ISG Insight: From Room to Grow to Room to Fall

The following is an updated insight from Goldman Sachs’ Investment Strategy Group.

Sharmin Mossavar-Rahmani, Chief Investment Officer

Brett Nelson, Head of Tactical Asset Allocation

Matthew Weir, Managing Director

Ylber Bajraktari, Vice President

Matheus Dibo, Vice President

Kelly Han, Vice President

Matthieu Walterspiler, Vice President

Harm Zebregs, Vice President

“What a Difference a Day Makes.” In less than a month, we have shifted from explaining why the US economy and bull market had room to grow to how much the global economy, equity markets, interest rates, and oil prices could fall.

The purpose of this note is to provide a synopsis of our views and those of our guest speakers on a series of client conference calls over the last six weeks. We begin with a summary of the issues discussed with infectious and biodefense specialists—Dr. Barry Bloom of Harvard T. H. Chan School of Public Health and formerly head of the School, and Dr. Luciana Borio of In-Q-Tel and former Director of Medical and Biodefense Preparedness at the National Security Council and Acting Chief Scientist of the US Food and Drug Administration. We provide some historical context of this pandemic relative to other viral epidemics. We then turn to the likely economic impact of the Covid-19 pandemic, including the views of our Goldman Sachs Global Investment Research (GIR) colleagues on the likelihood of recession. We will conclude with our views on the investment implications.

The Fear of the Unknown: SARS-CoV-2 and its Disease COVID-19

Since our first client call addressing the new virus on February 4 (when the S&P 500 was about 25% higher than current levels), we have emphasized the enormous uncertainty surrounding the virus at this time. Our infectious-disease specialists have warned, and continue to warn, that it is too early to know the fatality rate, the incubation period, the reproduction number, and the contagious period. Therefore, as you hear estimates of how many people will contract the disease in the US and Europe, and how many people will die as a result, please keep in mind that nobody knows. As Dr. Bloom said on our call, “one has to take any specific number, like the mortality rates, with a grain of salt.”

Widely quoted Harvard Epidemiologist Marc Lipsitch initially projected that “40 to 70 percent of the human population could potentially be infected by the virus if it becomes pandemic.”1 He later qualified the statement to apply only to adults since children seem to be less affected. The number was further revised down to 20-60%.2 He also stated that measures from self-quarantining to social distancing will affect these estimates.

The data from China shows the extent to which effective policy can produce a completely different set of numbers. If we were to use the current reported rate of growth in the number of infections through early May, the number of infected people in China may peak at 100,000. Given a population of 1.4 billion people, the infection rate would be .007%. Dr. Xihong Lin of the Department of Biostatistics and Department of Statistics Harvard University and Broad Institute estimates that, by early May, the number of new cases in Wuhan will fall to zero!3 She attributes this low rate to a number of policy measures starting with:

- social distancing,

- extensive testing,

- centralized quarantining,

- lock-down of Wuhan,

- a traffic ban.

It is obvious that the government policy has a significant impact on the relevant numbers.

What are the relevant numbers?

Fatality Rate: The Fatality Rate is the number of people who have died from the disease divided by the number of infected people. Obviously, no one knows the number of infected people in every country at this time, so the fatality rate may well be overstated because we are measuring a known number by an estimate of the number of infected people. There is also significant dispersion in the fatality rate between age groups and regions. The fatality rate among 40-49 year olds in China is 0.44%, compared to 14.77% in Chinese over 80.4 The fatality rate in Wuhan, the epicenter of the virus, is estimated at 4.87%, compared to 0.88% in mainland China outside of Hubei.5 In Italy, the estimate is 6.81%,6 compared to 0.92% in South Korea.7

Incubation Period: Here, again, there is some uncertainty. The World Health Organization estimates a 2-7 day window where a person may have become infected before they show symptoms. The US CDC estimates a 2-14 day incubation period. Earlier in this epidemic, one Chinese study indicated it could be as long as 24 days.8

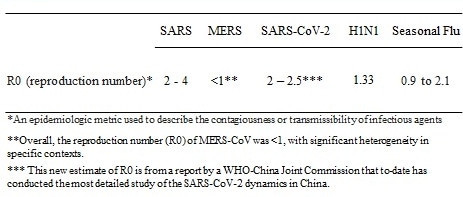

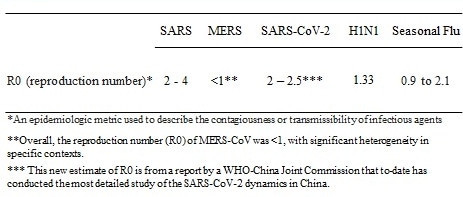

Reproduction Number (R0): The reproduction number is the number of people every infected person infects. Originally, the number was estimated at 2-4 people. It has been lowered to 2-3. However, this is an extremely rough estimate because there is uncertainty about the contagious period.

