Why digital asset adoption is accelerating

Corporate and institutional interest in digital assets has been gaining pace on the heels of broader market maturation trends and demand for innovation in financial infrastructure. A wave of digital asset regulation has provided companies with much-welcomed clarity and is encouraging new solutions that drive the ecosystem from theoretical use cases to real-world adoption.

- Why digital asset adoption is acceleratingYasmine Coupal, a partner in the Technology, Media, and Telecom Group within Investment Banking who leads coverage of digital asset companies, and Mathew McDermott, global head of Digital Assets, discuss what’s driving this momentum and the opportunities that lie ahead.

Each industry is discovering its own unique applications, but blockchain technology is broadly driving tangible benefits by enhancing transparency, reducing risk, improving capital efficiency, and enabling new levels of programmability.

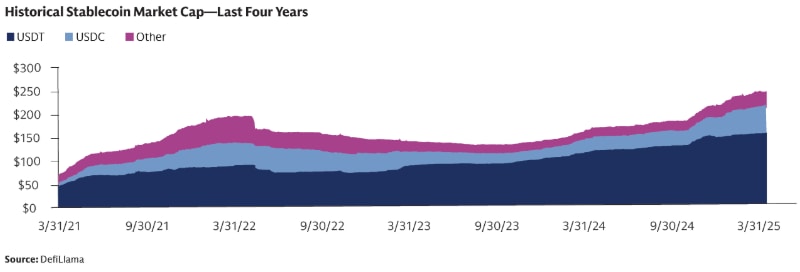

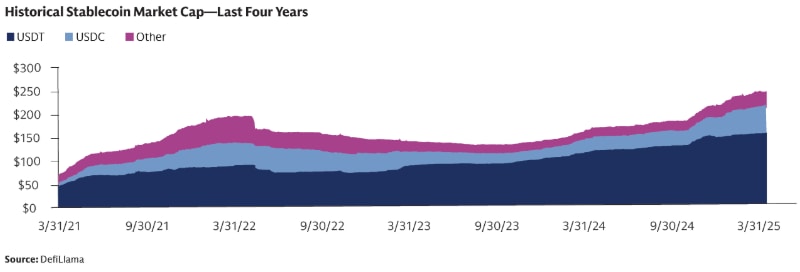

In particular, stablecoins – digital currencies designed to maintain a stable value by being pegged to traditional currencies like the US dollar – have become one of the fastest growing segments in digital assets. By leveraging blockchain technology, stablecoins can unlock cross-border payments at internet speed and at negligible cost, removing the inefficiencies of traditional rails and infrastructure.

As this evolution moves past the “why digital assets” phase to “how do I integrate them,” capital markets activity is accelerating – digital asset M&A volumes reached $15.8B in 2024, up from just $1B in 2019.* Going forward, the convergence of traditional finance (TradFi) and cryptocurrencies – alongside rising demand for access from investors – will facilitate strategic opportunities for industry leaders to cement their position, and emerging players to elevate their standing.

The future of digital assets is still being written, and the window for gaining early-mover advantages remains open.

*Pitchbook as of 12/31/2024.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.