China Lockdowns Risk Supply Line Fractures

Covid lockdown restrictions in mainland China are starting to impede local economic activity, with potential ramifications for global supply lines.

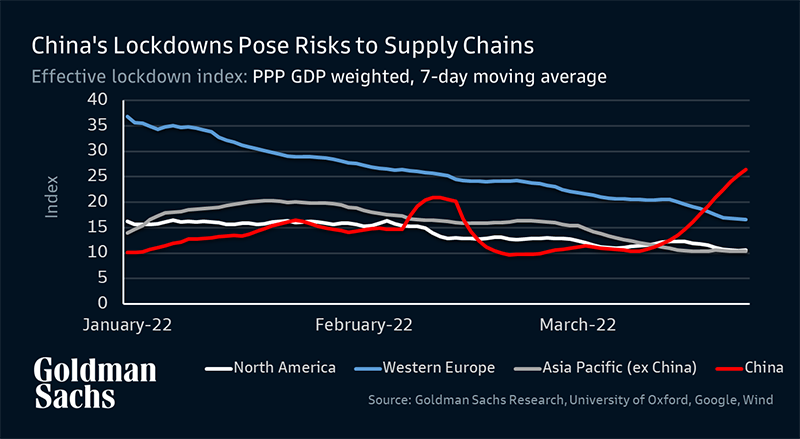

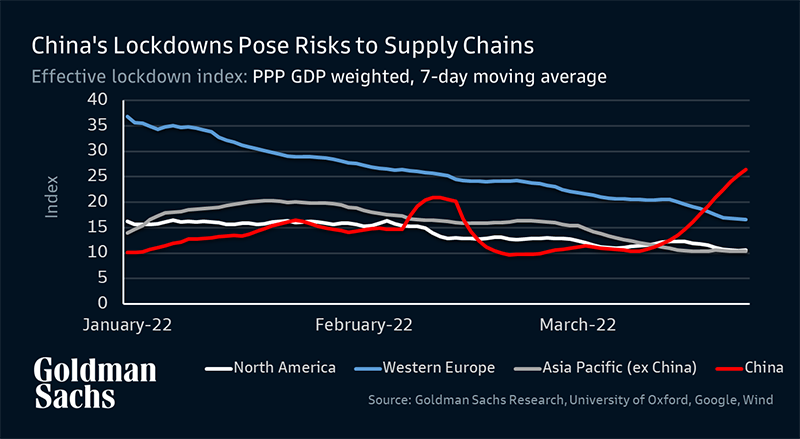

Goldman Sachs Research’s global GS Effective Lockdown Index (ELI) – a combination of official restrictions and actual mobility data from 46 economies, weighted by PPP GDP – tightened in the fourth week of March, with China’s national ELI driving higher. This is the first time since February 2020 that China’s ELI has been tighter than other main regions.

Slowing activity in Mainland China is both regional – in areas like Jiangsu, Jilin, Guangdong, Shaanxi and Shanghai, which play an important role in nationwide supply chains – and within manufacturing subsectors. Industries with notable production or exposure to suppliers in these locations include chemicals, transportation equipment, and timber/wood product (like furniture), but anecdotal evidence also suggests that regions designated by the government as “high-risk” or “mid-risk” for Covid-19 are facing both delivery delays and production suspensions.

The longer lockdowns stay in place, the greater the potential global impact. Production across some vehicle and equipment manufacturing industries (Shanghai area plays a meaningful role in national auto and equipment production) appears to be most vulnerable to the current local Covid restrictions.

With surging cases suggesting this Covid wave could be the most severe Mainland outbreak since early 2020, the disruptions to logistics, particularly at key hubs like ports, could be larger than the snarls in early 2021 and through last summer.

A critical element of the latest outbreak is how local restrictions could further drive asymmetries in broader supply chain disruption. Government officials have stated that factories and districts should customize their production plan based on their local situation (“one factory one policy”). Shenzhen has announced the gradual restart of production activities from March 21st, after three rounds of mass Covid testing.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.