Goldman Sachs is a leading global investment banking and securities

firm with three principal business lines:

- Investment Banking;

- Trading and Principal Investments; and

- Asset Management and Securities Services.

Our goal is to be the advisor of choice for our clients and a leading

participant in global financial markets. We provide services worldwide to a

substantial and diversified client base, which includes corporations, financial

institutions, governments and high net worth individuals.

Because we believe that the needs of our clients are global and that

international markets have high growth potential, we have built upon our

strength in the United States to achieve leading positions in other parts of the

world. Today, we have a strong global presence as evidenced by the geographic

breadth of our transactions, leadership in our core products and the size of our

international operations. As of February 1999, we operated offices in 23

countries and 36% of our 13,000 employees were based outside the United

States.

We are committed to a distinctive culture and set of core values. These

values are reflected in our Business Principles, which emphasize placing our

clients' interests first, integrity, commitment to excellence and innovation,

and teamwork.

Goldman Sachs is managed by its principal owners. Simultaneously with

the offerings, we will grant restricted stock units, stock options or interests

in a defined contribution plan to substantially all of our employees. Following

the offerings, our employees, including former partners, will own approximately

65% of Goldman Sachs. None of our employees are selling shares in the

offerings.

Goldman Sachs is the successor to a commercial paper business founded

in 1869 by Marcus Goldman. Since then, we have grown our business as a

participant and intermediary in securities and other financial activities to

become one of the leading firms in the industry.

In 1989, The Goldman Sachs Group, L.P. was formed to serve as the

parent company of the Goldman Sachs organization. As of November 30, 1996, The

Goldman Sachs Group, L.P. was restructured. On that date, the non-retiring

former general partners of The Goldman Sachs Group, L.P. converted their general

partner interests into limited partner interests and became profit participating

limited partners of The Goldman Sachs Group, L.P. Concurrently, The Goldman

Sachs Corporation was admitted as The Goldman Sachs Group, L.P.'s sole general

partner. The common stock of The Goldman Sachs Corporation is owned by our

managing directors who are profit participating limited partners, all of whom

are active in our businesses.

The Goldman Sachs Group, Inc. was formed to succeed to the business of

The Goldman Sachs Group, L.P. Simultaneously with the offerings, we will

complete a number of transactions in order to convert from partnership to

corporate form. See "Certain Relationships and Related

Transactions — Incorporation and Related Transactions" for additional

information concerning these transactions.

Except as otherwise indicated, all amounts with respect to the volume,

number and market share of mergers and acquisitions and underwriting

transactions and related ranking information have been derived from information

compiled and classified by Securities Data Company. Securities Data Company

obtains and gathers its information from sources it considers reliable, but

Securities Data Company does not guarantee the accuracy or completeness of the

information. In the case of mergers and acquisitions, data are based upon the

dollar value of announced transactions for the period indicated, taken as a

whole, with full credit to each of the advisors to each party in a transaction.

In the case of underwritings, data are based upon the dollar value of total

proceeds raised (exclusive of any option to purchase additional shares) with

equal credit to each bookrunner for the period indicated, taken as a whole. As a

result of this method of compiling data, percentages may add to more than

100%.

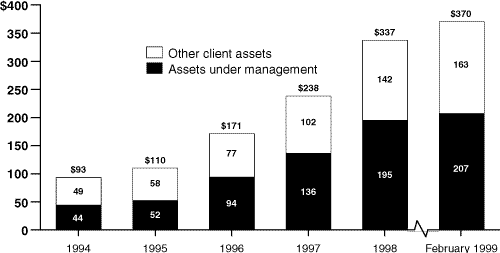

Our strategy is to grow our three core businesses — Investment

Banking, Trading and Principal Investments, and Asset Management and Securities

Services — in markets throughout the world. Our leadership position in

investment banking provides us with access to governments, financial

institutions and corporate clients globally. Trading and principal investing has

been an important part of our culture and earnings, and we remain committed to

these businesses irrespective of their volatility. Managing wealth is one of the

fastest growing segments of the financial services industry and we are

positioning our asset management and securities services businesses to take

advantage of that growth. Our assets under supervision, for example, have grown

from $92.7 billion as of November 1994 to $369.7 billion as of February 1999,

representing a compound annual growth rate of 38%.

Our business lines are comprised of various product and service

offerings that are set forth in the following chart:

| Investment Banking |

Trading and Principal Investments |

Asset Management and Securities Services |

| — Equity and debt underwriting — Financial restructuring advisory services — Mergers and acquisitions advisory services — Real estate advisory services |

— Bank loans — Commodities — Currencies — Equity and fixed income derivatives — Equity and fixed income securities — Principal investments — Proprietary arbitrage |

— Commissions — Institutional and high net worth asset management — Margin lending — Matched book — Merchant banking fees — Increased shares of merchant banking fund income and gains — Mutual funds — Prime brokerage — Securities lending |

Investment Banking

Investment Banking represented 39% of 1998 net revenues and 35% of 1997

net revenues. We are a market leader in both the

financial advisory and underwriting businesses, serving over 3,000 clients

worldwide. For the period January 1, 1994 to December 31, 1998, we had the

industry-leading market share of 25.3% in worldwide mergers and acquisitions

advisory services, having advised on over $1.7 trillion of transactions. Over

the same period, we also achieved number one market shares of 15.2% in

underwriting worldwide initial public offerings and 14.4% in underwriting

worldwide common stock issues.

Trading and Principal Investments

Trading and Principal Investments represented 28% of 1998 net revenues

and 39% of 1997 net revenues. We make markets in equity and fixed income

products, currencies and commodities; enter into swaps and other derivative

transactions; engage in proprietary trading and arbitrage; and make principal

investments. In trading, we focus on building lasting relationships with our

most active clients while maintaining leadership positions in our key markets.

We believe our research, market-making and proprietary activities enhance our

understanding of markets and ability to serve our clients.

Asset Management and Securities Services

Asset Management and Securities Services represented 33% of 1998 net

revenues and 26% of 1997 net revenues. We provide global investment management

and advisory services; earn commissions on agency transactions; manage merchant

banking funds; and provide prime brokerage, securities lending and financing

services. Our asset management business has grown rapidly, with assets under

supervision increasing from $92.7 billion as of November 25, 1994 to $369.7

billion as of February 26, 1999, representing a compound annual growth rate of

38%. As of February 26, 1999, we had $206.4 billion of assets under management.

We manage merchant banking funds that had $15.5 billion of capital commitments

as of the end of 1998.

We pursue our strategy to grow our three core businesses through an

emphasis on:

Expanding High Value-Added Businesses

To achieve strong growth and high returns, we seek to build leadership

positions in high value-added services for our clients. For example, we have

substantially increased the number of professionals in investment banking to

improve and expand our ability to execute mergers and acquisitions, initial

public offerings and high-yield financings. In trading, we structure and execute

large and complex transactions for institutional investors, pension funds and

corporate clients around the world. In asset management, we emphasize equity and

alternative investment products and use our established international presence

to build a global asset management franchise.

