Global M&A in 2H: A strong foundation to leverage growth

Appetite from all buyer types and most industries is contributing to a steady pace of M&A dealmaking as we enter the second half of 2024.

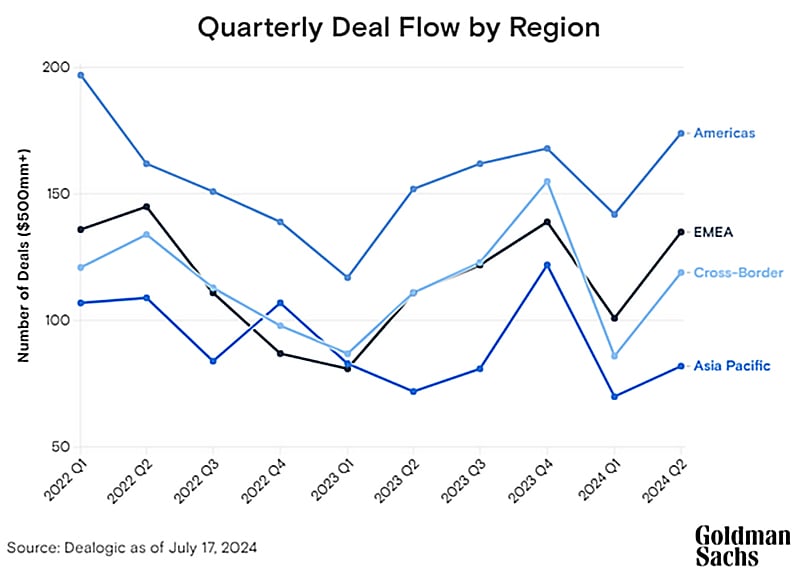

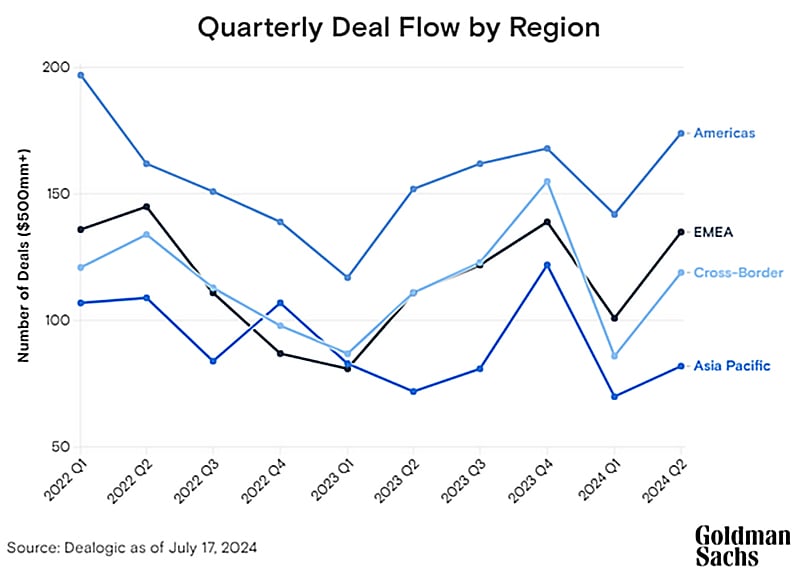

Although headwinds have not fully subsided — with persistently high interest rates and heightened regulatory concerns unfolding amid 40 national elections around the globe — M&A volumes are still returning to “normalized” levels ($275B monthly average in 1H vs. $265B in FY 2023), and deal count continues to improve (+19% YoY) as buyers and sellers increasingly look to drive growth and generate value creation.

These risk factors have all impacted the primary drivers of M&A: CEO confidence and board confidence – yet signs indicate a healthy rebound. “Appetite from corporate acquirors to add to their portfolio through M&A remains strong,” notes Mark Sorrell, global co-head of M&A, “in addition to recent signs that the sponsor-to-sponsor M&A market may be starting to pick up as valuation gaps narrow.”

Regionally, continued deal count improvement in the Americas (+14%), paired with positive momentum in Europe (+22%), is collectively expected to drive a further uptick in 2H. “History would show that we’re in the early innings of a cyclical M&A rally,” said Andre Kelleners, senior leader of M&A in EMEA, in a recent interview on the near-term outlook.

