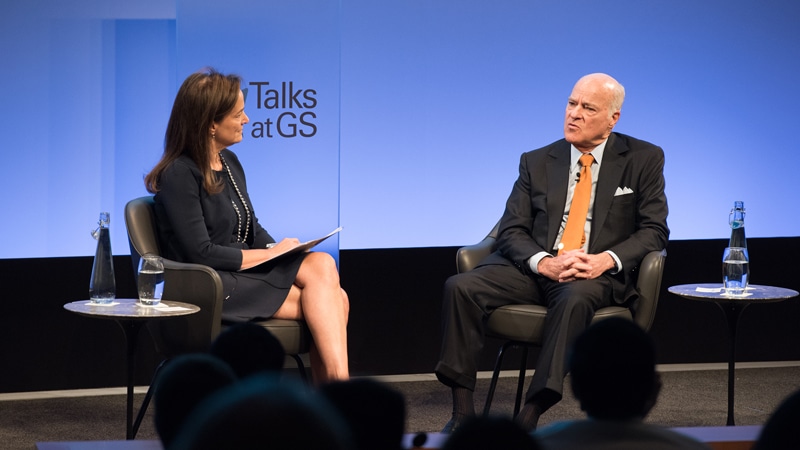

Henry Kravis, 40 Years of Innovation in Finance

Henry Kravis was a trailblazer in the financial services industry when he co-founded Kohlberg Kravis Roberts (KKR) in 1976, building what is today one of the most successful global investment firms in the world. In this discussion, he opens up about the founding of KKR, his unique approach to creating value in investments, and the importance of creating a forward-looking corporate culture to stay relevant in an increasingly dynamic industry.

On being successful in the industry: “No one in my mind can be a great investor unless you’re curious, and that means thinking about how to connect the dots.”

On how he treats his investments: “We like to say to people, ‘Don’t congratulate us when we buy a company.’ Any fool can buy a company…the hard part is what do you do with the business once you have major investment? How do you create value? What do you do to make that company much more efficient?”

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newletter via email.