Companies Should Think ‘Circular’ to Cut Waste, Costs and Emissions

For centuries companies that produce goods have followed a trusted formula: take the planet’s resources, make products, sell them to customers that then, after a period of use, throw out the goods as waste. Repeat.

“Our take-make-waste linear economy is increasingly becoming outdated and will eventually become counterproductive to economic growth given the finite resources available,” says Evan Tylenda, head of GS SUSTAIN in EMEA.

Transitioning to a circular economy, in which industries reuse resource and the consumption is less than what the planet can regenerate, is essential to decarbonization and could unlock $1 trillion of annual materials savings. According to Tylenda, rising energy prices, increasing focus on low carbon solutions, and extending the EU Taxonomy to include so-called circular economy categories could catalyse the transition.

We spoke with Tylenda about the circular solutions that could reduce global emissions and unlock new revenue opportunities for companies.

Decarbonization efforts have traditionally focused on renewable energy and energy efficiency, but that’s only half of the picture. Why is transitioning towards a circular economy important to decarbonization?

Our take-make-waste linear economy is increasingly becoming outdated and will eventually become counterproductive to economic growth given the finite resources available. Moreover, this inefficient use of resources leads to excess CO2 emissions. In 2016, solid waste management is estimated to have generated around 1.6 billion tonnes of CO2 emissions — the equivalent of about 350 million cars on the road. So, transitioning to a circular economy, where we’ll get more value from the resources and materials we use, is essential to decarbonization.

We’ve identified 21 circular solutions across various sectors of the economy that could reduce global emissions by 39% (from 2019 levels), helping to bridge the gap left by the most recent COP26 Paris Commitments towards a 1.5-degree scenario by 2050. The housing industry, for example, is resource and emission-intensive, but reducing floor space, switching to natural housing solutions and improving construction efficiency could significantly reduce emissions. In the mobility industry, key circular solutions include improving the durability of vehicles and reducing travel.

How is global waste generation expected to change over the next decade?

The world already consumes more resources than the Earth produces, yet global waste generation is on track to increase 70% by 2050. Developed economies disproportionately generate more waste generation per capita, but waste growth is set to come from developing countries. North American waste, for example, is expected to increase 37% between 2016 and 2050, compared with 197% in Sub-Saharan Africa and 98% in South Asia.

This is because economic growth in developing economies typically leads to an increase in waste. What’s more, the vast majority of waste in low-income countries is mismanaged through open dumping, leading to excess methane emissions and public health issues. This makes it critical to establish proper means for recovery or safe disposal in both developed and developing economies.

How can companies embed the principles of the circular economy into their business models and decouple growth from consumption?

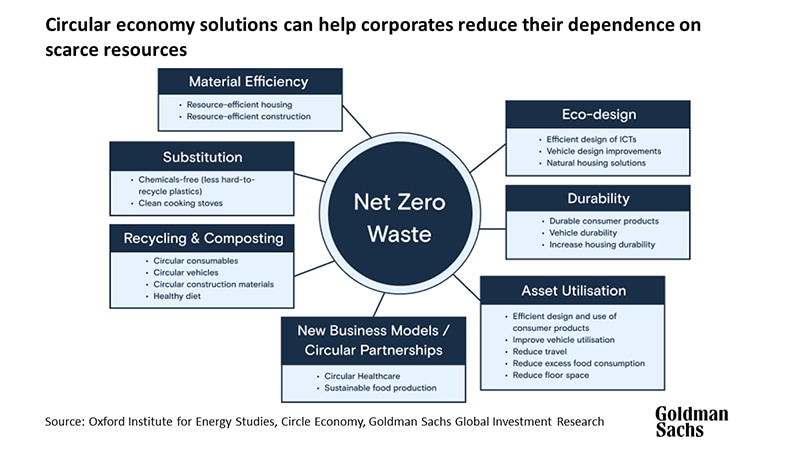

By 2025, recycling, reuse, and remanufacturing could help unlock $1 trillion a year in wasted resources, according to the World Economic Forum and Ellen MacArthur Foundation. We’ve identified circular economy solutions that can help corporates reduce their dependence on increasingly scarce resources and generate new revenue opportunities.

