Chairman and Chief Executive Officer (right)

President and Chief Operating Officer (left)

Fellow Shareholders:

This past year for the global economy may be best described as one of incremental, but noticeable improvement. In the United States, the economic recovery finally began to take hold with continued underlying economic growth and slowly accelerating gains in the labor market. In Europe, while conditions remained broadly difficult, we began to see nascent growth and, in certain countries, such as the United Kingdom, a more advanced recovery.

Fears of a sharp slowdown in China receded somewhat and the country’s new leadership signaled a more assertive posture on economic and financial reform. In Japan, aggressive fiscal and monetary policies spurred a reinvigorated economic and financial environment.

At the same time, political impasse in the United States for much of the year and uncertainty over central bank policy both highlighted and, to some extent, contributed to the fragility of the economic recovery. As a result, many of our clients remained cautious, which hindered a broad-based resumption of their business activities.

Amidst these shifting factors, we are pleased to report that Goldman Sachs performed relatively well, generating solid results for the year. This was the by-product of our commitment to a core set of businesses and actions we have taken over the last several years in three important areas: strengthening our balance sheet, allocating capital efficiently across our businesses and managing our costs prudently.

For 2013, the firm produced net revenues of $34.2 billion and net earnings of $8.0 billion, an eight percent increase from $7.5 billion of net earnings in 2012. Diluted earnings per common share were $15.46 compared with $14.13 for 2012. Our return on average common shareholders’ equity (ROE) was 11.0 percent. Book value per common share increased by approximately five percent during 2013 and has grown from $20.94 at the end of our first year as a public company in 1999 to $152.48, a compounded annual growth rate of approximately 15 percent over this period. Our capital management in 2013 reflected a prudent approach as our capital ratios continued to improve despite returning $7.2 billion to common shareholders through share buybacks and dividends.

In this year’s letter, we would like to review the significant steps we have taken in recent years to adapt and respond to the post-financial crisis world, and, building on those efforts, our priorities for enhancing returns to our shareholders going forward. In that vein, we also will discuss our competitive position across our major businesses. Lastly, we want to share with you some of the initiatives we undertook related to our people, culture and business standards and practices.

Adapting and Positioning the Firm

The past year marked the five-year anniversary of the global financial crisis. Later in the letter, we will discuss the impact of the changes we have made from the extensive review of our business standards and practices. Importantly, this is also an opportune time to highlight the significant actions the firm has taken over the last five years related to our capital, liquidity and overall financial profile to adapt to the realities of the operating and, more specifically, regulatory environment. Some of those actions are represented to the right.

We have focused not only on strengthening our balance sheet, but also on ensuring that we are allocating capital efficiently both to meet the needs of our clients and to generate stronger returns going forward.

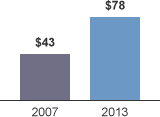

Shareholders’ Equity (in billions)

Our shareholders’ equity has grown from nearly $43 billion at the end of 2007 to more than $78 billion at the end of 2013, an increase of 83 percent.

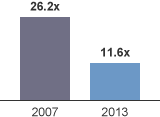

Gross Leverage

Our leverage ratio has fallen by more than one-half from 26 times at the end of 2007 to less than 12 times at the end of 2013.

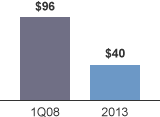

Level 3 Assets (in billions)

We have reduced our holdings of level 3, or illiquid, assets by nearly 60 percent since the first quarter of 2008 to $40 billion.

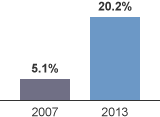

GCE/Assets

Our excess liquidity pool (Global Core Excess), as a percentage of our total assets, has grown from more than 5 percent at the end of 2007 to more than 20 percent in 2013.

New regulation is pushing the industry to be even more sensitive to risk-adjusted returns, whether through higher capital requirements or the application of stress tests. Over time, this may translate into greater pricing discipline across the entire industry, which we view as a positive development.

Well in advance of any regulations being finalized, we have been focused on developing and implementing tools to help us better price the provision of liquidity to the marketplace, and better manage our capital usage. In that regard, at the conclusion of 2013, our estimated transitional Basel III Advanced Common Equity Tier 1 ratio was in excess of 11 percent.

