Gary D. Cohn President and

Chief Operating Officer

Lloyd C. Blankfein Chairman and Chief

Executive Officer

Fellow Shareholders:

For much of the last year, the global economy grew in fits and starts. In the United States, the economic recovery accelerated, evidenced by a steadily improving labor market. In Europe, challenges remained pronounced as growth was constrained. And in Asia, conditions slowed in both China and Japan.

Different countries are clearly at different stages of the economic cycle, and the interconnectedness of these economies has made the transition to growth somewhat extended, choppy and, oftentimes, unpredictable. As a result, client activity was uneven across regions and asset classes.

CEO confidence improved and merger and acquisition (M&A) volumes, in particular, rebounded. However, client volumes remained generally lower across our Institutional Client Services business. Despite uneven conditions, we are pleased to report that Goldman Sachs performed well, generating solid results for the year. Our performance benefited from the strength of our global client franchise, diversity of our largely institutional set of businesses and our culture of adaptability.

For 2014, the firm produced net revenues of $34.53 billion and net earnings of $8.48 billion, a five percent increase from $8.04 billion of net earnings in 2013. Diluted earnings per common share were $17.07 compared with $15.46 for 2013. Our return on average common shareholders’ equity (ROE) was 11.2 percent. Book value per common share increased by seven percent during 2014 and has grown from $20.94 at the end of our first year as a public company in 1999 to $163.01, a compounded annual growth rate of approximately 15 percent over this period. Our capital management in 2014 reflected a prudent approach as our capital ratios continued to improve despite returning $6.5 billion to common shareholders through share buybacks and dividends.

In our previous letter to shareholders, we discussed our focus on driving returns in a challenging macroeconomic environment. At the same time, we emphasized the need to protect our ability to provide significant upside to our shareholders as the economic cycle turns.

The basis for meeting these goals rests on a strong financial profile and a sustained operating discipline. Our capital and liquidity levels help ensure stability during periods of market stress and position the firm to add value to our clients when they need it most. And, generating operating efficiency has bolstered our capacity to improve returns consistently, despite the lackluster operating environment of recent years.

Against this backdrop, in this year’s letter, we would like to review our financial strength and the benefits embedded in our business model. We will also discuss our operating strategy in the recent environment and our major businesses with a focus on their competitive positions and opportunities for growth. Finally, we will update you on our efforts to protect and sustain our culture of client focus and teamwork, as well as the important progress being made across our corporate engagement initiatives.

Financial Profile

Since the end of 2007, our balance sheet is down by nearly one-quarter, while our common equity is up 85 percent. As a result, gross leverage has been cut by more than one-half. Our liquidity is approximately three times higher than the end of 2007, representing more than 20 percent of our total balance sheet at the end of 2014. And, less liquid level 3 financial assets are down nearly 40 percent over this period.

As represented in the charts above, our balance sheet measures have improved across the board. As a result, we have demonstrated our ability to meet or exceed the requirements of various regulations, including Basel III capital, the supplementary leverage ratio and the liquidity coverage ratio.

The combination of a solid financial foundation and a focused operating strategy provides the ability to adapt quickly. Our balance sheet is less than one-half the size of the peer average.* And, our total staff level is less than 20 percent of the peer average. We are an institutional client firm, with a broad range of services. Our retail clients are largely high-net-worth individuals, with an average account size of more than $40 million. In short, we are not simple, but we are simpler.

* U.S. peers include BAC, C, JPM and MS.

Our strong and stable financial footing has given us the wherewithal to stay committed to our core set of businesses over the cycle. We work with tens of thousands of companies, institutions, investing entities, governments and high-net-worth individuals around the world.

Partly because we have remained focused on executing our strategy through our core businesses, we have grown our client franchise over the last several years. Institutional Client Services, for example, has seen an approximately 10 percent increase in active clients since 2010.

Our mix of businesses reflects the diverse needs of our clients. And, the products and services we provide produce a diverse and balanced revenue stream.

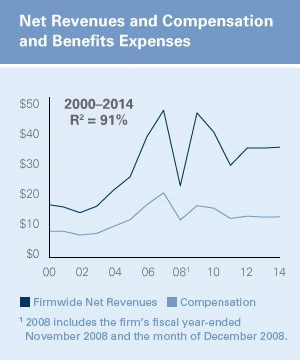

In addition to better revenue stability, we have benefited from a variable cost structure. We have long had a “pay for performance” culture. The bottom chart depicts the strong correlation between the firm’s performance and its levels of compensation and benefits expense.

