How the ECB Plans to Avoid Fragmentation and Contain Inflation

The euro area economy is starting to look more like the picture in the U.S. and the U.K. – wage growth is accelerating and inflation seems to be getting stickier. Those concerns are pushing the European Central Bank to act faster to tighten monetary policy.

But as they get ready to leave behind nearly a decade of negative interest rates, government bond yields in parts of the continent have crept into the “danger zone,” says Sven Jari Stehn, chief European economist at Goldman Sachs. As Italian government bond yields climb, officials in Frankfurt are assembling a new backstop for sovereign debt to make sure they can hike rates as needed to cool inflation.

We spoke with Stehn, a former economist at the International Monetary Fund, about how officials are likely to handle concerns about sovereign credit in southern Europe and his forecasts for ECB policy.

Last week the ECB had an emergency meeting as government bond yields in Italy jumped. Is this just the beginning of renewed fiscal stress in Europe or do you think the ECB can contain worries about sovereign stress in the eurozone?

The Governing Council came together on 15 June with an ad-hoc meeting to discuss market conditions, especially the rising sovereign yields. The ECB reiterated its commitment to avoid fragmentation risk, which is their language for non-fundamental sovereign stress in the euro area that risks undermining the smooth transmission of monetary policy. And I think there were two important conclusions from that meeting.

The first is that they decided to activate reinvestment flexibility for the pandemic asset holdings, which basically means that they can skew the reinvestment of maturing bonds across time and across countries to avoid fiscal stress that could interfere with the monetary policy normalisation.

And the second was a signal that they want to accelerate the completion of a new anti-fragmentation tool, which we expect them to announce at their July meeting.

These are important signals. We had looked for a backstop announcement to come, but it’s come earlier than we anticipated and at lower yield levels than we would have thought.

The euro area still has a number of important risks related to the war in Ukraine, related to more fundamental economic issues. But we do think that this new tool and commitment that they have issued is going to be quite effective in anchoring sovereign credit in Europe to ensure that its monetary policy is transmitted across all parts of the euro area.

You’ve written that government bond yields in the likes of Italy have moved into the danger zone. What does that mean exactly?

It’s the level of bond yields where fiscal sustainability concerns could suddenly reappear and endanger the transmission of monetary policy. Debt sustainability depends on nominal growth, on interest rates and on fiscal policy. For now, high nominal growth helps. So you’re seeing very strong tax revenues for example in Italy because the tax base has grown quite strongly. But we do expect nominal growth to slow as inflation comes down, and interest rates are expected to remain higher. So that means the path to reducing debt, particularly in Italy, has narrowed. Rises in bond yields, or shocks, from here can quite quickly become self-fulfilling. And that’s of course exactly what the ECB is trying to avoid.

This danger zone means that yields have moved up to levels where the risk of rising debt and fiscal stress has gone up. It doesn’t mean it’s inevitable, but we are in a place where these fiscal concerns could suddenly reappear and lead to a fragmentation of financing conditions for reasons that are unrelated to the fundamentals of the economy, and that’s why I think the ECB stepped up rhetoric this last week.

You expect the ECB to unveil a new tool at its July meeting. What do you think this instrument will entail and what is important about it?

We think it will have a number of key features. The most important is we think it will be unlimited in terms of size, essentially to maximize the announcement effect of this tool. And so it will be similar to the Outright Monetary Transaction (OMT) program, which was launched during the sovereign debt crisis. And that was very helpful in reassuring markets via its big announcement effect.

If the program is unlimited, there needs to be conditionality as there was with OMT. For the new tool, we think it’s more likely to be linked to the existing EU monitoring framework—for example the Recovery Fund. So you have an existing surveillance system that we think the new instrument could make use of.

We also think the program is going to be flexible so that you can essentially buy bonds where the stresses are. That was one of the key insights from the pandemic quantitative easing program. We think the trigger point for activating purchases under the new backstop is going to be non-fundamental fragmentation risk—so basically a sense that yields are moving rapidly away from levels that are consistent with fundamentals.

We don’t think they will come out with a specific target for spreads. But it’s going to be a more holistic assessment where the Governing Council makes the decision when yields and spreads are moving in an undesirable fashion, away from underlying fundamentals in a way that undermines monetary transmission.

There’s still a number of open questions—what exactly the details will look like—but we think those are going to be the key parameters.

In combination with the measure announced last week, do you think this tool will be sufficient to keep sovereign credit worries from spreading so that the central bank can also deal with rising inflation? Or has the ECB’s inflation-fighting goal been compromised?

It’s a difficult balancing act because on the one hand you need to tighten policy to cool inflation pressures, but on the other hand you need to make sure you avoid this fragmentation risk, which could undermine your efforts to get inflation down in an orderly fashion. Our take is that the tool is likely to be effective in anchoring sovereign credit and in protecting the hiking cycle.

