One Liner: Goldilocks Was the Main Character, but Don't Forget the Three Bears

This article is from the weekly Some Macro Thoughts comment by Nohshad Shah, Managing Director, Co-head of EMEA Interest Rate Products Sales, Global Markets Division, published on August 13, 2021. The full note and Nohshad’s weekly analysis are available on Marquee’s Global Markets Insights.

By Nohshad Shah

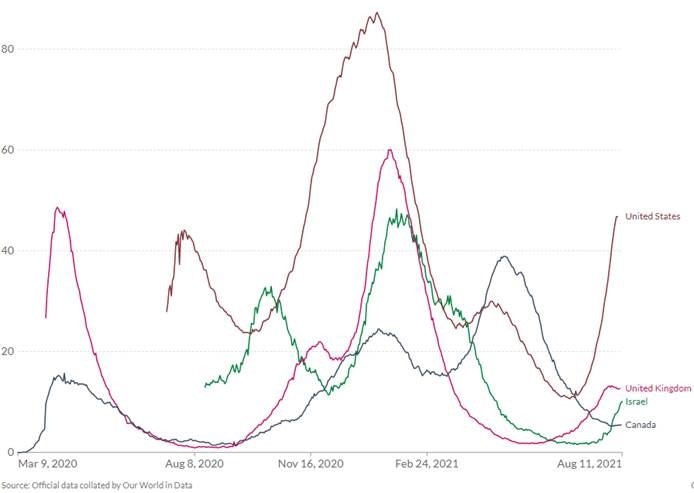

The market has long-COVID. I sense a great deal of intellectual fatigue and reluctance to dwell on COVID risk anymore... given the constantly evolving virus landscape however, it is important to stress test our assumptions about vaccine efficacy and the path for variants. The data coming out of Israel is moderately concerning as it shows a highly vaccinated country experiencing a surge in COVID cases with a meaningful but steady rise in ICU admissions...the Financial Times reports that over 90% of new infectious are in people aged 50+ and that Israel is considering re-imposing restrictions. Given the country’s early vaccine lead, it’s an important leading indicator for what could come for DM policy. ICU data suggests that there are currently around 400 people in serious condition and local expert Prof. Eran Segal said earlier this week that “In the last wave we hit 1,200 serious patients and that seems to be the critical limit. That’s scary. And if this does happen, or seem to be happening, we should go to lockdown.” Our Global Economics team’s view (partly informed by the Netherlands/UK experience) is that hospitalizations will remain under control due to the combination of (i) targeted restrictions (e.g. digital vaccine passports, tighter restrictions on mass gatherings), (ii) the boost to immunity from a growing impact of booster shots and natural infections, and (iii) voluntary social distancing/mask-wearing. However the broad outlook is ridden with risks, even for highly vaccinated nations...

So what does the Israeli data suggest about vaccine efficacy? The data on the efficacy of the Pfizer vaccine administered in Israel suggests a substantial decline in its ability to prevent infection to around 43%, following the emergence of Delta and with the passage of time since vaccination. On the more promising side, there appears to be a more limited decline in the ability of Pfizer to prevent severe cases (to around 83%) and booster shots look to significantly boost efficacy against infection to around 80%. This lines up with our thinking on vaccines remaining highly effective against preventing severe disease and hospitalizations. Also, there is evidence that vaccine efficacy declines through time, with data from a study of 34,000 fully-vaccinated individuals where 1.8% had breakthrough cases and that the odds of testing positive were higher when the last vaccine dose was received at least 146 days earlier. Focusing on patients over 60, the odds of breakthrough cases were almost three times higher in this study when at least 146 days had passed. This reinforces the view that booster shots will need to be a global strategic priority…and for markets this means that vaccines aren’t a “two-shots-and-done” phenomena.

What about the path for variants? This is a deeply complex issue and professional opinion is divided on the risks of further mutations. I am no expert but my understanding is that ultimately there are 3 main pathways for the virus: (i) the virus simply fails to meaningfully escape vaccine-generated immunity (e.g. measles, polio, smallpox), (ii) the virus mutates to partially evade immune defenses but becomes less infectious/lethal as a result, (iii) mutation allows the virus to evade immunity (without compromising infectiousness/lethality). On the more hopeful end of the spectrum, the scientific journal Nature recently published an article by renowned virologist Roberto Burioni that suggests the virus may (eventually) reach a peak fitness state: “more-fit variants can be expected to emerge over time...but we believe that these will not continue to emerge indefinitely: nothing is infinite in nature, and eventually the virus will reach its form of ‘maximum transmission’. After then, new variants will provide no further advantage in infectivity. The virus will thus stabilize and this ‘final’ variant will prevail and become the dominant strain, experiencing only occasional, minimal variations.”. The article is also optimistic on the scope for mutations to avoid prior immunity: “molecular data gathered thus far have made it clear that the ‘evolutionary space’ that SARS-CoV-2 has for evading vaccine-induced immunity is remarkably narrow relative to that available for increases in transmission rates”

