Resource realism: The geopolitics of critical mineral supply chains

Jared Cohen is president of Global Affairs and co-head of the Goldman Sachs Global Institute.

Wilson Shirley and Klara Svensson are contributors.

- We expect geopolitical competition to increase countries’ and companies’ focus on building more resilient and diversified supply chains. Critical mineral supply chains will receive particular attention due to their growing importance for the green-energy transition, defense systems, and other high-tech applications, as well as their vulnerability to supply shocks.

- China has a strong position in critical mineral mining and a dominant position in processing and manufacturing. China accounts for 85-90% of global rare earth element mine-to-metal refining and refines 68% of the world’s cobalt, 65% of nickel, and 60% of lithium of the grade needed for electric vehicle batteries. Seventy-five percent of all batteries and a majority of electric vehicles are made in China.

- Geopolitical competition and geographic concentration have increased concerns in many countries about critical mineral supply chains. In the past, China has imposed restrictions on exports of select critical minerals to several countries, including the United States, Japan, and Sweden. Other countries have imposed their own restrictions. In the last decade and a half, there has been a five-fold increase in export controls on critical minerals.

- Critical mineral supply chains are complex, and building more diverse and resilient supply chains will require significant investments of time, expertise, and resources. However, in the last decade there has been significant diversification in the sourcing of critical minerals, and a slight diversification in global processing and manufacturing capacity.

- Future success in diversifying and building more resilient global supply chains will require investments and partnerships by the public and private sectors at every step of the value chain, streamlined project development, cooperation with likeminded partners, a global engagement strategy, and training a new generation of mining professionals. Some of the most important developments that will provide new alternative materials and lower costs will also come from advances in science and technology, many of which are being deployed and tested at scale.

Introduction

Competition between the US and China has put the need for more resilient and diversified supply chains in focus. Both countries rely on complex, international networks of suppliers, manufacturers and distributors to provide the goods and services that make the two largest economies, and the global economy, run. The most important questions about global supply chains used to be about economics – what is the price of a given good, and how efficient is the delivery? But today, some of the most important questions are about geopolitics – where are goods coming from, are they important for national security, and how can we know that the supply is secure and resilient to shocks?

Those geopolitical questions are at the forefront of businesses and governments’ minds after the COVID-19 pandemic, Russia’s full-scale invasion of Ukraine, and ongoing tensions between the US and China. Chinese leaders are calling for greater economic and technological “self reliance” while advancing policies like “Made in China 2025” and a “dual circulation” model to increase self-sufficiency while maintaining global market share for manufacturers. Meanwhile, US and EU leaders alike are calling for “de-risking” strategies, as global supply chains are becoming more fragmented and even, as US National Security Advisor Jake Sullivan recently stated, “weaponized.”

The path forward to reconcile political and national-security goals with economic realities is not clear. Reorienting and diversifying critical supply chains—from microelectronics, to pharmaceuticals, to the material and chemicals needed for defense systems—often lie in tension with what is economically possible or desirable. An area of increased concern is the supply chain for critical minerals, the essential building blocks for clean technologies, advanced weapons systems, and the broader technological ecosystem. As the integrated global economy evolves into the diversified global economy, the critical mineral supply chains will be the proving ground where the hopes of a green-energy, tech-enabled future will have to reconcile with geopolitical and resource realities.

The importance of critical minerals

The 50 critical minerals and the subset of 17 rare earth elements (REEs) identified by the US Geological Survey(USGS) make the modern digital economy work. These materials are used to manufacture wind turbines, electric vehicle motors, and smartphones, as well as F-35 fighter aircraft and many other high-tech goods. Many countries and companies are worried about market disruptions, and the US Department of Energy has listed lithium, nickel, and cobalt (all used in batteries), as well as dysprosium (data storage devices), iridium (anode coatings), neodymium (magnets), praseodymium (aerospace alloys), and terbium (fiber optics) as the minerals most important for energy needs and that are also most at risk of supply shocks.

While there are reserves of different quantities of these essential materials all over the world, their supply chain is increasingly vulnerable to geopolitical shocks, as they are processed into usable, constituent materials predominantly—and for some almost exclusively—in one country: China.

