From left to right:

John Waldron

David Solomon

Denis Coleman

From left to right:

John Waldron

David Solomon

Denis Coleman

In January 2020, I stood in the auditorium of our New York headquarters at 200 West Street and kicked off our first Investor Day. Back then, our leadership team and I laid out a comprehensive strategy to strengthen and grow the firm: First, we would invest in our core businesses. Second, we would pursue four growth initiatives: asset management, wealth management, transaction banking and consumer banking. And third, we would run the firm more efficiently. In addition, for the first time, we set public, firmwide financial targets to help investors hold us accountable.

In February 2023, we took another step on our journey when we held our second Investor Day, and as I said then, it has certainly been an interesting three years. Back in January 2020, nobody would have imagined that just a few weeks later a pandemic would break out and there would be such disruption in the global economy. Even today, we’re operating in an uncertain environment. The war in Ukraine has roiled energy markets, and an increase in inflation has triggered monetary tightening.

But through it all, we’ve stayed focused on shareholders, and I’m proud of what we’ve accomplished. Since our first Investor Day, our total shareholder return is 60 percent, outperforming our peer average meaningfully.1 Our book value per share is up by nearly 40 percent, roughly twice that of our closest competitor.1 Our earnings per share is up by over 40 percent. We’ve returned nearly $18 billion in capital to common shareholders. And our average returns over the past three years are in line with our current targets of 14–16 percent return on equity (ROE) and 15–17 percent return on tangible equity (ROTE).2

When you look at our 2022 results specifically, there’s no question that the operating environment was challenging. The same business mix that did so well in 2021 faced headwinds, such as low capital markets issuance activity and falling equity and fixed income asset prices. At the same time, we continued to make strategic investments in our acquisitions and technology that, though important to the firm’s longterm strength, weighed on our financial performance in the short run.

Despite those difficulties, we delivered for shareholders in 2022. Net revenues were $47.4 billion, net earnings were $11.3 billion and diluted earnings per common share were $30.06. ROE was 10.2 percent and ROTE2 was 11.0 percent. We also grew our book value per share by 6.7 percent and continued to make significant progress on our strategic evolution. As a result, in a macro environment where equity issuance hit a nearly two-decade low, we performed better than we would have three years ago.

In the pages that follow, we lay out in detail the state of our franchise as well as the progress we’ve made in our businesses, and as you’ll see, our strategy is a reflection of our purpose: We aspire to be the world’s most exceptional financial institution, united by our core values of partnership, client service, integrity and excellence. Being exceptional is not a given, but we always learn and adapt. We are constantly focused on outperforming for our clients.

And what’s most exceptional about our firm is our people. As I travel around the world meeting with clients, I’m often told how talented our people are. We couldn’t have anticipated all the challenges we’d face over the past three years, and yet our people met them all with hard work, creativity and determination. I’m grateful to call them my colleagues. I’m also fortunate to work with a leadership team that is laser-focused on executing our strategy: our president and chief operating officer, John Waldron; our chief financial officer, Denis Coleman; and our entire Management Committee.

The path ahead is never certain, and there will be plenty of challenges along the way, but we head into 2023 energized, excited and determined to deliver for shareholders.

At the heart of our strategy is a focus on clients. We believe that serving our clients exceptionally well will both strengthen our franchise and deliver returns for our shareholders. As a result, in 2019, we started a pilot program that we believed would help demonstrate that commitment: One Goldman Sachs.

One Goldman Sachs is now the organizational philosophy that underpins how we cover our clients in an increasingly complex world. It puts clients at the center of everything we do. It brings to bear our intellectual capital and expertise across all our businesses to serve our global client franchise in a more integrated and comprehensive manner.

Today, we have partners who are responsible for owning the entire firmwide relationship with One Goldman Sachs clients, and as part of that, they are responsible for building dedicated teams that bring together the relevant experts and thought leaders across the firm to serve the client. One Goldman Sachs is highly accretive to multiple parts of our business and, more importantly, it’s highly accretive to our clients, who get the best of Goldman Sachs. One Goldman Sachs has expanded beyond a pilot program. We believe this ethos is applicable and extensible to a much broader set of clients.

