Global stocks are vulnerable in 2025

Solid economic growth and the prospect of falling interest rates provide a backdrop for further gains in global equities. But soaring valuations over the past two years, particularly in the US, leave global stocks in a vulnerable position, according to Goldman Sachs Research.

By the end of last year, the S&P 500 clocked one of its strongest two-year periods of returns for the index since 1928. Much of the rise in stocks reflects better fundamental growth than investors had expected, and rising valuations have been a significant contributor to recent performance.

“The powerful rally in equity prices in recent months leaves equities priced for perfection,” Peter Oppenheimer, chief global equity strategist and head of Macro Research in Europe, writes in the team’s report. “While we expect equity markets to make further progress over the year as a whole — largely driven by earnings — they are increasingly vulnerable to a correction driven either by further rises in bond yields and/or disappointments on growth in economic data or earnings.”

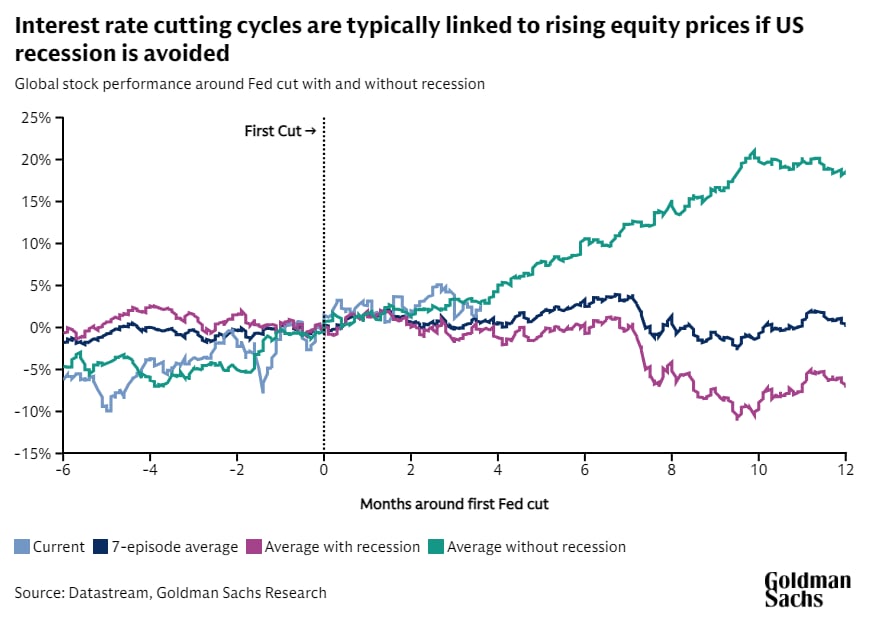

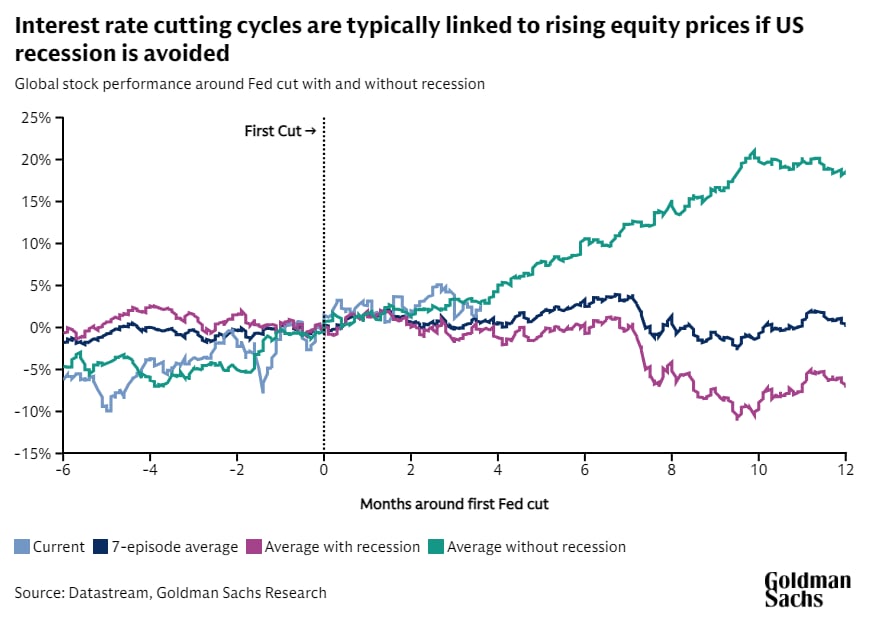

A decline in interest rates has been associated with strong equity returns in the past. In the US, for example, Federal Reserve rate-cutting cycles have often coincided with rising stock prices as long as the economy avoids slipping into recession.

Despite the favorable backdrop, the outlook for an ongoing stock rally is complicated by three main factors.

First, the speed of recent gains in stock prices already reflects much of the good news that our analysts are expecting in terms of economic growth. Goldman Sachs Research finds that cyclical parts of the market are outperforming the defensive parts.

“Much of the strength in equities in recent months has reflected higher growth expectations, particularly in the US where optimism on US deregulation and tax cuts have played a role,” Oppenheimer writes. “This leaves equities vulnerable to any growth disappointments, particularly depending on specific policy measures by the incoming US administration in relation to tax and tariff decisions.”

