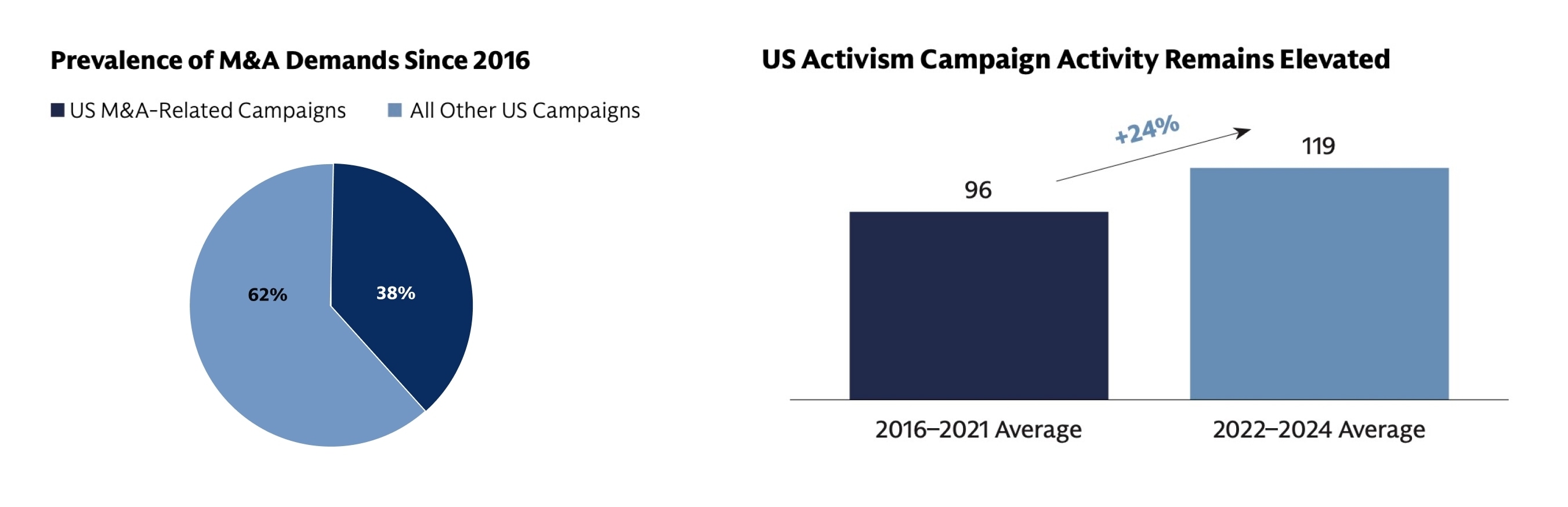

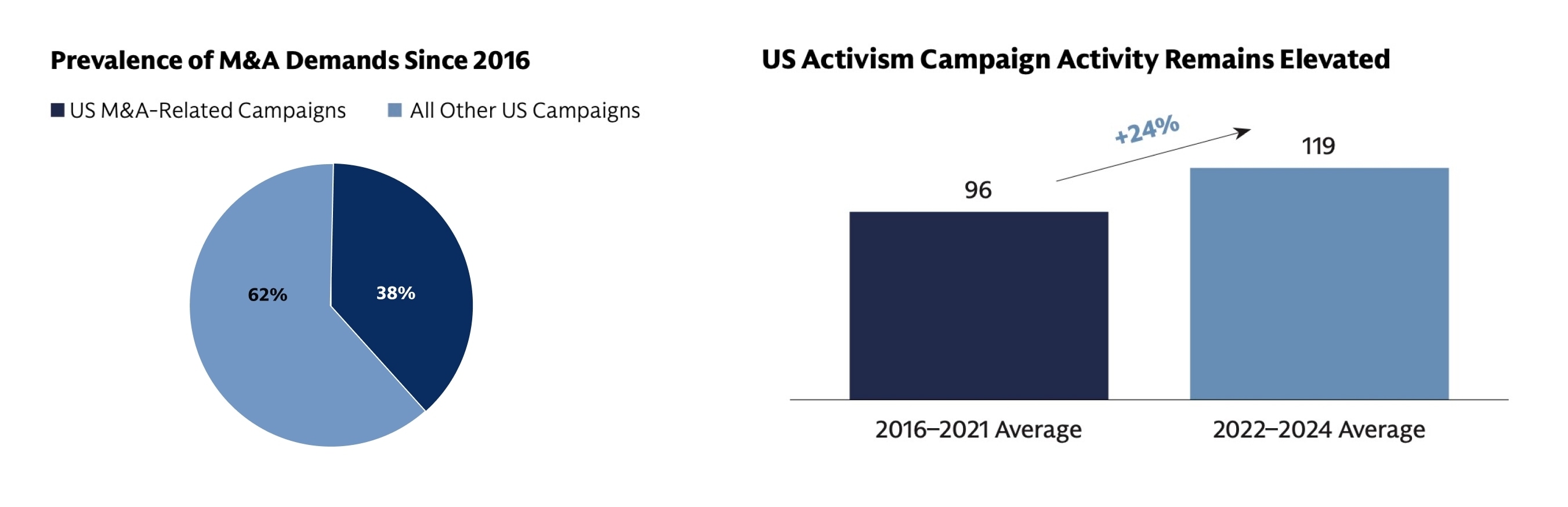

Corporate separation activity continues to accelerate globally as companies highlight undervalued assets, separate divergent businesses, and sharpen geographic focus. The ensuing wave of new public market SpinCos has provided fertile ground for activists. Since 2014, one in four* US SpinCos with a $1bn+ market capitalization have faced public activism campaigns within three years of going public.

Our latest playbook discusses key drivers of corporate separations and how companies can proactively prepare defense strategies.

Why are New SpinCos Attractive Activist Targets?

New Management and Balance Sheet More than 80%** of SpinCo CEOs are promoted internally and may lack experience in managing a standalone public company. This transition leaves them vulnerable to activist activity, especially while the ParentCo's priorities are split between managing the public market vulnerabilities of potentially higher-leverage SpinCos, and maximizing cash proceeds for their own capital structure.

Early Underperformance SpinCos generally deliver strong returns, but those that underperform in their first year as independent companies are more likely to attract activist investors that see an opportunity to push for change.

Position Building In a separation, the distribution of SpinCo shares to ParentCo shareholders typically results in a 50%*** turnover rate during the first four quarters post-separation. Activists can capitalize on price volatility to acquire or increase stakes, even as increasingly larger SpinCos are spun out of mega-cap companies.

*Source: FactSet, Deal Point Data, Diligent Market Intelligence, Goldman Sachs internal analytics, public filings

**“Strategies for Successful Corporate Separations,” Goldman Sachs and EY, May 2023

***LSEG

Source: Factset, Diligent Market Intelligence, Bloomber, public filings (Note: Includes campaigns for maximize shareholder value, enhance corporate governance and Board changes at U.S. companies with market caps >$500mm)

“

A structured, thoughtful separation at both ParentCo and SpinCo, implementation of activism defense best practices, and the right team of advisors are critical for a successful transaction over the long-term.”

Pursuing Separations in an Activist Era

A Strategic Playbook

Connect with Investment Banking