Another important capital management effort that we have undertaken is refining our business mix in light of new capital requirements. Certain businesses, like the Americas reinsurance and European insurance businesses, no longer generated attractive returns under a Basel III framework and, as a result, we opted to sell a majority stake in them.

Even with investments, such as the longstanding one that Goldman Sachs had in Industrial and Commercial Bank of China Limited (ICBC), which was both strategic and financial, we elected to make adjustments given the new capital requirements. Collectively, ICBC and our insurance businesses used approximately 125 basis points of the Basel III Advanced Common Equity Tier 1 ratio and consumed $40 billion of balance sheet.

While these are three larger, public examples, we continue to make risk-adjusted return decisions across the firm every day.

Shareholder Returns

As a firm, we have a long track record of delivering superior returns to our shareholders over the cycle. We demonstrated this before the financial crisis, during it and after. If you look at our average ROE since the onset of the financial crisis in 2007, we have outperformed each of our U.S. competitors, having produced an average ROE during this period of more than four times the peer average.

Nevertheless, while we have generated solid returns in the last five years, they fall below our aspirations. We are committed to improving them notwithstanding the challenges presented in the current environment. At the same time, we want to protect our ability to provide significant upside to shareholders as the economic cycle turns.

By focusing on revenues, expenses and capital efficiency, we are building near-term benefits, but also driving material operating leverage into our business.

Our performance over the last few years is an important example of the firm’s ability to proactively manage a cyclical business and to capitalize on creating operating leverage in our business model. In 2011, we announced an initial $1.2 billion expense savings initiative, the size of which was subsequently increased twice, ultimately reaching a run-rate of $1.9 billion. In 2012, a 19 percent increase in net revenues translated into an 82 percent increase in pre-tax earnings and a ROE expansion to 10.7 percent. In 2013, despite essentially unchanged net revenues, our continued focus on expenses enabled us to grow pre-tax earnings by five percent and expand ROE to 11.0 percent. Longer term, we expect that a more robust environment will enable us to deliver even more operating leverage to our shareholders.

With respect to capital management, our strong capital generation and balance sheet management have allowed us to grow our Basel III ratio while returning capital to shareholders. Since year-end 2010, we have repurchased approximately $17 billion of our shares, and reduced our basic share count by approximately 80 million shares or 15 percent, while our U.S. peers, taken together, actually showed an average increase in share count. Our approach drives shareholder value through both higher returns and growth in earnings per common share.

Controlling Costs

In addition to effective capital management, we are acutely focused on expense management as a lever for driving incremental shareholder returns. From 2009 through 2013, our average compensation and benefits expense to net revenues ratio was approximately 880 basis points lower than the average ratio from 2000 to 2007.

Compensation and benefits is our largest expense and we remain committed to paying for performance. In lower net revenue years, like 2008 and 2011, we demonstrated significant flexibility in our compensation and benefits expense. In years with net revenue growth, this expense generally increased at a lower rate than net revenues, thereby driving operating leverage and enhancing shareholder returns.

The firm remains committed to operating efficiently for our shareholders, while providing world-class service to our clients. Of course, maintaining discipline around costs requires making tough decisions regarding staffing levels and compensation. We have strived to get the balance right, between improving shareholder returns and investing in the future of our client franchise. To do so, we have leveraged technology, adjusted our allocation of resources and managed both compensation and non-compensation expenses.

Our expense savings initiatives included enhancements in technology and greater geographic diversity in our workforce. Currently, we have approximately 8,200 staff, or roughly 25 percent of our workforce, located in Bangalore, Salt Lake City, Dallas and Singapore, compared with 10 percent in 2007. Additionally, 38 percent of all campus and experienced hires since 2011 have been hired into those offices.

We were among the first global banks to embark on an expense savings initiative and, although painful, the exercise was necessary. Being an early mover allowed ongoing recognition of savings over the past two years and protected returns in what continues to be a challenging operating environment.