Dr. Bloom has said that the epidemic will be under control when R0 equals 1 or less. The path of R0 in Wuhan, shown in Exhibit 1, is an example of how quickly the epidemic was brought under control by reducing the reproduction rate from 3.88 in mid-January to 0.32 by mid-February.9

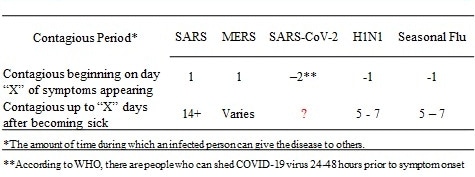

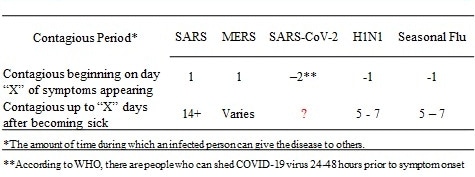

Contagious Period: This period is the amount of time someone is contagious and there are no estimates at this time. On our February 4 client call, we shared the Chinese observation that some patients have been contagious prior to the onset of any symptoms. The recent data from New Rochelle, NY, confirms that individuals have tested positive who have no symptoms. Our guest speakers have highlighted that infected individuals seem to shed a lot of the virus two days before the symptoms appear. The World Health Organization has noted that some patients can shed virus 24-48 hours before the onset of symptoms,10 which means people are highly contagious and can easily spread the virus without knowing they are sick and before they quarantine themselves. Finally, some people who had recovered in China still had “detectable virus in their respiratory tract.”11

Such uncertainty has created a tremendous fear of the unknown:

- The virus is a new pathogen—hence all the uncertainty about its characteristics.

- It is highly transmissible—even before someone has visible symptoms.

- We do not have any immunity given that it is a new pathogen.

- Diagnosis in the US has been poor because of shortcomings of diagnostic tests.

- There is no therapeutic drug yet.

- There is no vaccine yet.

To allay such fears, the healthcare system has to address three issues:

1. Proper diagnostics: Fear has been compounded by the fact we do not know how widespread the disease is in the US since the US healthcare system does not have enough functioning testing kits. Both Dr. Bloom and Dr. Borio expressed significant concern about this shortcoming. Problems have ranged from faulty testing kits to shortages of an RNA extraction kit. On Thursday, March 12, at a congressional hearing, Dr. Anthony Fauci, Director of the National Institute of Allergy and Infectious Diseases, stated that the US testing system is “not really geared to what we need right now … That is a failing. Let’s admit it.”12 Dr. Borio has referred to this shortage as “one of the most dramatic failures in our early public health response” that she can think of.13

However, several manufacturers have now undertaken the task of ramping up production of testing kits and the President has committed that his administration would work with the private sector to provide the drive-thru testing widely available in South Korea. Slowly but surely, the issue of diagnostics will be addressed.

In the meantime, it is important to be prepared for a substantial increase in the number of infections. As highlighted by our guest speakers, the numbers are certainly in the thousands. We should keep in mind that increased testing likely means that some portion of this expected increase represents the identification of cases that already existed instead of newly acquired infections.

2. Therapeutics: While a therapy is not yet available, our experts have expressed some optimism that a therapy to treat infected patients could be forthcoming in the next several months. The CEO of Gilead Sciences has stated that he expects the results of clinical trials on Remdesivir to be available by April.14 Regeneron is evaluating Kevzara, their drug for rheumatoid arthritis, since it has been effective with patients in China and Italy. The Lancet, one of the world’s most prestigious medical journals, has just published an article on convalescent plasma or immunoglobulins as a potential therapy of Covid-19 patients.15 Such therapy was used as a last resort to improve the survival rate of patients with SARS.

3. Vaccines: While the general consensus is that a vaccine will not be available for the next one to two years, some of the experts we spoke to were moderately more optimistic, referring to the work of several companies supported by CEPI, the Coalition for Epidemic Preparedness Innovations. CEPI has launched four programs to develop vaccines against Covid-19, working with Inovio, The University of Queensland, Moderna, and CureVac. These programs will leverage a “rapid response platform” that is already supported by CEPI. The aim is to advance vaccine candidates into clinical testing as soon as possible. Moderna has already delivered a vaccine candidate to the National Institute of Health for clinical testing and CureVac has suggested developing a vaccine ready for clinical testing in a few months. The expectation is that scientific and medical community will have a sense of the safety and potential immunogenicity of the vaccines against Covid-19 by the summer, and then move to more advanced efficacy studies with data available towards the end of the year.