Increasing the Stability of Our Earnings

We seek to balance the stability of our earnings with return on equity

and long-term earnings growth. We believe our trading businesses are key

ingredients to our success. While we plan to continue to grow our trading

businesses, the financial market shocks of the past year underscored the

importance of our strategy of emphasizing growth in our investment banking,

asset management and securities services businesses. Through a greater relative

emphasis on these businesses, our goal is to gradually increase the stability of

our earnings.

Pursuing International Opportunities

We believe that our global reach will allow us to take advantage of

growth in international markets. In Europe, for example, we anticipate that the

recent establishment of the European Economic and Monetary Union will, over

time, create a large pan-European market rivaling the U.S. capital markets in

size and liquidity. We believe this will generate increased activity across our

businesses in the region. In Asia, we believe that an increase in corporate

restructurings and in the need for liquidity will increase our mergers and

acquisitions and trading opportunities. In the longer term, we anticipate

additional opportunities in asset management activities due to a shift we

anticipate toward the privatization of pension systems and in demographics.

Leveraging the Franchise

We believe our various businesses are generally stronger and more

successful because they are part of the Goldman Sachs franchise. Our culture of

teamwork fosters cooperation among our businesses, which allows us to provide

our clients with a full range of products and services on a coordinated basis.

Our investment bankers, for example, refer clients who are selling their

businesses to those in Goldman Sachs who manage wealth. In addition, our

merchant banking investments in companies lead to future clients for investment

banking.

Strong Client Relationships

We focus on building long-term client relationships. In 1998, over 75%

of our Investment Banking revenues represented business from existing clients.

We also aggressively pursue new client relationships as evidenced by the over

400 investment banking transactions we completed for first-time clients in 1998.

In our trading businesses, we structure and execute transactions across a wide

array of markets and countries to meet our clients' needs. In our asset

management business, we managed assets for three of the five largest pension

pools in the United States as ranked as of September 30, 1998 by Pensions &

Investments and maintain accounts for 41% of the 1998 "Forbes 400 List of the

Richest Americans".

Distinctive People and Culture

Our most important asset is our people. We seek to reinforce our

employees' commitment to our culture and values through recruiting, training, a

comprehensive 360-degree review system and a compensation philosophy that

rewards teamwork. We were ranked number seven in Fortune magazine's "The

100 Best Companies to Work for in America" in January 1999 and were ranked

number three in Fortune magazine's 1999 "The Top 50 MBA Dream Companies",

the highest-ranked investment banking and securities firm in each case.

Global Reach

Over the past decade, we have made a significant commitment to building

a worldwide business. We have achieved leading positions in major international

markets by capitalizing on our product knowledge and global research, as well as

by building a local presence where appropriate. In doing so, we have become one

of the few truly global investment banking and securities firms with the ability

to execute large and complex cross-border transactions. We had the number one

market share of 23.2% in cross-border mergers and acquisitions for the period

January 1, 1994 to December 31, 1998. In addition, in Japan, we were the largest

non-Japanese mutual fund manager as of the end of February 1999, according to

The Investment Trusts Association.

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| Net revenues: | |||||

| Investment Banking | $2,113 | $2,587 | $3,368 | $ 633 | $ 902 |

| Trading and Principal Investments | 2,693 | 2,926 | 2,379 | 1,182 | 1,357 |

| Asset Management and Securities Services | 1,323 |

1,934 |

2,773 |

657 |

736 |

| Total net revenues | $6,129 |

$7,447 |

$8,520 |

$2,472 |

$2,995 |

Goldman Sachs provides a broad range of investment banking services to

a diverse group of over 3,000 clients worldwide, including corporations,

financial institutions, governments and individuals. Our investment banking

activities are divided into two categories:

- Financial Advisory. Financial advisory includes advisory

assignments with respect to mergers and acquisitions, divestitures,

corporate defense activities, restructurings and spin-offs; and

- Underwriting. Underwriting includes public offerings and private

placements of equity and debt securities.

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| Financial advisory | $ 931 | $1,184 | $1,774 | $363 | $522 |

| Underwriting | 1,182 |

1,403 |

1,594 |

270 |

380 |

| Total Investment Banking | $2,113 |

$2,587 |

$3,368 |

$633 |

$902 |

In Investment Banking, we provide our clients with quality advice and

execution as part of our effort to develop and maintain long-term relationships

as their lead investment bank.

Organization

We have continuously adapted our organizational structure to meet

changing market dynamics and our clients' needs. Our current structure, which is

organized along regional, execution and industry groups, seeks to combine

client-focused investment bankers with execution and industry expertise. Because

our businesses are global, we have adapted our organization to meet the demands

of our clients in each geographic region. Through our commitment to teamwork, we

believe that we provide services in an integrated fashion for the benefit of our

clients.

We believe an important competitive advantage in our marketing effort

is Investment Banking Services, a core group of professionals who focus on

developing and maintaining strong client relationships. These bankers, who are

organized regionally and/or by industry group, work with senior executives of

our clients to identify areas where Goldman Sachs can provide capital-raising,

financial advisory or other products and services. The broad base of experience

and knowledge of our Investment Banking Services professionals enables them to

analyze our clients' objectives efficiently and to bring to bear the appropriate

resources of Goldman Sachs to satisfy those objectives.

Our Corporate Finance, Debt and Equity Capital Markets, Leveraged

Finance and Mergers and Acquisitions groups bring product expertise and

innovation to clients in a variety of industries. These groups are responsible

for the execution of specific client transactions as well as the building of

strong client relationships.

In an effort to serve our clients' needs in targeted industries, we

have established several industry focus groups. These include: Chemicals;

Communications, Media and Entertainment; Energy and Power; Financial

Institutions; Healthcare; Technology; Hotels and Gaming; Real Estate;

Retailing; and Transportation. Drawing on specialized knowledge of

industry-specific trends, these groups provide the full range of investment

banking products and services to our clients.

Reflecting our commitment to innovation, Investment Banking has

established a New Products group whose professionals focus on creating new

financial products. These professionals have particular expertise in integrating

finance with accounting, tax and securities laws and work closely with other

investment banking teams to provide innovative solutions to difficult client

problems. Our structuring expertise has proven to be particularly valuable in

addressing client needs in areas such as complex cross-border mergers and

acquisitions and convertible and other hybrid equity financings.

Financial Advisory

Financial advisory includes a broad range of advisory assignments with

respect to mergers and acquisitions, divestitures, corporate defense activities,

restructurings and spin-offs. Goldman Sachs is a leading investment bank in

worldwide mergers and acquisitions. During calendar 1998, we advised on 340

mergers and acquisitions transactions with a combined value of $957 billion.

Our mergers and acquisitions capabilities are evidenced by our

significant share of assignments in large, complex transactions where we provide

multiple services, including "one-stop" acquisition financing, currency hedging

and cross-border structuring expertise. Goldman Sachs advised on seven of the

ten largest mergers and acquisitions transactions through December 31, 1998. We

have also been successful in Europe, including in intra-country transactions,

and we

are a leading mergers and acquisitions advisor in France, Germany and Spain.

