Brazil Wrestles with Stagflation as the Fed Starts Tightening

The article below is from our BRIEFINGS newsletter of 12 May 2022

Like many countries, Brazil faces a challenging mix of slowing economic growth and soaring inflation. But what makes Latin America’s largest economy different from other nations is that its central bank has lifted its benchmark rate 10-straight times to one of the highest policy rates in the world.

Such high interest rates mean that tight financial conditions and sluggish economic growth are among the key challenges for Brazil, which is gearing up for a presidential election later this year, according to Alberto Ramos, head of Latin American Economic Research at Goldman Sachs. We spoke with the former senior economist at the International Monetary Fund about the risk of stagflation in Brazil and what he plans to explore on May 16 at Goldman Sachs’ Brazil Macro Conference in São Paulo that will host many of the country’s most influential policy makers.

What is the biggest challenge for Brazil right now?

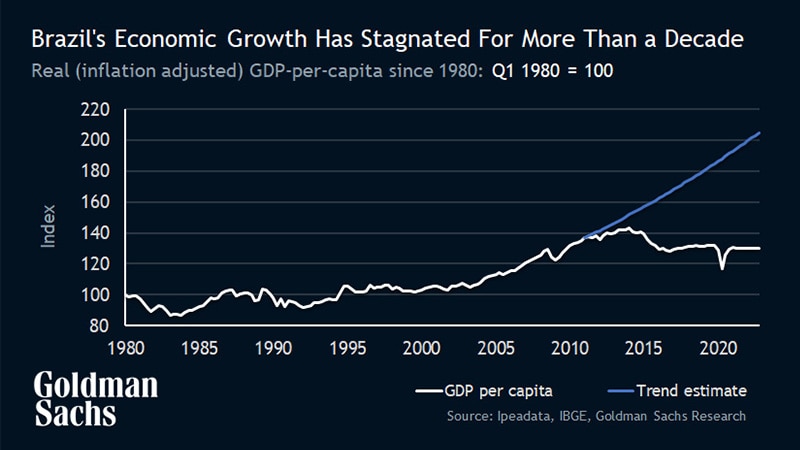

Now that the pandemic has mostly moved into the rearview mirror, Brazil continues to face the endemic issues of low investment, low productivity, low growth. Perhaps the most notable aspect of Brazil is that it continues to underwhelm on the growth front. Excluding 2021 — when growth rebounded from the sharp contraction in 2020 — the last time Brazil grew more than 3% was 12 years ago, and granted 3% is not a particularly impressive number.

That is the main macro challenge: to fix the broken engine of growth to deliver faster, more inclusive growth and, at the same time, to overcome perennial fiscal vulnerabilities which in and of themselves are undermining the growth dynamics. Investment spending has been notoriously low in Brazil as a share of GDP. So the big challenge for whoever gets to govern the country next year is to accelerate investment and growth. Slow social and economic progress for many years and diminished expectations with regards to the future generate social and political pressure and weaken governability. That is one of the key issues that comes up repeatedly in discussions with investors.

How high are the risks of stagflation and recession for Brazil?

Stagflation is no longer a risk — it’s a reality. Brazil’s inflation has been high, and growth, which has been mediocre since the second quarter of 2021, is expected to remain weak throughout 2022. The risk of a recession is significant, particularly in the second half of the year given the tightness of financial conditions. And as you exhaust the gains from the reopening of the economy post-COVID, we may see growth at the margin approaching zero and eventually dipping into negative territory.

Why are inflation and interest rates so high in Brazil relative to the rest of the world and even other parts of Latin America?

This is not the happiest of times in Brazil for a number of reasons. Inflation is very high, it’s in double digits and highly disseminated, the growth outlook is rather modest and monetary policy is very restrictive.

Why is inflation so high in Brazil? It’s a combination of domestic and external factors. The external factors are related to high commodity prices and rising input and logistical costs. On the domestic side there are two things that are idiosyncratic to the Brazilian story on inflation. One is related to the electricity sector and a drought that led to very significant hikes in electricity tariffs because of the country’s reliance on hydroelectric power. The second one is that the currency was for a long time significantly dislocated. Brazil’s real was much cheaper than our theoretical fair value models, and that was a reflection of the significant fiscal risk premia — concerns about the medium-term sustainability of the public finances — and political and policy uncertainty. The undervalued currency amplified the commodity price shock.

So when you combine the global factors that have pressured inflation everywhere — imported inflation — amplified by the shock to electricity tariffs due to the drought and the undervaluation of the currency, that explains why inflation in Brazil is already in double digits and higher than peers across LatAm. And in response to that, the central bank has already hiked the policy rate a lot and they’re not yet done, but in our assessment they’re close to it. I think we’re now in the late-cycle fine-tuning stage.

How has the surge in commodity prices amid the war in Ukraine played out for the Latin American economies like Brazil that are big commodity producers?

Higher commodity prices are a positive development for these commodity exporters. The problem is that high commodity prices amplify already significant inflationary pressures and will lead to even tighter monetary policy. So financial conditions are going to tighten more because of the surge in commodity prices.

On the one hand the windfall income from higher commodity prices will grease the wheels of activity, but on the other hand inflation will accelerate further and rates will go even higher and that undermines growth. So net-net, it really depends on the mix of commodities that particular countries export and how serious are the inflation dynamics and the policy response to it.

In addition, you have to factor in that what’s going on in Europe is also leading to downward revisions to global growth and trade, particularly in Europe but globally in general, and is generating logistical and supply-chain disruptions. That further dampens the already lackluster growth outlook.

There are many headlines right now about central banks from Sweden to the U.S. raising interest rates. Where is Brazil in that constellation of polices?

Brazil has probably one of the most mature and advanced monetary cycles. The policy rate was pushed way too low during the second half of 2020 to last — it was pushed to 2% and that’s one of the reasons why the currency didn’t trade well throughout most of 2021. The interest-carry was way too low. But then they were steadfast in swiftly pushing the policy rate from 2% to close to 13%. That is admittedly a very steep monetary cycle.

While Brazil is now in the late-cycle fine-tuning iterations, the Fed is starting its own cycle at a time when monetary policy in Brazil is already quite tight. Name one other country on this planet where the ex-ante real rate is 7% and is facing a very modest growth profile. It goes without saying this is not sustainable: you’ve can’t maintain real rates of 7% for a long period of time.

So ideally when the inflation dynamics allow you to do it, the central bank should be cutting rates. The problem is, can you actually be cutting rates in a significant way when the Fed is hiking?

I think the central bank will be able to cut rates somewhat in 2023, but global monetary conditions and the Fed’s hiking will limit the policy room to ease. So most likely Brazil will be living for a few years with a restricted monetary policy. Part of that reflects their own inflation reality —we also expect inflation to be downward sticky due to inertial forces — and a global backdrop of higher core rates.

Is there anything you’re especially excited to explore at Goldman’s upcoming conference?

It’s always a high-profile event that brings together a vast array of senior policy makers, high-profile political figures, local and international pundits, senior investors and many macro analysts from Goldman Sachs Research. It’s really a unique opportunity for both domestic and foreign investors that travel to Brazil on this occasion to, in one day, have a top-down 360-degree view on all things Brazil.

For this year’s conference, the political moment and outlook will certainly be top of mind. Getting more clarity about the election dynamics — presidential and legislative elections will take place later in the year — and what is the vision of the most competitive candidates for Brazil. Furthermore, other key issues for debate and discussion will be the medium-term fiscal outlook and strategy and the near-term macro monetary policy strategy to put the inflation genie back in the bottle.