Regeneron is also working on leveraging its approach to developing monoclonal antibodies that was used to fight ebola to develop a similar vaccine to prevent people from getting Covid-19.

As medical progress is made in diagnosis in the next few weeks, therapy in the next few months, and vaccines starting in the summer with more extensive efficacy studies by year-end, fear will inevitably abate.

At this point, however, as emphasized by Dr. Borio, the most important factor is to mitigate the growth of the pandemic curve through various social distancing measures. The growth curve has to be flattened to prevent strains on the healthcare system and to buy time for therapies and vaccines to be developed.

Some Context

Let’s briefly examine the data of past viral epidemics to provide some context for this pandemic. While this viral pandemic is different than past epidemics or pandemics and is not an influenza virus like H1N1, we still believe that it is helpful to have some context for the number of cases and the fatality rate.

There are two key takeaways from Exhibits 2-5 below:

1. The H1N1 pandemic was quite significant in terms of numbers of people affected but the mortality rate was very low. Sixty million people were infected and 12,000 people died in the US. The impact was overshadowed by the Global Financial Crisis, but the scare was not insignificant, as illustrated by several magazine covers at the time (see Exhibit 6), and the number of deaths was high.

2. About 36-51 million Americans have been infected by the seasonal flu so far this year through early March, and the US CDC estimates 22-55 thousand deaths have occurred. Of course, the seasonal flu does not create such panic, partly due to the low case fatality rate. However, the absolute number of deaths is still quite staggering.

We should note that comparisons to the Spanish flu of 1918 in terms of number of infections and deaths are gross exaggerations. One-third of the world’s population was infected and the case fatality rate was 10%—equivalent to over 200 million people today. As Dr. Bloom pointed out, in 1918 the world “did not have ventilators, a lot of healthcare facilities, or epidemiology at that time.” Moreover, many of the fatalities were actually caused by bacterial infections in the lungs, not the virus itself. Today, those complications could be treated with antibiotics which did not exist then. While such exaggerations have the benefit of spurring governments and society into action, no one actually expects those levels of infections and fatality. The key lesson from the Spanish flu is that US cities which imposed non-pharmaceutical interventions such as social distancing and banning large gatherings early in the epidemic, and maintained their interventions over a long period, had fewer total cases of pandemic influenza than those which waited.16

External Shocks

As Larry Summers, former Secretary of the Treasury and President Emeritus of Harvard University, wrote earlier in March, Covid-19 is “one of the most dangerous and disruptive disease outbreaks since WWI.”17 However, it is important to keep in mind that this is not the first time that the United States has been hit with an external shock that has ground many parts of its economy to a halt.

A picture is worth a thousand words: hence, the image of the World Trade Center towers after the two hijacked airplanes struck the towers on September 11, 2001. The Department of Transportation closed the National Airspace System for two days. The New York Stock Exchange was closed for four days. Downtown Manhattan was closed for several days and ready access was limited for over a month.

Fears of further terrorist attacks were exacerbated by the delivery of anthrax, a deadly toxin, to recipients in Washington DC, West Palm Beach, and New York City starting on September 18. Twenty-two people were infected and five died.

Across the country, Americans became concerned about biological, chemical, and nuclear attacks, worrying about the security of the water supply and the safety of trains, airplanes, bridges, and tunnels. Antibiotic CIPRO, water purifiers, and gas masks were flying off the shelfs. Some people working in high-rise offices bought low-altitude parachutes in case another airplane struck a building. Nearly 3,000 Americans were killed.

Yet, the financial markets have reacted much more negatively to Covid-19 than to 9/11, as shown in Exhibit 7. We use the airline sector since it is the one sector most affected by both shocks. Of course, we understand that the world is more interconnected, supply chains are more complex across different countries, and China is a critical link in the global supply chain; however, as the pandemic has started to abate in China, the financial markets have shrugged off the improvement.

Therefore, the key question is whether Covid-19 is the external shock that will throw the US, China, and other regions and large countries, such as the Eurozone and Japan, into a deep and prolonged recession that will be substantially worse than the 9/11 terrorist shock, or is there a greater fear of the unknown that is driving the current markets.

