Family Office Investment Insights Report

The macroeconomic and geopolitical backdrop has evolved dramatically over the last year. While capital markets have been challenged, family offices have remained calm and kept a steady hand on the wheel.

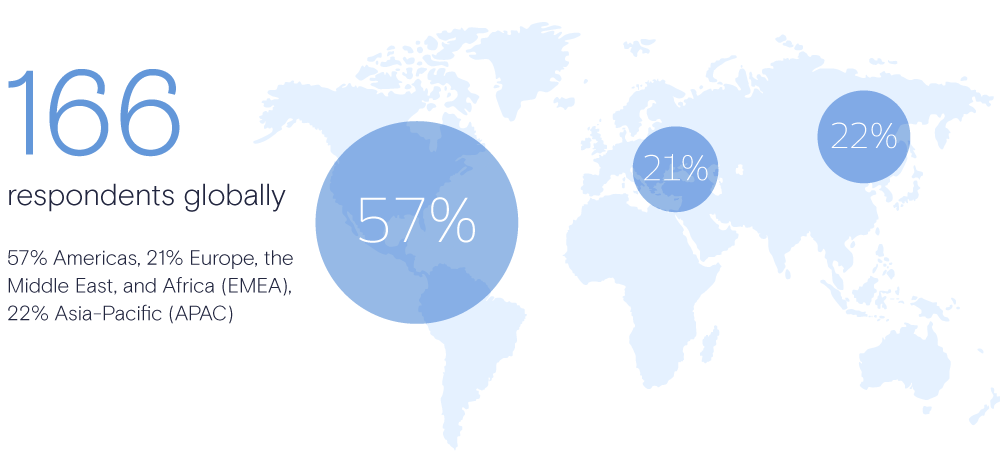

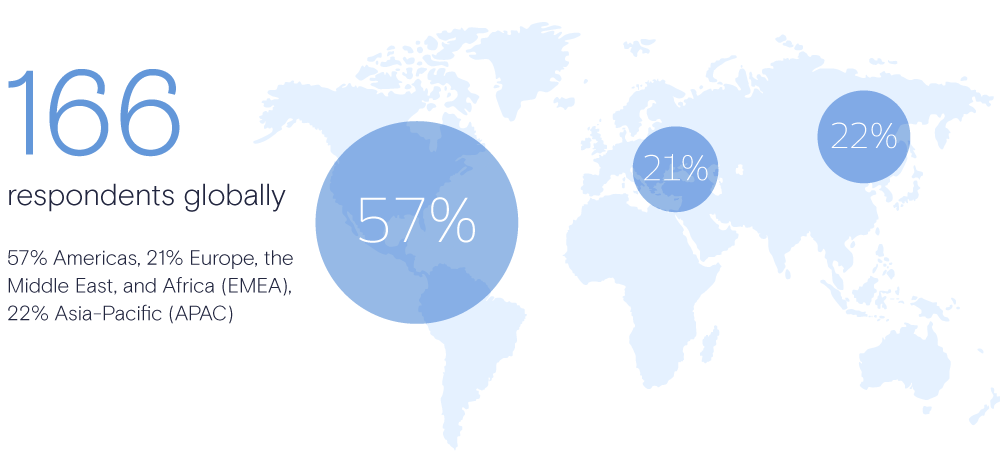

In our second Goldman Sachs Family Office Investment Insights report, Eyes on the Horizon, we explore how institutional family offices are allocating capital, leveraging the viewpoints of 165+ distinct family office decision makers globally.

