Systemic change requires concerted, comprehensive and enduring effort across industries, regions, and disciplines. Collaboration and diversity are at the core of Goldman Sachs, and they drive excellence and results in our efforts to build a more sustainable world.

We look to partners whose strengths complement our own, such as in regional and emerging markets where there may be varying paths to climate transition, or in listening to and working with community leaders and experts to drive racial equity.

Net Zero in Asia

Reaching the climate goals set out in the Paris Agreement will require an estimated $120 trillion in investment by 2050—55% of which will need to be focused on Asian economies.

The deployment of that capital will need to be swift and significant: Post-pandemic investment in energy transition contracted by a fifth in emerging markets. Moreover, the largest investment need is in regional electrification—and the corresponding switch from fossil-fuel-based power to renewable sources, which is cash intensive.

- With Bloomberg Philanthropies and the Asian Development Bank (ADB), we launched the Climate Innovation and Development Fund to deploy capital and catalyze investment in clean energy projects across South and Southeast Asia. The fund is seeded with $25 million of grant capital and has the potential to unlock up to $500 million in private sector and governmental investments. Managed by the ADB, the fund will target projects including clean energy systems, sustainable transportation, and energy efficiency.

-

The Climate Finance Leadership Initiative (CFLI) is an industry-led initiative to unlock private capital to help finance the low-carbon transition in emerging markets. CLFI has piloted a program to strengthen the enabling environment for the climate transition in India and accelerate private capital to drive this transition. We are a founding member of this pilot.

- Goldman Sachs, together with the China-based International Finance Forum (IFF), launched a Green Finance Working Group in December 2021. Co-chaired by John Waldron, President and Chief Operating Officer of Goldman Sachs, and Zhu Xian, Vice President and Secretary-General of the IFF, the Working Group will convene senior executives from global corporations and researchers from leading institutions to explore how green finance and capital markets can power climate action.

- The Singapore Green Finance Center is that country’s first research institute dedicated to green finance and talent development for Asia. The only US bank among SGFC’s founding members, we now serve on the advisory board, contributing our insights to help guide strategic direction.

Partnership for Equity

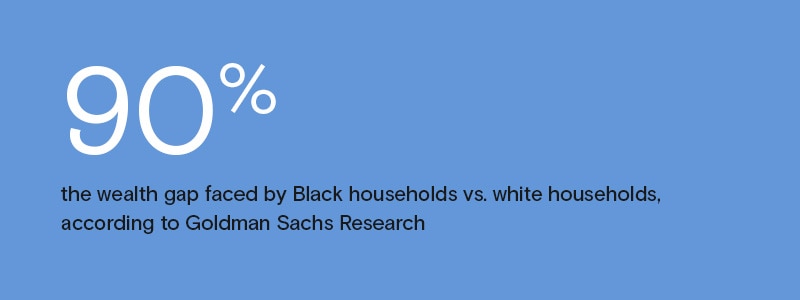

Black women remain heavily disadvantaged across a broad range of economic measures, including wealth, earnings, and health, as underlined in our 2021 research Black Womenomics – Investing in the Underinvested. The median Black household in the U.S. owns almost 90% less wealth than the median white household; 55% of Black women in renting households spend 30% or more of their income on rent; and Black women have a childbirth mortality rate that is more than three times higher than white women.

One of the fastest ways to accelerate change and effectively address the racial wealth gap is to listen to, and invest in, Black women. We’ve mapped our commercial and philanthropic activity to major events in the lives of Black women, like buying a house, starting a business, or having a child. While these life events are not unique to Black women, the asymmetries in the lived experience of these milestones are vast.

- Grameen America works to advance financial inclusion and economic mobility for financially underserved women entrepreneurs. As announced earlier this year, we will provide a $20 million loan to help finance small business loans delivered through Grameen’s new racial equity initiative Elevate.

- Chime Solutions is a Black-woman led human resources and staffing company providing customer support services to large corporations. We provided a $35 million loan to accelerate its mission of creating jobs and economic opportunity for people in underserved communities. More than 80% of Chime employees are Black women, and Black women hold 65% of the firm’s management positions. Chime also partners with daycare operators to provide onsite subsidized child care services to its employees, a critical need in low-income communities.

- The National Affordable Housing Trust (NAHT) Black Developers Initiative is a fund that will finance affordable housing projects sponsored by primarily Black women-led developers. We committed to investing $75 million in the fund. It will help Laurel Street, a Black woman-led real estate firm, to develop South Meadows, a mixed use project in Rome, GA. The development is 100% affordable and comprises 80 multi-family units and a 5,500 square-foot early learning center adjacent to a community farm.

- Black women face disproportionate maternal mortality. Our grant funds will help the Center for Maternal Health Equity at Morehouse School of Medicine to build key partnerships, conduct research, and train clinicians to reduce maternal morbidity and mortality at local, national, and global levels.