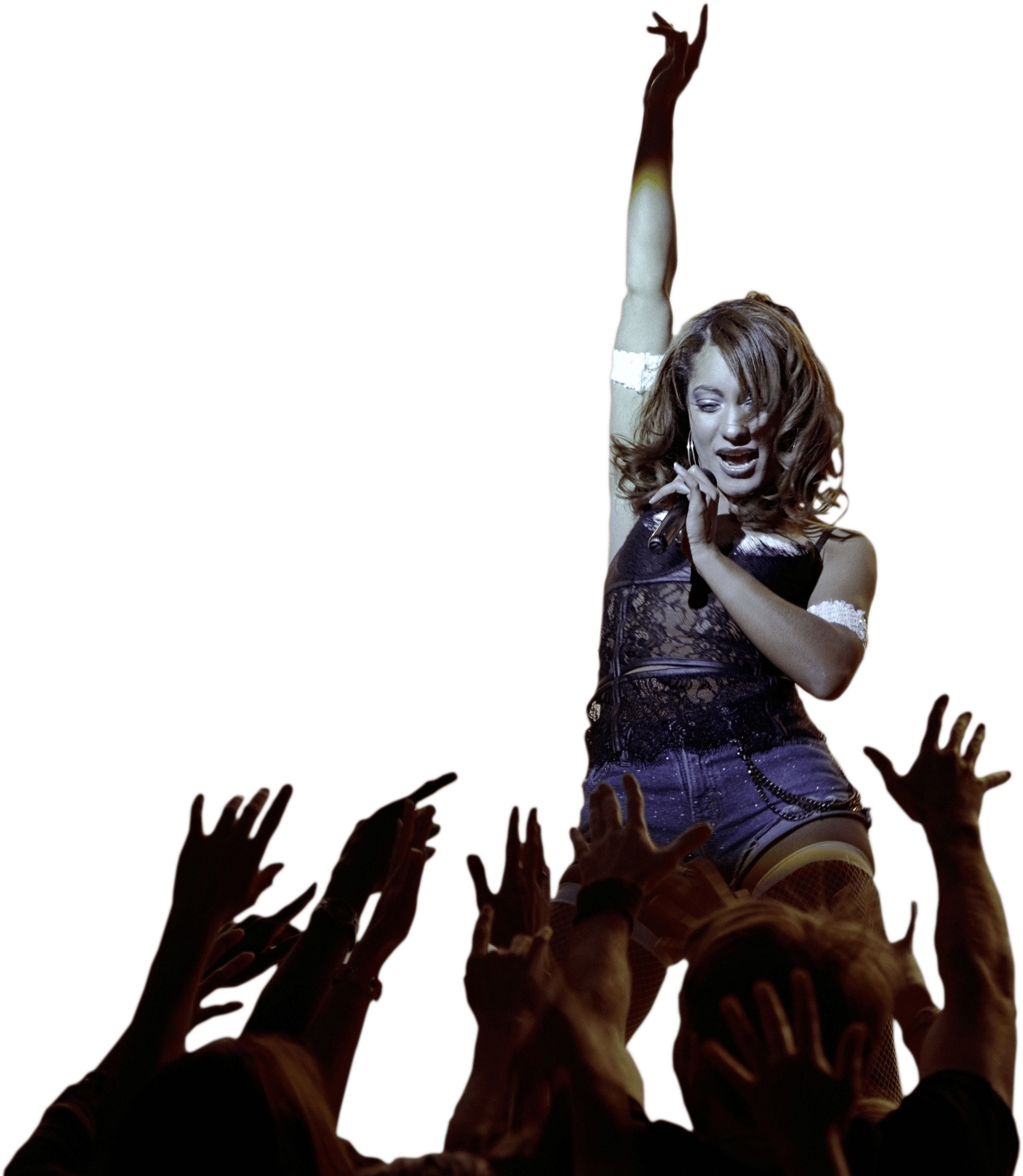

People streamed more than 4 trillion songs last year

In fact, little more than 1-in-10 internet users pays for a streaming plan

New music streaming subscriptions are slowing in developed markets

Emerging markets are less lucrative, but that’s expected to change over time

The rise of non-English music will reverberate through the industry

The global music industry grew faster than expected last year and is still forecast to expand rapidly