This concentration is causing concern in many world capitals. The Biden administration and many US allies and partners have put technology and the green-energy transition at the top of their domestic and foreign policy agendas. Meanwhile, countries in the Global South, including India, are advocating for greater electric vehicle adoption to increase their energy independence and reduce reliance on oil and gas imports. But, given recent geopolitical tensions and China’s dominant role in critical mineral processing and battery manufacturing, those goals aren’t entirely within nations’ control. As the US Department of Energy recently stated, “US decarbonization goals are reliant on both Chinese firms and the Chinese government.”

Ideas like “derisking” or “diversifying” national-security-sensitive supply chains get a great deal of attention, but the related costs and complexities—including important questions about what is prudent, cost effective, and achievable—often keep rhetoric from turning into reality. However, building a more resilient and diversified critical mineral supply chain for mining, processing, and manufacturing isn’t impossible. With the right strategy and investments—not to mention recent technological advancements—that goal can be approached in a way that reduces geopolitical risks, creates new market opportunities, and provides a more sustainable path to the new, green economy.

Demand for critical minerals is growing, and China dominates the supply chain

Global demand for critical minerals is growing rapidly. In the last five years, the critical minerals market doubled in size, to $320 billion, and is forecast to double again before the end of the decade. But even these rapidly growing figures understate the importance of the industry, as nearly every piece of technology used in daily life and business requires critical mineral inputs.

Further growth will primarily be driven by increased demand for clean energy technologies. Electric vehicle batteries, for example, require on average 200kg of critical minerals per vehicle, roughly six times the amount needed for a conventional car. Goldman Sachs forecasts that electric vehicles will constitute 72% of all new vehicle sales in the EU and 50% in the US by 2030, on track to reach half of global sales by 2035. Those numbers will continue to climb globally, with the UK banning the sale of new petrol and diesel cars by 2030 and the EU launching a similar ban in 2035. Surging demand for electric vehicles will require a surging supply of many thousands of kilotons of critical minerals.

