After Long Decline, Oil and Gas Investing is Poised to Boom

The article below is from our BRIEFINGS newsletter of 28 April 2022

Against the backdrop of war in Ukraine, 2022 is seeing renewed focus on energy security as Europe grapples with how to restructure its supply to reduce its reliance on Russia. The crisis has revealed the challenge ahead for the world as it faces geopolitical conflict, efforts to decarbonize and high global inflation. Today, the energy industry is at turning point, with an expected increase in investment across commodities, including oil and gas, according to Top Projects, Goldman Sachs Research’s annual analysis of the energy sector. We spoke with Michele Della Vigna, head of Goldman Sachs’ natural resources research in EMEA, to learn more.

In Top Projects 2022, which GS Research has been publishing for nearly 20 years, you talk about an underinvestment in energy over the last seven years. What has this meant for the sector?

There are three ways we can look at the depths of the underinvestment we have witnessed since 2015. Firstly, we can look at the reserve life in the sector. It used to be 50 years and it’s now declined to 25 on the back of falling oil reserves and increasing production. This shows the lack of focus in exploration and resource expansion on the back of the push for decarbonization.

The second way to look at it is to ask ourselves: How much future production have we lost because of all the delays in investment decisions on new oil and gas projects? The answer is 10 million barrels per day of oil, which is the equivalent of Saudi Arabia’s daily production and 3 million barrels per day of oil equivalent in liquefied natural gas (LNG), which is more than the equivalent of Qatar’s daily production. If we had not kept delaying new investment decisions in oil and gas since 2014, we essentially could have had a new Saudi Arabia and a new Qatar.

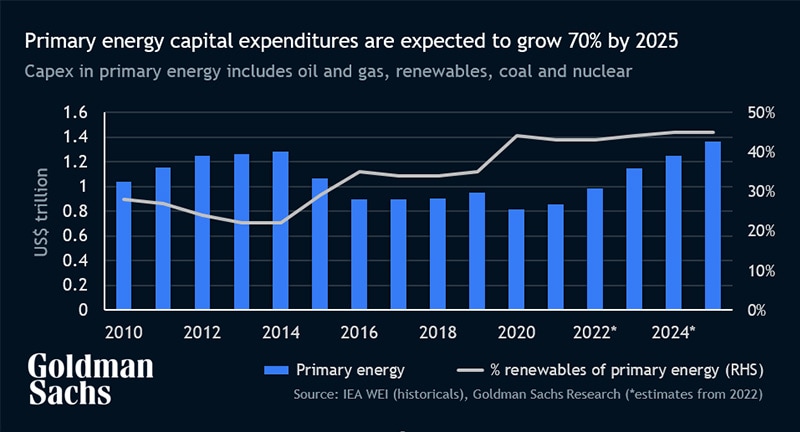

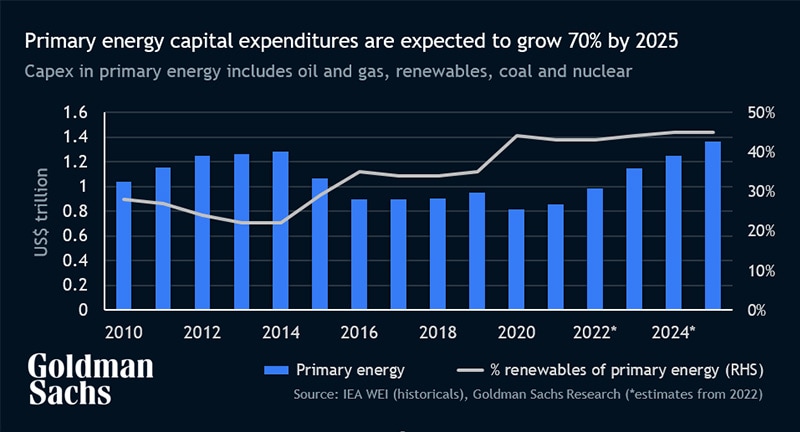

The third way is just to look at the billion dollar numbers. In upstream oil and gas, the industry at the peak was spending $900 billion dollars per annum which troughed at $300 billion dollars in 2020, so a two-thirds reduction in capex. These are three different ways to look at the issue but the answer is the same: We have exhausted all of the spare capacity in the system, and now we are no longer able to cope with supply disruptions like the one we are currently witnessing because of the Russia-Ukraine conflict.

What role has the war between Russia and Ukraine had on investment in the energy space? Is the conflict the reason you expect energy investment to increase?

The issues around Russia and Ukraine have brought the importance of security of supply and the social importance of guaranteeing affordable energy access to a growing world population back to the forefront. Within that context, the conflict is also leading to a broader rebalancing of social versus environmental issues in the environmental, social and governance (ESG) frameworks of the investing community. Decarbonization is a key driver of decision-making but it needs to be balanced carefully with the social importance of affordable energy and the key role of natural gas in the energy transition.

We need more investment in energy as a whole following these seven years of underinvestment, including renewables, hydrogen and other low carbon sources of energy, but we also expect oil and gas investment to go up. We are seeing it first of all in the shorter cycle projects like U.S. shale but that also needs to extend to the longer cycle investments of deepwater, oil, gas and LNG. We think the pace of big oil and gas decisions is likely going to triple over the next three to five years versus what we have seen at the trough of the cycle in 2020.

Top Projects details a “shrinking” and “steepening” oil cost curve. What exactly does this mean?

In every commodity, when you try to forecast a future price, you want to understand the price needed to get enough new projects to be developed. Since 2017, the cost curve of oil has become smaller because there are fewer available resources and it’s become steeper because higher oil prices will be needed for production and to supply energy for a growing world population. That’s how a cost curve can help you in understanding the price dynamic in a commodity and that’s what we tried to do in Top Projects for oil and gas. At the current cost of capital, we need $90-per-barrel oil prices in order to get enough capacity on stream. A shrinking and steeping cost curve suggests upward pressure to long-term energy prices.

Is Europe’s search for an alternative gas supply achievable? Top Projects expects the global production of LNG to be slow until 2025.

Europe needs new gas to come in to substitute the Russian imports and the obvious market to source that from is LNG because it’s transported by ship, while pipeline gas supply is much more difficult to shift across geographies. LNG is one of the few alternatives of scale to Russian gas. There are two clear ways Europe can get more of this energy. Either it outbids current recipients and pays more than the likes of India and China, effectively taking LNG from that market. Alternatively, Europe needs to get new LNG to come to the continent. The problem with that is it takes four to seven years for new LNG projects to start production (from investment decision), so it’s a very delayed answer to current higher prices. Our analysis shows there are not many projects coming on stream until 2025, which will make it very expensive for Europe to substitute Russian gas.

Are there any other key developments we should watch out for in energy sector in 2022?

There are three major areas of new investments. There is U.S. shale. We are already seeing strong activity leading to very strong cost inflation there (close to 30%). We think we are going to need a revival of new LNG projects in the U.S. and places like Africa and Papua New Guinea. We will also see a recovery of deepwater oil investments, mostly focused on Brazil, Guyana, the Gulf of Mexico and West Africa.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.