The following table illustrates our leadership in the mergers and

acquisitions advisory market for the indicated period taken as a whole:

| Category |

Rank(1) |

Market Share |

Volume |

Number of Transactions |

|---|---|---|---|---|

| Worldwide | 1 | 25.3% | $1,715 | 1,334 |

| Worldwide, transactions over $500 million | 1 | 34.8 | 1,593 | 470 |

| Worldwide, transactions over $1 billion | 1 | 38.4 | 1,470 | 297 |

| United States | 1 | 32.8 | 1,316 | 907 |

| United States, transactions over $500 million | 1 | 41.3 | 1,228 | 339 |

| United States, transactions over $1 billion | 1 | 44.3 | 1,142 | 221 |

(1) Rank in any one year during the period presented may vary from the

rank for the period taken as a whole.

Mergers and acquisitions is an example of how one activity can generate

cross-selling opportunities for other areas of Goldman Sachs. For example, a

client we are advising in a purchase transaction may seek our assistance in

obtaining financing and in hedging interest rate or foreign currency risks

associated with the acquisition. In the case of dispositions, owners and senior

executives of the acquired company often will seek asset management services. In

these cases, our high net worth relationship managers provide comprehensive

advice on investment alternatives and execute the client's desired strategy.

Underwriting

From January 1, 1994 through March 31, 1999, Goldman Sachs has served

as lead manager in transactions that have raised more than $1 trillion of

capital for clients worldwide. We underwrite a wide range of securities and

other instruments, including common and preferred stock, convertible securities,

investment grade debt, high-yield debt, sovereign and emerging markets debt,

municipal debt, bank loans, asset-backed securities and real estate-related

securities, such as mortgage-backed securities and the securities of real estate

investment trusts.

Equity Underwriting. Equity underwriting has been a long-term

core strength of Goldman Sachs. The following table illustrates our leadership

position in equity underwriting for the indicated period taken as a whole:

| Category |

Rank(1) |

Market Share |

Total Proceeds Raised |

Number of Issues(2) |

|---|---|---|---|---|

| Worldwide initial public offerings | 1 | 15.2% | $ 44 | 300 |

| Worldwide initial public offerings, proceeds over $500 million | 1 | 23.3 | 25 | 59 |

| Worldwide public common stock offerings | 1 | 14.4 | 101 | 634 |

| U.S. initial public offerings | 1 | 15.3 | 31 | 179 |

| U.S. initial public offerings, proceeds over $500 million | 1 | 30.1 | 16 | 29 |

| U.S. public common stock offerings | 2 | 14.3 | 71 | 381 |

(1) Rank in any one year during the period presented may vary from the

rank for the period taken as a whole.

(2) The number of issues reflects the number of tranches; an offering by

a single issuer could have multiple tranches.

As with mergers and acquisitions, we have been particularly successful

in winning mandates for large, complex equity underwritings. As evidenced in the

chart above, our market share of initial public offerings with total proceeds

over $500 million is substantially higher than our market share of all initial

public offerings. We believe our leadership in large initial public offerings

reflects our expertise in complex transactions, research strengths, track record

and distribution capabilities. In the international arena, we have also acted as

lead manager on many of the largest initial public offerings. We were named the

Asian Equity House of the Year by International Financing Review in

1998.

We believe that a key factor in our equity underwriting success is the

close working relationship between the investment bankers, research analysts and

sales force as coordinated by our Equity Capital Markets group. Goldman Sachs'

equities sales force is one of the most experienced and effective sales

organizations in the industry. With 350 institutional sales professionals and

420 high net worth relationship managers located in every major market around

the world, Goldman Sachs has relationships with a large and diverse group of

investors.

Global Investment Research is critical to our ability to succeed in the

equity underwriting business. We believe that high quality equity research is a

significant competitive advantage in the market for new equity issues. In this

regard, Goldman Sachs' research has been consistently ranked among the

industry's global leaders. See "— Global Investment Research" for detailed

information regarding our Global Investment Research Department.

Debt Underwriting. We engage in the underwriting and origination

of various types of debt instruments that we broadly categorize as follows:

investment grade debt for corporations, governments, municipalities and

agencies; leveraged finance, which includes high-yield debt and bank loans for

non-investment grade issuers; emerging market debt, which includes corporate and

sovereign issues; and asset-backed securities. We have employed a focused

approach in debt underwriting, emphasizing high value-added areas in servicing

our clients.

We believe that the leveraged finance market is a key growth

opportunity for our debt underwriting business. Over the last three years, we

have more than doubled the number of debt underwriting professionals dedicated

to this area.

The table below sets forth our rank, market position, our total

proceeds raised and the number of debt transactions in which we have acted as underwriter in the following areas for the indicated period

taken as a whole:

| Category(1) |

Rank(5) |

Market Share |

Total Proceeds Raised |

Number of Issues(6) |

|---|---|---|---|---|

| Worldwide debt(2) | 3 | 8.4% | $695 | 4,684 |

| Worldwide straight debt(3) | 3 | 8.9 | 559 | 4,165 |

| U.S. investment grade straight debt(3) | 3 | 12.0 | 419 | 3,590 |

| U.S. investment grade industrial straight debt(3) | 1 | 19.5 | 81 | 517 |

| U.S. high-yield debt(4) | 5 | 8.0 | 33 | 184 |

(1) All categories include publicly registered and Rule 144A issues.

(2) Includes non-convertible preferred stock, mortgage-backed

securities, asset-backed securities and taxable municipal debt.

(3) "Straight debt" excludes non-convertible preferred stock,

mortgage-backed securities, asset-backed securities and municipal

debt.

(4) Excludes issues with both investment grade and non-investment grade

ratings, often referred to as "split-rated issues".

(5) Rank in any one year during the period presented may vary from the

rank for the period taken as a whole.

(6) The number of issues reflects the number of tranches; an offering by

a single issuer could have multiple tranches.

Our Trading and Principal Investments business facilitates customer

transactions and takes proprietary positions through market-making in and

trading of fixed income and equity products, currencies, commodities, and swaps

and other derivatives. In order to meet the needs of our clients, our Trading

and Principal Investments business is diversified across a wide range of

products. For example, we make markets in traditional investment grade debt

securities, structure complex derivatives and securitize mortgages and insurance

risk. A fundamental tenet of our approach is that we believe our willingness and

ability to take risk distinguishes us and substantially enhances our client

relationships. Our Trading and Principal Investments business includes the

following:

- Fixed Income, Currency and Commodities. Goldman Sachs makes markets

in and trades fixed income products, currencies and commodities,

structures and enters into a wide variety of derivative transactions and

engages in proprietary trading and arbitrage activities;

- Equities. Goldman Sachs makes markets in and trades equities and

equity-related products, structures and enters into equity derivative

transactions and engages in proprietary trading and equity arbitrage;

and

- Principal Investments. Principal investments primarily represents

Goldman Sachs' net revenues from its investments in its merchant banking

funds.

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| FICC | $1,749 | $2,055 | $1,438 | $ 741 | $ 876 |

| Equities | 730 | 573 | 795 | 365 | 455 |

| Principal investments | 214 |

298 |

146 |

76 |

26 |

| Total Trading and Principal Investments | $2,693 |

$2,926 |

$2,379 |

$1,182 |

$1,357 |

Fixed Income, Currency and Commodities

FICC is a large and diversified operation through which we engage in a

variety of customer-driven market-making and proprietary trading and arbitrage

activities. FICC's principal products are:

- Bank loans

- Commodities

- Currencies

- Derivatives

- Emerging market debt

- Global government securities

- High-yield securities

- Investment grade corporate securities

- Money market instruments

- Mortgage securities and loans

- Municipal securities

In our proprietary activities, we assume a variety of risks and devote

substantial resources to identify, analyze and benefit from these exposures. We

leverage our strong research capabilities and capitalize on our proprietary

analytical models to analyze information and make informed trading judgments. We

seek to benefit from perceived disparities in the value of assets in the trading

markets and from macroeconomic and company-specific trends.