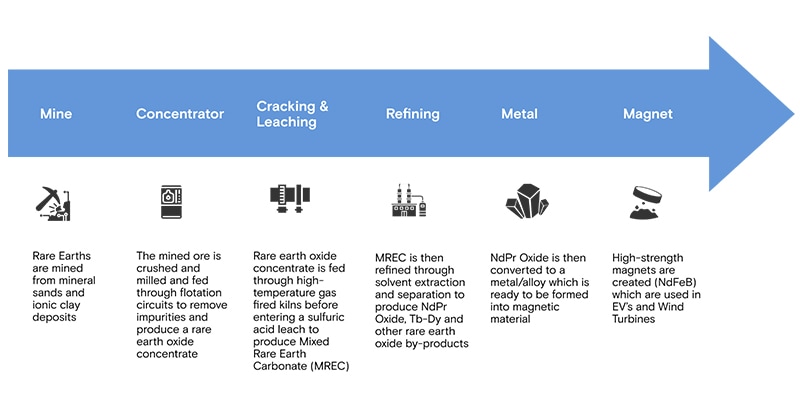

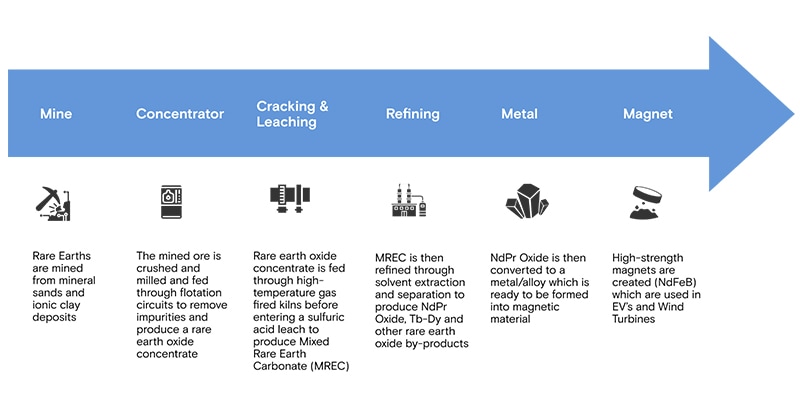

But for those minerals to be of used for applications like electric vehicle batteries, they must first be refined and processed into high-grade materials. There are variations in processing for each commodity, but this multi-step procedure typically involves the crushing and roasting of mined ores, followed by a series of chemical treatments to create a purified metal that can be used as an input in consumer products. For REEs, the process is even more complex, as illustrated in the Goldman Sachs Research graphic below. The high purity metal must then be converted into magnets to be used for applications like wind turbines and electric vehicle drivetrains. It is a six-step, time- and capital-intensive process requiring advanced expertise and specific machinery.

China has a long history as a producer and refiner of critical minerals. REEs were first discovered in the country in 1927, and production began in the Bayan Obo Mining District of Inner Mongolia three decades later. Rare earths have since been found in 21 Chinese provinces and autonomous regions. Thanks to a decades-long strategy of investment and industrial policy, supported by cheaper labor, faster permitting, and looser environmental and labor regulations than in many other countries, China has developed these resources and achieved a dominant global position in many areas. The US Department of Defense also describes how China has taken an aggressive, competitive posture to undermine potential rivals. It notes that China has in the past “strategically flood[ed] the global market” with REEs at lower prices to decrease incentives for foreign companies to start new projects, or to put competing companies out of business. More recently, inflation in Western countries and deflation in China has provided further incentives for Chinese manufacturers to undercut prices offered by their Western counterparts.

The results of China’s long-term strategy and asymmetric advantages in the critical mineral field are now clear throughout the supply chain. According to Goldman Sachs Research, China now accounts for 85 – 90% of global REEs mine-to-metal refining and 92% of global manufacturing of REE magnets. Likewise, China refines 68% of the world’s cobalt, 65% of nickel, and 60% of lithium of the grade needed for electric vehicle batteries. Goldman Sachs Research also estimates that 65% of battery components, 71% battery cells, and 57% of the world’s electric vehicles are made in China.

Neither the United States nor any other single nation is currently positioned to outcompete China in these domains. But while China holds a dominant position in the downstream global supply chain, many nations are recognizing their vulnerability to supply disruptions. For example, in March 2023 the EU’s Critical Minerals Act made explicit the goal to “reduce dependence on third countries to access critical raw minerals.” Likeminded countries are improving their positions and can continue to do so in a way that protects their economic and national security and increases their market share in a growing industry.

Critical minerals and geopolitics

Whenever a single country holds a dominant position in a key supply chain, it increases the risks and potential magnitude of economic disruptions. But the concern for critical mineral supply chains looks particularly acute as both demand and geopolitical competition are increasing, giving an advantage to countries with significant reserves or, more importantly, dominant positions in processing and manufacturing.

Over the last decade, geopolitics have increasingly driven economic policies, leading to increased risks and disruptions in global markets. In 2010, Beijing embargoed REE exports to Tokyo as a result of a dispute with Japan. In 2020, China reportedly cut off exports of graphite to Sweden. Following up on the October 2022 US-led export controls on advanced computing and semiconductor products to China, Beijing announced its own export controls on gallium and germanium products to the United States in the summer of 2023.

At the same time, we are seeing trends toward greater protectionism and resource nationalism around the world. Zimbabwe has banned the export of unprocessed lithium to incentivize local processing. Indonesia, home to 21% of the world’s nickel reserves and 37% of nickel mine production, has progressively restricted nickel ore exports. The Philippines, the world’s second-biggest nickel supplier (12%), may soon tax nickel exports to encourage domestic industry. And Chile’s President Gabriel Boric has made moves to nationalize his country’s lithium industry, which accounts for 26% of the world’s reserves. These trends are global – in the last decade and a half, there’s been a five-fold increase in export restrictions on critical minerals.

Resource nationalism and supply-chains shocks present significant risks to global markets. Recognizing that reality, the Trump White House declared America’s reliance on China for critical minerals a “national emergency” in 2020. And in its first 100 days, the Biden White House released a comprehensive report on supply chains listing critical minerals as a key area of national-security and economic importance. However, while the EU has outlined a critical minerals strategy that includes additional extraction and processing, more recycling, and minimum domestic requirements, leaders in neither US political party have yet articulated a comprehensive plan to secure critical mineral supply chains, much less put such a strategy into action.