To us, this graph underscores the value of a true partnership culture. Culture is not preordained or guaranteed in perpetuity. Since we became a public company, we have invested an enormous amount of time and resources to sustain our culture. Rigorous partner selection and aligning compensation with long-term performance reinforce an ethos of long-term ownership.

The combination of a diverse set of businesses, effective risk management and a “pay for performance” culture has produced a track record of lower earnings volatility than our peers. From 2005 through 2014, Goldman Sachs’ net earnings to common volatility averaged roughly 50 percent vs. 130 percent for peers.

Our relative earnings stability is critical to our ability to outperform throughout the cycle. We performed when conditions were challenged and we also performed when the environment was more favorable.

Against the backdrop of relatively consistent revenues, we have performed well across several key metrics.

Compared to 2012, earnings per share is 21 percent higher, book value per share is 13 percent higher and our common stock dividends per share have grown 27 percent. Over this three-year period, we have returned $16 billion via share repurchases, while maintaining stronger capital ratios.

Net revenues were roughly flat over the past three years. But, that’s not the story. Since 2012, we undertook several strategic initiatives to respond to new regulations, including higher capital requirements. We sold a majority stake in both our Americas reinsurance business and our European insurance business — and we liquidated our investment in the Industrial and Commercial Bank of China. We also sold our hedge fund administration business and our REDI platform.

In 2012, these businesses and investments produced $2.3 billion in net revenues. So, on a “like-for-like” basis, net revenues in 2014 were about $2.7 billion higher than 2012. Investment Management and Investment Banking contributed $2.4 billion to this growth.

We have grown revenues while managing expenses and capital. Our average compensation and benefits to net revenues ratio from 2009 through 2014 was more than 900 basis points lower than it was from 2000 through 2007, despite a tougher revenue environment.

We have been equally focused on capital efficiency. We have developed technology to help inform our capital allocation decisions. The combination of our profitability and risk management allowed us to pay out roughly 70 percent of our net earnings to common shareholders since the beginning of 2009 and basic share count has declined by 17 percent since the end of that year. Since the end of 1999, our basic share count is seven percent lower, while our common equity is actually more than seven times higher.

These efforts not only protected near-term returns, they have also positioned the firm to benefit from operating leverage when the environment improves.

As the cycle turns, our strategic focus shifts to growing revenues and the ability to deliver greater operating leverage to our shareholders through margin expansion. In that vein, we want to review our businesses and opportunities.

Investment Banking

In Investment Banking, we have the preeminent client franchise. We advised on more than $1 trillion of announced transactions last year, the highest level since 2007. We have maintained a leading market share over the last 25 years. We maintained our market position when M&A activity was dominated by technology in 1999, by financials in 2008 and by natural resources in 2014.

And, we have maintained our position when volumes were low and when they were higher. Our performance carries through to different industries, market environments and regions. Our success is rooted in decades of investment, consistency of coverage and a broad client franchise by both industry and geography.

We see a number of growth opportunities on the horizon. Global economic growth continues to be the biggest driver of the opportunity set. In 2014, global M&A volume as a percentage of market capitalization was roughly 100 basis points below the 15-year average. Returning to the historical average would drive $630 billion of incremental M&A volume.

We are particularly well-positioned for growth in cross-border activity given our global footprint. And, we believe that the demand for funding and capital remains highly correlated to economic growth and broader corporate activity.

Institutional Client Services

In Institutional Client Services, we benefit from having both a leading fixed income franchise and a leading equities franchise. And, we have a global footprint. While having a diversified mix of businesses supports revenue stability, it is also crucial to driving stable and attractive margins. We also have a balance of activities and products that are “high” capital and “low” capital intensive.

Institutional Client Services is one of our most dynamic businesses. It has always been in a state of evolution. The introduction of new regulations has accelerated the evolution in certain areas, including market structure. As a consequence, the value placed on adaptability and operational excellence has significantly grown.

Regulatory requirements and technological investments have raised the barriers to entry higher than at any other time in recent history. This is an expensive business to be in if you don’t have the market share and scale. Consider the numerous business exits that have been announced by our peers, as they reassess their competitive positioning and relative returns.

