Stock Broking

Company Profile

Name of the Company

Goldman Sachs (India) Securities Private Limited

Registered Office

10th Floor, Ascent-Worli, Sudam Kalu Ahire Marg

Worli, Mumbai India - 400 025

Telephone No.

+91 22 6616 9000

Fax

+91 22 6616 9001

SEBI Registration No. for Stock Broking

INZ000277034

Corporate Identification No (CIN)

U74140MH2006FTC160634

Investor grievance ID

india-client-support@gs.com

INVESTOR AWARENESS AND SAFEGUARDING CLIENTS’ ASSETS1

Attention Investors

- Beware of fixed/guaranteed/regular returns/ capital protection schemes. Brokers or their authorized persons or any of their associates are not authorized to offer fixed/guaranteed/regular returns/ capital protection on your investment or authorized to enter into any loan agreement with you to pay interest on the funds offered by you. Please note that in case of default of a member claim for funds or securities given to the broker under any arrangement/ agreement of indicative return will not be accepted by the relevant Committee of the Exchange as per the approved norms.

- Do not keep funds idle with the Stock Broker. Please note that your stock broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days. Please note that in case of default of a Member, claim for funds and securities, without any transaction on the exchange will not be accepted by the relevant Committee of the Exchange as per the approved norms.

- Check the frequency of accounts settlement opted for. If you have opted for running account, please ensure that your broker settles your account and, in any case, not later than once in 90 days (or 30 days if you have opted for 30 days’ settlement). In case of declaration of trading member as defaulter, the claims of clients against such defaulter member would be subject to norms for eligibility of claims for compensation from IPF to the clients of the defaulter member. These norms are available on Exchange website at following links:

NSE- https://www.nseindia.com/invest/about-defaulter-section

BSE- https://www.bseindia.com/static/investors/Claim_against_Defaulter.aspx

- Brokers are not permitted to accept transfer of securities as margin. Securities offered as margin/ collateral MUST remain in the account of the client and can be pledged to the broker only by way of ‘margin pledge’, created in the Depository system. Clients are not permitted to place any securities with the broker or associate of the broker or authorized person of the broker for any reason. Broker can take securities belonging to clients only for settlement of securities sold by the client.

- Always keep your contact details viz. Mobile number/Email ID updated with the stock broker. Email and mobile number is mandatory and you must provide the same to your broker for updation in Exchange records. You must immediately take up the matter with Stock Broker/Exchange if you are not receiving the messages from Exchange/Depositories regularly.

- Don’t ignore any emails/SMSs received from the Exchange for trades done by you. Verify the same with the Contract notes/Statement of accounts received from your broker and report discrepancy, if any, to your broker in writing immediately and if the Stock Broker does not respond, please take this up with the Exchange/Depositories forthwith.

- Check messages sent by Exchanges on a weekly basis regarding funds and securities balances reported by the trading member, compare it with the weekly statement of account sent by broker and immediately raise a concern to the exchange if you notice a discrepancy.

- Please do not transfer funds, for the purposes of trading to anyone, including an authorized person or an associate of the broker, other than a SEBI registered Stock broker