In December 2022, building off our renewed commitment to client centricity, we reorganized the firm into three segments: 1) Global Banking & Markets; 2) Asset & Wealth Management; and 3) Platform Solutions, into which we have integrated two lines of businesses: Transaction banking and Consumer platforms, which consists of our consumer card partnerships and GreenSky. We saw this as the logical next step in our strategic journey to building a more durable firm that generates higher returns through the cycle.

We are now reporting our results under our new structure, and we have also announced three key execution priorities: 1) maximizing wallet share and growing financing activities in GBM; 2) growing management and other fees in AWM; and 3) scaling Platform Solutions to deliver profitability. We believe we’re now well positioned to execute our strategy, capitalize on our strengths and achieve our execution priorities in all three of our segments.

Global Banking & Markets

Global Banking & Markets is an extraordinary franchise. We’ve been #1 in global completed M&A for 23 of the last 24 years,3 and once again this year we were the advisor of choice. We were also #2 in equity and equity-related underwriting as well as in high-yield debt underwriting.

And yet, over the past three years, we’ve seen significant growth. We’ve increased wallet share by 370 basis points.4 We’ve increased our financing activities in FICC and Equities at a 16 percent compound annual growth rate (CAGR) to more than $7 billion in net revenues for 2022. And we’re now ranked in the top 3 with 77 of the top 100 institutional clients across FICC and Equities, up from a base of 51 at our first Investor Day.5 We had a very good business and we’ve made it better.

In 2022, GBM generated revenues of $32.5 billion, a 12 percent decline from 2021, as significantly higher FICC net revenues were more than offset by a steep decline in Investment banking fees. Advisory net revenues, however, were $4.7 billion, the second highest in our history.

Asset & Wealth Management

In Asset & Wealth Management, we’ve taken several disparate businesses inside the firm and combined them into one powerful platform. Today, we are a top 5 global active asset manager6 and a top 5 global alternatives manager6 with a premier wealth management franchise. We now have more than $2.5 trillion in assets under supervision (AUS).

We had a record year in alternatives fundraising in 2022, with $72 billion raised across our franchise. Overall, we’ve raised nearly $180 billion since 2019, making real progress toward our revised target of $225 billion. Of that $72 billion in alternatives, $27 billion came through our wealth platform. And we now have loan penetration7 with approximately 30 percent of our U.S. private wealth clients, leaving us plenty of room for growth. Our total client assets8 in Wealth management stand at more than $1 trillion.

In 2022, our Asset & Wealth Management business generated net revenues of $13.4 billion, a 39 percent decline from 2021. A steep drop in the net revenues related to Equity and Debt investments offset an additional $1 billion of Management and other fees and a strong increase in Private banking and lending net revenues. Full-year Management and other fees were $8.8 billion, putting us well on track to hit our 2024 target of more than $10 billion.

Platform Solutions

In 2022, we decided to significantly narrow our ambitions for our consumer strategy.

Now we have a smaller set of emerging businesses. We are working to drive them to profitability, and we’re also considering strategic alternatives for our Consumer platforms.

Total operating expenses for the year were $31.2 billion, down by 2 percent from 2021. Compensation and benefits expenses fell by 15 percent, despite a 10 percent increase in headcount, and were largely offset by higher non-compensation expenses. The increase in non-compensation expenses was primarily related to acquisitions, transaction-based costs and continued investments in technology. In addition, client-related market development costs were higher following lower levels during the pandemic. We remain highly focused on operating efficiency. We are actively engaged in expense mitigation efforts as we look to appropriately calibrate the firm for the operating environment.

Our balance sheet ended the year at $1.4 trillion, down by $114 billion versus the third quarter and relatively flat year over year as we focused on actively managing our resources. Deposits ended the year at $387 billion, up by approximately $23 billion year over year, reflecting growth in private bank and consumer deposits and transaction banking deposits. At the end of the fourth quarter, our standardized CET1 ratio was 15.0 percent, up by 80 basis points year over year. This represents a 120-basispoint buffer to our new capital requirement of 13.8 percent in the beginning of 2023. We returned $6.7 billion to common shareholders, including common stock repurchases of $3.5 billion and common stock dividends of $3.2 billion.