Reorienting supply chains is possible, but processing is a challenge

Critical mineral supply chains are complex, and reorientation in specific areas will require significant investments of time, expertise, and resources, but it is possible in many domains. In some ways, it has already begun.

On the upstream supply side, there is no danger of the world running out of critical minerals soon. Every year, the USGS releases summaries of mineral commodities, including data on known, economically extractable reserves. These numbers vary, depending on a variety of factors. When ore is extracted, known reserves are depleted. But when new deposits are discovered and the full extent of known deposits is explored, reserve numbers increase. While the total fluctuates, a trend is clear: From 2013 to 2022, the USGS summaries reveal that, on net, the world’s known reserves of cobalt, lithium, and nickel are increasing, as are known reserves of other critical minerals – the global supply of critical minerals is elastic.

The data also show that no country has a monopoly on critical minerals reserves. Ten years ago, 50% of all known REE deposits were in China. Today, that figure is down to 34%. There have also been significant new discoveries in countries as diverse as Indonesia, Argentina, Australia, and Vietnam. Earlier this year Sweden discovered Europe’s largest deposits of REEs, and there was recently a find of an estimated 20 to 40 million tons of lithium in a volcanic crater along the Nevada-Oregon border, making it potentially the world’s largest deposit. By the end of the next decade, there’s every reason to expect additional discoveries that will deepen our understanding of the diverse potential sources of supply.

Even though new discoveries of critical mineral reserves around the world continue to be made, China is still the top producer of 30 of the 50 critical minerals, in part because it mines at greater rates than other countries. China also has a significant share of the reserves of many materials identified by the US Department of Energy as both important for energy purposes and whose supply is at risk, including graphite (16% of global reserves) and gallium (86% of global reserves), as well as REEs like dysprosium, neodymium, and terbium (China holds 34% of global rare earth reserves).

Despite the current state of play, the data show there is a reasonable roadmap to building an ex-China supply chain for mining and extracting many critical minerals and REEs. A decade ago, China accounted for over 97% of both REE supply and refined output, shares that have fallen to 63% and below 90% respectively, according to Wood Mackenzie, which also expects China’s share of global REE supply may fall to around half by 2050. In the United States alone, REE mine production increased from 6% of global output in 2013 to 14% in 2022, and Australia, Vietnam, and Japan increased their shares significantly as well.

But additional critical mineral mining capacity outside of China is only part of what would be required to build an ex-China supply chain that would serve global consumers and countries’ needs. As it stands, even when those minerals are mined outside of China, based on the distribution of global capacity, they are almost always sent to China for processing and manufacturing. This asymmetric capacity represents a meaningful bottleneck that can only be addressed if other countries move quickly to develop their own downstream processing and manufacturing capacities.

That task is easier said than done. Building new processing facilities is less expensive and time consuming than constructing new mines, but it comes with its own costs and difficulties. Processing facilities require expertise and advanced machinery. They create environmental and social concerns, including over water usage, carbon emissions, and radioactive waste produced by REE magnet manufacturing.

Despite the significant attention given to critical minerals and REEs in recent years, there are currently only five ex-China REE refineries in operation, under construction, or being recommissioned. According to Goldman Sachs Research, these refineries are in Nevada, Malaysia, France, Estonia, and Western Australia.

Without prudent action, it is unlikely that the share of ex-China processing capacity will change soon. Though Goldman Sachs Research estimates there are more than 20 planned rare-earths projects around the world that, if successful, might produce more than 100 kilotons per year of REEs and approximately 20 kilotons per year of NdPr (neodymium and praseodymium, magnets used in electric vehicles), these projects will likely face a significant rate of failure. Given the amount of time, capital, and expertise each will require, Goldman Sachs Research estimates that, of these 20 projects, it is likely that only two or three will become operational by 2030.

