How China aims to mitigate the economic impact of US tariffs

China’s efforts to offset higher US tariffs on Chinese imports are unlikely to blunt all of the duties’ impact on its economy, according to Goldman Sachs Research.

Chinese policymakers are expected to ramp up monetary, fiscal, and other policy easing measures to mitigate the US import taxes, including 6 trillion RMB ($823 billion) of additional net government spending this year compared with 2024. But even so, our economists recently cut their 2025 and 2026 real GDP growth forecasts by 0.5 percentage points each, to 4% and 3.5% respectively.

“We caution that these easing measures are unlikely to be sufficient to fully offset external shocks if the current elevated US tariff rates remain in place,” Chief China Economist Hui Shan writes in Goldman Sachs Research’s recent Top of Mind report.

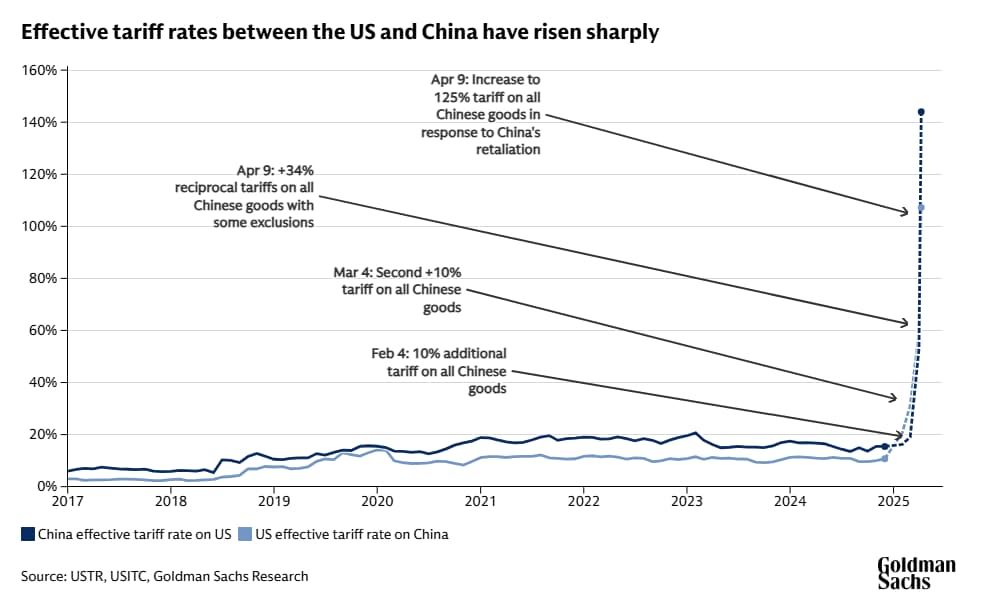

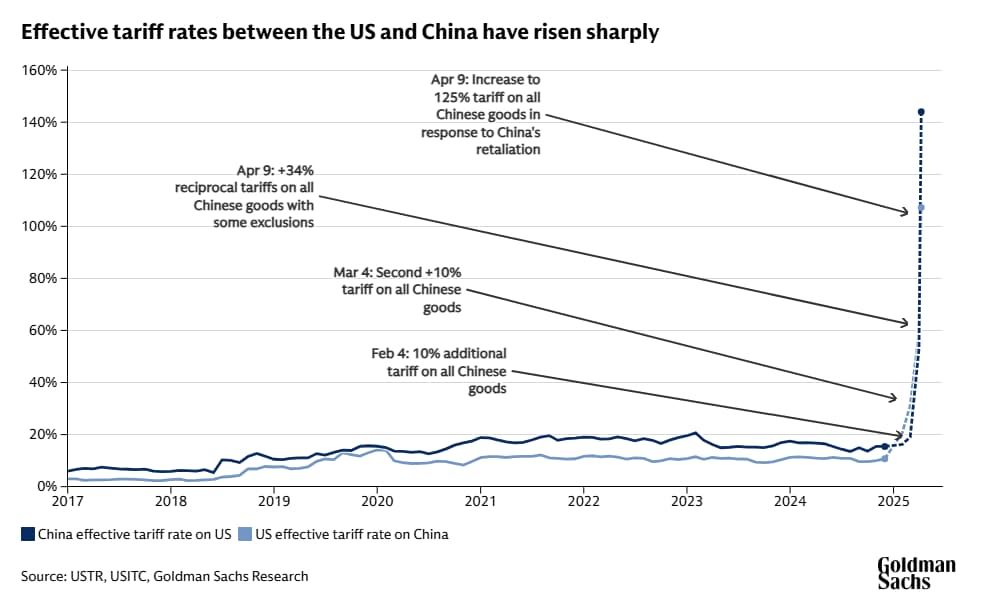

After several rounds of escalation, and the likely temporary exemption of consumer electronics from reciprocal tariffs, the US effective tariff rate on imports from China stands at 107% versus the 144% effective rate China has placed on US imports.

“While such tariffs rates are likely unsustainable, the path to de-escalation remains unclear and, in the meantime, the implications of tariffs will continue to reverberate,” Shan writes.

The economic impact of tariffs is likely to be nonlinear — meaning, for example, that a 2,000% tariff would likely have no greater effect on trade flows than that of a 1,000% tariff rate. Our researchers estimate that a 60% US tariff on Chinese imports would reduce China’s real GDP by roughly 2 percentage points. But doubling that levy to 120% wouldn’t necessarily result in a 4 percentage-point GDP reduction, given that US-bound exports contribute only an estimated 3 percentage points to China's total GDP.

How will US tariffs impact China’s economic growth?

Goldman Sachs Research estimates that the cumulative increase in the effective US tariff rate on Chinese goods since President Trump's inauguration, if sustained, will reduce the level of Chinese real GDP by 2.6 percentage points, with about 2.2 percentage points of that impact occurring in 2025.

