New technologies are inherently disruptive. Better batteries make for new modes of transport. More convenient charging stations makes electric vehicle ownership more viable. New software applications let care providers dramatically scale their reach. Harnessing the power of this disruption is vital to accelerating our transition to a more sustainable economy and bridging gaps to inclusive economic growth.

Driving a New Climate

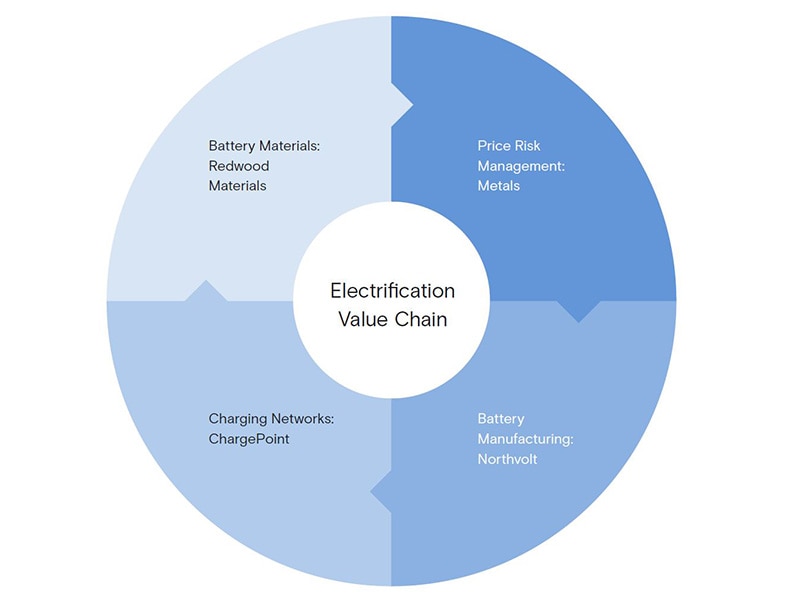

Part of our work focuses on the Electrification Value Chain, where we help to finance the development of technologies that will fuel the next era of transportation. Given 29% of greenhouse gas emissions in the U.S. come from transportation, the faster new technologies can scale, the greater – and more immediate – the environmental benefit:

- Northvolt, a lithium-ion battery manufacturer, chose Goldman Sachs as its equity investment partner in 2019. We raised more than $1.6 billion in sequential rounds, accelerating Northvolt’s plans to supply sustainable batteries to the automotive industry.

- ChargePoint is an electric vehicle charging network operating in North America and Europe. We acted as exclusive financial advisor in their 2021 acquisition of ViriCiti, a provider of electrification for eBus and commercial vehicles, accelerating ChargePoint’s fleet electrification.

- Redwood Materials is recycling batteries, optimizing battery materials, and designing recycling programs and collaborations with both Ford and Volvo. We invested during their $775 million Series C equity round in 2021, helping to scale the firm’s capacity.

- TIER is a European micromobility company, and the first such firm to be 100% carbon neutral. We helped the firm raise $60 million in 2021, which will allow the operator to expand its network of e-scooters and charging stations.

Disruptive Equity

When it comes to creating inclusive growth, technology can drive change by narrowing systemic asymmetries.

The digitization of healthcare is leading to better accessibility. Online services that promote financial inclusion, like insurance products and alternative credit, are infinitely more scalable. Education and resources can be made broadly accessible and affordable through the internet. Communities can better address service shortages through apps that focus on childcare or transport.

Sometimes, technology drives a wholesale reimagining of the way vital services are delivered to end users. We acted as an exclusive financial advisor to EVERFI, which offers high-impact free classes to underserved communities and reaches more than 7 million learners annually.

In other instances, technology can help remove barriers to financial services. We invested in Propel, which supports individuals that qualify for Electronic Benefits Transfer (EBT) cards through a platform that enables users to manage their EBT benefits, plan their shopping trips, save money on groceries, and connect to other essential resources.

Consumer technology and innovative software are clearly not new drivers of economic growth, but what is changing is their explicit application to solving systemic imbalances and bridging gaps in access.