New investment, regulation, and cooperation for a more resilient global supply chain

A coordinated, successful strategy to build more diverse and resilient critical mineral supply chains would need to take a comprehensive view of where the most pressing needs are today, where demand is heading, and include technological solutions to make the supply chain more resilient, efficient, and cost-effective. Such a strategy would require the public and private sectors to work together on new investments, new approaches to regulation, and new forms of international cooperation.

In our view, the following six steps would advance nations and markets toward this goal:

Invest in every step of the value chain. Many of the investments in the critical mineral supply chain are focused on mining of raw materials or manufacturing of clean technology components, the first and final steps of the value chain. But these investments often miss the critical middle component, which is processing.

Building a more resilient supply chain at every step will come at a short- and medium-term cost in exchange for long-term security, resilience, and returns. The estimated cost to replicate China’s production of refined REEs used in magnets for electric vehicle batteries outside of China, for example, is between $15 billion and $30 billion according to Goldman Sachs Research. This figure includes the full mine-to-magnet value chain and assumes at least 20 projects, at a cost of between $1 billion and $2 billion, as well as up to $500 million for metal and magnet processing. However, this figure is only part of the equation, and a fully-localized battery supply chain for the US and EU would cost $160 billion by 2030, Goldman Sachs Research estimates.

This is a significant level of investment, requiring partnerships between the public and private sectors. As a comparison, the US’s CHIPS and Science Act of 2022 provided $39 billion of public funds in semiconductor manufacturing, and was soon followed by tens of billions of dollars of private investment.

A more resilient and diversified critical mineral supply chain will require new spending and partnerships. China has a decades-long head start and provides its industry with asymmetric benefits, including economies of scale, abundant capacity, cheap labor, and its own government subsidies. Because of such asymmetric advantages, Goldman Sachs Research indicates that a $230 million 50 kiloton per annum (ktpa) lithium hydroxide plant in China would cost $650 million in Australia. The current heightened inflationary environment only increases capital and operating expenditure concerns, significantly reducing the internal rate of return for many projects and increasing the need for public support for strategic sectors.

But many governments are now recognizing that geopolitical risks impose costs of their own, making new investments more desirable. In June 2023, Australia announced a critical minerals strategy to “help Australia become a renewable energy superpower.” Canberra has provided debt support to several developers, as well as a $1.2 billion funding line to an Australian REE mining company, with production expected to commence in 2024. In the United States, the $1.2 trillion US Inflation Reduction Act provides a 10% tax credit for the cost of production of certain critical minerals as well as subsidies for purchases of certain electric vehicles. And the EU’s Critical Raw Materials Act’s stated objective, which is still subject to negotiations, is to reduce reliance on third countries and diversify sourcing, increase domestic extraction to 10% of EU consumption by 2030 and domestic processing to 40%.

Our view is that many of these government-sponsored initiatives are promising, but it is still too soon to tell how effective they will be. Many provisions remain non-specific and aspirational. In our view, strategies that offer incentives across the supply chain, not just on end products, and prioritize where supplies are most likely to fall short of demand will achieve the greatest levels of success.

Streamline project development. Industry leaders have pointed out that time spent financing, permitting, and executing critical mineral projects is often wasted due to burdensome regulatory requirements, often dooming them to failure. Updated regulatory policies can reduce the time and costs needed to develop new mines and processing facilities, while also respecting environmental and social concerns.

Unnecessarily long timelines for project development are often the result of outdated regulatory policies. In the United States, independent of the permitting process, completion of a mine can take 10 years or more, and must abide by the General Mining Law of 1872, a statute that has not been significantly updated. However, there is room for regulatory reform at multiple levels of government. US states like Oklahoma, home to a new REE magnet manufacturing facility, are advocating for new domestic permitting guidelines. The Aspen Institute Energy and Environment Program’s 2023 report offered an innovative subnational solution, a place-based permitting plan that would offer strict timelines on critical mineral project permitting adjudication.

