How AI is re-platforming the economy

AI has fundamentally changed the software and technology paradigm, with three critical vectors driving this evolution. In compute, we have seen a progression from traditional CPU chips to more dynamic and powerful GPUs made by companies like Nvidia – albeit with newer CPUs equipped for targeted and specific AI workloads also emerging. Software, meanwhile, has evolved from application-centric to data-centric design – with data becoming a foundational input for application development.

- How AI is re-platforming the economyKarthik Subramanian and Usman Ashraf, who lead Infrastructure Software Investment Banking at Goldman Sachs, discuss these profound shifts and the opportunities they are creating.

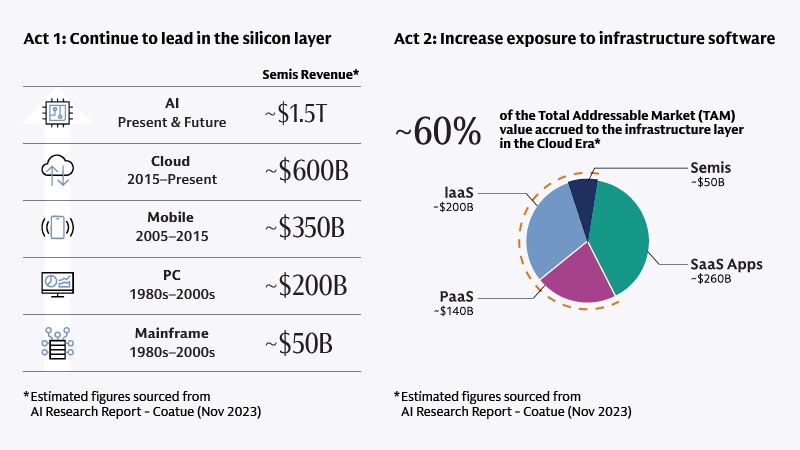

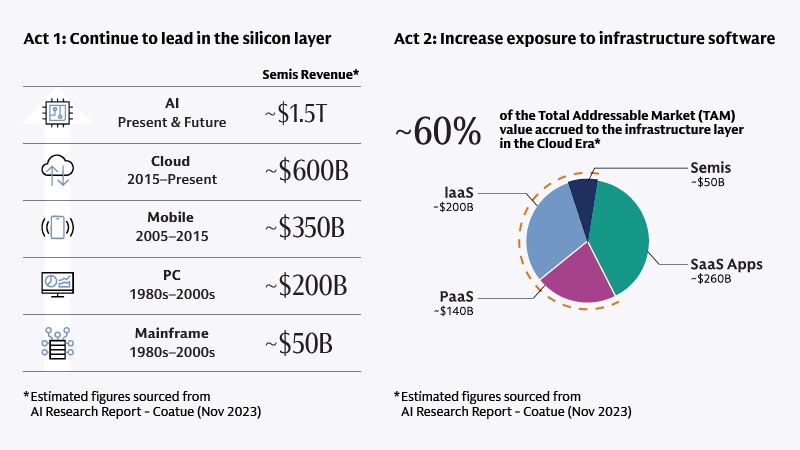

Historically, major technology shifts have followed a similar pattern: virtually all financial gains are first captured by semiconductor and hardware companies, but then “blossom” in the infrastructure software layer.

Today, infrastructure software sits at the heart of this AI re-platforming, bridging innovation in hardware at the bottom of the stack with application development at the top. As in previous eras, infrastructure software will be the next investment horizon following outsized CapEx in AI hardware (e.g., chips) – unlocking significant opportunities as legacy infrastructure markets are redefined and completely new ones emerge.

M&A will play a critical role in defining this new era. We expect many smaller AI companies to seek consolidation with larger players, corporates to cement their AI capabilities via opportunistic M&A and financial sponsors to increase their exposure to the re-platforming of our global economy through strategic transactions—creating a dynamic environment ripe for high-impact deals.

As AI appears to be leveling the playing field, the software and technology ecosystem is rapidly evolving – only scratching the surface of its transformative potential. These shifts are disrupting traditional boundaries, and the subsequent land grab is unfolding in real time.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.