Longer term, we believe that the value being placed on liquidity provisioning is likely to grow, especially in the context of a more rational marketplace. This provides an opportunity for market share expansion for those firms with strong, global and stable client franchises. Technological innovation will continue to be important and may increasingly become a differentiator amongst competitors and a potential driver of new or incremental revenues. Going forward, we believe that these requirements will likely lead to only a handful of players being able to effectively compete on a global basis.

Investing & Lending

Another core part of our mission and strategy is to provide promising businesses with the capital they need to grow. Sometimes that means offering a loan and, other times, it means making an equity investment. We are able to leverage our global investor network and invest alongside these clients in industries that create jobs and promote economic growth.

These loans and commitments include major infrastructure projects, clean energy and technology companies, and cutting-edge healthcare businesses. Including our own commitments, during 2014 we closed on more than $15 billion of debt and equity capital raised in private equity and credit funds.**

** Fees generated through the management of client assets in such funds are included in Investment Management.

Our ability to provide equity capital has been important to growing companies. We have a diversified portfolio of companies which helps drive strong performance for both our co-investors and shareholders. For example, between 2012 and 2014, our private equity and credit funds distributed more than $40 billion. And generally, our co-investors are clients of the firm, whether it is with Investment Banking, Institutional Client Services or Investment Management.

We will continue to invest and grow our existing investment strategies. At the same time, we will seek growth in new regions and across new strategies.

Lending has become an increasingly important part of our strategy as it relates to corporate, real estate and private wealth clients.

Our private wealth commitments and lending portfolio has been a particular source of significant growth. The portfolio benefits from both the level of collateralization and the fact that borrower credit quality for our average private wealth client is extremely high.

We see an opportunity to continue to grow our lending activities in ways that are accretive to current returns. Since 2012, we’ve made great strides in this business, growing lending by roughly 100 percent. As we grow, we maintain our same conservative and rigorous risk management policies to ensure quality and prudence.

Investment Management

We have made significant progress in our Investment Management business over the last few years. Assets under supervision have grown 32 percent since 2011 to nearly $1.2 trillion at the end of 2014. Still, we are only the 10th-largest asset manager globally, so there is significant room for growth. Within fixed income products, we are approximately 40 percent of the size of the largest peer. Within equities products, we are about one-quarter of the size of our largest competitor. And for alternatives, we are approximately two-thirds the size of the largest peer.

We remain focused on delivering strong performance for clients, which has already driven meaningful growth. At the end of last year, 83 percent of our client mutual fund assets ranked in the top two quartiles on a 3-year basis, and 75 percent ranked in the top two quartiles on a 5-year basis.*** In 2014, Investment Management attracted over $85 billion in fee-based assets organically.

*** Performance calculated using period-end data for global long-term fund assets (non-money market) for all share classes ranked by Morningstar.

We also see attractive opportunities to expand our private wealth management platform. Among the distinguishing characteristics of this franchise is its connectivity to our investment banking efforts, which serves as an important sourcing mechanism. For example, the opportunity for our private wealth clients to invest in Facebook and Uber originated from a banking relationship.

We continue to invest in long-term strategic initiatives, like advisory, defined contribution, insurance and private banking. We have also looked for accretive acquisitions, having recently bought Deutsche Asset & Wealth Management’s stable value business and Dwight Asset Management. Performing for our clients and expanding our product offerings will help support continued growth going forward.

Our People

This year, we marked our 145th anniversary as a firm. Over that time, our people and culture have helped define our success. We place a huge priority on preserving and enhancing a tangible environment of teamwork, client focus and long-term stewardship. We are proud that these attributes are as strong and vibrant as ever.

In terms of recruiting, in 2014, nearly 270,000 applicants applied for 8,300 positions. And, of those receiving offers, nearly 90 percent chose to come to Goldman Sachs.

In November 2014, we announced our newest class of 78 partners. The rigor and focus surrounding this biennial process is intense and that investment continues to pay dividends. The partnership is vital to helping ensure a real sense of long-term ownership.

For all of our people, we continue to invest in a workplace environment, including programs and training, which has consistently earned the firm recognition as one of the most attractive places to work.

In 2014, we were proud to be named as one of Fortune magazine’s “100 Best Companies to Work For.” Goldman Sachs is one of only five companies to be recognized every year that the Great Place to Work Institute has issued its list since 1984. And for nine consecutive years, the firm has been named to Working Mother magazine’s “100 Best Companies,” which ranks companies with the best programs that support working parents.