Economic Slowdown or Deep and Prolonged Recession

China

The uncertainty with respect to this virus extends to the uncertainty with respect to the depth and length of a recession. We begin with the epicenter of the pandemic by looking at China. China’s impact on global growth is four-fold, as described by our colleagues in GIR:

- Direct impact of slower growth in China

- Spillover to other countries from reduced goods imports

- Spillover to other countries from reduced spending by Chinese tourists; for example, Chinese tourists account for nearly one-third of all tourists in Japan.

- Disruption to supply chains relying on Chinese parts. Dun and Bradstreet estimate that 16.3% of Fortune 100 companies have Tier 1 suppliers that supply parts directly into the US manufacturing process, and 93.8% have Tier 2 suppliers that supply parts to the Tier 1 suppliers, all based in affected areas of China.18

The aggressive measures taken in China to slow down the rate of Covid-19 infections have been successful as illustrated in Exhibit 8, but they have also led to a significant decrease in economic activity. According to Andrew Tilton, GIR’s Chief Asia Pacific Economist, daily indicators of economic activity, such as coal consumption, passenger volume, and property transactions, were about 70-80% below their 2019 levels immediately after the Lunar New Year. At the current rate of improvement of 5-10% per week, he estimates that China should reach normal levels of capacity utilization by sometime in April.

The slower pace of normalization is driven by several constraints, including shortage of labor as migrant workers have not yet returned to their place of work, and companies not having the required equipment such as masks.

The GIR Asia team estimates that first-quarter GDP will probably drop by about 6%, given a double-digit decrease in their measures of economic activity and only a gradual pace of recovery in March. They expect aggressive monetary and fiscal policy measures to provide a floor to the slowdown. Policy response measures could include:

- Monetary measures including cuts in reserve requirement ratios for a total of 200 basis points, and 50 basis point cuts in the medium-term lending facility rate, the loan prime rate, and the deposit rate.

- Fiscal deficit of 3.2% of GDP and increase in total social financing of 12.8%.

- Financial support to property developers and city-level easing.

An additional boost to China’s growth has been the substantial drop in oil prices, exacerbated by the recent Saudi-Russia oil price war and the cumulative drop in oil prices of about 50% since the beginning of 2020.

Logan Wright of the Rhodium Group, who shared their measures of Chinese activity to monitor the recovery in China on one of our client calls, estimates that around two-thirds of migrant workers have returned to employment at this point, which would suggest national production levels are close to 75-80% of normal levels. At this point, actual transportation numbers have not accelerated sharply and are still around 16-17 million trips per day, compared to 40-50 million trips per day in normal times. He expects a return to full production levels closer to the second week of April, with some uncertainty related to quarantines workers may face upon return.

He also believes that the most important factor to watch for the full-year outlook is the growth in property transactions, which remains over one-third below normal levels so far in March as shown below. The weaker property sales will reduce developers’ capacity to continue construction activity at last year’s levels. As a result, aggregate industrial production, as measured through our Rhodium China Activity Tracker—where residential construction demand is a key contributor—is likely to remain in negative territory for the full year. He estimates that GDP for 2020 could be “a few percentage points” below the stated growth target of 6%.

Charlene Chu of Autonomous Research estimates that first quarter GDP can be as much as 12% lower than the level of GDP in the first quarter of 2019.19

The uncertainty around the path of growth in China in 2020 is extremely high and it is not clear whether the government will slowly walk away from its 6% growth target.

United States

Estimates of US growth have also been downgraded since the emergence of the Covid-19. Jan Hatzius, Head of GIR and Chief Economist, has downgraded his overall 2020 growth target from 2.3% to 2.1% in February, after incorporating the impact of the growth slowdown and supply disruptions in China. It was further revised down to 1.3% in early March and to 1.2% a week later.

As the epidemic in China grew to a global pandemic, the growth forecast has been revised further, to 0.4% for 2020, comprised of annualized real GDP growth of 0% in Q1, -5% in Q2, +3% in Q3 and +4% in Q4. While Jan Hatzius has not formally called for a recession, he thinks there is a high probability that the NBER business-cycle dating committee would classify the new forecast as a recession.20 An annualized drop of 5%, which is an actual decrease of 1.2%, may be deep enough even if short-lived.

The drivers of the slowdown are shown in Exhibit 9 below. The same factors that will flatten the growth curve of this pandemic in the US are the same factors that will push the economy to a drop in GDP, albeit temporary.