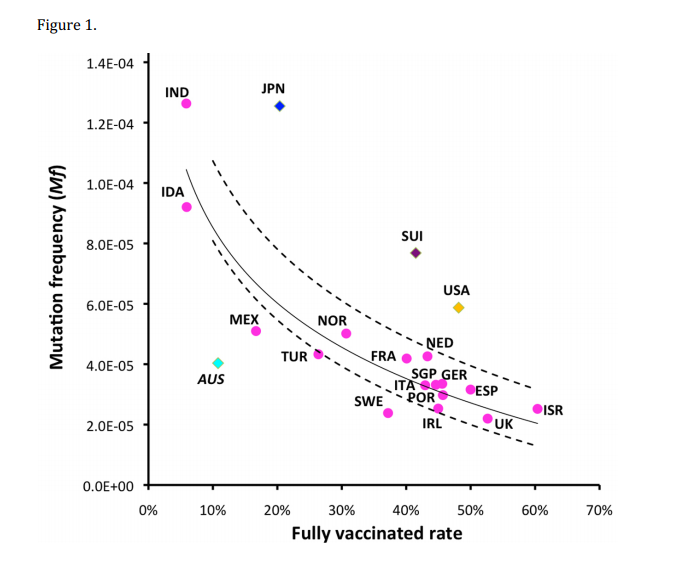

Ultimately, the scale on which this virus is currently operating means that countless more mutations will occur and there will always remain the tail risk of a totally vaccine resistant strain emerging (until the global population is vaccinated). Some experts see the inevitability of such a strain, given we already have some evidence of that direction of travel, but this is balanced by the opportunity to use data on the evolutionary pathways driving current vaccine escape to inform the preparation of updated vaccines/boosters. The New Yorker (here) highlights that T-cell immunity (relevant for fighting the disease once infected) may be more robust/durable than antibody immunity (relevant for prevention of infection). Vaccines deliver both types of immunity but biological lab constraints make it much easier to study antibody immunity and that’s why there is so much more attention/media focus…this means that the antibody-focused narrative may be somewhat more negative than the full picture. Finally, there is some encouraging evidence from a new study suggesting that higher vaccination rates reduce the propensity of the virus to mutate (chart below). However, in this globally connected world, one nation’s variant problem today is the world’s problem tomorrow.

Taken together, variants and vaccine efficacy point to…1) the importance of booster shots, 2) the ongoing risks of variants and 3) the likelihood of ongoing lite-restrictions (digital vaccine passports, tighter restrictions on mass gatherings) for highly vaccinated economies, rather than full-scale lockdowns and 4) re-asserts the global urgency for ongoing vaccine rollout, with any spare doses in DMs channeled to nations that have shortages. The low or zero COVID strategies of the Asian and Australasian continents are being increasingly challenged due to low vaccination rates and low natural immunity, in the context of the delta variant being much harder to control than the original strain. Indeed GS has reduced the Q3 GDP forecast for China by 3.5pp to 2.3% (quarter-on-quarter annualized) and took down full-year 2021 growth by 0.3pp to 8.3%. The uncertainty remains high, and the restrictions on travel and entertainment could push Q3 growth as low as zero if we see a nationwide rerun of Q1, when several provinces in Northern China imposed travel and social distancing measures in response to an earlier outbreak. Our economists also downgraded ASEAN, Australia, and Japan.

However, the market's beta to COVID news has oscillated…with the market-pandemic timeline something like this: dismissive, not great but V-shaped, PANIC, STIMULUS, recovery, hope, it’s back, more stimulus, VACCINE, Biden, stimulus, DELTA. Part of the reason for this oscillation in market beta is the change in the sensitivity of GDP to lockdowns and policy exhaustion. Declining sensitivity to lockdowns may continue. I would however, caution that we are likely at the peak of policy easing from both central banks and governments…and therefore, as we move towards accommodation removal, any moderate downside on virus developments could be more difficult for the market to digest going forward.

Big picture, I see the risk of an inverse goldilocks scenario…whereby the ongoing presence of the virus prevents economic activity from reaching 100% with consumer caution (in certain cohorts) and via mini-lockdowns in selective environments (e.g. international travel, office adjacent economies)…but the performance of the wider consumer/investment side of the economy is strong enough for things to tick along. This scenario would be one where the economy isn’t weak enough to merit further stimulus but equally not strong enough for risk assets to continue to race higher. This could be a challenging environment for equities, not just because the growth impulse could moderately disappoint, but also because policymakers likely continue on their pre-determined pathway to reduce stimulus. The fiscal tailwinds will start to fade and the fed looks set to taper at some point towards the end of this year…recent communication from Clarida + other Fed officials has kept the door firmly open for rate hikes in 2022. In such an outlook I’d expect correlations to drop – with stocks contending with virus driven risks whilst interest rates drift higher as CB policy changes setting…add into the mix the risk of a not-so-transitory inflation and/or a faster/higher policy rate cycle and the picture doesn’t look so rosy…