Growth and the State of Our Client Franchise

While we have strengthened our balance sheet, prioritized efficient capital allocation and taken a disciplined approach to costs, we have continued to invest in a broad set of institutionally focused businesses that have a track record of providing higher returns than many other businesses within financial services. Because of a consistent focus on our clients’ needs and orienting our businesses to meet their ongoing objectives, we believe we have provided solid returns in a challenging period, while seeking to protect our ability to provide significant upside to our shareholders as the economic cycle turns.

We believe our businesses are particularly well positioned for the time when broad-based growth resumes. And, we see reasons to be confident in the fundamentals of the global economy. While emerging markets typically entail higher risk and volatility, we believe that over time they will generate stronger growth as the middle class in those countries expands and consumption and investment trends evolve. In developed economies, greater CEO confidence is driving more strategic acquisitions as more companies are committing to longer term growth plans. Investor sentiment has also rebounded, and more companies are taking advantage of a better operating environment to raise equity and debt. In the U.S., the process of ending quantitative easing has begun, and while unsettling for certain markets, the move to a more normalized market environment is necessary and ultimately reassuring. All of these trends play to the strengths and position of our businesses.

Investment Banking

Investment Banking not only includes our advisory and financing services; it also serves as an important source of opportunities for all parts of the firm. For example, working with clients in our financing business often drives demand for hedging solutions, while our advisory franchise can create opportunities for co-investment with our business partners.

“The past year represented one of our strongest market share performances in our advisory and underwriting franchises since 2000.”

We continue to demonstrate outperformance in our advisory franchise. In 2013, we ranked first in both announced and completed global mergers and acquisitions.

Our equity underwriting franchise was equally strong in 2013, ranking first in global equity and equity-related offerings, common stock offerings and initial public offerings (IPOs). We served as bookrunner on eight of the ten largest IPOs for the year. The technology sector was especially active and Goldman Sachs was the lead-left bookrunner for nearly twice as many technology IPOs in the U.S. than the next most active underwriter.

In debt underwriting, we had our best year ever in net revenues. While we believe that we could further strengthen our league table position, we do not aim to be ranked first in this business. Despite our natural desire to be ranked at the top of any league table, we believe achieving that position, in this case, would require a significant increase in lending at rates that would ultimately dilute long-term returns. Our approach could change to the extent that regulatory changes drive more attractive pricing.

More broadly, the past year represented one of our strongest market share performances in our advisory and underwriting franchises since 2000.

Institutional Client Services

In Institutional Client Services, our equities franchise is built on the premise of providing a broad suite of services to our investing clients. This means having a state-of-the-art electronic platform, comprehensive prime brokerage services and the capacity to be an effective liquidity provider for our clients.

It also means leveraging our global technology platform to have a scalable “high touch” and “low touch” approach to meeting our clients’ needs. It is not sustainable to have only one approach if your goal is to serve a diverse set of clients and to produce strong returns. Clients determine how they engage the firm, and they are increasingly looking to transact electronically with us in both cash and derivative products.

The long-term demand, however, for product innovation and “high touch” services remains. So, our ability to offer unique solutions across equities products continues to be critical to our clients. This dual approach of “high touch” and “low touch” is a by-product of the many market structure and regulatory changes in the equity markets over the past 15 years. Our ability to adjust to a changing regulatory environment has been critical to maintaining a leadership position within our Equities business.

This is also true in Fixed Income, Currency and Commodities Client Execution (FICC). We maintain a leading position across a broad range of products and geographies, with a focus on being responsive to our clients’ needs. There is considerable discussion about the outlook for FICC given the numerous regulatory changes taking place and the lower client volumes. We remain committed to our FICC businesses, which, here again, reflects the value our clients place on the services that we provide in these markets. And, our commitment has allowed our client franchise to grow. Over the past three years, for example, the number of corporate and growth market relationships have each grown by approximately 30 percent.

Some of our competitors may elect to deemphasize or exit some FICC businesses, given their particular circumstances. But, we believe this is likely to increase the value that clients place on the services provided by those who remain, especially as broader economic activity rebounds and the trading environment improves.