Our teams are focused on a few key themes driving activity through the remainder of 2024:

Transformational M&A continues at elevated pace

Despite a softer-than-expected Q1, the return of large-scale transactions — defined as $10B+ and inclusive of 20 deals announced in 1H — is significantly contributing to overall dealmaking momentum as the macro environment continues to improve. Driven by a heightened focus on accelerating growth and business transformation, strategic activity has picked up across sectors and geographies, with specific deal volume upticks in Industrials (+38%), Healthcare (+23%), and Technology, Media, and Telecommunications (+41%).

Client dialogue around AI is also picking up meaningfully, and we expect AI-driven M&A to accelerate and expand beyond the technology sector. This movement is forcing the emergence of creative deal structures to support large investments in early-stage companies, although maturation of legal regulatory frameworks is still necessary to provide investor clarity.

Private equity has reached an inflection point

Sponsor-related M&A, in particular, rebounded in the back half of 1H (+50% from Q1 to Q2) – momentum driven by sponsor buyside volumes given record levels of dry powder.

Despite only a modest uptick on the half-year overall (+7% YoY), we’re still observing a persistent level of take-private transactions, with 1H 2024 having the second highest number of announcements compared to any half year period historically. "Take-private deals that have been historically difficult to get done." says Christina Minnis, head of global credit finance and global acquisition finance, in a recent interview with Bloomberg. "Now, markets are more efficient and the activity around take-privates both in Europe and the US has really picked up.” The secondary market has also been very active, with record volume in 1H of ~$70B across both GP-led and LP transactions. We expect that GP-led transaction flow will continue to accelerate through the remainder of the year.

Looking forward, we believe that the $3T backlog of portfolio company exits and low levels of DPI, relative to historical vintages, will drive continued momentum in the market.

Simplification is going global

Corporate separations also continue at a steady clip, with 26 global separations announced in 1H, of which two-thirds were outside the US. Separations comprised 10% of M&A quarterly volume as investors and activists push companies to reimagine their asset portfolios.

Momentum has been growing specifically in Europe, driven by a strategic motivation from corporates across the region to identify underappreciated assets, separate divergent businesses, and create geographic focus. “A change we’ve seen in capital markets over the past few years has been the rise in interest rates and cost of capital, which has led to corporate boards and management teams reassessing effectively what they are the optimal owners of,” noted David Dubner, global head of M&A structuring.

Activist activity is accelerating

Despite continued economic uncertainty and an evolving regulatory landscape as stakeholders continue to push for company-wide changes they believe will create value, activism campaigns in 1H remained in-line with the last 5-year average.

The most common demand from activists — issued in 65% of campaigns in 1H — was a push to increase board representation. M&A-related activist demands continue to be driven by a push for breakups and portfolio simplification as the dealmaking environment improves, which we expect will lead to an uptick in campaigns around the sale of companies throughout the back half of the year.

Activists are also finding added incentives in campaigns, particularly on the public stage. “Publicly announcing a potential breakup puts parts of a company in play and can even turn into a sale of a whole company — that’s a great upside for activists,” says Pam Codo-Lotti, global chief operating officer of activism and shareholder advisory.

What comes next?

Overall, the back half of 2023 marked a positive start toward the next M&A upcycle, and the first half of this year has maintained that momentum. Goldman Sachs economists forecast an encouraging macroeconomic outlook on the horizon, with a focus on GDP growth, lower inflation, and lower interest rates.

With a broadening of sector contributions across industries, the reemergence of cross-border activity, elevated levels of large-scale M&A, and an uptick in innovative deal structures, among other indications, we’re cautiously optimistic that this year’s momentum will continue. And while the percentage of M&A relative to the global market cap remains at all-time lows (~3% vs longer-term averages of 4-6%), a window for continued activity gains is expected to persist if capital markets remain resilient.

“I don’t think it’s going to be a straight line of green shoots growing,” Stephan Feldgoise, co-head of global M&A, remarked. “But the underlying trend, the multi-period average as we look back over time – we’re going to see that it was steadily building.”

Sources: Dealogic, FactSet, Deal Point and Public Company Filings as of July 24, 2024.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.