The United States is not alone in exploring ways to update its regulatory framework. Norway—a leader on climate and sustainability with significant reserves of nickel, copper, and cobalt—is launching an initiative to fast-track licensing applications. Oslo has also proposed a state mineral fund and made plans to open the nearby ocean to deep-sea mining, a promising area for other nations to explore as well. Canada, where it can take between five and 25 years to develop new mines, is streamlining its permitting process as a part of its $3 billion critical minerals strategy and is working with indigenous communities to do so. And the European Union aims to accelerate permitting of projects to 24 months for mining, down from as much as 15 years today, and to 12 months for processing and recycling. These proposed timelines are reduced to six to nine months for projected deemed to be of strategic common importance.

Streamlined project development will require greater public engagement and communication, including efforts by the public and private sectors to combat disinformation. For example, in 2022, a social media campaign “comprising a network of thousands of inauthentic accounts” targeted an Australia-based company developing an REE processing facility in Texas with $30 million in backing from the US Department of Defense. The social media campaign accused the US government-backed project of causing significant environmental damage and called for protests, despite the significant environmental reviews the project had undergone at the federal, state, and local levels. The US Department of Defense labeled the campaign “disinformation.”

Building an ex-China supply chain for critical mineral extraction and processing could also reduce the industry’s carbon footprint and advance sustainability goals. First, production in China often emits more greenhouse gases than production in other countries. While many Western countries are reducing their reliance on fossil fuels, 63% of China’s power generation comes from coal-fired power plants, and the Chinese government adds as many as two new coal power plants a week. Industry expert Wood Mackenzie estimates that >50% of all lithium refining done in China today is powered by coal. Shipping raw minerals to China from around the world for processing is also a carbon-intensive process that increases supply-chain complexity. Additional processing facilities closer to extraction sites could reduce the need for this step. And second, according to Wood Mackenzie, the lithium mining and processing operations that predominate in China produce on average 8.8 tons of CO2 per ton of lithium product, as compared to just 2.3 tons of CO2 for each ton lithium produced from brine extraction processes that predominate in many Latin American countries.

Strengthen cooperation with like-minded partners. Economic competition does not have to lead to economic nationalism. In fact, economic competition can increase international cooperation with like-minded partners.

The competition for critical minerals is creating new avenues for global cooperation. As the United Kingdom and the United States do not have a free trade agreement, UK companies are currently ineligible for Inflation Reduction Act credits. Noting that gap, the US-UK Atlantic Declaration launched negotiations on a critical mineral agreement, which would allow UK-sourced components to become eligible for credits. The US and the EU have entered into similar negotiations. Likewise, the United States and Japan signed a critical minerals agreement in March of 2023. The US, the EU, Japan, and the UK are exploring creating a critical mineral “buyers’ club” to reduce reliance on China. And the 13-member Mineral Security Partnership – which does not yet include any Latin American or Southeast Asian countries, but could – has planned 15 potential projects for development across several regions.

The growing diplomatic and economic relationship between China and Russia has made the geopolitical case for greater cooperation between the United States and likeminded partners stronger. Largely cut off from direct access to Western markets due to sanctions, Russia has pivoted to Asia. In the first seven months of 2023, bilateral trade between Moscow and Beijing reached $134 billion, up 36% from the previous year. China’s imports from Russia include not only crude oil, but also critical minerals like aluminum and nickel, which are now sold at below-market rates.

Compete globally. No country will achieve self-sufficiency in critical minerals mining and processing. Building a more resilient global supply chain will require countries to seek out new opportunities and partnerships abroad.

Every country relies on imports of critical minerals. The United States imports half its consumption. Even China is under-resourced relative to its population. But unlike the United States, China has pursued a comprehensive investment strategy to secure and control a domestic and global supply.

China invests at home and abroad in the critical mineral supply chain. In the last few years, Beijing has doubled domestic production of light REEs, particularly in Inner Mongolia and Sichuan. As part of its “going out” strategy, from 2018 through the first half of 2021, Chinese companies invested at twice the levels of American, Australian, and Canadian companies combined to acquire global lithium assets, including in places like Zimbabwe and Namibia and in the “Lithium Triangle” of Argentina, Bolivia, and Chile. China will also likely pursue new mining opportunities in Iran, which claims to have recently discovered an 8.5-million-ton lithium reserve.