For our FICC businesses, providing liquidity to our investing clients requires us to take risk, and as a consequence, FICC is the largest consumer of our capital. Our commitment to these businesses does not mean that we haven’t taken significant action regarding how we utilize capital. We have meaningfully reduced risk-weighted assets in FICC and are very focused on managing it for risk-adjusted returns. Chasing revenue market share within FICC businesses can lead to risk management lapses and inferior returns. Focusing on the right balance between risk, revenue and returns has been important to building a leading global franchise and consistently delivering strong returns for our shareholders.

Investment Management

With total assets under supervision surpassing a record trillion dollars, our Investment Management business is one of the largest in the world. We have a strong position across a diverse set of products spanning all major asset classes and geographies. And, despite the challenging market environment, we have been able to grow long-term assets under supervision by 36 percent since the beginning of 2007.

Additionally, we have expanded our defined contribution franchise, with approximately $50 billion in new assets from our acquisition of Dwight Asset Management and our pending acquisition of Deutsche Bank’s stable value business.

Like our other businesses, success in Investment Management is a function of performing for our clients. Our asset-weighted mutual fund performance has been above the industry average for nine consecutive quarters through 2013. Two-thirds of our mutual fund assets were ranked in the top two quartiles by Morningstar across one, three and five year performance periods.

As performance has improved, so have asset inflows. We had net sales in long-term assets under supervision of $41 billion, the highest since 2007, which were broadly distributed across our three key client channels: High-net-worth individuals, Third-party distributed and Institutional. This focus on performance has been a critical component in generating our highest net revenues for Investment Management since 2007.

Investing & Lending

Investing & Lending includes direct investing, our investing through funds, as well as lending to both corporations and high-net-worth individuals.

Our investing activity, including co-investing with our clients, has established itself as an important complement to our other franchise businesses. We have a history of strong investment performance over the years, and that reputation, along with deep client relationships, have allowed us to invest in opportunities that are not available to others.

Our debt investments are driven by senior loan and mezzanine investments, and our direct financing and lending businesses. Our Investing & Lending business includes approximately $31 billion of direct loans, primarily extended to corporate clients and high-net-worth individuals. Our equity investments include private equity funds, direct equity investments and hedge fund investments. The “Volcker Rule,” which we will discuss in more detail, limits our ability to invest in hedge funds and private equity through a fund structure; as such, for some time now in anticipation, we have been redeeming our hedge fund investments to be compliant. While we’ve been actively harvesting our private equity funds, solid asset price performance has kept balance sheet levels relatively flat.

Our investing and lending activities are synergistic with our other activities and are valuable to our clients. We remain committed to these businesses and, now with greater regulatory clarity, we know that with the necessary adjustments, we will continue to work with our clients as an investor.

Regulation

In December, regulators passed the final Volcker Rule, which restricts banking entities’ proprietary trading activities and certain interests in, and relationships with, hedge funds and private equity funds.

Throughout the rulemaking process, we stated that it was critical that the rulemaking proceed in a way that is not counterproductive to the ability of companies and investors to continue to use the capital markets to accomplish their business objectives.

Importantly, the final Volcker Rule explicitly permitted market making, lending and investing on balance sheet. Regulators allowed these activities because financial intermediation plays an essential role in capital raising and risk management, supporting broader economic activity and growth.

As we indicated earlier, while the rule was only recently finalized, we have been preparing to comply with certain portions of the rule for nearly three years. We liquidated substantially all of our proprietary trading positions, specifically our Principal Strategies and our Global Macro Proprietary positions. And in 2012, we announced our intention to redeem certain hedge fund investments. Since then, we have redeemed approximately $2.2 billion of hedge fund investments and we will continue to redeem our interests.

We are now focused on ensuring that we are in the position to effectively and efficiently comply with the requirements of this new and significant legal regime.

“The quality and breadth of our client franchise are a direct by-product of our ability to attract and retain high-caliber professionals.”

