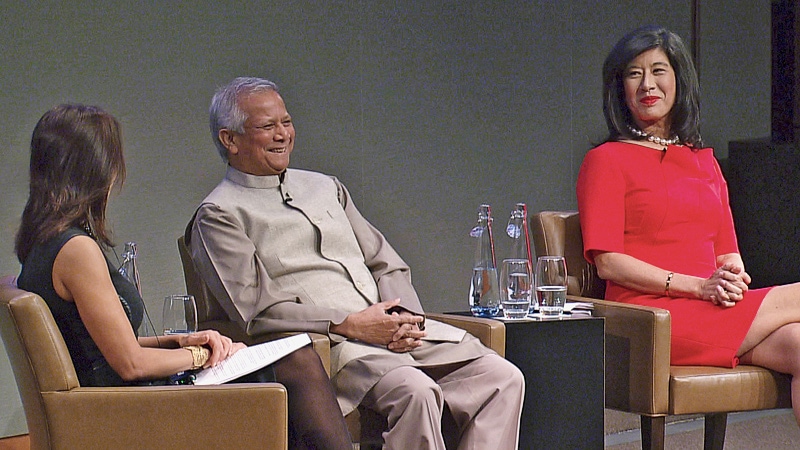

Muhammad Junus and Andrea Jung, Changing Communities Through Microfinance

Nobel Peace Prize laureate and Grameen Bank founder Muhammad Yunus, along with former CEO of Avon Products, Inc. and current CEO of Grameen America Andrea Jung, discuss the social and economic impact of microfinance.

Yunus, on the role of microcredit: “You cannot catch a dollar with an empty hand. If you don’t have a dollar in your hand, your journey doesn’t begin. Previously, there was no mechanism to provide that first dollar in the hands [of the disadvantaged] – that’s what [Grameen Bank] did, and that became known as microcredit.”

Jung, on the persistent need for capital in developed countries: “I’ve been involved in a lot of economic development globally, and the focus is often on emerging markets. Having been to multiple cities [in the United States] with concentrated poverty, the lack of access to capital right here in the richest nation in the world is staggering – it needs to be solved.”

Jung, on Grameen America’s lending model to women entrepreneurs: “[Grameen America] is a sustainable [organization] in that the interest income offsets the cost of the program. The non-profit aspect is that the profits are continually invested back into the program to loan more capital to more women.”

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newletter via email.