|

Trading and Principal Investments

Our Trading and Principal Investments business facilitates customer transactions and takes proprietary positions through market making in and trading of fixed income and equity products, currencies, commodities, and swaps and other derivatives. In addition, we engage in floor-based and electronic market making as a specialist on U.S. equities and options exchanges.

Our Trading and Principal Investments activities are divided into three categories: Fixed Income, Currency and Commodities, Equities and Principal Investments.

Fixed Income, Currency and Commodities (FICC)

FICC makes markets in and trades fixed income products, currencies and commodities, structures and enters into a wide variety of derivative transactions, and engages in proprietary trading and arbitrage activities. FICC's principal products are: bank loans, commodities, currencies, derivatives, emerging market debt, global government securities, high-yield securities, investment-grade securities, money market instruments, mortgage securities and loans and municipal securities.

Equities

Equities makes markets in, acts as a specialist for, and trades equities and equity-related products, structures and enters into equity derivative transactions, and engages in proprietary trading and equity arbitrage. We make markets and position blocks of stock to facilitate customers' transactions and to provide liquidity in the marketplace.

Principal Investments

Principal Investments primarily represents net revenues from our merchant banking investments. We make principal investments directly and through the funds we raise and manage.

|

|

|

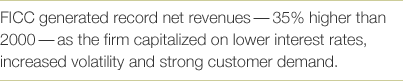

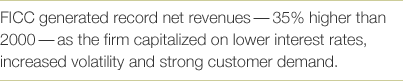

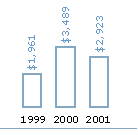

Trading and Principal Investments

Net Revenues

(in millions of dollars)

|

|

|

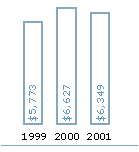

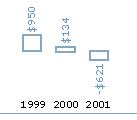

FICC

Net Revenues

(in millions of dollars)

|

|

|

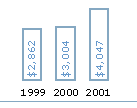

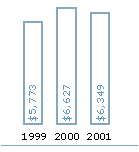

Equities

Net Revenues

(in millions of dollars)

|

|

|

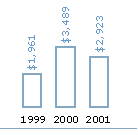

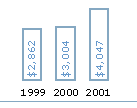

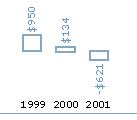

Principal Investments

Net Revenues

(in millions of dollars)

|

|

|