As is the case in China, monetary policy and fiscal policy are key to minimizing further downside to this scenario. The Federal Reserve has cut the federal funds rate to basically zero and launched a new round of quantitative easing, purchasing at least $700 billion of US Treasury and mortgage-backed securities. As pointed out by Adam Posen of the Petersen Institute of International Economics, the Federal Reserve has paved the way for other policy makers to provide the necessary fiscal stimulus.21

As suggested by Henry Paulson, former Secretary of the Treasury and former CEO of Goldman Sachs, in a recent opinion piece in the Washington Post, targeted fiscal stimulus to address areas most hit by Covid-19 are critical.22 Some may recall his reference to a powerful “bazooka” in July 2008.

While the specifics of the current proposal from the House of Representatives are being finalized by the Secretary of the Treasury and Speaker of the House, this package is considered one of several upcoming measures to stimulate the economy. Alec Phillips, GIR’s Chief Political Economist, expects fiscal stimulus between 1-2% of GDP in both 2020 and 2021, with more frontloading of the stimulus in 2020.23 This compares to 0.5% and 2.0% in 2001 and 2002, respectively, and 1.7% and 2.6% in 2008 and 2009, respectively.

Global Growth

In spite of lowering US growth, the GIR team has left its baseline scenario for global growth unchanged. As presented in our client calls, the team estimates global growth of 2% for 2020, with an upside scenario of 3% and a downside scenario of zero growth, with greater risk to the downside. Components of the base case are shown in Exhibit 10 below.

Adding Fuel to the Fire: Saudi-Russia Oil Price War

When it rains it pours. Just as we were getting some respite from the diminished tensions of the US-China trade wars, two of the three largest oil producers have engaged in an oil price war, in what Fereydoun Fesharaki, founder of Facts Global Energy, has called “A Collective Suicide.”

When Russia announced, on March 6, that it would no longer participate in further supply cuts after the expiry of the current oil production quotas on April 1, Saudi Arabia responded quickly and aggressively. It offered meaningful discounts to prevailing prices and announced plans to increase production from 9.7 million barrels per day (mmbd) to a target of 12.3 mmbd by April.

Oil prices and energy-related stocks, which had already been on the decline since early January, nosedived lower. Oil experienced its largest one-day drop, with both West Texas Intermediate and Brent falling 23% and energy stocks declining 20%, bringing the cumulative drop in oil and energy stocks to about 50%.

This drop will be helpful to net oil importers like China, Japan, and Europe. The benefits of lower oil prices for the consumer and airline industry are mostly offset by the hit to the energy sector, especially the shale oil producers.

On our latest client call on the energy sector on March 12, Antoine Halff, co-founder of Kayrros (an energy data analytics company) and former chief oil analyst at the International Energy Agency and lead industry economist at the US Energy Information Administration, said that bankruptcies and restructurings were inevitable, but there would also be significant consolidation that would ultimately make the industry stronger and more diversified.

If Russia or Saudi Arabia’s goal was to eliminate the US shale industry and reverse the increase in US market share as shown in Exhibit 11 below, the goal is unlikely to be realized, since the industry as a whole has shown great resilience, as seen in 2014.

Investment Implications

Before we finish with our investment conclusions, we think it is important to highlight a comment we made on February 14, as reported by the Dow Jones News Wire. We said that we, in the Investment Strategy Group were “surprised at how sanguine the market is … realistically, the data are very, very uncertain.”24 We were surprised that the S&P 500 had rallied about 5% from its low after its first moderate drop of 3% after the first case of Covid-19 was reported in Washington State on January 17.

But we were equally surprised by the speed and magnitude of the market’s 27% peak-to-trough decline. In fact, this was the fastest decline of 25% from an all-time-high in history. In our view, the market decline is pricing a 90% probability of a recession.

The question posed by our clients is why do we continue to suggest remaining invested rather than going underweight equities, especially in light of lower US and global growth estimates, lower projected earnings per share growth, and a lower interim price target of 2000 for the S&P 500 put forth by GIR’s US equity strategist, David Kostin.

This question is even more pertinent when we consider that the guest speakers on our early series of Covid-19 conference calls for clients were adamant that the epidemic at the time was already a pandemic. We also asked them if infections in the US would rise by the thousands and they also said yes. Our base case was that the China epidemic was rapidly transforming into a pandemic and the numbers in the US would not be contained to a few dozen people in Seattle but would grow by the thousands.

We also note that in our 2020 Outlook we wrote that external shocks were one of the three factors that have historically led to a recession. Covid-19 is certainly a shock.