FICC has established itself as a leading market participant by using a

three-part approach to deliver high quality service to its clients. First, we

offer broad market-making, research and market knowledge to our clients on a

global basis. Second, we create innovative solutions to complex client problems

by drawing upon our structuring and trading expertise. Third, we use our

expertise to take positions in markets when we believe the return is at least

commensurate with the risk.

A core activity in FICC is market-making in a broad array of securities

and products. For example, we are a primary dealer in many of the largest

government bond markets around the world, including the United States, Japan,

the United Kingdom and Canada; we are a member of the major futures exchanges;

and we have interbank dealer status in the currency markets in New York, London,

Tokyo and Hong Kong. Our willingness to make markets in a broad range of fixed

income, currency and commodity products and their derivatives is crucial both to

our client relationships and to support our underwriting business by providing

secondary market liquidity. Our clients value counterparties that are active in

the marketplace and are willing to provide liquidity and research-based points

of view. In addition, we believe that our significant investment in research

capabilities and proprietary analytical models are critical to our ability to

provide advice to our clients. Our research capabilities include quantitative

and qualitative analyses of global economic, currency and financial market

trends, as well as credit analyses of corporate and sovereign fixed income

securities.

Our clients often confront complex problems that require creative

approaches. We assist our clients who seek to hedge or reallocate their risks

and profit from expected price movements. To do this we bring to bear the

ability of our experienced professionals to understand the needs of our clients

and our ability to manage the risks associated with complex solutions to

problems. In recognition of our ability to meet these client needs, we were

ranked by Institutional Investor in February 1999 as the number two

derivatives dealer for the second straight year. In addition, we were named by

Euroweek in January 1999 as the "Best provider of swaps and other

derivatives".

Equities

Goldman Sachs engages in a variety of market-making, proprietary

trading and arbitrage activities in equity securities and equity-related

products (such as convertible securities and equity derivative instruments) on a

global basis. Goldman Sachs makes markets and positions blocks of stock to

facilitate customers' transactions and to provide liquidity in the marketplace.

Goldman Sachs is a member of most of the major stock exchanges, including New

York, London, Frankfurt, Tokyo and Hong Kong.

As agent, we execute brokerage transactions in equity securities for

institutional and

individual customers that generate commission revenues. Commissions earned on

agency transactions are recorded in Asset Management and Securities

Services.

In equity trading, as in FICC, we generate net revenues from our

customer-driven business in three ways. First, in large, highly liquid principal

markets, such as the over-the-counter market for equity securities, we undertake

a high volume of transactions for modest spreads. In the Nasdaq National Market,

we were the second largest market maker, by aggregate volume, among the top 100

most actively traded stocks in calendar 1998. Second, by capitalizing on our

strong market relationships and capital position, we also undertake large

transactions, such as block trades and positions in securities, in which we

benefit from spreads that are generally larger. Finally, we also benefit from

structuring complex transactions.

Goldman Sachs was a pioneer and is a leader in the execution of large

block trades (trades of 50,000 or more shares) in the United States and abroad.

In calendar 1998, we executed over 50 block trades of at least $100 million

each. We have been able to capitalize on our expertise in block trading, our

global distribution network and our willingness to commit capital to effect

increasingly large and complex customer transactions. We expect corporate

consolidation and restructuring and increased demand for certainty and speed of

execution by sellers and issuers of securities to increase both the frequency

and size of sales of large blocks of equity securities. We believe that we are

well positioned to benefit from this trend. Block transactions, however, expose

us to increased risks, including those arising from holding large and

concentrated positions and decreasing spreads. See "Risk Factors — Market

Fluctuations Could Adversely Affect Our Businesses in Many Ways — Holding

Large and Concentrated Positions May Expose Us to Large Losses" for a discussion

of the risks associated with holding a large position in a single issuer and

"Risk Factors — The Financial Services Industry Is Intensely Competitive and

Rapidly Consolidating" for a discussion of the competitive risks that we

face.

We are active in the listed options and futures markets, and we

structure, distribute and execute over-the-counter derivatives on market

indices, industry groups and individual company stocks to facilitate customer

transactions and our proprietary activities. We develop quantitative strategies

and render advice with respect to portfolio hedging and restructuring and asset

allocation transactions. We also create specially tailored instruments to enable

sophisticated investors to undertake hedging strategies and establish or

liquidate investment positions. We are one of the leading participants in the

trading and development of equity derivative instruments. We are an active

participant in the trading of futures and options on most of the major exchanges

in the United States, Europe and Asia.

Equity arbitrage has long been an important part of our equity

franchise. Our strategy is based on making investments on a global basis through

a diversified portfolio across different markets and event categories. This

business focuses on event-oriented special situations where we are not acting as

an advisor and on relative value trades. These special situations include

mergers and acquisitions, corporate restructurings, recapitalizations and legal

and regulatory events. Equity arbitrage leverages our global infrastructure and

network of research analysts to analyze carefully a broad range of trading and

investment strategies across a wide variety of markets. Investment decisions are

the product of rigorous fundamental, situational and, frequently, regulatory and

legal analysis. Although market conditions led us to decrease the number and

size of positions maintained by our equity arbitrage business during 1998, we

believe that over time, as opportunities present themselves, our equity

arbitrage business will likely increase its activity.

Trading Risk Management

We believe that our trading and market-making capabilities are key

ingredients to our success. While these businesses have generally earned

attractive returns, we have in the past incurred significant trading losses in

periods of market turbulence, such as in 1994 and 1998. Our trading risk

management process seeks to balance our ability to profit from trading positions

with our exposure to potential losses. Risk management includes input from all

levels of Goldman Sachs, from the trading desks to the Firmwide Risk Committee.

See "Management's Discussion and Analysis of Financial Condition and Results of

Operations — Risk Management" for a further discussion of our risk management

policies and procedures.

1998 Experience. From mid-August to mid-October 1998, the

Russian economic crisis, the turmoil in Asian and Latin American emerging

markets and the resulting move to higher quality fixed income securities by many

investors led to substantial declines in global financial markets. Investors

broadly sold credit-sensitive products, such as corporate and high-yield debt,

and bought higher-rated instruments, such as U.S. Treasury securities, which

caused credit spreads to widen dramatically. This market turmoil also caused a

widespread decline in global equity markets.

As a major dealer in fixed income securities, we maintain substantial

inventories of corporate and high-yield debt. We regularly seek to hedge the

interest rate risk on these positions through, among other strategies, short

positions in U.S. Treasury securities. In the second half of 1998, we suffered

losses from both the decline in the prices of corporate and high-yield debt

instruments that we owned and the increase in the prices of the U.S. Treasury

securities in which we had short positions.