Streaming penetration by market (as % of Internet users), 2013-30E

Paid subscriber yoy growth in developed markets

By contrast, new streaming subscribers are driving growth in emerging markets

% of paid subscriber net adds from developed

markets and emerging markets

The ratio of paid streaming is much higher in

developed markets (33%) than in

emerging ones (7%).

Almost 60% of net new streaming music subscribers were in emerging markets in 2023.

Average revenue per unit is much lower in emerging markets ($8) than in developed ones ($34).

Live music revenue growth was stronger than expected in 2023, as was growth in

music publishing, and recorded music.

Yang expects these companies to make emerging markets a priority. There’s already been a step-up in acquisitions and partnerships.

Our analysts see an opportunity for pricing in emerging markets to improve as incomes rise.

Our analysts forecast emerging markets share to rise to about 70% by 2030.

Paid streaming in developed markets is expected to climb to 48% by 2030 and to 13% in emerging markets during that span.

Revenue growth is expected to be driven by price increases in developed markets.

Lisa Yang, Goldman Sachs Research

Lisa Yang, Goldman Sachs Research

The three major music companies account for about 70% of streaming music in

developed markets, compared with 15% to 50% in emerging markets.

Top 3 major label recorded music market share by geography (GSe), 2023

Lisa Yang, Goldman Sachs Research

Revenue breakdown by recorded, publishing, and live music segments ($ billion)

“We’ve seen price hikes from the major streaming platforms. But even so, music is still significantly undervalued.”

“There’s no reason streaming paid penetration won’t get close to 20% by 2030.”

“ Emerging markets have overtaken

developed markets as the main source of subscriber growth.”

“That has major implications for the industry, including how the labels should rethink their capital allocation strategy. Today, they have relatively low market share in emerging markets.”

Lisa Yang, Goldman Sachs Research

Music streaming revenues are forecast to compound at 10% each year for the rest of the decade – and it’s still early days for making money from those listeners, says Lisa Yang, Head of the European Media and Internet Research team. She expects the global music industry, which is projected to generate more than $100 billion in revenue this year (approximately 8% more than 2023), to get better at charging for streaming and driving revenue from emerging markets.

Yang’s team forecasts the overall industry to grow by a compound annual rate of 7.6% (up from 7.4%) through 2030. This reflects a stronger outlook for the live music (2030 estimates raised by 31%) and music publishing segments (2030 estimates raised by 4%).

Yet revenue per stream fell

Lisa Yang, Goldman Sachs Research

“You pay the same price for music streaming whether you're a hardcore fan or a regular user. We think there are music fans who would be willing to pay a lot more because they are super fans.”

Source: IFPI Global Music Report 2024, Goldman Sachs Research

Source: IFPI Global Music Report 2024, Goldman Sachs Research

Source: IFPI Global Music Report 2024, Goldman Sachs Research

Source: Goldman Sachs Research

Source: Music and Copyright, company data, IFPI Global Music Report 2024, Goldman Sachs Research

Source: Luminate

Global on-demand audio song streams increased 23% yoy in 2023, more than quadrupling since 2017

Source: Luminate, IFPI Global Music Report 2024

Global revenue per stream ($) fell 10% yoy in 2023 and was 28% lower than in 2017

Only about 12% of internet users around the world pay for streaming (as a % of total internet users).

Source: Goldman Sachs Research, IFPI Global Music Report 2024

Yang expects streaming music to have a compound annual growth rate of 10% (down from the previous estimate of 11%).

That’s mainly because of the team’s lower assumptions for revenue from ads and emerging platforms, and the shift to subscription revenue from emerging markets.

