|

Our Global Capital Markets segment is divided into Investment Banking and Trading and Principal Investments.

Investment Banking

Our current structure, which is organized along regional, product and industry groups, seeks to combine client-focused investment bankers with execution and industry expertise.

Our Investment Banking activities are divided into two categories: Financial Advisory and Underwriting.

Financial Advisory

Financial Advisory includes advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense activities, restructurings and spin-offs.

Underwriting

Underwriting includes public offerings and private placements of equity and debt securities.

|

|

|

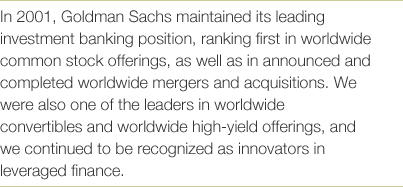

Global Capital Markets

Net Revenues

(in millions of dollars)

|

|

|

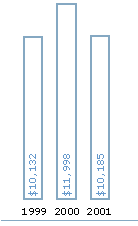

Investment Banking

Net Revenues

(in millions of dollars)

|

|

|

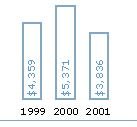

Financial Advisory

Net Revenues

(in millions of dollars)

|

|

|

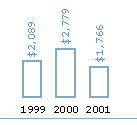

Underwriting

Net Revenues

(in millions of dollars)

|

|

|