These market shocks also led to trading losses in our fixed income

relative value trading positions. Relative value trading positions are intended

to profit from a perceived temporary dislocation in the relationship between the

values of different financial instruments. From mid-August to mid-October 1998,

the components of these relative value positions moved in directions that we did

not anticipate and the volatilities of certain positions increased to three

times prior levels. When we and other market participants with similar positions

simultaneously sought to reduce positions and exposures, this caused a

substantial reduction in market liquidity and a continuing decline in

prices.

In the second half of 1998, we also experienced losses in equity

arbitrage and in the value of a number of merchant banking investments.

Risk Reduction. Over the course of this period, we actively

reduced our positions and exposure to severe market disruptions of the type

described above. Our current scenario models estimate our exposure to a

substantial widening in credit spreads and adverse movements in relative value

trades of the type experienced in mid-August to mid-October 1998. These models

indicate that, as of November 1998, our exposure to a potential reduction in net

trading revenues as a result of these events was over 40% lower than in August

1998. In addition, the daily VaR of substantially all of our trading positions

declined from $47 million as of May 29, 1998 to $43 million as of November 1998.

The November 1998 daily VaR reflects the reduction in positions discussed above,

offset by the higher market volatility, changes in correlation and other market

conditions experienced in the second half of 1998. If the daily VaR as of

November 1998 had been determined using the volatility and correlation data as

of May 29, 1998, the daily VaR would have been $31 million. See "Management's

Discussion and Analysis of Financial Condition and Results of

Operations — Risk Management" for a discussion of VaR and its

limitations.

As part of the continuous effort to refine our risk management policies

and procedures, we have recently made a number of adjustments to the way that we

evaluate risk

and set risk limits. See "Management's Discussion and Analysis of Financial

Condition and Results of Operations — Risk Management — Market Risk" for a

further discussion of our policies and procedures for evaluating market risk and

setting related limits.

Notwithstanding these actions, we continue to hold trading positions

that are substantial in both number and size, and are subject to significant

market risk. In addition, management may choose to increase our risk levels in

the future. See "Risk Factors — Market Fluctuations Could Adversely Affect

Our Businesses in Many Ways" and "— Our Risk Management Policies and

Procedures May Leave Us Exposed to Unidentified or Unanticipated Risk" for a

discussion of the risks associated with our trading positions.

Principal Investments

In connection with our merchant banking activities, we invest with our

clients by making principal investments in funds that we raise and manage. As of

November 1998, we had committed $2.8 billion, of which $1.7 billion had been

funded, of the $15.5 billion total equity capital committed for our merchant

banking funds. The funds' investments generate capital appreciation or

depreciation and, upon disposition, realized gains or losses. See "— Asset

Management and Securities Services — Merchant Banking" for a discussion of

our merchant banking funds. As of November 1998, our aggregate carrying value of

principal investments held directly or through our merchant banking funds was

approximately $1.4 billion, which was comprised of corporate principal

investments with an aggregate carrying value of approximately $609 million and

real estate investments with an aggregate carrying value of approximately $753

million.

Asset Management and Securities Services is comprised of the

following:

- Asset Management. Asset management generates management fees by

providing investment advisory services to a diverse and rapidly growing

client base of institutions and individuals;

- Securities Services. Securities services includes prime

brokerage, financing services and securities lending and our matched

book businesses, all of which generate revenue primarily in the form of

fees or interest rate spreads; and

- Commissions. Commission-based businesses include agency

transactions for clients on major stock and futures exchanges. Revenues

from the increased share of income and gains derived from our merchant

banking funds are also included in commissions.

| Year Ended November |

Three Months Ended February |

||||

|---|---|---|---|---|---|

| 1996 |

1997 |

1998 |

1998 |

1999 |

|

| Asset management | $ 242 | $ 458 | $ 675 | $139 | $202 |

| Securities services | 354 | 487 | 730 | 170 | 207 |

| Commissions | 727 |

989 |

1,368 |

348 |

327 |

| Total Asset Management and Securities Services | $1,323 |

$1,934 |

$2,773 |

$657 |

$736 |

Asset Management

Goldman Sachs is seeking to build a premier global asset management

business. We offer a broad array of investment strategies and advice across all

major asset classes: global equity; fixed income, including money markets;

currency; and alternative investment products (i.e., investment vehicles

with non-traditional investment objectives and/or strategies). Assets under

supervision are comprised of assets under management and other client assets.

Assets under management typically generate fees based on a percentage of their

value and include our mutual funds, separate accounts managed for institutional

and individual investors, our merchant banking funds and other alternative

investment funds. Other client assets are comprised of assets in brokerage

accounts of primarily high net worth individuals, on which we earn

commissions.

Over the last five years, we have rapidly grown our assets under

supervision, as set forth in the graph below:

(in billions)

The following table sets forth the amount of assets under management by

asset class:

| As of November |

As of February |

|||||

|---|---|---|---|---|---|---|

| 1994 |

1995 |

1996 |

1997 |

1998 |

1999 |

|

| Asset Class | ||||||

| Equity | $ 6 | $ 9 | $34 | $ 52 | $ 69 | $ 73 |

| Fixed income and currency | 17 | 19 | 26 | 36 | 50 | 53 |

| Money markets | 18 | 20 | 27 | 31 | 46 | 48 |

| Alternative investment(1) | 3 |

4 |

8 |

17 |

30 |

32 |

| Total | $44 |

$52 |

$95 |

$136 |

$195 |

$206 |

(1) Includes private equity, real estate, quantitative asset

allocation and other funds that we manage.

Since the beginning of 1996, we have increased the resources devoted to

our asset management business, including adding over 850 employees. In addition,

over the past three years, Goldman Sachs has made three asset management

acquisitions in order to expand its geographic reach and broaden its global

equity and alternative investment portfolio management capabilities.

Our global reach has been important in growing assets under management.

From November 1996 to February 1999, our assets under management, excluding our

merchant banking funds, sourced from outside the United States grew by over $35

billion. As of February 1999, we managed approximately $46 billion sourced from

Europe.

In Japan, deregulation, high individual savings rates and low local

rates of return have been important drivers of growth for our asset management

business during the 1990s. Over the last three years, we have built a

significant asset management business in Japan, and, as of February 1999, we

managed $23 billion of assets sourced from Japan. In Japan, as of the end of

February 1999, we were the largest non-Japanese investment trust manager,

according to The Investment Trusts Association, and we managed four of the top

15 open-ended mutual funds ranked by mutual fund assets, according to IFIS Inc.

We believe that substantial opportunities exist to grow our asset management

business in Japan, by increasing our institutional client base and expanding the

third-party distribution network through which we offer our mutual funds.

Clients. Our primary clients are institutions, high net worth

individuals and retail investors. We access clients through both direct and

third-party channels.

The table below sets forth the amount of assets under supervision by

distribution channel and client category as of November 1998:

| Assets Under Supervision(1) |

Primary Investment Vehicles |

|

|---|---|---|

|

— Institutional |

$ 121 | Separate managed accounts Commingled vehicles |

| — High net worth individuals | 156 | Brokerage accounts Limited partnerships Separate managed accounts |

|

— Institutional and retail |

48 |

Mutual funds |

| Total | $ 325 |

(1) Excludes $12 billion in our merchant banking funds.

