US equities are ripe for stock pickers

The S&P 500 may offer a good opportunity for active stock pickers, as company-specific factors take precedence over macro trends in driving returns. The opportunity for active investing comes as Goldman Sachs Research predicts the S&P 500 Index will climb some 6% this year.

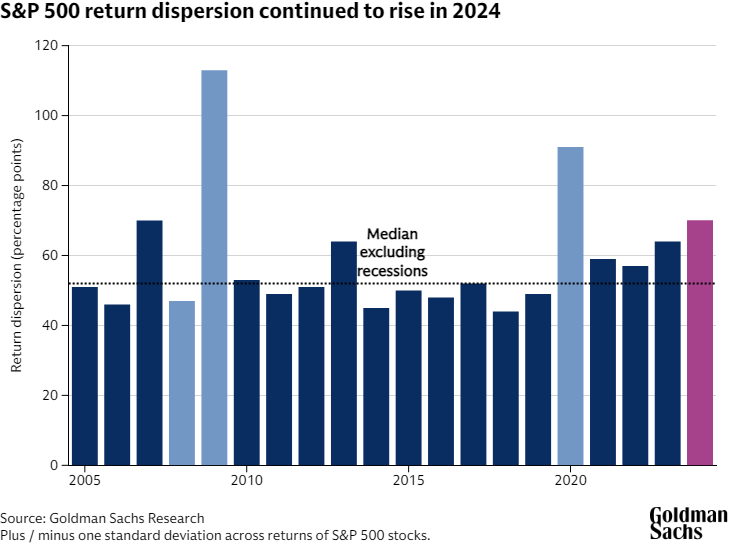

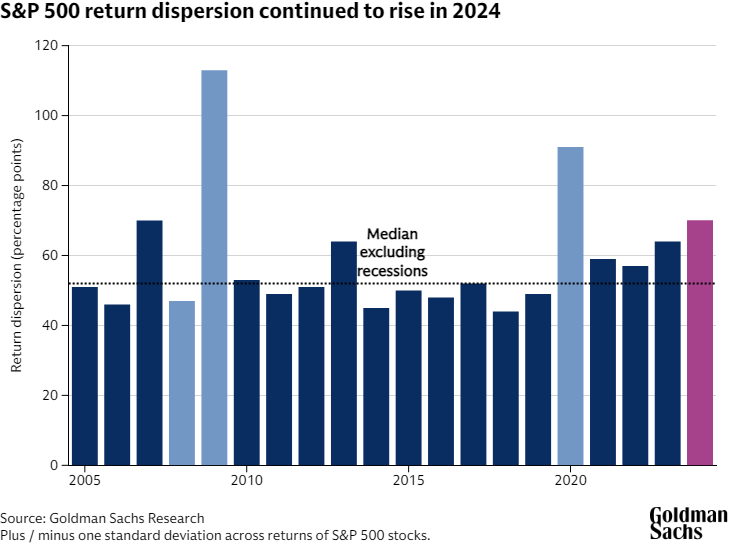

S&P 500 return dispersion last year registered one of the highest levels on record, meaning there was a considerable gap between the best and worst performers in the index. High single-stock volatility and low correlation within the index also point towards a favorable backdrop for stock pickers, according to David Kostin, chief US equity strategist at Goldman Sachs Research.

Is this a good time to buy single stocks?

There are a number of reasons why there could be opportunities for investors who target specific companies rather than investing in broad indexes. Last year's S&P 500 dispersion reading of 70 percentage points was the highest since 2007 (outside of recessions). Six out of 11 sectors in the S&P 500 registered above-average return dispersion — the highest being Information Technology at 106 percentage points, while Real Estate was the lowest at 39 percentage points.

The jump in dispersion was accompanied by increasing certainty surrounding the economic outlook and the growing importance of debates about themes such as artificial intelligence and the US election, according to Goldman Sachs Research.

Another indicator of the high dispersion in the S&P 500 in 2024 is the elevated level of single-stock volatility compared to volatility of the broader index. Over the past three months, the average S&P 500 stock has exhibited 1.7% volatility — more than twice the level of the aggregate index, at 0.8%. An analysis of implied volatility (the market’s expectation for future volatility) on three-month S&P 500 options contracts suggests traders are positioned for this dynamic to continue.

In addition to the high level of return dispersion last year, stock correlation within the S&P 500 — a measure of how consistent the movements of stocks are in relation to one another — was near historic lows.

This combination of high return dispersion and low stock correlations reflects a market where returns are driven by micro, rather than macro, factors, Kostin writes in the team’s report. Goldman Sachs Research forecasts the S&P 500 Index will rise to 6500 in 2025 (as of February 13).

“In a micro-driven market, a high share of the typical stock’s return is explained by company-specific factors, while a macro-driven market means the returns for the typical stock are primarily explained by factors such as beta, sector, size, and valuation,” Kostin writes. Beta measures the volatility of an equity relative to the overall market.

Is the less predictable environment here to stay?

Recently, 74% of the typical S&P 500 stock’s returns have been driven by fundamental factors rather than macro factors, a significant increase on the average of 58% over the past two decades.

Goldman Sachs Research expects this micro-driven environment to persist in 2025, for three reasons: “First, GS economic forecasts point to a healthy growth environment this year. Second, continued AI development and adoption should create differentiation across stocks. Third, elevated policy uncertainty also suggests elevated dispersion,” Kostin writes.

The Economic Policy Uncertainty Index — based on newspaper coverage, reports from the Congressional Budget Office, and a survey of economic forecasters — has spiked amid tariff announcements by President Trump and his administration. The index hit 496 at the end of January, one of the highest levels since the Covid pandemic.

“Looking ahead, debates over trade, tax, fiscal, and other policies represent potential catalysts for additional return dispersion,” Kostin writes.

Which sectors are best for stock pickers?

Sectors with high dispersion are attractive for stock pickers: Goldman Sachs Research’s dispersion framework ranks Consumer Discretionary as the sector with the highest dispersion, followed by Information Technology, and Communication Services.

More macro-driven sectors such as Real Estate and Utilities have the lowest dispersion scores, indicating less opportunity for stock pickers.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newletter via email.