Despite China’s lead in global investments, there are opportunities for other countries to develop alternatives. In our view, many of the most promising REEs opportunities are driven by companies based in Australia. But there are also potential projects in Japan, South Korea, Indonesia, Vietnam, Norway, Sweden, Canada, the United States, and elsewhere.

Even in countries where China has a significant first mover advantage, there is room for other governments and companies to compete. From Sri Lanka to Italy, which recently signaled its intent to withdraw from Beijing’s Belt and Road Initiative, states are seeking new economic partners. Even the Democratic Republic of Congo (DRC), which mines 70% of the world’s cobalt, and where 15 of 17 cobalt-producing mines are financed by China, could be a case in point: The head of the Democratic Republic of Congo’s state-owned mining company recently commented on arrangements with Chinese-owned companies, “We’re not satisfied. None of these contracts create value for us.” However, the DRC presents significant challenges for many countries and companies to engage, due to human-rights abuses, poor governance, and corruption.

Governments and companies can make their bids more attractive by investing in local communities, strengthening the domestic workforce, and working transparently and equitably with partners. Taking into account local conditions and the strength of the relationship with host countries, they can also co-locate new processing capacity with new mines, taking advantage of opportunities for nearshoring and friendshoring. This approach could alleviate many of the concerns of economic nationalists and environmental advocates.

Train a new generation of mining professionals. Mining and processing critical minerals are complex tasks, as is manufacturing consumer products like electric vehicle batteries. Without a talent development strategy, even the most innovative supply chain strategy will fail.

The United States’ mining workforce is declining due to decades of neglect. In 1996, The United States closed its Bureau of Mines. The number of mining and mining engineering programs at American colleges and universities has been declining for four decades, from 25 in 1982 to 14 in 2014. Today, there are only 70 faculty members in these programs (average age 52). Meanwhile, half of the aging US mining workforce (median age 46), or more than 200,000 miners, is expected to retire by 2029. At the same time, there are 39 Chinese universities granting mining degrees and ensuring a long-term mining workforce in the process.

The United States and likeminded partners would need to commit resources to close this talent deficit and compete globally. In our view, this would require prioritizing high-skilled immigration so trained workers can relocate to where their skills are needed most. In the long term, it would also mean investing in job training and vocational education to meet industry needs and consumer demand.

Focus on research and development. Many of the most significant changes to the critical mineral supply chains may not come from new investments to build new mines, processing plants, or manufacturing facilities. They may come from technological innovations that provide new substitutes, new production techniques, new sources, and new extraction methods.

New substitutes: Sodium-ion batteries are increasingly being used as substitutes for batteries made from lithium, cobalt, and graphite. For example, from 2020 to 2023, the percent of Chinese-made electric vehicles that are cobalt-free leapt 18% to 60%.

New production techniques: Hydroxide precipitate production is providing a new alternative to cobalt sources from the Democratic Republic of the Congo, where concerns about human rights and instability present significant risks. Last year, Indonesia used this technique to produce 9,500 tons of cobalt, 5% of the world’s supply, up from a baseline of near zero.

New sources: Critical minerals recycling provides a new source of inputs and reduces dependency and waste, and the technique shows great promise. According to Goldman Sachs Research, recycled material already provides a quarter of global NdPr. With the right policies, our research also estimates that >50% of European lithium demand and 92% of cobalt demand for electric vehicle batteries could be sourced from recycling by 2040.

New extraction methods: Direct Lithium Extraction (DLE) is an innovative technique being tested at scale, with some projects currently in construction. Whereas traditional lithium extraction techniques can take as long as a year and a half, with concentrated brine going through a slow evaporation process in an open-air pond for up to 18 months, Goldman Sachs Research has shown that DLE may reduce that timeframe to less than 60 days, and could double lithium production and increase the supply of lithium from brine projects. Given its potential to lower costs and increase efficiencies for the green-energy transition, DLE could do for lithium what “the shale revolution did for oil.” At a cost of around $5,700/ton, if implemented in countries like Chile and Argentina where there are significant lithium reserves, there would be benefits not only in better supply but also in improved sustainability practices in land and water usage.