Our institutional clients include corporations, insurance companies,

pension funds, foundations and endowments. We managed assets for three of the

five largest pension pools in the United States as ranked as of September 30,

1998 by Pensions & Investments, and we have 18 clients for whom we manage

at least $1 billion each.

In the individual high net worth area, we have established

approximately 10,000 high net worth accounts worldwide, including accounts with

41% of the 1998 "Forbes 400 List of the Richest Americans". We believe this is a

high growth opportunity because this market (defined as the market for

individual investors with a net worth in excess of $5 million) is highly

fragmented and growing rapidly and accounts for approximately $10 trillion of

investable assets according to a study by McKinsey & Co. At the center of our

effort is a team of over 420 relationship managers, located in 12 U.S. and six

international offices. These professionals have an average of over seven years

of experience at Goldman Sachs and have exhibited low turnover and superior

productivity relative to the industry average.

In the third-party distribution channel, we distribute our mutual funds

on a worldwide basis through banks, brokerage firms, insurance companies and

other financial intermediaries. As of December 31, 1998, we were the third

largest manager in the U.S. institutional money market sector according to

information compiled by Strategic Insight. In Japan, we also utilize a

third-party distribution network consisting principally of the largest Japanese

brokerage firms.

Merchant Banking

Goldman Sachs has an established successful record in the corporate and

real

estate merchant banking business, having raised $15.5 billion of committed

capital for 15 private investment funds, as of November 1998, of which $9.0

billion had been funded. We have committed $2.8 billion and funded $1.7 billion

of these amounts; our clients, including pension plans, endowments, charitable

institutions and high net worth individuals, have provided the remainder. Some

of these investment funds pursue, on a global basis, long-term investments in

equity and debt securities in privately negotiated transactions, leveraged

buyouts and acquisitions. As of November 1998, these funds had total committed

capital of $7.7 billion, which includes two funds with $1.0 billion of committed

capital that are in the process of being wound down. Other funds, with total

committed capital of $7.8 billion as of November 1998, invest in real estate

operating companies and debt and equity interests in real estate assets.

Our strategy with respect to each merchant banking fund is to invest

opportunistically to build a portfolio of investments that is diversified by

industry, product type, geographic region and transaction structure and type.

Our merchant banking funds leverage our long-standing relationships with

companies, investors, entrepreneurs and financial intermediaries around the

world to source potential investment opportunities. In addition, our merchant

banking funds and their portfolio companies have generated business for other

areas of Goldman Sachs, including equity underwriting, leveraged and other

financing fees and merger advisory fees.

Located in eight offices around the world, our investment professionals

identify, manage and sell investments on behalf of our merchant banking funds.

Goldman Sachs has two subsidiaries that manage real estate assets, The Archon

Group, L.P. and Archon Group (France) S.C.A. In addition, our merchant banking

professionals work closely with other departments and benefit from the expertise

of specialists in debt and equity research, investment banking, leveraged and

mortgage finance and equity capital markets.

Merchant banking activities generate three revenue streams. First, we

receive a management fee that is generally a percentage of a fund's committed

capital, invested capital, total gross acquisition cost or asset value. These

annual management fees, which are included in our asset management revenues,

have historically been a recurring source of revenue. Second, we receive from

each fund, after that fund has achieved a minimum return for fund investors, an

increased share of the fund's income and gains that is a percentage, typically

20%, of the capital appreciation and gains from the fund's investments. Revenues

from the increased share of the funds' income and gains are included in

commissions. Third, Goldman Sachs, as a substantial investor in these funds, is

allocated its proportionate share of the funds' unrealized appreciation or

depreciation arising from changes in fair value as well as gains and losses upon

realization. These items are included in Trading and Principal Investments.

Securities Services

Securities services consists predominantly of Global Securities

Services, which provides prime brokerage, financing services and securities

lending to a diversified U.S. and international customer base, including hedge

funds, pension funds and high net worth individuals. Securities services also

includes our matched book businesses.

We offer prime brokerage services to our clients, allowing them the

flexibility to trade with most brokers while maintaining a single source for

financing and portfolio reports. Our prime brokerage activities provide

multi-product clearing and custody in 50 markets, consolidated multi-currency

accounting and reporting and offshore fund administration and servicing for our

most active clients. Additionally, we provide financing to our clients through

margin loans collateralized by securities held in the client's account. In

recent years, we have significantly increased our prime brokerage client

base.

Securities lending activities principally involve the borrowing and

lending of equity securities to cover customer and Goldman Sachs' short sales

and to finance Goldman Sachs' long positions. In addition, we are an active

participant in the securities lending broker-to-broker business and the

third-party agency lending business. Trading desks in New York, Boston, London,

Tokyo and Hong Kong provide 24-hour coverage in equity markets worldwide. We

believe the rapidly developing international stock lending market presents a

significant growth opportunity for us.

Lenders of securities include pension plan sponsors, mutual funds,

insurance companies, investment advisors, endowments, bank trust departments and

individuals. We have entered into exclusive relationships with certain lenders

that have given us access to large pools of securities, some of which are often

hard to locate in the general lender market, providing us with a competitive

advantage. We believe that a significant cause of the growth in short sales,

which require the borrowing of securities, has been the rapid increase in

complex trading strategies, such as index arbitrage, convertible bond and

warrant arbitrage, option strategies, and sector and market neutral strategies

where shares are sold short to hedge exposure from derivative instruments.

Commissions

Goldman Sachs generates commissions by executing agency transactions on

major stock and futures exchanges worldwide. We effect agency transactions for

clients located throughout the world. In recent years, aggregate commissions

have increased as a result of growth in transaction volume on the major

exchanges. As discussed above, commissions also include the increased share of

income and gains from merchant banking funds as well as commissions earned from

brokerage transactions for high net worth individuals. For a discussion

regarding our increased share of the income and gains from our merchant banking

funds, see "— Merchant Banking" above, and for a discussion regarding high

net worth individuals, see "— Asset Management — Clients" above.

In anticipation of continued growth in electronic connectivity and

online trading, Goldman Sachs has made strategic investments in alternative

trading systems to gain experience and participate in the development of this

market. See "Risk Factors — The Financial Services Industry Is Intensely

Competitive and Rapidly Consolidating — Our Revenues May Decline Due to

Competition from Alternative Trading Systems" for a discussion of the

competitive risks posed by alternative trading systems generally.

Our Global Investment Research Department provides fundamental research

on economies, debt and equity markets, commodities markets, industries and

companies on a worldwide basis. For over two decades, we have committed the

resources on a global scale to develop an industry-leading position for our

investment research products. We believe that investment research is a

significant factor in our strong competitive position in debt and equity

underwritings and in our generation of commission revenues.

Major investors worldwide recognize Goldman Sachs for its value-added

research products, which are highly rated in client polls across the Americas,

Europe and Asia. Our Research Department is the only one to rank in the top

three in each of the last 15 calendar years in Institutional Investor's

"All-America Research Team" survey. In December 1998, the Research Department

also achieved top honors for global investment research from Institutional

Investor. In Europe, based on the Institutional Investor "1999 All- Europe Research Team" survey, the Research Department ranked number one for

coverage of pan-European sectors and number three in European Strategy and

Economics.