We believe our strategy positions us well to meet our financial targets through the cycle. And, while in tougher environments we may not hit our return targets, our actions over the past several years have raised the floor of our returns, while retaining the upside in more conducive markets and lowering the overall volatility. Across all our businesses, we are focused on the forward.

The integration of our #1 Investment Banking franchise9 with our leading FICC and Equities businesses positions Global Banking & Markets to continue delivering strong returns. Now we are focused on capturing share, particularly in favorable environments, while maintaining resource discipline. The size, breadth and diversity of our mix of activities have made revenues relatively stable over time. Our share gains and higher financing revenues over the past few years have further increased durability. This is a great business, and we are performing for clients at the highest level.

In Asset & Wealth Management, our franchise benefits from the Goldman Sachs ecosystem that gives clients access to a wide breadth of products and solutions as well as our unique market insight and expertise. We’re focused on investment performance and client experience to drive a more durable revenue stream from fees and Private banking and lending. We are keeping ourselves accountable with our new medium-term targets on revenue growth, margin and ROE. This is the area where there is the most significant growth opportunity for us, and where we are already operating at scale.

And in Platform Solutions, though this segment remains small in the context of the broader firm, we see potential in these emerging platforms. We believe these are attractive businesses that provide stable, more recurring revenue derived from net interest income and fees, and we offer innovative, tech-forward products for our end customers.

Firmwide, we remain committed to delivering on our financial targets, and we are confident in our ability to do so, given the underlying strength of our franchise. In the past three years, our average ROE was 14.8 percent. This was in line with our targets and 320 basis points higher than the peer10 average. And, if you exclude the impact of litigation in 2020, our average ROE would have been roughly 130 basis points higher.

As we look ahead, we are committed to making the firm more transparent and accountable to shareholders. This is just as important to us as our business level targets. We’ve made a conscious effort to be open and accessible, with enhanced disclosures, more frequent investor conferences and regular strategic updates. We’ve continued to lay out targets for our firm and our businesses, and we’ve provided robust disclosure of key performance indicators to measure our progress.

We’ve also made important changes to better align employee incentives. All our Management Committee members receive 100 percent of their annual stock-based compensation in performance-based shares that are earned based on future results. This is intended specifically to enhance collaboration and align our entire leadership team with long-term shareholder value creation. Beyond that, many of our employees are shareholders as well. We are united in driving shareholder value.

We returned $6.7 billion to common shareholders

In addition to serving our clients and delivering for shareholders, we’re also focused on taking care of our people. We have a longstanding commitment to recruiting, developing and promoting the best talent available with the widest range of backgrounds, experiences and perspectives. We have made headway with our diverse representation goals at the analyst, associate and vice president levels. We were proud that our 2022 partner class was the most diverse to date. That said, we still have much work to do to build and retain a pipeline of diverse leadership.

We’re also continuing our long tradition of investing in our communities.

In 2023, we mark the 15th anniversary of Goldman Sachs 10,000 Women, our ongoing initiative to foster economic growth by providing women entrepreneurs around the world with a business and management education and access to capital. The 10,000 Women in-person business education program was launched in 2008, and in 2018, the curriculum was made available online through Coursera, further democratizing access. In 2014, in partnership with the International Finance Corporation (IFC), 10,000 Women launched a first-of-its-kind global finance facility, the Women Entrepreneurs Opportunity Facility, to enable access to capital for more women entrepreneurs. As of March 2023, the facility had reached more than 164,000 women entrepreneurs, eclipsing the 100,000 target set when the initiative was launched, and contributing to an over $4.5 billion increase in the volume of loans on-lent by financial institutions to women-owned businesses. Overall, Goldman Sachs 10,000 Women has reached more than 200,000 women from over 150 countries.

Building on what we learned from 10,000 Women, in 2009 we launched our signature entrepreneurship initiative, Goldman Sachs 10,000 Small Businesses. Today, the program has served more than 13,600 small businesses in all 50 states through our education program, and it has also partnered with select Community Development Financial Institutions to provide loans to small businesses. In 2020, we launched a new advocacy initiative, Goldman Sachs 10,000 Small Business Voices, to help small business owners in the U.S. advocate for policy changes that matter to them. In July 2022, we brought together more than 2,500 entrepreneurs at our summit in Washington, D.C. — the largest gathering of its kind — to hear from top business leaders, devise new strategies for business growth and meet with more than 300 members of Congress to call for policy action, specifically to modernize and reauthorize the Small Business Administration for the first time in more than 20 years.