The first line of defense is going to be the flexibility in pandemic asset holdings and only after that will they activate this broader backstop. The ECB will hope that the announcement effect here is strong enough that they don’t need to actually use it, similar to OMT where you had a big announcement effect.

We think it will be effective in protecting the hiking cycle, and we think the Governing Council will start to hike in July by 25 basis points, and it will be 50 basis points in both September and October. We think the deposit rate will increase to 1.75% next year.

That said, it’s important to keep in mind that a number of risks remain. Continued spill overs from the war in Ukraine via reduced gas supply are a risk. We have of course seen a sharp reduction in the gas supply over the past few weeks. Our base case remains for flows to improve again once the pipeline maintenance period is over in mid-July, but we have estimated that a complete cut of the Russian gas supply would push the euro area to recession, and that’s something that could reignite sovereign worries.

And then the second is around fundamental fragmentation risk—in other words a real shift in economic fundamentals that implies real sovereign risk. And so here they key risk is the election of a populist leader somewhere in the euro area whose policies are at odds with debt sustainability. In that case, a fiscal solution would likely be required because the ECB has only committed to avoid non-fundamental fragmentation risk.

What is your view of the likelihood of recession in the eurozone and how do you analyze that?

Our baseline is that there will be pretty weak growth in the euro area for 2022. We basically have growth of about 1% at an annualized pace from the current quarter to the end of the year, and that’s slightly below trend. We’re below consensus in terms of the growth pace, but we don’t have a recession as part of the base case because households are still sitting on quite a bit of excess savings. You have fiscal support and there is still room to grow in services, in tourism for example.

Those are the reasons we don’t have a recession in our baseline, but recession risk is certainly elevated in Europe.

How does the potential for reduced gas supply feed into recession worries for the euro area?

It’s the key near-term recession risk because the euro area is highly dependent on Russian gas supplies, particularly in Germany and Italy. We have seen already a significant reduction in gas flows from Russia and estimate that a complete ban of Russian gas supply would lower growth in the euro area by more than 2 percentage points this year, and the hit would be significantly larger than that in Italy and Germany.

A discontinuation of the gas flows from Russia would likely push the euro area into recession pretty quickly because the euro area is highly dependent on it and it’s quite hard to substitute away from gas.

Inflation is rising just about everywhere. What is your take on the inflation picture in Europe right now?

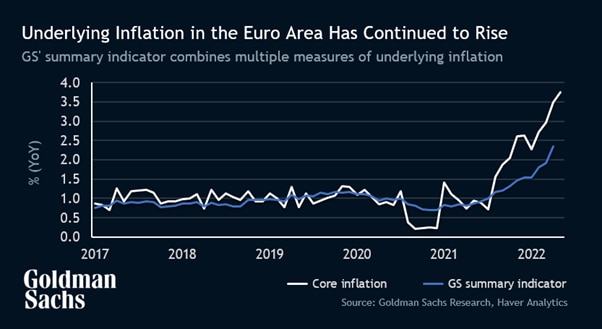

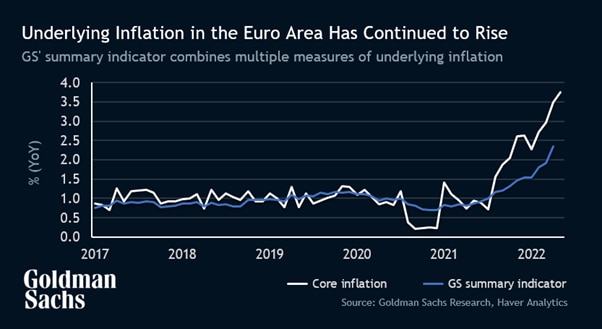

You have headline inflation of 8% to 9% in the U.S., U.K. and euro area, and the numbers here have continued to surprise on the upside. Now, the euro area inflation picture has been different from other countries in a number of respects. There’s a higher energy contribution in Europe; it’s about twice as large as in the U.S. Core inflation and wage growth so far have been weaker, which has basically been because the labor market is less overheated than for example in the U.S.

But the euro area inflation picture has started to look more like the U.S. and U.K. If you look at core inflation over the last six months, it’s been running essentially at the same level. Inflation expectations have been rising and wage growth has stated to accelerate. It’s still below U.S. and U.K. levels, but we do think it’s going to rise further from here.

The bottom line is that inflation is also likely to remain above 2 percent for the next two to three years, and that does mean there’s more urgency for the ECB to act. That said, the underlying inflation pressures for Europe are still lower and so we think the ECB doesn’t need to hurry quite as much as the Fed.

But, with the latest data, there has been some evolution of the euro area looking a bit more like the U.S.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newletter via email.