Global Investment Research employs a team approach that provides equity

research coverage of approximately 2,300 companies worldwide, 53 economies and

26 stock markets. This is accomplished through four groups:

- the Economic Research group, which formulates macroeconomic forecasts

for economic activity, foreign exchange, and interest rates based on the

globally coordinated views of its regional economists;

- the Portfolio Strategy group, which forecasts equity market returns and

provides recommendations on both asset allocation and industry

representation;

- the Company/Industry group, which provides fundamental analysis,

forecasts and investment recommendations for companies and industries

worldwide. Equity research analysts are organized regionally by sector

and globally into more than 20 industry teams, which allows for

extensive collaboration and knowledge sharing on important investment

themes; and

- the Commodities Research group, which provides research on the global

commodity markets.

We believe that Internet technology and electronic commerce will, over

time, change the ways that securities are traded and distributed, creating both

opportunities and challenges for our businesses. In response, we have a program

of internal development and external investment.

Internally, we are extending our global electronic trading and

information distribution capabilities to our clients via the Internet. These

capabilities cover many of our fixed income, equities and mutual fund products

in markets around the world. We are also using the Internet to improve the ease

and quality of communication with our institutional and high net worth clients.

For example, investors have on-line access to our investment research, mutual

fund data and valuation models and our high net worth clients are increasingly

accessing their portfolio information over the Internet. We have also recently

established GS-Onlinesm, which, in conjunction with Goldman, Sachs &

Co., will act as an underwriter of securities offerings via the Internet and

other electronic means. GS-Onlinesm will deal initially only with other

underwriters and syndicate members and not with members of the public.

Externally, we have invested in electronic commerce concerns such as

Bridge Information Systems, Inc., TradeWeb LLC, Archipelago, L.L.C., The BRASS

Utility, L.L.C., OptiMark Technologies, Inc. and, most recently, Wit Capital

Group, Inc. Through these investments, we gain an increased understanding of

business developments and opportunities in this emerging sector. For a

discussion of how Goldman Sachs could be adversely affected by these

developments, see "Risk Factors — The Financial Services Industry Is

Intensely Competitive and Rapidly Consolidating — Our Revenues May Decline

Due to Competition from Alternative Trading Systems".

Technology is fundamental to our overall business strategy. Goldman

Sachs is committed to the ongoing development, maintenance and use of technology

throughout the organization, with expenditures, including employee costs, of

approximately $970 million in 1998 and a budget of $1.2 billion in 1999. We have

developed significant software and systems over the past several years. Our

technology initiatives can be broadly categorized into three efforts:

- enhancing client service through increased connectivity and the

provision of high value-added, tailored services;

- risk management; and

- overall efficiency and control.

We have also developed software that enables us to monitor and analyze

our market and credit risks. This risk management software not only analyzes

market risk on firmwide, divisional and trading desk levels, but also breaks

down our risk into its underlying exposures, permitting management to evaluate

exposures on the basis of specific interest rate, currency rate, equity price or

commodity price changes. To assist further in the management of our credit

exposures, data from many sources are aggregated daily into credit management

systems that give senior management and professionals in the Credit and

Controllers Departments the ability to receive timely information with respect

to credit exposures worldwide, including netting information, and the ability to

analyze complex risk situations effectively. Our software accesses these data,

allows for quick analysis at the level of individual trades and interacts with

other Goldman Sachs systems.

Technology has been a significant factor in improving the overall

efficiency of many areas of Goldman Sachs. By automating many trading

procedures, we have substantially increased our efficiency and accuracy.

We currently have projects under way to ensure that our technology is

Year 2000 compliant. See "Risk Factors — Our Computer Systems and Those of

Third Parties May Not Achieve Year 2000 Readiness — Year 2000 Readiness

Disclosure" and "Management's Discussion and Analysis of Financial Condition and

Results of Operations — Risk Management — Operational and Year 2000

Risks — Year 2000 Readiness Disclosure" for a further discussion of the risks

we face in achieving Year 2000 readiness and our progress to date.

Management believes that one of the strengths and principal reasons for

the success of Goldman Sachs is the quality and dedication of its people and the

shared sense of being part of a team. Goldman Sachs was ranked number seven in

Fortune magazine's "The 100 Best Companies to Work for in America" in

January 1999 and was ranked number three in Fortune magazine's 1999 "The

Top 50 MBA Dream Companies", the highest ranking investment banking and

securities firm in each case. We strive to maintain a work environment that

fosters professionalism, excellence, diversity and cooperation among our

employees worldwide.

Instilling the Goldman Sachs culture in all employees is a continuous

process, of which training is an essential part. We recently opened a 34,000

square foot training center in New York City, near our world headquarters. All

employees are offered the opportunity to participate in education and periodic

seminars that we sponsor at various locations throughout the world. We also

sponsor off-site meetings for the various business units that are designed to

promote collaboration among co-workers.

Another important part of instilling the Goldman Sachs culture in all

employees is our employee review process. Employees are

reviewed by supervisors, co-workers and employees they supervise in a 360-degree

review process that is integral to our team approach. In 1998, over 140,000

reviews were completed, evidencing the comprehensive nature of this process.

We also believe that good citizenship is an important part of being a

member of the Goldman Sachs team. To that end, we established our Community

TeamWorks initiative in 1997. As part of Community TeamWorks, all employees are

offered the opportunity to spend a day working at a charitable organization of

their choice while continuing to receive their full salary for that day. In

1998, approximately two-thirds of our employees participated in Community

TeamWorks. The commitment of our partners to the community is also demonstrated

by their having given over $90 million in each of the last two years to

charities, including private foundations.

As of February 1999, we had approximately 13,000 employees. In

addition, The Archon Group, L.P. and Archon Group (France) S.C.A., subsidiaries

of Goldman Sachs that provide real estate services for our real estate

investment funds, had a total of approximately 1,260 employees as of February

1999. Goldman Sachs is reimbursed for substantially all of the costs of these

employees by these funds.

See "Management — The Employee Initial Public Offering Awards" for a

discussion of the steps taken by Goldman Sachs to encourage the continued

service of its employees after the offerings and see "Risk Factors — Our

Conversion to Corporate Form May Adversely Affect Our Ability to Recruit, Retain

and Motivate Key Employees" for a discussion of the factors that may have an

adverse impact on the effectiveness of these efforts.

The financial services industry — and all of our businesses — are

intensely competitive, and we expect them to remain so. Our competitors are

other brokers and dealers, investment banking firms, insurance companies,

investment advisors, mutual funds, hedge funds, commercial banks and merchant

banks. We compete with some of our competitors globally and with some others on

a regional, product or niche basis. We compete on the basis of a number of

factors, including transaction execution, our products and services, innovation,

reputation and price.

Competition is also intense for the attraction and retention of

qualified employees. Our ability to continue to compete effectively in our

businesses will depend upon our ability to attract new employees and retain and

motivate our existing employees. See "— Employees" for a discussion of our

efforts in this regard.

In recent years there has been substantial consolidation and

convergence among companies in the financial services industry. In particular, a

number of large commercial banks, insurance companies and other broad-based

financial services firms have established or acquired broker-dealers or have

merged with other financial institutions. Many of these firms have the ability

to offer a wide range of products, from loans, deposit-taking and insurance to

brokerage, asset management and investment banking services, which may enhance

their competitive position. They also have the ability to support investment

banking and securities products with commercial banking, insurance and other

financial services revenues in an effort to gain market share, which could

result in pricing pressure in our businesses.