Corporates could substitute difficult-to-recycle materials with more circular alternatives, increase the life of their products through enhanced durability, and switch consumer focus towards service-oriented business models. They can also seek new business models, such as ‘circular partnerships’ that cluster industrial activities to prevent by-products from becoming waste. For instance, in Kalundborg, Denmark, an oil refinery, a power station, a gypsum board facility, and a pharmaceutical company exchange various by-products that become feedstocks in other processes.

What could drive progress toward a circular economy in the near term?

We see three major catalysts. First, given the spike in energy prices, we expect businesses and investors to focus on the value potential of circular solutions to help alleviate dependence on scarce resources and generate new revenue opportunities. Second, we think the intrinsic link between materials and emissions is becoming more apparent, along with the recognition that net zero carbon cannot be achieved without moving towards a circular economy.

Finally, we think the EU Taxonomy will be another strong push here, with circular activities a big winner of the next phase of the Green Taxonomy. We see the corporate and investor adoption of the EU Taxonomy as inevitable, serving as a tool for investment and corporate strategic decision-making. The current Climate Taxonomy already recognizes the interconnection of the circular Economy and GHG emissions savings, giving credit for activities such as ‘manufacturing of plastics in primary form’ and ‘collection and material recovery from non-hazardous waste’, but the new circular economy activities will further expand coverage of the existing Taxonomy. We also note that new sectors covered under the circular economy include some of the most underweight sectors in ESG funds currently, presenting opportunities for re-weighting.

Which sectors could be made more circular, and which are more efficient following a traditional take-make-waste model?

Stepping back and reflecting on the broader challenges and opportunities presented by the circular economy, I point to a helpful quote by Bill McDonough, the founder of Cradle to Cradle, who said, “the world doesn’t have a waste issue; it has a design issue.” I find this quote quite powerful for helping frame the broader issues and opportunities, as it points to the systems-level issues associated with our treatment of resources at the end of their useful life. It indicates that there is no such thing as bad materials, just improper handling and recovery of materials at the end of their useful life.

Let’s take plastic as an example, which often gets a bad rap due to plastic pollution ending up in our oceans. But plastic is not a bad material per se if we redesign our recovery systems and recycle it via advanced chemical recycling. According to an analysis conducted by AFARA and Google, a total investment of $634 billion - 995 billion is needed over the next 20 years to close the plastics circularity gap. So, rethinking our systems can open opportunities to be more circular across nearly every sector, either directly through manufacturing or by enabling more efficient outcomes from critical circular services.

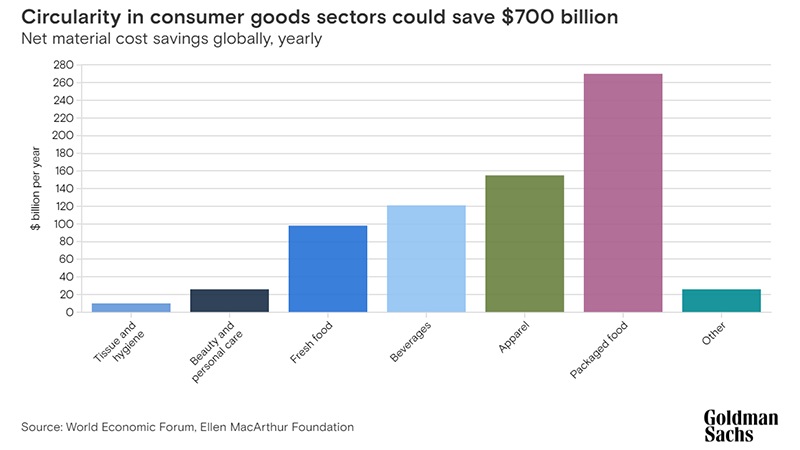

To put some more figures behind this, according to the Ellen MacArthur Foundation, the fast-moving consumer goods sector could have net material costs savings of roughly $700bn per annum, with sectors like packaged foods, beverages, and apparel benefiting the most.

- GS SUSTAIN: The Evolution Towards a Circular Economy03 MAY 2022

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.