Cars

2025In the next ten years, the auto industry will undergo a profound transformation: the cars it builds, the companies that build them and the consumers who buy them will look significantly different. Technology will be leading this change, but it will be shaped by four key themes. The car of 2025 will be:

-

Green

Consumers and regulators concerned about climate change are putting pressure on automakers to reduce CO2 emissions.

% of global greenhouse gases

emitted by the transportation sector -

Convenient

Traffic in the world’s growing cities is getting worse. Ownership costs are rising, while cars sit unused 95% of the time. This creates opportunity for businesses that can more efficiently match cars with people who need them.

Increase in the world’s

urban population from 2010 to 2025 -

Safe

Reducing accidents has long been an industry priority, but an aging global population is increasing the need for safe transportation.

people killed

people injured

In Traffic Accidents worldwide

-

Affordable

As the world’s per-capita income rises, car ownership will increase in developing countries. These new consumers will be looking for models that are small and inexpensive.

Projected auto sales volume in 2025

chinaindiaglobal(Projected auto sales volume in 2025)

The car of 2025 won’t look like today’s automobiles. Here are the trends reshaping the way we drive.

trend onefilling up, plugging in

Concerns about greenhouse gases and pollution are driving an industry-wide change in the way cars are powered. Regulations on fuel economy and CO2 emissions are forcing carmakers to make engines more efficient. By 2025, 25% of cars sold will have electric engines, up from 5% today. But most of those will be hybrids, and 95% of cars will still rely on fossil fuels for at least part of their power. That means automakers will need to make internal combustion engines more efficient to comply with new standards.

The development of alternative power sources such as fuel cells will add to overall efficiency, but only if people can afford them. The Japanese government has set a target price of ¥2.2million—around US $18,000—for fuel-cell vehicles by 2025. While they would still be a small niche in global sales, that target price would allow them to become competitive with popular hybrids.

Comparing power systems

-

Internal Combustion

A combination of technologies throughout the powertrain can increase the fuel economy of cars with internal combustion engines. These include gasoline direct injection, turbocharging and high-speed automatic transmissions.

-

hybrids

Hybrid vehicles rely on a combination of gasoline or diesel engines and electric power to increase fuel economy. They use regenerative braking and the vehicle’s engine to recharge their electric batteries.

-

plug-in hybrids

Plug-in hybrids have a wider all-electric range than traditional hybrids because they can recharge their batteries from an external power source. Like hybrids, they retain internal combustion engines.

-

Electric Vehicles

Vehicles that rely solely on electric power for propulsion have simpler powertrains than hybrids or traditional cars. Makers of electric vehicles are focused on reducing the cost of their batteries, which can account for 50% of the purchase price today.

-

Fuel-cell vehicles

Fuel-cell vehicles produce their electric power from fuel cells that use hydrogen. They produce no emissions other than water while driving.

trend twolightening up

To increase efficiency, automakers have been looking to reduce cars’ overall weight. But stricter auto safety standards have typically required using heavier body parts.

That conflict is starting to ease, as companies explore materials that are both light and strong—including aluminum, high-tensile steel and carbon fiber reinforced plastic (CFRP).

However, these are more expensive materials. CFRP, in particular, is primarily used only in specialty sports cars today. Over time, the push for fuel efficiency will mean more use of aluminum and high-tensile steel.

increased cost of materials with weight

The new materials are stronger and lighter—but they’re much more expensive for automakers.

normal steel

high-tensile steel

aluminum

aluminum alloy

carbon fiber reinforced plastic

trend threeself-driving cars

Once found only in science fiction, self-driving cars are about to become a reality. They can help reduce road accidents, clear up traffic and provide mobility to more people.

The competition to lead this change is intense, coming from companies both inside and outside the industry. Fully autonomous cars are being tested on roads today, and the first commercially available semi-autonomous cars could be on the road in the next 1-2 years.

However, that innovation comes with risks. Turning control over to software could lead to new hacking vulnerabilities and other hazards—liability issues that companies can’t ignore. Cars that allow drivers to intervene in emergencies is a more likely scenario in the near future.

Levels of Autonomous Driving

- Adaptive Cruise Control

- Lane Centering

- Electronic ABS Controller

- Automatic Braking

- Fuel-Cell Power System

- Thermal Imaging Camera

- Steering Wheel For Emergency Use

- Multi-Range Sensors

- Ultrasonic Sensors

- Milliwave Radar

- Variable Seating

- Destination Input

- Fully Autonomous Steering

- Electric Power System

- Milliwave Radar

Safety Assistance

The driver can turn over one system to the car's control.

