Seizing the innovation supercycle through transformative M&A.

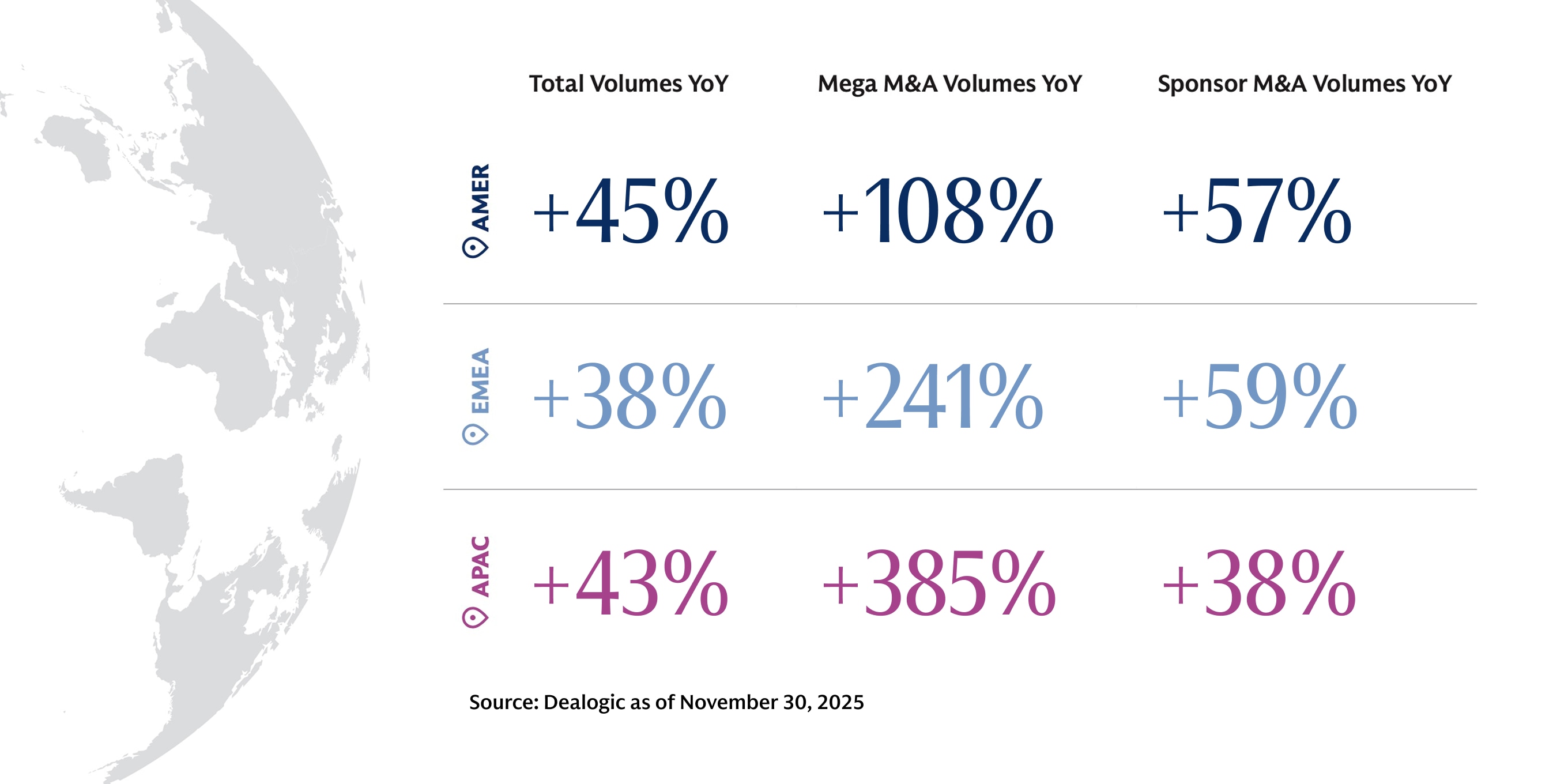

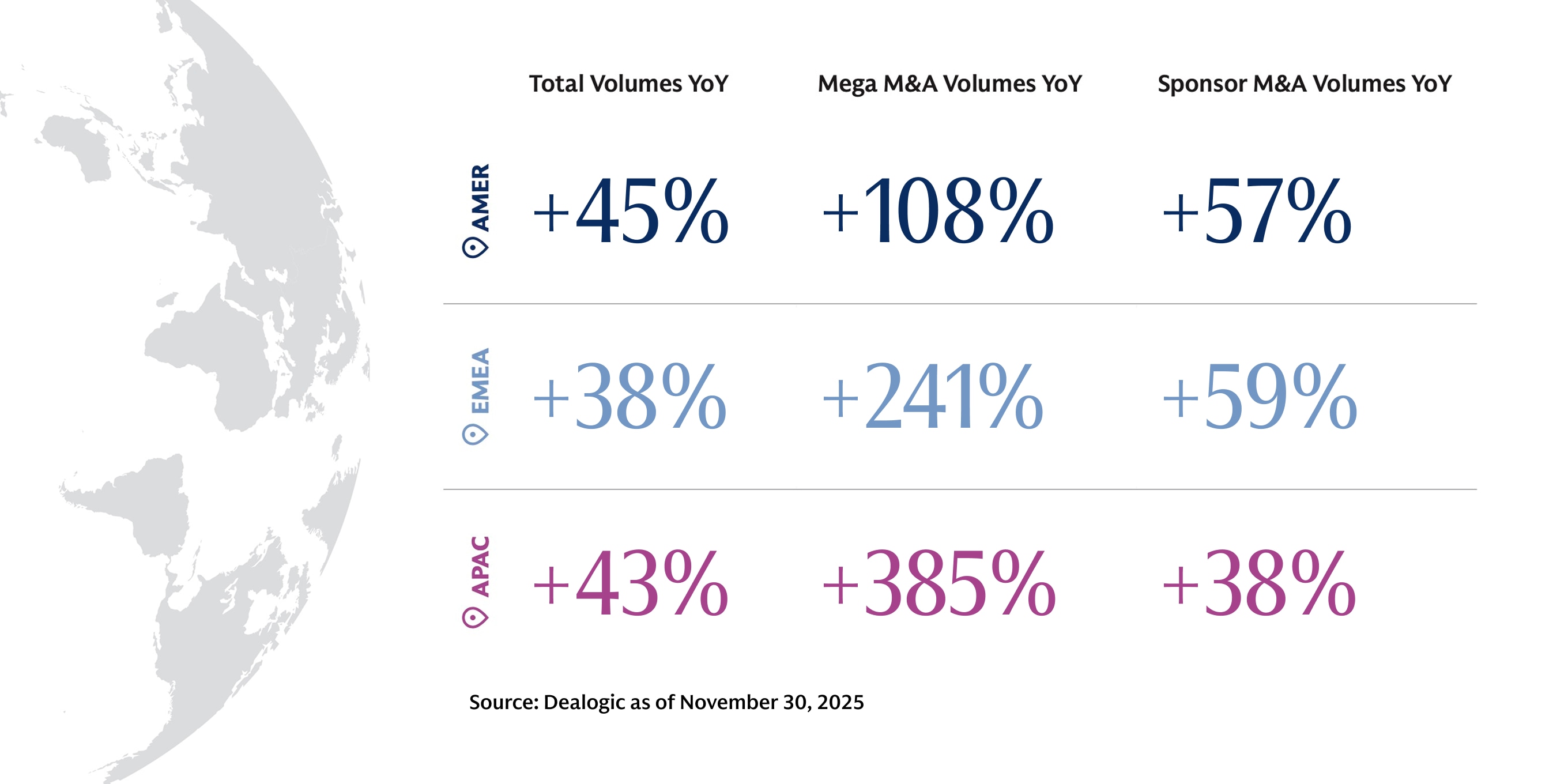

The 2026 global M&A landscape will be defined by strategic repositioning and building for scale. Tremendous public and private capital, the powerful macrocurrent of AI, and a constructive regulatory and economic environment are all contributing to what should be another strong M&A cycle.

Extraordinary ambition is accelerating the pace of these moves. Companies are reimagining their portfolios as technology reshapes industries and capital awaits deployment. Those who think strategically and act boldly will set the course for what comes next.

To better navigate the path ahead, read the Goldman Sachs 2026 Global M&A Outlook.

*Source: FactSet, public company filings.

Think Big, Build Bigger.