The team expects monetization to improve amid price increases, premium plans for super fans, new payment models for artists, and the monetization of generative AI models.

People streamed more than 4 trillion songs last year

In fact, little more than 1-in-10 internet users pays for a streaming plan

New music streaming subscriptions are slowing in developed markets

Emerging markets are less lucrative, but that’s expected to change over time

The rise of non-English music will reverberate through the industry

The global music industry grew faster than expected last year and is still forecast to expand rapidly

Paid subscriber yoy growth in developed markets

By contrast, new streaming subscribers are driving growth in emerging markets

Average revenue per unit is much lower in emerging markets ($8) than in developed ones ($34).

Yang expects these companies to make emerging markets a priority. There’s already been a step-up in acquisitions and partnerships.

Our analysts see an opportunity for pricing in emerging markets to improve as incomes rise.

Streaming penetration by market (as % of Internet users), 2013-30E

The ratio of paid streaming is much higher in

developed markets (33%) than in

emerging ones (7%).

% of paid subscriber net adds from developed

markets and emerging markets

Almost 60% of net new streaming music subscribers were in emerging markets in 2023.

Paid streaming in developed markets is expected to climb to 48% by 2030 and to 13% in emerging markets during that span.

Our analysts forecast emerging markets share to rise to about 70% by 2030.

Revenue growth is expected to be driven by price increases in developed markets.

Lisa Yang, Goldman Sachs Research

The three major music companies account for about 70% of streaming music in

developed markets, compared with 15% to 50% in emerging markets.

Top 3 major label recorded music market share by geography (GSe), 2023

“We’ve seen price hikes from the major streaming platforms. But even so, music is still significantly undervalued.”

“There’s no reason streaming paid penetration won’t get close to 20% by 2030.”

Lisa Yang, Goldman Sachs Research

“That has major implications for the industry, including how the labels should rethink their capital allocation strategy. Today, they have relatively low market share in emerging markets.”

Lisa Yang, Goldman Sachs Research

Live music revenue growth was stronger than expected in 2023, as was growth in

music publishing, and recorded music.

Revenue breakdown by recorded, publishing, and live music segments ($ billion)

Music streaming revenues are forecast to compound at 10% each year for the rest of the decade – and it’s still early days for making money from those listeners, says Lisa Yang, Head of the European Media and Internet Research team. She expects the global music industry, which is projected to generate more than $100 billion in revenue this year (approximately 8% more than 2023), to get better at charging for streaming and driving revenue from emerging markets.

Yang’s team forecasts the overall industry to grow by a compound annual rate of 7.6% (up from 7.4%) through 2030. This reflects a stronger outlook for the live music (2030 estimates raised by 31%) and music publishing segments (2030 estimates raised by 4%).

Lisa Yang, Goldman Sachs Research

“ Emerging markets have overtaken

developed markets as the main source of subscriber growth.”

Yet revenue per stream fell

Lisa Yang, Goldman Sachs Research

“You pay the same price for music streaming whether you're a hardcore fan or a regular user. We think there are music fans who would be willing to pay a lot more because they are super fans.”

Source: IFPI Global Music Report 2024, Goldman Sachs Research

Source: IFPI Global Music Report 2024, Goldman Sachs Research

Source: IFPI Global Music Report 2024, Goldman Sachs Research

Source: Goldman Sachs Research

Source: Goldman Sachs Research, IFPI Global Music Report 2024

Source: Music and Copyright, company data, IFPI Global Music Report 2024, Goldman Sachs Research

Source: Luminate

Global on-demand audio song streams increased 23% yoy in 2023, more than quadrupling since 2017

Source: Luminate, IFPI Global Music Report 2024

Global revenue per stream ($) fell 10% yoy in 2023 and was 28% lower than in 2017

Only about 12% of internet users around the world pay for streaming (as a % of total internet users).

Read the latest "Music in the Air" report for more on the future of the music industry.

Read the latest "Music in the Air" report for more on the future of the music industry.