This trend toward consolidation and convergence has significantly

increased the capital base and geographic reach of our competitors. This trend

has also hastened the globalization of the securities and other finan-cial

services markets. As a result, we have had to commit capital to support our

international operations and to execute large global transactions.

We believe that some of our most significant challenges and

opportunities will arise outside the United States. See "Industry and Economic

Outlook" for a discussion of these challenges and opportunities. In order to

take advantage of these opportunities, we will have to compete successfully with

financial institutions based in important non-U.S. markets, particularly in

Europe. Some of these institutions are larger, better capitalized and have a

stronger local presence and a longer operating history in these markets.

We have experienced intense price competition in some of our businesses

in recent years. For example, equity and debt underwriting discounts have been

under pressure for a number of years and the ability to execute trades

electronically, through the Internet and other alternative trading systems may

increase the pressure on trading commissions. It appears that this trend toward

alternative trading systems will continue and perhaps accelerate. Similarly,

underwriting spreads in Latin American and other privatizations have been

subject to considerable pressure in the last year. We believe that we may

experience pricing pressures in these and other areas in the future as some of

our competitors seek to obtain market share by reducing prices.

See "Risk Factors — The Financial Services Industry Is Intensely

Competitive and Rapidly Consolidating" for a discussion of the competitive risks

we face in our businesses.

Goldman Sachs' business is, and the securities and commodity futures

and options industries generally are, subject to extensive regulation in the

United States and elsewhere. As a matter of public policy, regulatory bodies in

the United States and the rest of the world are charged with safeguarding the

integrity of the securities and other financial markets and with protecting the

interests of customers participating in those markets, not with protecting the

interests of Goldman Sachs' shareholders or creditors. In the United States, the

SEC is the federal agency responsible for the administration of the federal

securities laws. Goldman, Sachs & Co. is registered as a broker-dealer and as an

investment adviser with the SEC and as a broker-dealer in all 50 states and the

District of Columbia. Self-regulatory organizations, such as the NYSE, adopt

rules and examine broker-dealers, such as Goldman, Sachs & Co. In addition,

state securities and other regulators also have regulatory or oversight

authority over Goldman, Sachs & Co. Similarly, our businesses are also subject

to regulation by various non-U.S. governmental and regulatory bodies and

self-regulatory authorities in virtually all countries where we have

offices.

Broker-dealers are subject to regulations that cover all aspects of the

securities business, including sales methods, trade practices among

broker-dealers, use and safekeeping of customers' funds and securities, capital

structure, record-keeping, the financing of customers' purchases and the conduct

of directors, officers and employees. Additional legislation, changes in rules

promulgated by self-regulatory organizations or changes in the interpretation or

enforcement of existing laws and rules, either in the United States or

elsewhere, may directly affect the mode of operation and profitability of

Goldman Sachs.

The U.S. and non-U.S. government agencies and self-regulatory

organizations, as well as state securities commissions in the United States, are

empowered to conduct administrative proceedings that can result in censure,

fine, the issuance of cease-and-desist orders or the suspension or expulsion of

a broker-dealer or its directors, officers or employees. Occasionally, our

subsidiaries have been subject to investigations and proceedings, and sanctions

have been imposed for infractions of various regulations relating to our

activities, none of which has had a material adverse effect on us or our

businesses.

The commodity futures and options industry in the United States is

subject to

regulation under the Commodity Exchange Act, as amended. The Commodity Futures

Trading Commission is the federal agency charged with the administration of the

Commodity Exchange Act and the regulations thereunder. Goldman, Sachs & Co. is

registered with the Commodity Futures Trading Commission as a futures commission

merchant, commodity pool operator and commodity trading advisor.

As a registered broker-dealer and member of various self-regulatory

organizations, Goldman, Sachs & Co. is subject to the SEC's uniform net capital

rule, Rule 15c3-1. This rule specifies the minimum level of net capital a

broker-dealer must maintain and also requires that at least a minimum part of

its assets be kept in relatively liquid form. Goldman, Sachs & Co. is also

subject to the net capital requirements of the Commodity Futures Trading

Commission and various securities and commodity exchanges. See Note 8 to the

audited consolidated financial statements and Note 5 to the unaudited condensed

consolidated financial statements for a discussion of our net capital.

The SEC and various self-regulatory organizations impose rules that

require notification when net capital falls below certain predefined criteria,

dictate the ratio of subordinated debt to equity in the regulatory capital

composition of a broker-dealer and constrain the ability of a broker-dealer to

expand its business under certain circumstances. Additionally, the SEC's uniform

net capital rule imposes certain requirements that may have the effect of

prohibiting a broker-dealer from distributing or withdrawing capital and

requiring prior notice to the SEC for certain withdrawals of capital.

In January 1999, the SEC adopted revisions to its uniform net capital

rule and related regulations that permit the registration of over-the-counter

derivatives dealers as broker-dealers. An over-the-counter derivatives dealer

can, upon adoption of a risk management framework in accordance with the new

rules, utilize a capital requirement based upon proprietary models for

estimating market risk exposures. We have established Goldman Sachs Financial

Markets, L.P. and are in the process of registering this company with the SEC as

an over-the-counter derivatives dealer to conduct in a more capital efficient

manner certain over-the-counter derivative businesses now conducted in other

affiliates.

Goldman Sachs is an active participant in the international fixed

income and equity markets. Many of our affiliates that participate in those

markets are subject to comprehensive regulations that include some form of

capital adequacy rule and other customer protection rules. For example, Goldman

Sachs provides investment services in and from the United Kingdom under a

regulatory regime that is undergoing comprehensive restructuring aimed at

implementing the Financial Services Authority as the United Kingdom's unified

regulator. The relevant Goldman Sachs entities in London are at present

regulated by the Securities and Futures Authority Limited in respect of their

investment banking, individual asset management, brokerage and principal trading

activities, and the Investment Management Regulatory Organization in respect of

their institutional asset management and fund management activities. Some of

these Goldman Sachs entities are also regulated by the London Stock Exchange and

other United Kingdom securities and commodities exchanges of which they are

members. It is expected, however, that commencing in 2000 the responsibilities

of the Securities and Futures Authority Limited and Investment Management

Regulatory Organization will be taken over by the Financial Services Authority.

The investment services that are subject to oversight by United Kingdom

regulators are regulated in accordance with European Union directives requiring,

among other things, compliance with certain capital adequacy standards, customer

protection requirements and conduct of business rules. These standards,

requirements and rules are similarly implemented, under the same directives,

throughout the European Union and are broadly comparable in scope and purpose to

the

regulatory capital and customer protection requirements imposed under the SEC

and Commodity Futures Trading Commission rules. European Union directives also

permit local regulation in each jurisdiction, including those in which we

operate, to be more restrictive than the requirements of such directives and

these local requirements can result in certain competitive disadvantages to

Goldman Sachs. In addition, the Japanese Ministry of Finance and the Financial

Supervisory Agency in Japan as well as German, French and Swiss banking

authorities, among others, regulate various of our subsidiaries and also have