Complex Driver Assistance

Two or more automated systems work together. The driver monitors the road and takes control if needed.

Semi-Autonomous Driving

The car is fully automated, but the driver can take control in emergencies.

Fully Autonomous Driving

The car handles all safety-critical operations with no human input.

Source: Goldman Sachs Global Investment Research.

The technological changes transforming the car will also cause significant changes for the companies that make them.

trend fourevolving the supply chain

The need for more fuel-efficient automobiles will greatly increase the cost of parts—by more than $2,500 per vehicle. The businesses that supply these parts will need to find ways to keep up with technology while keeping costs down. While challenging, this situation also provides opportunities for parts manufacturers.

Spending on Lowering CO2 Emissions

Weighted average cost increase per vehicle (US$)

Source: IHS, company interviews, Goldman Sachs Global Investment Research.

For large companies, mitigating risks could mean increasing their R&D budgets and diversifying across a range of technologies. Smaller businesses, on the other hand, can deepen their focus on core technologies while forming alliances with other suppliers for areas outside their expertise.

trend fivenew competitors

With software and other technologies taking the lead, it’s no surprise that consumer tech companies are entering the automotive world. While a car may not be a mobile phone, these businesses’ focus on design, ease of use, automated assistance and battery life will bring new kinds of innovation to the field.

One catalyst for tech innovators to move into the automotive industry now: electric vehicles have just 1/3 the parts of conventional vehicles, lowering the barriers to entry.

FEWER PARTS = SIMPLER MANUFACTURING

Source: METI, company interview, Goldman Sachs Global Investment Research.

The car of 2025 will also be shaped by the world around it. New groups of drivers and new ways of driving will create new opportunities for automakers.

trend sixThe internet of cars

THE INTERNET OF THINGS DEMONSTRATES HOW CONNECTING EVERYDAY DEVICES TO A NETWORK TRANSFORMS WHAT WE CAN DO WITH THEM. THE INTERNET OF CARS WILL DO THE SAME.

Connected cars, communicating with each other and with the larger world, will not only reduce accidents and ease traffic. They will have powerful effects beyond the auto industry. Insurers, for example, will have new ways to monitor driver behavior, reward good drivers and distribute costs to bad ones. And ride-sharing companies can better connect idle cars with the customers that need them.

Willingness to car share

Generation Z

Millennials

Generation X

Baby Boomers

The popularity of ride sharing differs across generational lines. More Millennials are willing to share cars. Source: Nielsen.

Ride sharing may be a mixed blessing for the auto industry. The majority of vehicles worldwide are used only to commute or for short trips during the day, leaving them idle 95% of the time. If drivers decide to forgo ownership and access cars only when they need them, car sales may be hurt.

Connected cars—especially self-driving ones—could also change the way people use their drive time. In a 2013 survey, more than 50% of respondents said they would prefer to listen to music, talk on the phone, watch videos or browse the Internet while traveling by car.

trend seventhe shift to emerging markets

Car ownership in most economies starts gaining momentum when per-capita incomes move into the $10,000 to $20,000 range.

By 2025, many developing nations will reach that level for the first time, creating a large demand for smaller cars with lower prices and lower operating costs.

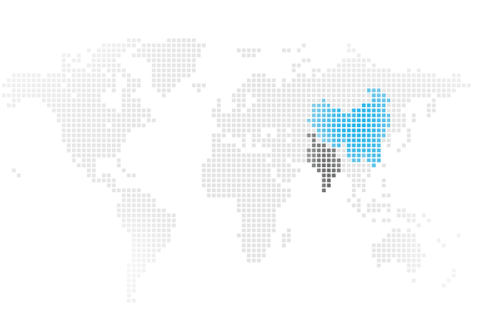

India, for example, will become the world’s third-largest car market by 2025, with 7.4 million vehicles. China, which has already experienced a boom in car ownership, will continue to grow, with car sharing expected to become more popular.

EMERGING MARKETS DOMINATE FUTURE GROWTH

As per-capita incomes rise, emerging markets will account for an ever-growing share of the world's new car purchases.

Millions of vehicles sold.

The global automobile industry is on the brink of a major transformation. Technology is driving this shift, shaped by demographic, regulatory and environmental pressures. By 2025, the car and the world around it will look quite different:

thecar

The car will grow smarter and more efficient, with high-efficiency engines, lighter materials and autonomous driving systems.

theindustry

The industry will evolve, with new competition from tech companies, and suppliers capable of producing high-tech parts at low prices.

thedriver

The driver will look at cars differently—sharing cars and using them as a space to consume media and make calls. A growing percentage of those drivers will come from emerging markets.