There are several reasons why we have not recommended underweighting equities:

First and most importantly, while we were surprised that the market was rallying to new highs in the face of deteriorating news on the virus in early February, we have been more surprised by the rapidity and force with which it has fallen in recent weeks, especially since none of the traditional recession indicators we follow have yet to trigger. But given that decline, we think a typical recession with a peak-to-trough decline of 30% has already been discounted by the market (see Exhibit 12).

Second, the level of volatility in this market has approached levels last seen near the trough of the Global Financial Crisis, as shown in Exhibit 13. Because such extremes typically reflect pervasive fear among market participants, they have represented better buy than sell signals historically. Of equal importance, high volatility coupled with today’s poor liquidity increases the risk of our clients getting whipsawed by the markets (see Exhibit 14). Consider that the S&P 500’s 9.3% gain on Friday, March 13th, was the best day since October 2008, while the 9.5% loss the day before was the worst day since Black Monday in 1987. When the market is generating a typical year’s worth of gains or losses in a single day, the penalty of trading missteps is high.

Third, the experience of several Asian countries with social distancing, frequent testing, and tracing of infected persons’ contacts shows that there is a template for bringing the spread of the virus under control. As a result, we believe that the current level of panic may be unwarranted. It is hard to imagine that this shock is significantly worse than that of the September 11 terrorist attacks when we consider the extreme fear pervading the residents of most large metropolitan areas in the US at that time.

Fourth, we believe that significant easing of monetary policy and strong fiscal stimulus will provide a floor to the depth of any economic contraction. Given such contractions are often borne of major financial and economic imbalances, it is notable that the US economy entered this downturn more balanced than its average level based on data since 1990. As the same time, the private sector financial balance—as measured by the savings of households and corporations—is strong by historical standards, and thus better able to absorb this shock. While it is impossible to predict a shock by definition, we had raised the prospects of geopolitical tensions between the US and Iran as a likely source of volatility, but believed that the US economy could weather that type of a shock.

Fifth, we share the optimism of the various vaccine experts and researchers at biotech companies based on the good progress that has been made on various therapies and vaccines so far. We believe that fear will abate at the first significant evidence of such progress.

Sixth, while our colleague, David Kostin, has steadily marked down his interim target as the impact of social distancing and travel bans on the earnings of various industries becomes more apparent, his year-end target is actually only slightly below his previous target, and it suggests a significant rally from current levels.

Here, we are reminded of a quote we used in a March 16, 2009 Sunday Night Insight, which turned out to be near the trough of the financial crisis although we did not know it at the time. The quote below was from Seth Klarman, one of the most highly respected investors in the financial industry:

“To maintain a truly long-term view, investors must be willing to experience significant short-term losses; without the possibility of near-term pain, there can be no long term gain. The ability to remain an investor (and not become a day-trader or a bystander) confers an almost unprecedented advantage in this environment.”25

Trying to trade to a possible downside target when the year-end target is substantially higher is appropriate for day traders, momentum followers, and some hedge fund managers, but not for long-term investors. Of equal importance, there is no guarantee that the market reaches the lower levels that may be used as justification for selling today. On the other hand, we are more confident that the market will eventually reach the higher target given the resiliency and preeminence of the US economy.

And finally, we actually think that current levels provide an opportunity to slowly add to the risk levels of a portfolio. For those who may be sitting on excess cash and have staying power with the right strategic asset allocation, this is the time to start incrementally adding to S&P equities. We recommend clients consider the following ways to incrementally add exposure:

- Remove any portfolio hedging strategies

- Rebalance risk positions that have declined in value

- Use options in place of direct purchases of risk assets

- Directly purchase risk assets

As the market has declined in recent weeks and as the compensation for taking equity risk has become more attractive, we have taken a number of these steps, including taking advantage of elevated volatility in the market by using options in place of outright purchases of risk assets.

Endnotes:

(1) Carolyn Y. Johnson, Lena H. Sun, William Wan and Joel Achenbach, “Coronavirus Outbreak Edges Closer to Pandemic Status,” Washington Post, February 22, 2020.

(2) Tweet by Marc Lipsitch on March 3, 2020.

(3) Xihong Lin, “Analysis of 25,000 Lab-Confirmed COVID-19 Cases in Wuhan: Epidemiological Characteristics and Non-Pharmaceutical Intervention Effects,” Department of Biostatistics and Department of Statistics, Harvard University and Broad Institute, March 12, 2020.

(4) Yanping Zhang, “Vital Surveillances: The Epidemiological Characteristics of an Outbreak of 2019 Novel Coronavirus Diseases (COVID-19) — China, 2020,” China CDC Weekly, February 17, 2020.