In the meantime, Chinese authorities have indicated plans to increase policy easing. In addition to the 6 trillion RMB of additional government spending, Goldman Sachs Research expects China will reduce its reserve requirement ratio (RRR) by 100 basis points and cut its policy rate by 60 basis points this year (versus the 40 basis points of policy rate cuts Goldman Sachs Research expected previously). Beyond monetary and fiscal policies, Goldman Sachs Research also anticipates a pickup in total social financing (TSF) stock growth, and supportive housing policies and targeted social relief.

How is China is responding to US tariffs?

Since early April, the Chinese government appears to have adopted a tit-for-tat approach to bilateral trade with the US, a clear departure from relatively restrained reactions in February and March.

“This shift likely reflects a belief that US tariffs expressly target China and that decoupling may be irreversible,” Hui Shan writes.

Chinese manufacturers have strong incentives to redirect exports to the US through other countries — particularly because US tariff rates differ dramatically across countries (145% for China and 10% for other countries for many products).

In response to escalating US tariffs, the Chinese government also wants to deepen ties with other trading partners, as reflected in President Xi’s recent meeting with the Spanish prime minister, visits to Southeast Asian countries, and a potential meeting with EU leaders. However, building stronger relations, particularly with the EU, may require substantive efforts, including reducing trade barriers, increasing imports, and avoiding export surpluses that could disrupt the EU market.

How much does the US depend on US imports?

The path ahead remains highly uncertain. US importers are heavily reliant on Chinese goods, and short-term substitution solutions remain limited as many of the goods the US imports from China are in markets that China dominates, according to Goldman Sachs Research.

An estimated 36% of US imports from China are in categories where China accounts for over 70% of total US imports, according to Goldman Sachs research. This US dependence on China suggests triple-digit tariff rates may not be sustainable, but when and by how much they will decline remains unclear.

China’s policy reaction is also uncertain. If external shocks prove too great, policymakers could shift gears and focus entirely on ensuring employment stability, echoing the 2020 Covid response. Support measures could likely include retraining programs for workers displaced from export-oriented manufacturing, waivers on taxes, and social security contributions for exporters to retain workers, and enhancements to unemployment insurance programs.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.