|

Our Asset Management and Securities Services segment is divided into three categories: Asset Management, Securities Services and Commissions.

Asset Management

Asset Management generates management fees by providing investment advisory services to a diverse client base of institutions and individuals. Assets under management include our mutual funds, separate accounts managed for institutional and individual investors, our merchant banking funds and other alternative investment funds.

Securities Services

Securities Services includes prime brokerage, financing services and securities lending, and our matched book businesses, all of which generate revenues primarily in the form of fees or interest rate spreads.

Commissions

Commissions include fees from executing and clearing client transactions on major stock, options and futures markets worldwide. Commissions also include revenues from the increased share of the income and gains derived from our merchant banking funds.

|

|

|

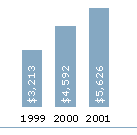

Asset Management and Securities Services

Net Revenues

(in millions of dollars)

|

|

|

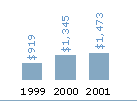

Asset Management

Net Revenues

(in millions of dollars)

|

|

|

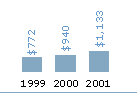

Securities Services

Net Revenues

(in millions of dollars)

|

|

|

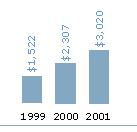

Commissions

Net Revenues

(in millions of dollars)

|

|

|