(5) National Health Commission of People’s Republic of China, “March 13: Daily Briefing on Novel Coronavirus Cases in China,” March 13, 2020.

(6) Center for Systems Science and Engineering at Johns Hopkins University, “Coronavirus COVID-19 Global Cases,” March 15, 2020.

(7) KCDC, “The Updates on COVID-19 in Korea as of 15 March,” March 15, 2020.

(8) Zhong Nan-shan et. al., “Clinical Characteristics of 2019 Novel Coronavirus Infection in China,” medRxiv, February 9, 2020.

(9) Yanping Zhang, “Vital Surveillances: The Epidemiological Characteristics of an Outbreak of 2019 Novel Coronavirus Diseases (COVID-19) — China, 2020,” China CDC Weekly, February 17, 2020.

(10) World Health Organization, “Coronavirus Disease 2019 (COVID-19) Situation Report – 46,” March 6, 2020.

(11) Dr. Barry Bloom, in the Investment Strategy Group client conference call, February 25, 2020.

(12) House Committee on Oversight and Reform, “Fauci Testifies Coronavirus Testing System ‘Not Really Geared to What We Need Right Now,’” March 12, 2020.

(13) Dr. Luciana Borio, in the Investment Strategy Group client conference call, March 9, 2020.

(14) White House, “Remarks by President Trump and Members of the Coronavirus Task Force in Meeting with Pharmaceutical Companies,” March 2, 2020.

(15) Long Chen, Jing Xiong, Lei Bao and Yuan Shi, “Convalescent Plasma as a Potential Therapy for COVID-19,” The Lancet, February 27, 2020.

(16) Richard J. Hatchett, Carter E. Mecher and Marc Lipsitch, “Public Health Interventions and Epidemic Intensity during the 1918 Influenza Pandemic,” Proceedings of the National Academy of Sciences, June 2007.

(17) Lawrence H. Summers, “What the Fed can do to help with coronavirus’s economic aftershock,” Washington Post, March 3, 2020.

(18) Dun & Bradstreet, “Business Impact of the Coronavirus,” February 5, 2020.

(19) Charlene Chu, “China Macrofinancial: Assessing the damage from COVID-19,” Autonomous Research, March 2, 2020.

(20) US Economics Group, “US Daily: Downgrading our US GDP Forecasts,” Goldman Sachs Global Investment Research, March 15, 2020.

(21) Tweets by Adam Posen, March 15, 2020.

(22) Henry M. Paulson Jr., “How the 2008 Financial Panic Can Help Us Face Coronavirus,” Washington Post, March 11, 2020.

(23) Alec Phillips and Blake Taylor, “USA: Increasing our Fiscal Stimulus Assumptions Following Latest Administration and Congressional Actions,” Goldman Sachs Global Investment Research, March 14, 2020.

(24) Akane Otani, “Markets Hover Near Records Despite Growing Coronavirus Outbreak,” Wall Street Journal, February 14, 2020.

(25) Seth Klarman, “The Value of Not Being Sure,” Value Investor Insight, February 23, 2009.

This material represents the views of the Investment Strategy Group (“ISG”) in the Consumer and Investment Management Division of Goldman Sachs. It is not financial research or a product of Goldman Sachs Global Investment Research (“GIR”) and may vary significantly from those expressed by individual portfolio management teams within CIMD or other groups of Goldman Sachs.

Investment Strategy Group (“ISG”). ISG is focused on asset allocation strategy formation and market analysis for PWM. ISG material represents the views of ISG in the Consumer Investment Management Division (“CIMD”) of GS. It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. If shown, ISG Model Portfolios are provided for illustrative purposes only. Your actual asset allocation may look significantly different based on your particular circumstances and risk tolerance. If a model performance calculation is provided, it assumes that (1) each asset class was owned in accordance with the recommended weight; (2) all tactical tilts were implemented at the time the recommendation was made; and (3) the portfolio was rebalanced every time a tactical tilt change was made and at the end of every quarter (unless a tactical tilt was made within a month of quarter-end). If model performance is shown, it is calculated using the daily returns (actual or interpolated) of indices that ISG believes are representative of the asset classes included in the model. Results shown reflect the total return but generally do not take into account any investment management fees, commissions or other transaction expenses, which would reduce returns. The results shown reflect the reinvestment of dividends and other earnings. All returns are pre-tax and are not adjusted for inflation. Additional information about the model portfolio performance calculation, including asset class benchmarks used for modeling performance and a history of tactical tilts, is available upon request.

