Why the Fed May Cut Rates Earlier Than Expected

The Federal Reserve may cut its policy rate in September, according to Goldman Sachs Research economists, three months earlier than they had previously forecast.

Goldman Sachs Research shifted its forecast for rate cuts because very early evidence suggests the effects of this year’s tariff policies are a bit smaller than expected and other disinflationary forces have been stronger. Fed leadership may also share our economists’ view that tariffs will only have a one-time effect on price levels.

In addition, there are signs that the job market could be softening: “While the labor market still looks healthy, it has become hard to find a job,” David Mericle, chief US economist in Goldman Sachs Research, writes in the team’s report. Residual seasonality in the data and changes to immigration policy also pose downside risks to payroll figures in the near term.

When will the Fed cut rates?

Mericle estimates that the odds of a rate cut in September are “somewhat above” 50%. The team is penciling in 25-basis-point-cuts in September, October, and December, as well as cuts of the same magnitude in March and June 2026. “If there is any insurance motive for cutting, it would be most natural to cut at consecutive meetings,” Mericle writes of rate cuts in 2025. “We do not expect a cut in July.”

Goldman Sachs Research forecasts a terminal rate of 3-3.25% (compared with 3.5-3.75% previously).

Mericle writes that the team had expected the Federal Open Market Committee’s long-run dot plot (a chart summary of the FOMC’s expectation for the federal funds rate) to drift a bit higher. They also expected the Fed would conclude that a terminal funds rate modestly above long-run neutral is appropriate when the fiscal deficit is unusually large and robust risk sentiment is keeping financial conditions easy. However the FOMC’s dot plot was unchanged in June, and a new Fed chair (Jerome Powell’s term as Fed chair ends next year) may not agree with the view that large deficits and robust risk sentiment should keep the funds rate somewhat elevated.

What is the outlook for US inflation and employment?

Some Fed officials suggest that they could support a cut at the September meeting if upcoming inflation prints are not too high, Mericle writes. At the same time, category-level PCE data indicate a bit less impact from the earlier China tariffs, and survey evidence and alternative data suggest somewhat less passthrough to consumer prices than Goldman Sachs Research had assumed.

And an earlier jump in Michigan and Conference Board inflation expectations no longer looks like much of an impediment to an earlier cut: Both measures have fallen back a bit, and there seems to be a growing consensus that partisan bias and other technicalities have distorted them.

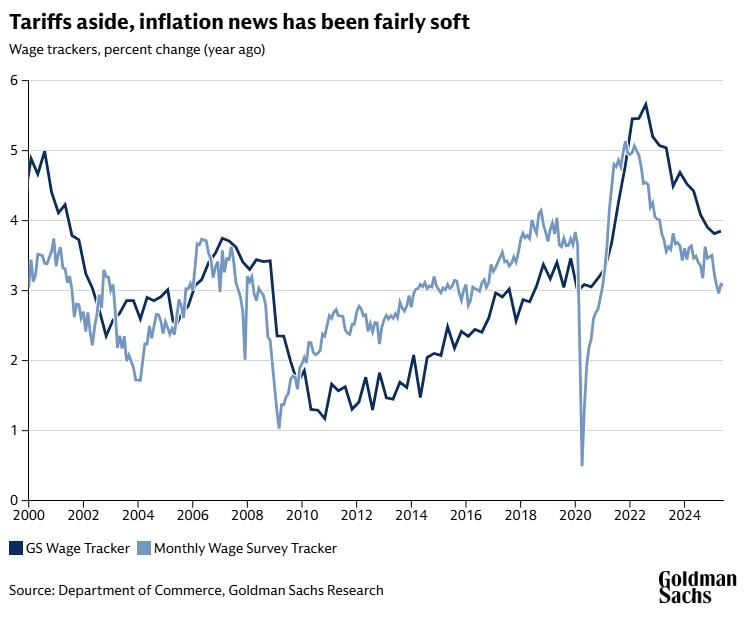

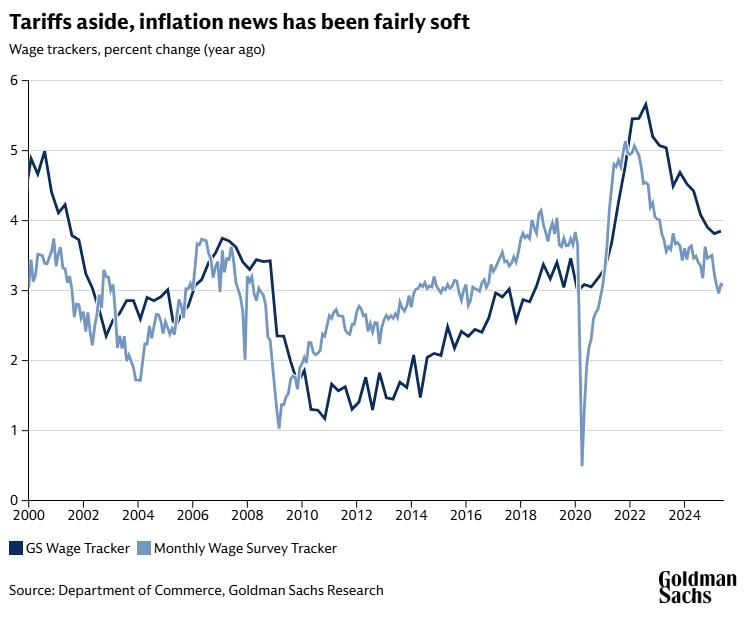

There are also indications of offsetting disinflationary pressures. Wage growth is moderating, the end of catch-up inflation is indeed coming through, and weak demand for travel has provided additional disinflationary pressure.

In the job market, meanwhile, openings have started to slowly fall again. “While Fed officials have tried to set a higher bar for cutting than in 2019, any scare in an upcoming employment report could make cutting sooner the path of least resistance again,” Mericle writes.

What is the outlook for the Fed’s terminal rate?

Goldman Sachs Research’s lower terminal rate forecast of 3-3.25% doesn’t reflect a change in view on the economy’s true long-run neutral rate or on the likely state of the economy a year from now. “Rather, we have shown in past research that modest changes in the funds rate have a limited enough impact on the economy to make the true neutral rate somewhat fuzzy,” Mericle writes.

Whether the terminal rate is 3-3.25% or 3.5-3.75%, the economy is likely to settle in a place that could defensibly be called maximum employment and 2% inflation, Mericle writes. “This fuzziness leaves some room for policymakers’ perceptions of neutral to matter,” he says.

This material is provided in conjunction with the associated video/audio content for convenience. The content of this material may differ from the associated video/audio and Goldman Sachs is not responsible for any errors in the material. The views expressed in this material are not necessarily those of Goldman Sachs or its affiliates. This material should not be copied, distributed, published, or reproduced, in whole or in part, or disclosed by any recipient to any other person. The information contained in this material does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this program or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this material and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

© 2025 Goldman Sachs. All rights reserved.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.