In 2021, we took what we had learned from both programs to launch our latest initiative, One Million Black Women. In the first two years, we’ve already seen progress and firmwide engagement. We’ve committed more than $1 billion of investment capital and more than $20 million in grant capital to 116 organizations, companies and projects, which puts us on track to directly impact the lives of more than 184,000 Black women and girls. Some examples include a growth equity investment in CareAcademy, a Black woman–led upskilling company; our Alternative Investment Management Black Equity Opportunities fund; and our people serving as executive coaches to Black women school principals through our partnership with New Leaders. From our experience, and with the guidance of our Advisory Council, we’ve learned that what we need most — more than good ideas — are partners. Only by combining our efforts can we hope to transform the economy we leave behind for the next generation.

Another area where we’ve long been focused is sustainability. We have been a leading voice in the financial services industry addressing climate change and other critical environmental challenges going back to 2005, when we established our Environmental Policy Framework. In 2019, we set a target of $750 billion in financing, advisory and investing activity over the next 10 years across the themes of climate transition and inclusive growth. We have achieved approximately 55 percent of our target in three years. By connecting our experience as a financial institution with the insights gained through our work with clients and partners and our ongoing engagement with the public sector, we are enabling capital to move toward solutions that will help clients not only adapt but also take ownership to drive the transition to a low-carbon economy. At the same time, we cannot address market gaps at scale on our own, so we continue to identify strategic partners whose strengths and areas of focus complement our own.

When you look at our strategy, our culture, our talent and our track record, I think we’re incredibly well positioned to serve our clients. We are stewards of their trust — a trust that has been built up over a very long period of time. Goldman Sachs has a deep history of working with clients who have had a huge impact on the world, and we work hard to uphold that tradition of exceptional client service every day.

As we go forward, we are focused on the success of our clients and our franchise so we can deliver for shareholders. We’re working hard to raise the floor on returns and achieve our through-the-cycle targets. Our leadership is focused on our key priorities to make the firm stronger and more diversified. And I believe if we stay true to our core values, our strategy and our people, the best days for Goldman Sachs are yet to come.

David Solomon

Chairman and Chief Executive Officer

We aspire to be the world’s most exceptional financial institution, united by our shared values of partnership, client service, integrity and excellence.

We distilled our Business Principles into 4 core values that inform everything we do:

Partnership | Client Service | Integrity | Excellence

Goldman Sachs Business Principles

Our clients’ interests always come first.

Our experience shows that if we serve our clients well, our own success will follow.

Our assets are our people, capital and reputation.

If any of these is ever diminished, the last is the most difficult to restore. We are dedicated to complying fully with the letter and spirit of the laws, rules and ethical principles that govern us. Our continued success depends upon unswerving adherence to this standard.

Our goal is to provide superior returns to our shareholders.

Profitability is critical to achieving superior returns, building our capital, and attracting and keeping our best people. Significant employee stock ownership aligns the interests of our employees and our shareholders.

We take great pride in the professional quality of our work.

We have an uncompromising determination to achieve excellence in everything we undertake. Though we may be involved in a wide variety and heavy volume of activity, we would, if it came to a choice, rather be best than biggest.

We stress creativity and imagination in everything we do.

While recognizing that the old way may still be the best way, we constantly strive to find a better solution to a client’s problems. We pride ourselves on having pioneered many of the practices and techniques that have become standard in the industry.

We make an unusual effort to identify and recruit the very best person for every job.

Although our activities are measured in billions of dollars, we select our people one by one. In a service business, we know that without the best people, we cannot be the best firm.

We offer our people the opportunity to move ahead more rapidly than is possible at most other places.

Advancement depends on merit and we have yet to find the limits to the responsibility our best people are able to assume. For us to be successful, our people must reflect the diversity of the communities and cultures in which we operate. That means we must attract, retain and motivate people from many backgrounds and perspectives. Being diverse is not optional; it is what we must be.