Our People

The quality and breadth of our client franchise are a direct by-product of our ability to attract and retain high-caliber professionals. As an investment bank, our main asset is our people and the advice and solutions that they provide to our clients. Great people build great relationships. And, we are fortunate to have a diverse group of young people from around the world who continue to view Goldman Sachs as a great place to begin and sustain their careers. For our latest analyst class, more than 43,000 candidates applied for 1,900 positions. We accepted about four percent of those applicants and of those receiving offers, more than 80 percent accepted.

In 2013, we were proud to be named as one of Fortune magazine’s “100 Best Companies to Work For.” Goldman Sachs is one of only five companies to be recognized every year that the Great Place to Work Institute has issued its list since 1984.

Of course, we operate in a global and competitive industry and we seek to attract from the broadest pool of talented people available. It is incumbent upon us to ensure that we are always adapting to the realities of a workplace, especially one now shaped by instant connectivity.

This past year, we closely examined the day-to-day work environment for junior bankers and its connection to long-term career development. After that review, we announced a series of initiatives so that these young professionals receive more regular feedback and career development guidance, more time with their managers and clients and more consistent and predictable periods when they can plan to be out of the office. We also are using new technology that will make the process of creating client-related materials easier. The goal through these initiatives is to recognize the difference between untargeted effort and productive work. Our measures of success will continue to be the quality of thought and work we do for our clients, something that is sustainable only in a workplace that emphasizes productivity over the expectation of hours in the office and greater balance in pursuit of a long-term career.

Business Standards & Practices

As we have written to you in the past, we have spent enormous time and effort, as a firm, reviewing and improving our business standards and practices. In January 2011, we published the Report of the Business Standards Committee (BSC), which was the culmination of an extensive eight-month review encompassing every major business, region and activity of the firm. The report made 39 recommendations for change in the above areas.

In January 2011, we established the BSC Implementation Oversight Group, which for the next two years was responsible for overseeing the implementation of each recommendation. By February 2013, all 39 recommendations had been fully implemented.

In May 2013, we released another public report, the Business Standards Committee Impact Report, which discussed the changes we made as a result of the BSC implementation and how they impacted our firm. We identified three unifying themes across the 39 recommendations, which capture the areas of greatest change and impact on the firm: (1) clients, and the higher standard of care we apply in serving them; (2) reputational sensitivity and awareness, and its importance in everything we do; and (3) the individual and collective accountability of our people.

Most significantly, for all our employees, the experience of initiating, approving and executing a transaction for a client at Goldman Sachs is now fundamentally different. This difference reflects significant changes to processes, business standards, documentation and transaction approvals, all of which impact our approach to decision making.

Process matters and the BSC changes have led to our processes being more clear, comprehensive and consistent. Business standards reflect the heightened scrutiny we bring to our own actions and activities, the role we play as a large financial institution and the responsibilities we have to our clients and to global financial intermediation. Documentation supporting our processes is more standardized and organized around escalation procedures. Transaction approvals focus on the core goals of serving our clients’ long-term interests and protecting the firm’s reputation. Taken together, these changes result in better judgments and decision making, which are among the most important impacts emerging from the BSC.

The work underlying the BSC is part of a much larger, ongoing commitment by the firm to be self-aware, to be open to change and to learn the right lessons from recent experiences. Going forward, we know we will inevitably make mistakes, but we commit to learn from them and respond in a way that meets the high expectations of our clients, shareholders, other stakeholders, regulators and the broader public.

On our Web site, in addition to the two reports, you can view other relevant material, including a discussion on the impact of the Client and Business Standards Committee, an illustrated example of the life cycle of a client transaction and video excerpts from the Chairman’s Forum, which was a series of internal discussions led by senior management on how we conduct ourselves in serving our clients and protecting the firm’s reputation.

Corporate Engagement

In 2013, Goldman Sachs committed more than $200 million to philanthropic endeavors, including our tradition of strong engagement through Goldman Sachs Gives and expanding 10,000 Women and 10,000 Small Businesses to include new academic and non-profit partners.

