Workng respondents with a personalized plan tend to be significantly better positioned for retirement than those without, as they are:

- more likely to have retirement savings on track or ahead of schedule (80% with a plan vs. 39% without one);

- more confident in their ability to reach retirement goals (80% vs. 42%);

- more likely to navigate competing priorities (43% vs. 35%); and

- more likely to increase their savings year-over-year (62% vs. 39%).

The primary motivators for working with a financial advisor are to gain confidence and develop a well-informed strategy, though the perceived cost of working with a financial advisor continues to be a factor keeping people from seeking advice.

Integrating planning into plan design

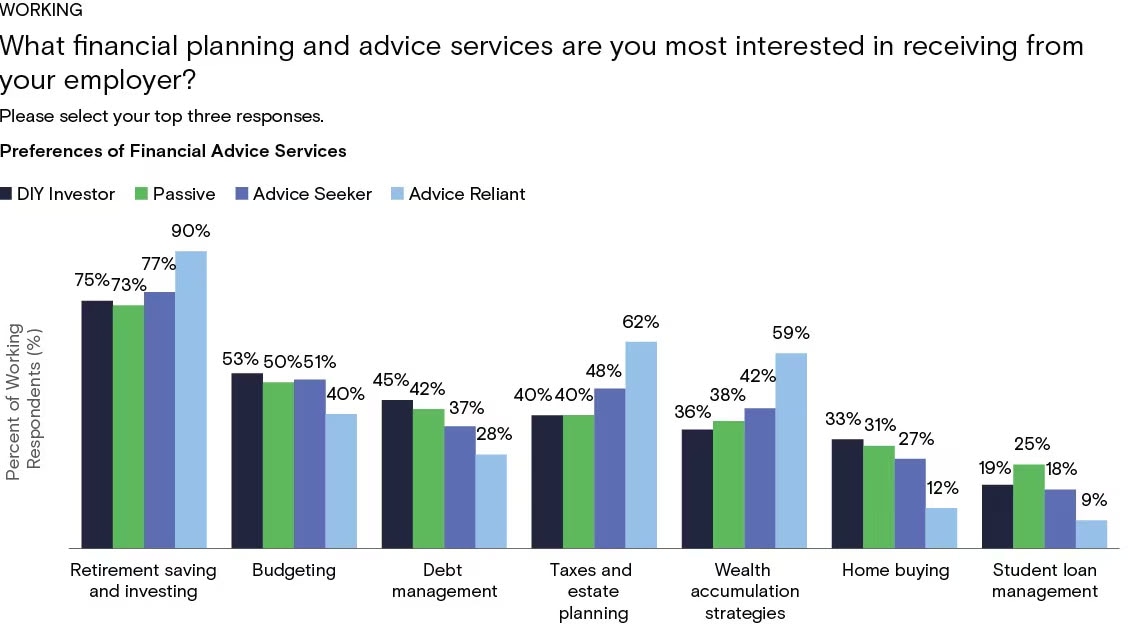

Over the past two decades, retirement plans have increasingly adopted default saving and investing features to encourage participation. Our analysis of the offerings at over 400 companies where Goldman Sachs Ayco provides financial counseling finds 80% of companies provide auto-enrollment and 61% provide auto-escalation features.3 While these default features may increase participation, the Retirement Survey & Insights Report notes they may not align with individual savings goals as they don’t always address how employees manage their savings or how they can optimize plan features.

For employers looking to enhance their current offerings, working respondents noted financial planning and advice, and employer contributions are the most valued services, surpassing all other focus areas. This preference reflects the significant challenges employees encounter in managing their savings. The top additional benefits employees want if their employer could contribute an additional $1,000 toward their available offerings include higher retirement contributions, emergency savings contributions and guaranteed retirement income.