Drones: Reporting for Work

DRONES

Reporting for Work

Like the internet and GPS before them, drones are evolving beyond their military origin to become powerful business tools. They’ve already made the leap to the consumer market, and now they're being put to work in commercial and civil government applications from firefighting to farming. That’s creating a market opportunity that's too large to ignore.

The opportunity ahead

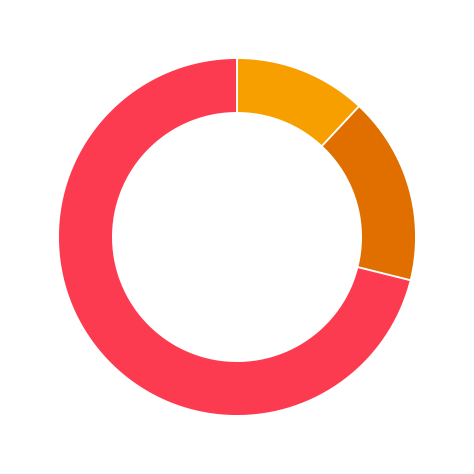

Between now and 2020, we forecast a $100 billion market opportunity for drones—helped by growing demand from the commercial and civil government sectors.

Source: Goldman Sachs Research

Military

Drones got their start as safer, cheaper and often more capable alternatives to manned military aircraft. Defense will remain the largest market for the foreseeable future as global competition heats up and technology continues to improve.

Source: Goldman Sachs Research

Consumer

The consumer drone market was the first to develop outside the military. Demand has taken off in the last two years and hobbyist drones have become a familiar sight, but there is plenty of room for growth.

Source: Goldman Sachs Research

Commercial/civil

The fastest growth opportunity comes from businesses and civil governments. They're just beginning to explore the possibilities, but we expect they'll spend $13 billion on drones between now and 2020, putting thousands of them in the sky. Here's where you might see them.

Source: Goldman Sachs Research

$100

$70

$17

$13

DRONES AT WORKBusiness & Civil Government

Drones are already generating climate data, monitoring the borders and more—and they're just scratching the surface of their commercial potential.

THE JOB OPPORTUNITIES

Total Addressable Market by Industry/Function

-

Construction

$11,164

-

Agriculture

$5,922

-

Insurance Claims

$1,418

-

Offshore Oil/Gas and Refining

$1,110

-

Police (US)

$885

-

Fire (US)

$881

-

Coast Guard (US)

$511

-

Journalism

$480

-

Customs and Border Protection (US)

$380

-

Real Estate

$265

-

Utilities

$93

-

Pipelines

$41

-

Mining

$40

-

Clean Energy

$25

-

Cinematography

$21

Source: Goldman Sachs Research

A DAY IN THE LIFE OF A COMMERCIAL DRONE Into the Fire

A wildfire has broken out and is spreading rapidly. Local firefighters want to conduct a water drop over the hottest parts of the blaze, but they need to give the helicopter pilot the coordinates.

A drone equipped with a thermal camera can fly over the scene and identify the hot spots.

A DAY IN THE LIFE OF A COMMERCIAL DRONE AIRBORNE INSPECTION

An oil and gas company is about to conduct its required monthly pipeline inspection. The company would usually hire a $2,500-an-hour helicopter crew for the job. But now they're using a drone.

A Drone can survey 150 miles of pipeline per day – on par with the helicopter crew but at a lower cost.

But these benefits depend on regulators allowing drone operations beyond a pilot's line of sight. Pipeline inspection isn't unique in this regard — most commercial applications will require or benefit from more relaxed flight regulations. Take agriculture, for example.

A DAY IN THE LIFE OF A COMMERCIAL DRONE CROP CIRCLES

A farmer decides to hire a drone to monitor his crops during the critical summer growing season. At current altitude restrictions, it could inspect up to 1,000 acres of farmland a day, turning around surveys faster and more accurately than planes or satellites.

If regulators were to increase the maximum flight height by just 40%, the drone could double the farmer’s daily coverage.

Drones for all The Consumer market

Flight, speed, dramatic photography – it’s easy to see why drones appeal to consumers. This is the largest non-military market today, and it’s still in its early stages.

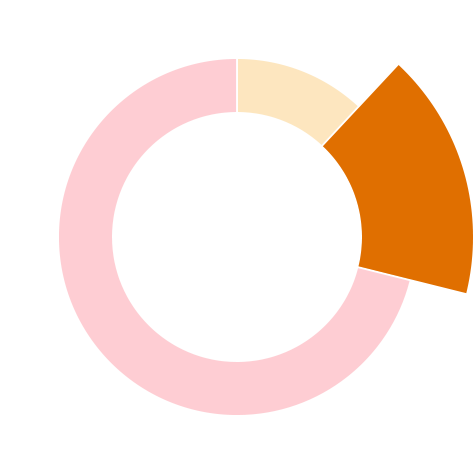

EARLY STAGES

The global consumer drone market is still a fraction of the size of other high-end consumer electronics.