Critical minerals and the global economic competition

The current focus on critical minerals has been a long time in the making. In 1992, Deng Xiaoping, the Chinese leader responsible for launching the country’s economic reform and opening up, stated, “The Middle East has oil. Chinas has rare earth metals.” In the 20th century, the world experienced energy shocks due to a lack of supply chain resilience and diversification, the concentration of energy resources, and geopolitical events like the Arab Oil Boycott of 1973 and the Iran Hostage Crisis. As countries transition from fossil fuels to green energy, allowing such vulnerabilities to persist in the 21st century would, in our view, present unnecessary risks.

Policymakers and business leaders can keep in mind lessons from recent case studies in successful supply-chain diversification. When China embargoed exports of REEs to Japan in 2010, prices rose, disrupting global markets and causing concern in Tokyo and around the world. But as a result of higher prices, new companies stepped up to meet demand where it had been cut off from supply. They launched new mining and refining projects, providing alternatives for Japan and for other buyers, and Japanese companies sought out friendlier markets, including in Australia. Over time, prices stabilized. As of 2023, Japan’s reliance on China for REEs has sunk from 90% in 2010 to 58%, a figure that could go as low as 50% by 2025. Market forces and networks of likeminded countries and enterprising companies worked together to build more resilient, diversified supply chains.

In our view, waiting for a geopolitical shock to make necessary investments in more diverse, resilient supply chains is not a strategy that will serve countries, companies, or consumers well. Russia’s full-scale invasion of Ukraine on February 24, 2022, continues to result in untold suffering for the Ukrainian people, despite Ukrainian battlefield victories that continue to push back Russian advances. The ongoing war also resulted in significant economic upheaval around the world, including food shortages and inflation. Many companies were caught in the geopolitical crossfire, and Europe has only been able to move away from Russian energy supplies due to a warm winter, renewable energy infrastructure, gas storage, reduced consumption, and alternate suppliers in the Middle East and North America.

The war in Europe and increased geopolitical competition have heightened companies’ and countries’ concerns about global supply chains. Many are increasingly exploring diversification and resilience strategies. For example, recognizing their vulnerability and seeking to mitigate other potential disruptions before they happen, the United States, Japan, and South Korea pledged at Camp David in August 2023 to “launch early warning system pilots” on “possible disruptions to global supply chains” and to be prepared, together, to “confront and overcome economic coercion.”

At the same time, policymakers and business leaders recognize the benefits of globalization. They are working to reinforce and establish guardrails on the economic relationship between China, the United States, and other countries. In the fourth high-level US visit to Beijing in recent months, US Commerce Secretary Gina Raimondo stated that her trip in August 2023 was “about maintaining our very consequential trade relationship, which is good for America, good for China and good for the world. An unstable economic relationship between China and the United States is bad for the world.”

But were additional critical mineral supply chains disruptions to happen today that affected not just one country, but the entire world, there are few ready alternatives. Absent additional ex-China capacity and without proper stockpiling, manufacturing processes that depend on critical mineral inputs could grind to a halt. Rapid supply-chain rotation would be costly. It would take more time for a less clear result, presenting significant risks for countries, companies, and consumers.

In our view, building a more diverse and resilient critical mineral supply chain would come at short-term and medium-term economic costs. But it would also reduce the potential for critical minerals to be used for geopolitical advantage and provide long-term security, environmental, and economic gains. In geopolitics, as in economics, there are rarely clear solutions. More often, there are complex choices and tradeoffs.

This document has been prepared by the Goldman Sachs Global Institute and is not a product of Goldman Sachs Global Investment Research. This document should not be used as a basis for trading in the securities or loans of the companies named herein or for any other investment decision. This document should not be construed as consisting of investment advice. This material is intended only to facilitate discussions with Goldman Sachs and is not intended to be used as a general guide to investing, or as source of any specific investment recommendations. Goldman Sachs is not providing any financial, economic, legal, accounting, or tax advice or recommendations. This material does not purport to contain a comprehensive overview of Goldman Sachs products and offering and may differ from the views and opinions of other departments or divisions of Goldman Sachs and its affiliates.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.