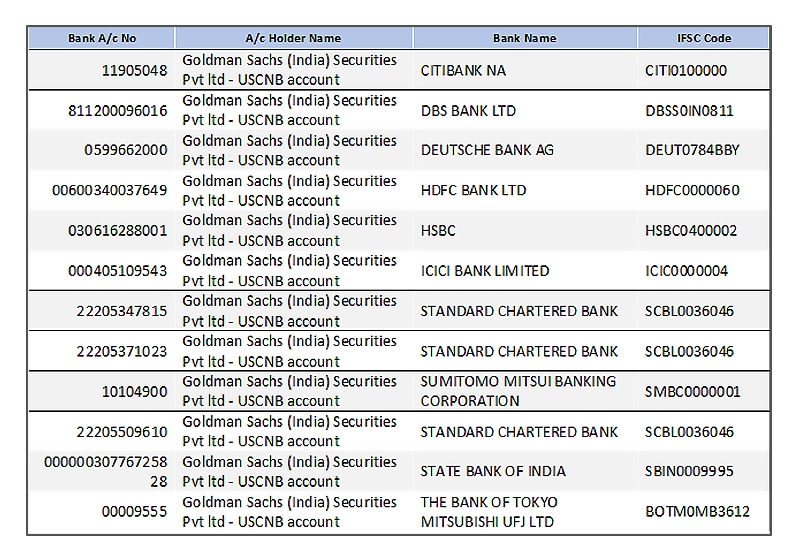

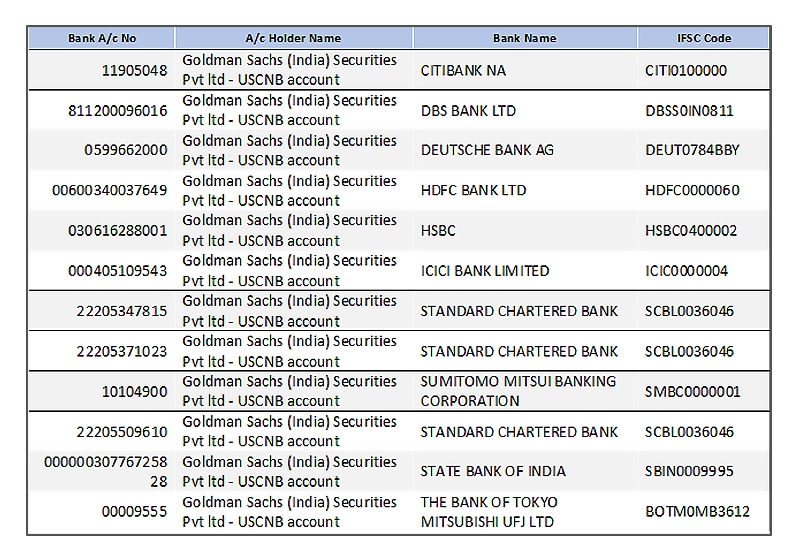

CLIENT MONEY BANK ACCOUNTS

Pursuant to BSE Ltd. notice no. 20230127-42 and National Stock Exchange of India Limited circular ref. no. NSE/INSP/55402 dated January 27, 2023, the details of active client bank accounts for Stock Broking business are as stated under:

“Investors are requested to note that Stock broker Goldman Sachs (India) Securities Private Limited (SEBI Regn.: INZ000277034) is permitted to receive money from investor through designated bank accounts only named as Up streaming Client Nodal Bank Account (USCNBA). Stock broker - Goldman Sachs (India) Securities Private Limited is also required to disclose these USCNB accounts to Stock Exchange. Hence, you are requested to use following USCNB accounts only for the purpose of dealings in your trading account with us. The details of these USCNB accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker.”

To view this information in a PDF, please click here.

INVESTOR AWARENESS REGARDING THE REVISED GUIDELINES ON MARGIN COLLECTION2

Attention Investors

- Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

- Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

- Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

.......... Issued in the interest of Investors

COLLECTION OF PENALTY LEVIED BY CLEARING CORPORATIONS FOR SHORT/NON-COLLECTION OF UPFRONT MARGINS.

Execution only client:

As permitted under National Stock Exchange of India Limited (“NSE”) circular dated October 01, 2024 having circular reference number NSE/INSP/64315, GIPL shall have the right to pass on the penalty levied by clearing corporation to the client if short/non collection of upfront margin is on account of following reasons attributable to client:

(A). Cheque issued by client to member is dishonored

(B). Increase in margins on account of change in hedge position by client/ expiry of some leg(s) of the hedge positions of the clients. Hedge break or margin benefit loss could be due to multiple reasons including but not limited, to square off trades, expiry of some leg(s) of the hedge position etc.

For Custodian Participant Clearing Clients:

As permitted under NCL circular dated November 26, 2020, having reference no. NCL/CMPL/46478, GIPL solely at its discretion may pass onto its clearing clients the penalty levied & collected by the clearing corporation. This penalty could be on account of violation of peak margin requirement or short / non collection of up front margin requirement.

