|

|

|

||

|

|

| |

Fellow Shareholders:  This is our first letter to shareholders, including everyone at Goldman Sachs who owns shares in the firm. Sharing ownership throughout the firm was one of our principal reasons for becoming a public company, and creating thousands of new owners has enhanced our culture and bound us more closely together. We are stewards of our own investments and yours.

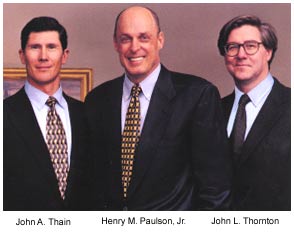

This is our first letter to shareholders, including everyone at Goldman Sachs who owns shares in the firm. Sharing ownership throughout the firm was one of our principal reasons for becoming a public company, and creating thousands of new owners has enhanced our culture and bound us more closely together. We are stewards of our own investments and yours.In our first year as a public company, Goldman Sachs reported record financial results. On a pro forma basis,1 the firm earned $2.6 billion in net earnings in 1999, or $5.27 per diluted share, versus $1.3 billion, or $2.62 per diluted share, in 1998. These results came from strong performances across all the firm's businesses. In 1999, we ranked first in worldwide mergers and acquisitions (M&A), advising on more than $1.3 trillion in announced merger transactions. We were also first in equity offerings worldwide, and third in global high-yield offerings, gaining momentum from a fourth-place high-yield ranking in 1998. And we enjoyed very strong performances in our trading and other businesses. Our performance far exceeded the financial goals we set for ourselves in the lead-up to our initial public offering (IPO). We told potential investors that we saw numerous opportunities to grow the firm's businesses, but emphasized that we work in an industry that does not produce predictable earnings on a quarter-to-quarter basis. Recognizing this reality, we set financial targets of an annual return on equity of more than 20 percent and 12 to 15 percent earnings growth over the cycle. In 1999, on a pro forma basis, we had a 31 percent return on equity, and our net earnings rose by more than 100 percent. We cannot, of course, predict a repeat of this performance in 2000, but we see favorable conditions for Goldman Sachs and our industry. Global economic growth should continue, driven by a remarkably resilient U.S. economy. Europe is one of the fastest growing investment banking markets, led by continued consolidation, restructuring, pension reform and the effects of the euro on financing markets. Asia is recovering, with the return of Asian companies to equity and debt markets creating further opportunities. Latin America is also recovering, and we are pursuing more opportunities in the region. We also see great potential to manage more private wealth around the world, an area where our strong brand and franchise give us a competitive advantage. And we have never seen more opportunities to put our market knowledge and global franchise to work by investing our capital alongside our clients in businesses ranging from Internet start-ups to real estate. Given our industry's accelerating growth and complexity, we have chosen to focus on areas where we have distinctive skills or competitive advantages. We are emphasizing three areas: growing our core businesses around the globe, becoming the world's best technology investment bank and continuing to recruit the most talented people. Core Businesses This year's record performance results from efforts to build our core businesses around the world: our Global Capital Markets businesses (Investment Banking, and Trading and Principal Investments) and our Asset Management and Securities Services business. Our success has come from steadily building these businesses to sufficient scale and flexibility to serve the complex needs of our clients in today's borderless economy. In the process, we have become a truly global bank - one that thrives in every major market. The outlook for our core businesses is bright. Our investment banking strengths - telecommunications, media and entertainment, high technology, healthcare, financial services, and energy and power - are all industries that are growing rapidly and consolidating around the world. We also have a strong and growing trading and market-making franchise. Our willingness and ability to take risk in often difficult and volatile markets distinguishes us from competitors and enhances our relationships with clients. We also enjoy great success and profitability in expanding our private equity business, in which we co-invest with clients in a diverse set of asset classes around the world. And we continue to build - through steady, organic growth - what is now a combined asset management and private wealth management business with nearly $500 billion in assets under supervision. Technology Our aim is to become the world's premier technology investment bank, with technology embedded in everything we do. We cannot serve our most forward-looking, technology-driven clients unless we are a great technology firm in our own right. We are the leading advisor to high-tech companies in the areas of M&A and IPOs. Goldman Sachs lead managed 47 high-tech offerings in 1999 that generated more than $150 billion in market capitalization, giving us an industry-leading 22 percent market share. This includes IPOs for Webvan, Terra Networks, Juniper Networks and Red Hat. These transactions follow IPOs in previous years for eBay, Yahoo!, Inktomi, Exodus and other leading Internet companies. We also advised on high-tech mergers totaling $145 billion during 1999, giving us the top market position in this area. We complemented this underwriting and M&A flow with the outstanding research coverage, trading and market making that our clients expect from us. Our strong relationships with high-tech clients, and our expertise in this sector, have helped us become a significant investor in high-tech companies. In recent years, we have invested $750 million of our own and our clients' capital in more than 70 technology companies. We are also focusing intensively on how technology can best be used within Goldman Sachs to change the way we work and serve our clients. We are doing this by drawing on our in-house experts who advise clients, what we learn from the best-of-class technology firms, and our own experience as high-tech investors. We are placing particular emphasis on innovative technologies that serve clients, including e-commerce ventures, as well as using technology to achieve operating efficiencies. The goal is to have technology that matches - and helps us manage - the web of relationships we have around the world and our knowledge of markets. Our emphasis on technology helps explain why our first acquisition as a public company was The Hull Group, a leading options-trading and electronic market-making firm. Hull uses technology to automate trades and quickly produce a two-way price, working in nine countries and 28 exchanges around the world. Hull complements our existing businesses, expands our trading capabilities and gives us a leading position in electronic markets. We are also looking at how our clients and the markets are affected by new technologies, particularly electronic trading. This has led to our call for a fundamental restructuring of traditional equities exchanges, including establishing an electronically driven, central market in the United States. We are also focusing on electronic trading of fixed income securities, and our investments in BrokerTec, TradeWeb, BondDesk and Bond.Hub will help to centralize liquidity and expand our sales and trading franchise across markets. People Our people have driven Goldman Sachs' success for 130 years through sustained, superb execution across a range of markets and products. The best way to maintain that advantage is by recruiting, training and mentoring people as we always have - one at a time, with great care. We want Goldman Sachs to be a magnet for the very best people in the world - from new graduates to senior hires. At the same time, we are focusing on developing our very deep bench of talented people and improving and extending their skills. We are, for instance, placing young leaders in demanding positions that stretch their abilities. We are also devoting more time and attention to the formal training and development of leaders, particularly senior leaders. As we begin the new century, we know that our success will depend on how well we respond to change and manage the firm's rapid growth. That requires a willingness to abandon old practices and discover new and innovative ways of conducting business. Everything is subject to change - everything but the values we live by and stand for: teamwork, putting clients' interests first, integrity, entrepreneurship and excellence. These values sustained the firm and set us apart during the 20th century. They must never change, but much else will. We can afford nothing less if we are to become a nimble, highly focused, technology-centered, 21st century business and remain the world's premier investment bank and securities firm. We thank our shareholders for choosing to invest in Goldman Sachs, our clients for choosing to work with us, and our people for leading the firm's record performance this year.

|

|

|

||

|

© Copyright 2007, The Goldman Sachs Group, Inc. All Rights Reserved. |