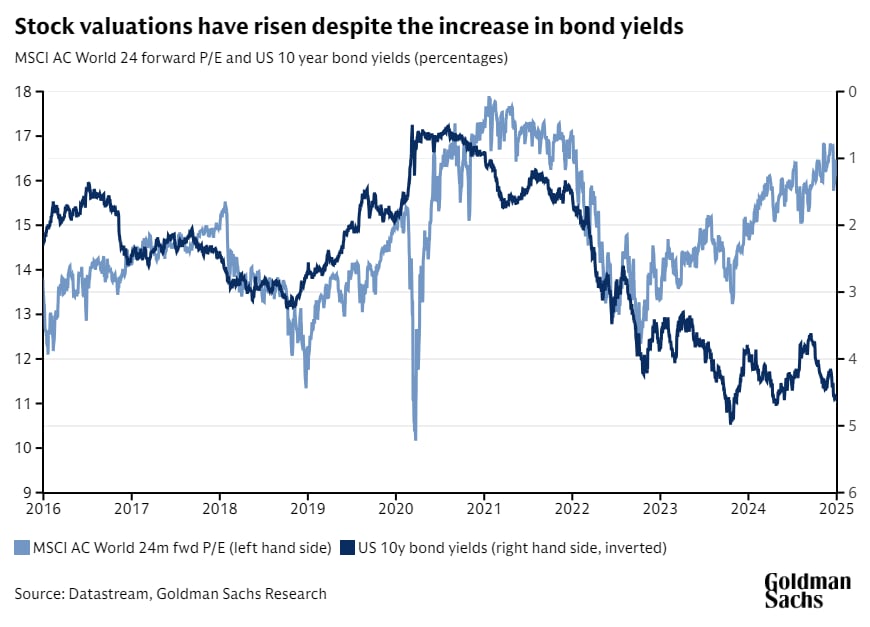

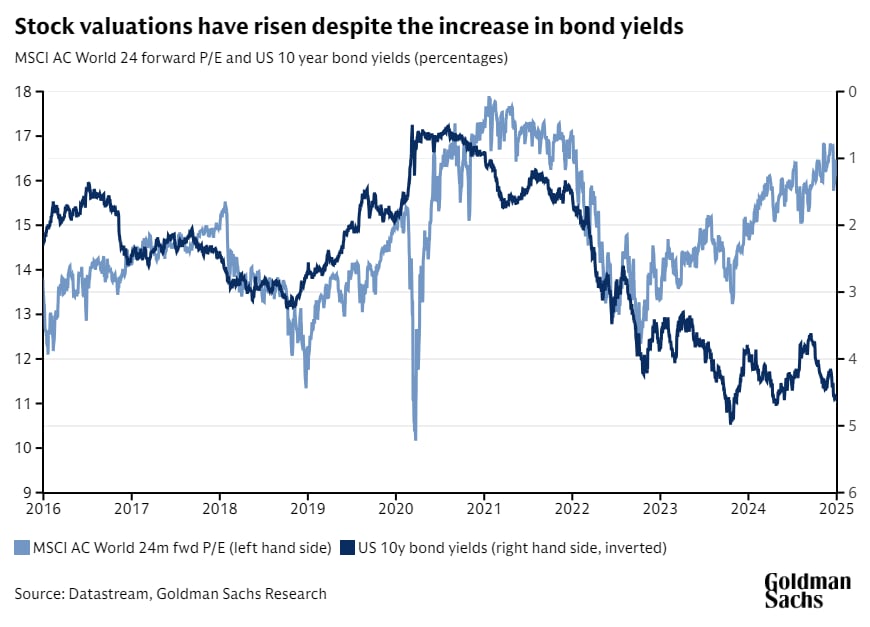

Second, high valuations are likely to limit forward returns. The gains have left the US stock market at its 20-year peak, even after excluding the biggest technology companies. Other markets are much cheaper relative to the US, but their valuations are broadly in line with their long-term averages (outside of China).

The third factor complicating the outlook for global equities is unusually high market concentration — by geography (the US has been increasingly dominant), by sector (technology has generated the bulk of equity returns), and by individual companies (the five biggest stocks in the US account for roughly a quarter of the index).

Stocks are more vulnerable to growth disappointments because of the increased concentration of equity market returns, Oppenheimer writes. The large US technology companies known as the Magnificent 7 rose by 47% last year, versus a 10% gain for the median company in the S&P 500.

“Encouragingly, the dominance of the largest US technology companies has reflected powerful fundamental growth rather than irrational exuberance,” Oppenheimer writes. “Nevertheless, the extraordinary ramp-up in capex spending that mega-cap technology companies are making is reducing free cash flow and the scale of future profit growth.”

There’s also a growing disconnect between stock performance and interest rate expectations. US 10-year Treasury yields have climbed back above 4.5%, which is 100 basis points higher than in September. And expectations for further rate cuts in 2025, as indicated by fed funds futures, have dropped from 125 basis points of cuts as recently as September to less than 40 basis points. Even if the increase in yields is starting to look stretched, as our rates research team estimates, rising equity prices in the face of higher bond yields leaves little cushion for equities markets in the event that bond yields climb further.

The key takeaway for investors is that diversification has become more important in the year ahead, according to Goldman Sachs Research. For starters, the portfolio strategy team recommends considering geographic diversification. The surging US dollar has benefited companies in other countries that count on the US for a higher share of their revenues, but they are still much cheaper than their US counterparts. Companies outside the technology sector are an opportunity, particularly “quality compounders” — companies that generate steady profit growth throughout the economic cycle. There are also signs that equity correlations are declining, which could open up opportunities for stock picking.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.