A small relative market

Market Units of Consumer Electronics Products, 2015E

-

Retail Drones

2

-

Action Cameras

11

-

Smart Wearables

24

-

Videogame Consoles

34

-

Tablets

218

Source: Company data, Gartner, IDC, Goldman Sachs Research

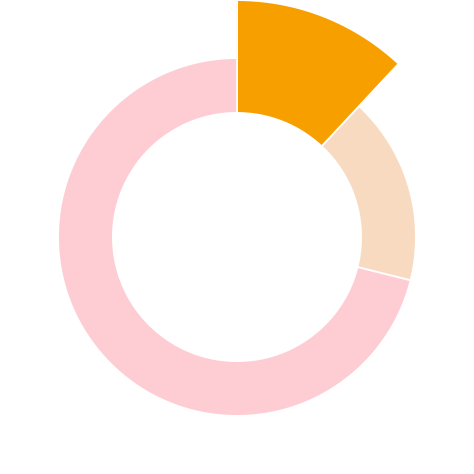

But Ready to Grow

Over the next few years, we expect consumer demand will continue to build. By 2020, we expect 7.8 million consumer drone shipments and $3.3 billion in revenue, versus only 450,000 shipments and $700 million in revenue in 2014.

Source: Goldman Sachs Research

Global Sales Set to Increase

Retail/Consumer Drone Market

2013

2014

2015E

2016E

2017E

2018E

2019E

2020E

$3.5 BN

$3.0 BN

$2.5 BN

$2.0 BN

$1.5 BN

$1.0 BN

$0.5 BN

0

Now in Service Drones in the Military

This is the most mature market, where drones have long been used to keep pilots out of harm's way while performing tasks like intelligence gathering or chemical detection.

131

One of the biggest drones is wider than a commercial jet.

6.5

One of the smallest is half the size of a blue jay.

comparing Wingspans

It’s a bird, it’s a plane

Today's soldiers work with drones of all sizes — from small, stealthy quadcopters the size of a bird to large, jet-sized aircraft.

Source: Goldman Sachs Research

GROWING CAPABILITY SET

Current drone technology has already surpassed manned aircraft in endurance, range, safety and cost efficiency — but research and development is far from over. The next generation of drones will widen the gap between manned and unmanned flight even further, adding greater stealth, sensory, payload, range, autonomous, and communications capabilities.

Source: Goldman Sachs Research

The Really Big Picture

Drone sensor technology currently in development can map 2.7 million square miles in a single flight – nearly the area of the 48 contiguous US states.

San Francisco

Chicago

2.7

GOING GLOBAL

Across the globe, demand is increasing for drone technology.

Brazil $0.8

germany $1.3

Italy $0.7

Turkey $1.5

United Arab Emirates $1.3

Japan $2.2

South Korea $1.9

India $2.5

Saudi Arabia $2.5

France $2.5

United States of America $17.5

United Kingdom $3.5

Russia $3.9

China $4.5

Australia $3.1

Reaching for the Sky

Estimated drone spending in USD, FY2017-FY2021

0

1.5

3

20

Source: DoD, Government of the UK, SIPRI, Defense News, Goldman Sachs Research

Rest of the World

$8.0

Navigating the HeadwindsRewriting the Rules

The rapid growth of the drone industry has outpaced the development of rules and systems to govern their use. This uncertainty weighs on innovation and commercial adoption, but anticipated regulatory clarity should unlock demand. NASA is leading a multibillion-dollar effort to develop a US airspace management system capable of safely coordinating manned and unmanned flight, while the Federal Aviation Administration (FAA) is expected to further ease restrictions that are keeping commercial drones from reaching their full potential.

Range

Drone flight is currently

limited to a pilot's line

of sight

Beyond line of sight

400 Feet

Current FAA Regulations

What's Needed to Unlock Commercial Demand

Altitude

Drones cannot fly over

400 feet

Flight above 400 feet

operations

Drones cannot operate over people and must be flown

by someone with a remote pilot certificate

Autonomous operations allowed,

along with flight over populated areas

the Takeaway

With the evolution of regulations, we see drones headed for new heights in the business world. The same safety, efficiency and cost benefits that appeal to the military make drones attractive for a wide range of business and civil government functions. The $100 billion market opportunity we forecast over the next five years is just the tip of the iceberg. Drones' full economic potential is likely to be multiple times that number, as their ripple effects reverberate through the economy.