UPDATION OF MOBILE NUMBER AND EMAIL ID OF CLIENTS3

Attention Investors

- Prevent Unauthorised transactions in your account --> Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day.......... Issued in the interest of investors

PROCEDURE TO VIEW COLLATERAL DATA BY CLIENTS ON NSE WEBSITE4

With a view to providing visibility of client-wise collateral in compliance with SEBI circular no. SEBI/HO/MRD2_DCAP/CIR/2021/0598 dated July 20, 2021, NSE Clearing has provided a web portal facility to allow clients to view their designated collateral placed with Member and as reported by their registered Trading Member / Clearing Member.

Clients can refer the below NSE Clearing process to register on the NSE Clearing web portal and view their collateral details.

GOLDMAN SACHS (INDIA) SECURITIES PVT LTD PROCEDURE FOR ACCOUNT OPENING

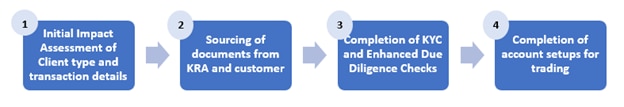

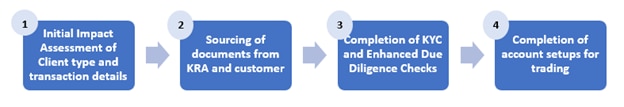

SEBI guidelines (in conjunction with the Prevention of Money Laundering Act of 2002) govern the Customer Identification Program or the Client Onboarding process for Goldman Sachs (India) Securities Pvt Ltd.

- Upon receipt of the Client Onboarding request from business representatives, the client Onboarding team performs an initial assessment of the client type (FPI/FDI/FVCI/Domestic/Individual), products and transaction details based on which Onboarding requirements are determined.

- Where available, documents are sourced from KYC Registration Agencies (KRA) and any remaining requirements are consolidated and requested from the customer. While there could be additional requirements depending on the customer’s jurisdiction, below is a list of standard documents that are required for the onboarding process.

- Board Resolutions passed to authorize account opening with Goldman Sachs (India) Securities Pvt Ltd

- PAN/Tax ID and Financials (both legal and natural persons)

- Constitutional/Existence documentation as applicable

- Address verification proof for entity and related natural persons (Authorized Signatories/Beneficial owners and Key Senior Management Officials)

- Ultimate Beneficial Ownership & Senior Management Officials Declaration and related details

- Authority documents and specimen signature for representatives (Authorized Signatories)

- Documentation for UCC code generation (Custodian & Bank details, Exchange & Trading Preference, Primary Contact for Exchange purposes etc.)

- Other Transaction related agreements/consents letters specific to Goldman Sachs’s engagement

- Based on information sourced from KRA and the customer, the Client Onboarding team completes KYC checks in line with the firm’s AML Policy and procedures. Where applicable, enhanced due diligence checks are completed by the Financial Crime Compliance team.

- Upon conclusion of the above process, the customer’s trading account setups are completed after which the customer will be ready to trade.

1Ref: NSE Circular NSE/INSP/49434 dated Aug 27, 2021 and BSE Notice 20210827-44 dated Aug 27, 2021

2Ref: NSE Circular NSE/INSP/45565 dated Sept 2, 2020 and BSE Notice 20200903-1 dated Sept 3, 2020

3Ref: NSE Circular NSE/INSP/27436 dated Aug 26, 2014 and BSE Notice 20140822-30 dated Aug 22, 2014

4Ref: https://archives.nseindia.com/content/circulars/CMPL49764.zip

DISCLOSURES

Policy on Corporate Social Responsibility - Goldman Sachs (India) Securities Private Limited [PDF]

Disclosure under Rule 15 of Companies (Appointment and Qualification of Directors) Rules, 2014 [PDF]

Goldman Sachs (India) Securities Private Limited – Annual Return – MGT-7 - FY 2023-24 [PDF]

Goldman Sachs (India) Securities Private Limited – Annual Return – MGT-7 – FY 2024-25 [PDF]

Stock Broking

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.