Few people have contributed more to our culture and generations of leaders at Goldman Sachs than John Whitehead. Earlier this year, John passed away. We honor his achievements and contributions in service to his country and our firm. John was a man of enormous grace and integrity, and his legacy will endure in the institutions he led and in the lives of those he cared for and mentored. We highlight John’s extraordinary contributions later in the Annual Report.

Our Board of Directors

We were also deeply sad to lose our former lead director, Jim Schiro, to cancer. Jim joined our Board of Directors in May 2009, and was elected lead director and named chair of the Corporate Governance, Nominating and Public Responsibilities Committee in May 2012.

Jim was an outstanding Board member and an exceptional individual who made an invaluable contribution to our firm and to all those who worked with him. We will remember him for his unfailing commitment to Goldman Sachs and to our shareholders and for the example he set as a leader and mentor.

He lived his life to make a difference and the mark he has left on institutions and people is powerful. Jim was methodical and careful, yet expansive and philosophical. He understood the black and white of the numbers better than anyone, but appreciated the human element better than most.

For a lot of his tenure on our Board, our firm faced tough scrutiny. He gave us the confidence to be proactive and to deal forthrightly with the issues we were confronting. He asked probing questions that always got to the heart of the matter. Jim had an enormous impact on Goldman Sachs, and on our leadership team. He made us a better company, and, for all those he worked with, better people.

Following Jim’s retirement, Adebayo Ogunlesi was appointed lead director and chair of the Corporate Governance, Nominating and Public Responsibilities Committee.

Adebayo is the managing partner and chairman of Global Infrastructure Partners, a private equity firm that invests worldwide in infrastructure assets. Previously, he held various positions at Credit Suisse Investment Bank (and predecessor firms), including as executive vice chairman and head of global investment banking. Adebayo’s extensive knowledge of finance and global capital markets provides valuable insight and direction for our Board.

After 12 years of distinguished service, Claes Dahlbäck decided to retire from the Goldman Sachs Board of Directors this coming May.

Claes’ global experience, independent and wise judgment and quiet leadership made him an invaluable voice on our Board. His deep understanding of global markets, our business and our culture has benefited the firm enormously.

We thank him for his unfailing commitment to our shareholders and our people.

We are pleased to announce two additions to our Board of Directors, Mark Flaherty and Mark Winkelman.

Mark Flaherty has more than 20 years of experience in investment management. He served as vice chairman of Wellington Management Company before retiring in 2012. Previously, he was director of the company’s global investment services from 2002 to 2012, and served as partner and senior vice president from 2001 to 2012.

Mark Winkelman currently serves on the Board of Directors of Anheuser-Busch InBev. From 2006 to 2008, he served as operating partner of J.C. Flowers & Co. Previously, Mark held several leadership positions at Goldman Sachs before retiring from the firm in 1994, including co-head of the Fixed Income Division. During the course of his career, Mark has demonstrated exceptional judgment, market knowledge and risk management.

We know that our Board, our shareholders and our people will benefit from their deep and varied understanding of economies, global markets and the financial services industry.

Corporate Engagement

Throughout the year, Goldman Sachs continued to engage on broader public policy matters that have the potential to spur economic growth and stability. In June, we convened the North American Energy Summit to discuss how to maximize the economic benefits of North American energy resources through enhanced regional integration and cooperation. Policymakers and corporate and NGO leaders examined the impact of relevant geopolitical, economic and environmental factors around the enormous energy opportunity that will continue to have a profound influence on the global economy.

We hosted the China-U.S. CEO Bilateral Investment Dialogue in Beijing and later in New York, bringing CEOs of some of the largest Chinese and U.S. companies together with policymakers to discuss how to encourage more cross-border trade and investment. Our collective futures are dependent on the relationship between the U.S. and China, and there’s nothing more important to that relationship than advancing the mechanisms for more economic activity between these two countries.

And, as explained below, we attended various 10,000 Small Businesses graduations across the U.S. At each event, whether it was in Detroit, Los Angeles or Miami, we saw how the combined impact from know-how and confidence can advance people and the local economy. And, with each entrepreneur we meet through 10,000 Women, we recognized how a practical business education and, increasingly, effective access to capital can transform a small business and consequently a family and a community.