We stress teamwork in everything we do.

While individual creativity is always encouraged, we have found that team effort often produces the best results. We have no room for those who put their personal interests ahead of the interests of the firm and its clients.

The dedication of our people to the firm and the intense effort they give their jobs are greater than one finds in most other organizations.

We think that this is an important part of our success.

We consider our size an asset that we try hard to preserve.

We want to be big enough to undertake the largest project that any of our clients could contemplate, yet small enough to maintain the loyalty, the intimacy and the esprit de corps that we all treasure and that contribute greatly to our success.

We constantly strive to anticipate the rapidly changing needs of our clients and to develop new services to meet those needs.

We know that the world of finance will not stand still and that complacency can lead to extinction.

We regularly receive confidential information as part of our normal client relationships.

To breach a confidence or to use confidential information improperly or carelessly would be unthinkable.

Our business is highly competitive, and we aggressively seek to expand our client relationships.

However, we must always be fair competitors and must never denigrate other firms.

Integrity and honesty are at the heart of our business.

We expect our people to maintain high ethical standards in everything they do, both in their work for the firm and in their personal lives.

Forward-Looking Statements

This letter contains forward-looking statements, including statements about our financial targets, business initiatives, operating expense savings and sustainability goals. You should read the cautionary notes on forward-looking statements in our Form 10-K for the period ended December 31, 2022.

1Data as of December 31, 2022, compared to December 31, 2019. Total shareholder return is sourced from Bloomberg. All other data is sourced from company filings. Peers include MS, JPM, BAC, C.

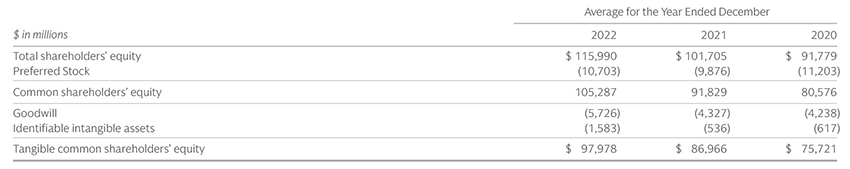

2ROTE is calculated by dividing net earnings applicable to common shareholders by average monthly tangible common shareholders’ equity. Tangible common shareholders’ equity is calculated as total shareholders’ equity less preferred stock, goodwill and identifiable intangible assets. Management believes that ROTE is meaningful because it measures the performance of businesses consistently, whether they were acquired or developed internally and that tangible common shareholders’ equity is meaningful because it is a measure that the firm and investors use to assess capital adequacy. ROTE and tangible common shareholders’ equity are non-GAAP measures and may not be comparable to similar non-GAAP measures used by other companies. The table below presents a reconciliation of average common shareholders’ equity to average tangible common shareholders’ equity.

3Source: Dealogic

4Revenue wallet share 2022 vs. 2019. Data based on reported revenues for Advisory, Equity underwriting, Debt underwriting, FICC and Equities. Total wallet includes GS, MS, JPM, BAC, C, BARC, CS, DB, UBS.

5Source: Top 100 client list and rankings compiled by GS through Client Ranking/Scorecard/Feedback and/or Coalition Greenwich 1H22 Institutional Client Analytics Global Markets ranking. Baseline comparative result not adjusted for provider changes.

6Rankings as of 4Q22. Peer data compiled from publicly available company filings, earnings releases and supplements, and websites, as well as eVestment databases and Morningstar Direct. GS total Alternatives investments of $450 billion at year end 4Q22 includes $263 billion of Alternatives AUS and $187 billion of non-fee-earning Alternatives assets.

7Loans include bank loans and mortgages; exclude margin loans. Penetration measures PWM accounts with bank loan/mortgage products vs. total accounts.

8Includes both Ultra High Net Worth and High Net Worth client assets within Private Wealth Management and Workplace and Personal Wealth. Consists of AUS and brokerage assets.

9Based on reported FY 2022 Investment Banking revenues. Peers include MS, JPM, BAC, C, BARC, CS, DB, UBS.

10Sourced from company filings. Peers include MS, JPM, BAC, C.