Goldman Sachs Gives

Goldman Sachs Gives is a donor-advised fund through which participating managing directors (PMDs) of the firm can recommend grants to qualified non-profit organizations around the world. Since the inception of Goldman Sachs Gives, PMD compensation has been reduced by approximately $1.2 billion to fund Goldman Sachs Gives, and approximately 15,000 grants totaling more than $720 million have been made to various organizations in 38 countries. Since the fund was created, more than $350 million has been granted to community organizations supporting veterans, poverty alleviation, medical research and other significant areas of need. In addition, more than $145 million has been granted to approximately 180 colleges and universities to support financial aid. In 2013, more generally, approximately $150 million was distributed through more than 4,500 individual grants.

10,000 Small Businesses

10,000 Small Businesses expanded its network of cities and partners to provide small businesses with the education, business services and capital they need to grow and create jobs. By year’s end, 10,000 Small Businesses was operating in more than 20 sites in the U.S. and United Kingdom. In the U.S., we launched new sites in Philadelphia, Miami and Detroit. In addition, loans through the program began to be offered in Oregon, Washington, Tennessee, Virginia and Maine. In the fall, we announced a new national partnership that allows qualified small business owners anywhere in the U.S. to receive training at Babson College, one of the nation’s leading entrepreneurial schools.

In the United Kingdom, we hosted the first gathering of 10,000 Small Businesses alumni from across the country, with more than 200 businesses attending. In conjunction with the event, academic program partners released a progress report on the graduating businesses to date showing that 66 percent of U.K. program participants had grown revenue and 77 percent of them had created jobs.

10,000 Women

2013 represented an important milestone for our 10,000 Women initiative. In December, the 10,000th woman entered the program and is expected to graduate in 2014. Since it was announced in 2008, this program has provided 10,000 underserved women entrepreneurs with a business and management education, access to mentors and networks, and links to capital. 10,000 Women has drawn participants from more than 40 countries around the world. Delivered through a network of 90 academic and non-profit partners, 10,000 Women continues to yield promising results. More than 80 percent of surveyed graduates have increased revenues and more than 70 percent have added new jobs.

We are focused on the next chapter of 10,000 Women and recently announced a new partnership with the International Finance Corporation (IFC), a member of the World Bank Group, to create the first-ever global finance facility dedicated exclusively to women-owned small and medium enterprises. Goldman Sachs Foundation, IFC and other investors will contribute up to $600 million to the facility, which will enable approximately 100,000 women entrepreneurs to access capital. 10,000 Women remains committed to expanding business and management education to reach more high-potential women entrepreneurs around the world. Through the capital this partnership will raise, women entrepreneurs will have a much greater chance of reaching their full potential.

Looking Ahead

In our shareholder letter to you for 2006, we wrote that “we are always cognizant that conditions can change quickly and in unforeseen ways...One of the worst things we could do, as a firm and as individuals, is to begin to believe that the laws of economics do not apply to us — that somehow markets aren’t cyclical.”

Much of the last five years has been challenged by the cyclical downturn. We believe that the upcoming year may very well represent the progression into a stronger global economy. But, this has not been a passive exercise. The banking sector, especially in the U.S., is well capitalized; companies are operating with strong balance sheets; new ways to tap sources of energy are making U.S. manufacturing more competitive; the housing market is recovering and individuals have significantly reduced their debt. In addition, the tail risks in Europe and the political impasse in Washington, D.C. appear less likely than a year ago. Collectively, we have made a lot of progress.

Of course, concerns about emerging economies, the effect of the Federal Reserve’s “taper,” and a host of other issues may challenge sentiment and complicate the recovery. As we look at the longer term fundamentals, however, we remain optimistic.

For Goldman Sachs, our businesses are well positioned and our client franchise is strong. We have taken important actions to manage efficiently our capital and cost structure. As a result, we are confident that we have achieved significant operating leverage for our shareholders, which will become only clearer with an improving economic environment. Our culture of teamwork and client focus has never been more alive and vibrant and continues to define who we are and the work we do. We remain intent on learning from the experience of recent years but maintain a firm eye on the future to do our part to contribute to economic growth and opportunity. In the process, we are confident that Goldman Sachs will produce significant value for our shareholders.

Lloyd C. Blankfein

Chairman and Chief Executive Officer

Gary D. Cohn

President and Chief Operating Officer