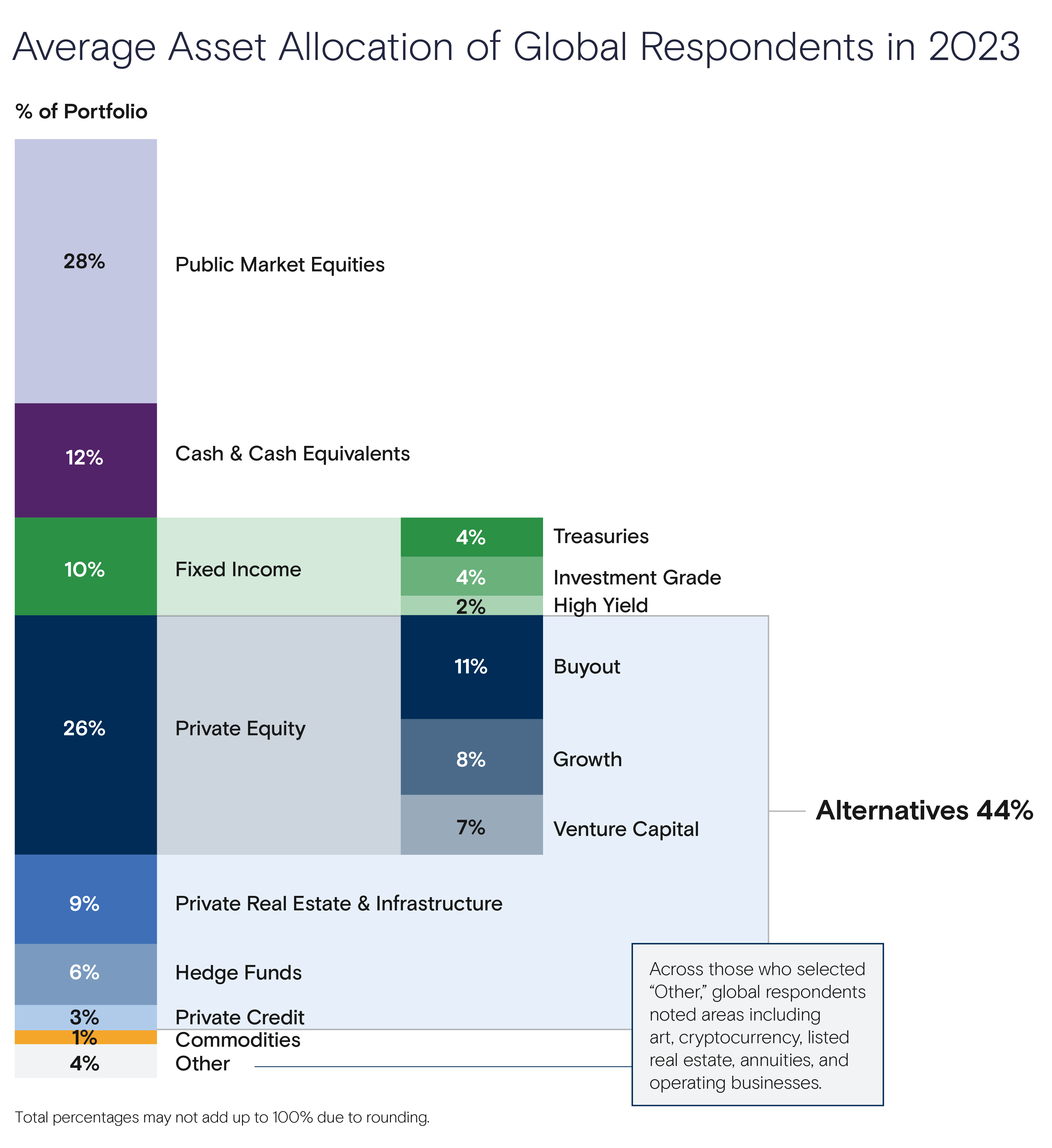

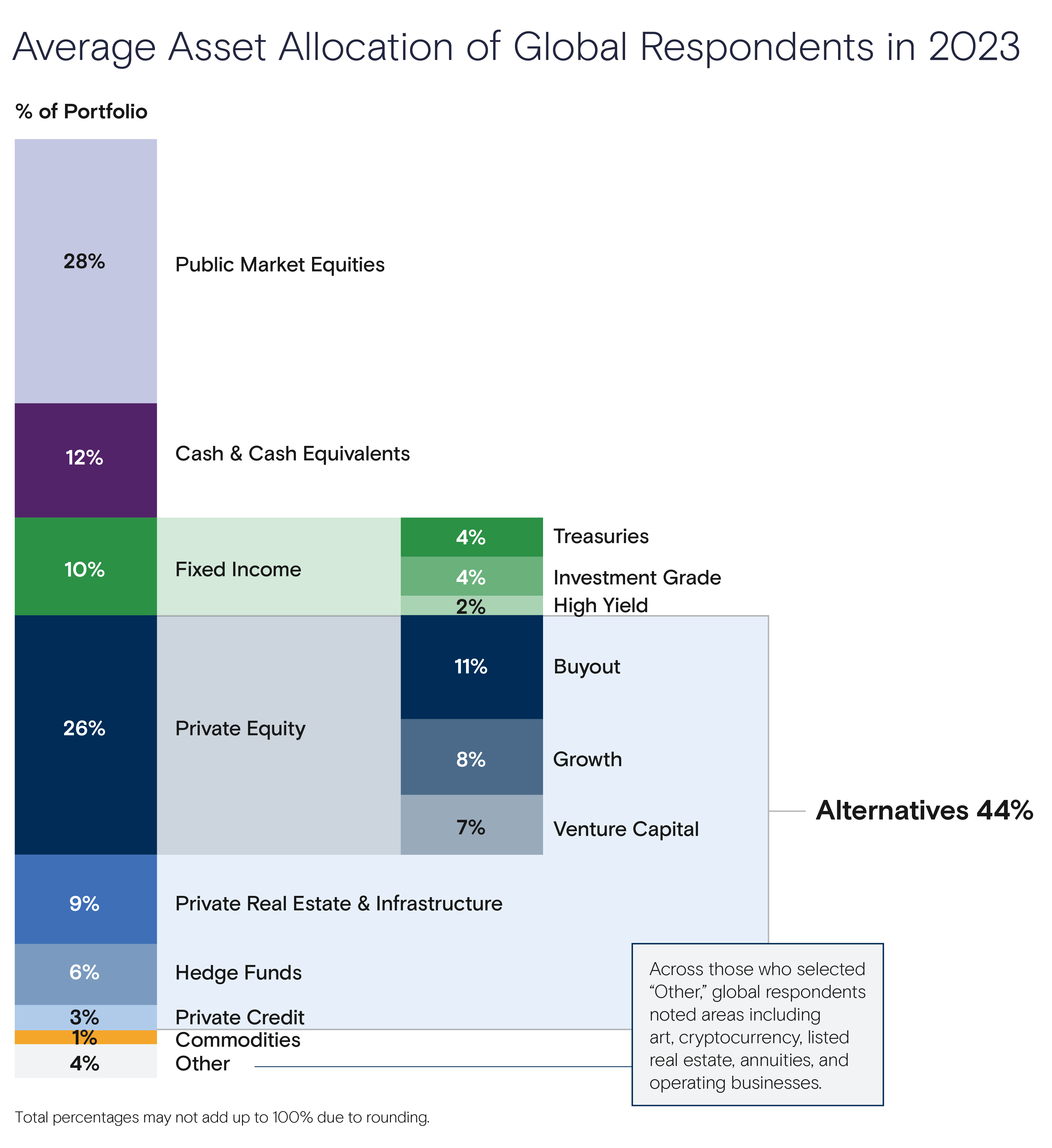

Our analysis shows family offices maintaining their overall strategic allocation. They have also held onto cash balances that have generated a higher yield, allowing them to opportunistically invest in the next 12 months. Many noted they plan to increase their allocation to private credit, among other asset classes. We anticipate family offices will continue to tactically capitalize on dislocations that may be less accessible to investors bound by benchmarks, fixed mandates, exit timelines and external capital.