10,000 Small Businesses

10,000 Small Businesses continued to help small business owners grow and create jobs through access to business and management education, business services and capital. By year’s end, 10,000 Small Businesses was operating in 23 sites in the U.S. and U.K. and had served over 4,000 entrepreneurs. In the U.S., we launched a new site in Dallas/Fort Worth as well as the inaugural cohort of a new national partnership that allows qualified small business owners from across the U.S. to receive training both online and at Babson College. This innovative model has extended the reach of 10,000 Small Businesses to business owners in 45 states across the U.S.

Stimulating Small Businesses Growth, a report released in 2014 from lead academic partner Babson College, demonstrates the impact of the program. Within six months of graduating, 64 percent of U.S. participants have reported increasing their revenues and 45 percent reported creating net new jobs. We are proud that the program maintains a 99 percent graduation rate and graduates have developed a strong marketplace among themselves, as 80 percent of participants have done some form of business with another graduate.

10,000 Women

10,000 Women launched an important new partnership in 2014 with International Finance Corporation (IFC), a member of the World Bank Group, to create the first-ever global finance facility dedicated exclusively to women-owned small- and medium-sized enterprises. The facility is a $600 million effort to enable approximately 100,000 women entrepreneurs to access capital. Since its launch, seven transactions in seven countries, including China, Brazil and Kenya, have been closed, representing over $150 million in commitments.

10,000 Women remains committed to providing a business and management education, mentoring and networking to high-potential women entrepreneurs around the world. Since it was announced in 2008, the initiative has reached more than 10,000 women entrepreneurs from over 40 countries around the world. Delivered through a network of 90 academic and nonprofit partners, 10,000 Women continues to yield promising results. Nearly 70 percent of surveyed graduates have increased revenues and 60 percent have added new jobs.

Goldman Sachs Gives

Goldman Sachs Gives is a donor-advised fund through which participating managing directors (PMDs) of the firm can recommend grants to qualified nonprofit organizations around the world. In 2014, PMD compensation was reduced by approximately $157 million related to Goldman Sachs Gives, $137 million of which was a charitable contribution in 2014, and 4,400 grants totaling more than $146 million were made to nonprofit organizations assisting underserved people and communities across a range of areas. Since the Goldman Sachs Gives’ launch in 2010, approximately 19,000 grants totaling more than $860 million have been made to various nonprofits in 45 countries.

A continuing focus for Goldman Sachs Gives is its support of need-based financial aid to more than 200 colleges and universities globally to ensure students are able to complete their college degrees. In particular, a number of the firm’s partners, including all of the U.S.-based members of our Management Committee, recently made individual Goldman Sachs Gives’ grant recommendations to support LaGuardia Community College, based in Queens, New York. These grants represent the largest private donation in the school’s history. In addition, the partners’ recommendations created the Goldman Sachs Community College Fund to provide need-based financial aid to additional community colleges around the country.

As part of the firm’s commitment to hire and retain veterans, and support the military community, Goldman Sachs Gives remains focused on making grants to honor service and veterans. Demonstrating Goldman Sachs Gives’ scope, during 2014, it supported nonprofit activities in 29 countries — from building libraries in Cambodia, to fighting Ebola in Africa, to raising awareness of hunger issues in India, and advancing cancer research in the United States and the United Kingdom.

Looking Ahead

The global economic recovery remains fragile and geopolitical risk in Europe and the Middle East will continue to have varying degrees of influence on market sentiment.

Still, conditions at this point are more conducive for our set of businesses than in recent years. Job growth in the U.S. is strong and prospects for above trend GDP growth are good. CEO confidence is up and consumer sentiment is generally better. More than six years after the financial crisis, we are finally seeing dispersion in central bank policies, which, over time, may contribute to more normalized markets and levels of volatility.

Over the last few years, we have protected and expanded our client franchise across our major businesses. Our client franchise today is as strong as ever. We have transformed the financial profile of the firm. We have been proactive in managing our cost structure. We have significantly adjusted both compensation levels and fixed expenses.

We have been judicious managers of capital. We have maintained our culture of client service and partnership. We remain the employer of choice in our industry.

Taken together, we are confident that we have positioned the firm to provide operating leverage for our shareholders as the economy and opportunity set improves.

Lloyd C. Blankfein

Chairman and Chief Executive Officer

Gary D. Cohn

President and Chief Operating Officer