Across both public and private markets, family offices have a bias toward sectors experiencing strong secular growth and business models that can transcend economic cycles. Additionally, family offices continue to maintain significant interest in operating businesses as they explore ways to strategically grow and support their existing complexes.

To learn more about these trends and other top-of-mind topics, read our report, Eyes on the Horizon.

From Our Leaders

Disclosures

This material has been prepared for informational purposes only. Goldman Sachs (“GS”) is a full-service, integrated investment banking, investment management, and brokerage firm. GS provides services and products through one or more affiliates including but not limited to Goldman Sachs & Co. LLC (“GS&Co.”), member FINRA/SIPC, Goldman Sachs International, authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority and Goldman Sachs Bank Europe SE, subject to direct prudential supervision by the European Central Bank and in other respects is supervised by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank, Goldman Sachs (Asia) L.L.C. (incorporated in the State of Delaware, U.S.A. as a Limited Liability Company; licensed by the Hong Kong Securities and Futures Commission with CE number ACC536) and Goldman Sachs (Singapore) Pte. (Company Number: 198602165W). Your Personal Data: We may collect and process information about you that may be subject to data protection laws. For more information about how we use and disclose your personal data, how we protect your information, our legal basis to use your information, your rights and who you can contact, please refer to: https://www.goldmansachs.com/privacy-and-cookies.html

Please see the GS&Co. Form CRS and GS&Co. Relationship Guide/Regulation Best Interest disclosures available at: https://www.goldmansachs.com/disclosures/customer-relationship-summary-form-crs.html for important information, including the difference between advisory and brokerage accounts, compensation, fees, conflicts of interest, and our obligations to you.

Investment Risks and Information. Risks vary by the type of investment. Before transacting or investing, you should review and understand the terms of a transaction/investment and the nature and extent of the associated risks, and you should be satisfied the investment is appropriate for you in light of your individual circumstances and financial condition.

Alternative Investments. Alternative investments may involve a substantial degree of risk, including the risk of total loss of an investor’s capital and the use of leverage, and may not be appropriate for all investors. Private equity, private real estate, hedge funds, and other alternative investments structured as private investment funds are subject to less regulation than other types of pooled vehicles and liquidity may be limited.

Digital Assets / Cryptocurrency. Digital assets regulation is still developing across all jurisdictions and governments may in the future restrict the use and exchange of any or all digital assets. Digital assets are generally not backed nor supported by any government or central bank, are not FDIC insured and do not have the same protections that U.S. or other countries’ bank deposits may have and are more volatile than traditional currencies. Transacting in digital assets carries the risk of market manipulation and cybersecurity failures such as the risk of hacking, theft, programming bugs, and accidental loss. Differing forms of digital assets may carry different risks. The volatility and unpredictability of the price of digital assets may lead to significant and immediate losses.

Not Investment Advice: This presentation should not be used as a basis for trading in securities or loans of any issuer or company or for any other investment decision. The information provided herein is not a recommendation of any decision you may make or action you may or may not take. Neither GS nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this document and any liability therefor including in respect of direct, indirect or consequential loss or damage is expressly disclaimed. The receipt of this document by any recipient is not to be taken as constituting the giving of investment advice by GS to that recipient, nor to constitute such person a client of GS.

Performance. Past Performance is not indicative of future results, which may vary. Current performance may be lower or higher than the performance data quoted. Where not relevant or representative, outliers may be excluded.

Tax Information. GS does not provide legal, tax or accounting advice, unless explicitly agreed in writing between you and GS. Clients should obtain your own independent tax advice based on your particular circumstances.

No Distribution; No Offer or Solicitation. This material may not, without GS’ prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of any security in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. We have no obligation to provide any updates or changes to this material.

© 2023 Goldman Sachs. All rights reserved.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.