Entities Providing Services. This presentation is intended only to facilitate your discussions with the applicable Goldman Sachs entity including, but not limited to, Goldman Sachs & Co. LLC, Goldman Sachs International, Goldman Sachs AG, Goldman Sachs Bank (Europe) plc, Goldman Sachs Paris Inc. et Cie., Goldman Sachs (Monaco) S.A.M., Goldman Sachs Saudi Arabia, Goldman Sachs Bank AG, GS International, Sucursal en Espana, Goldman Sachs (Asia) L.L.C, Goldman Sachs (Singapore) Pte (Company Number: 19862165W), Goldman Sachs Australia Pty Limited, and Brazil by Goldman Sachs do Brasil Banco Múltiplo S.A. as to the opportunities available to our private wealth management clients. In connection with its distribution in the United Kingdom, this material has been issued and approved by Goldman Sachs International which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. This material has been approved for issue in the United Kingdom solely for the purposes of Section 21 of the Financial Services and Markets Act 2000 by GSI, Peterborough Court, 133 Fleet Street, London EC4A 2BB; by Goldman Sachs Canada, in connection with its distribution in Canada; in the United States by Goldman Sachs & Co. LLC; in Hong Kong by Goldman Sachs (Asia)L.L.C.; in Korea by Goldman Sachs (Asia) L.L.C., Seoul Branch; in Japan by Goldman Sachs(Japan) Ltd; in Australia by Goldman Sachs Australia Pty Ltd (ACN 006 797 897); and in Singapore by Goldman Sachs (Singapore) Pte. (Company Number: 19862165W).

Options. Options involve risk and are not suitable for all investors. The purchase of options can result in the loss of an entire investment and the risk of uncovered options is potentially unlimited. You must read and understand the current Options Disclosure Document before entering into any options transactions. The booklet entitled Characteristics and Risk of Standardized Options can be obtained from your PWM team or at http://www.theocc.com/about/publications/character-risks.jsp. A secondary market may not be available for all options. Transaction costs may be significant in option strategies that require multiple purchases and sales of options, such as spreads. Supporting documentation for any comparisons, recommendations, statistics, technical data, or other information will be supplied upon request.

Derivatives. Investments that involve futures, equity swaps, and other derivatives give rise to substantial risk and are not available to or suitable for all investors.

No Distribution; No Offer or Solicitation. This material may not, without Goldman Sachs’ prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. This material is not an offer or solicitation with respect to the purchase or sale of a security in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. This material is a solicitation of derivatives business generally, only for the purposes of, and to the extent it would otherwise be subject to, §§ 1.71 and 23.605 of the U.S. Commodity Exchange Act.

Currencies. Currency exchange rates can be extremely volatile, particularly during times of political or economic uncertainty. There is a risk of loss when an investor has exposure to foreign currency or is in foreign currency traded investments.

Australia: This material is being disseminated in Australia by Goldman Sachs & Co (“GSCo”); Goldman Sachs International (“GSI”); Goldman Sachs (Singapore) Pte (“GSSP”) and/or Goldman Sachs (Asia) LLC (“GSALLC”). In Australia, this document, and any access to it, is intended only for a person that has first satisfied Goldman Sachs that:

• The person is a Sophisticated or Professional Investor for the purposes of section 708 of the Corporations Act 2001 (Cth) (“Corporations Act”); or

• The person is a wholesale client for the purposes of section 761G of the Corporations Act.

No offer to acquire any financial product or interest in any securities or interests of any kind is being made to you in this document. If financial products or interests in any securities or interests of any kind do become available in the future, the offer may be arranged by an appropriately licensed Goldman Sachs entity in Australia in accordance with section 911A(2)(b) of the Corporations Act. Any offer will only be made in circumstances where disclosures and/or disclosure statements are not required under Part 6D.2 or Part 7.9 of the Corporations Act (as relevant).

To the extent that any financial service is provided in Australia by GSCo, GSI, GSSP and/or GSALLC, those services are provided on the basis that they are provided only to “wholesale clients”, as defined for the purposes of the Corporations Act. GSCo, GSI, GSSP and GSALLC are exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act and do not therefore hold an Australian Financial Services Licence. GSCo is regulated by the Securities and Exchange Commission under US laws; GSI is regulated by the Financial Conduct Authority and the Prudential Regulation Authority under laws in the United Kingdom; GSSP is regulated by the Monetary Authority of Singapore under Singaporean laws; and GSALLC is regulated by the Securities and Futures Commission under Hong Kong laws; all of which differ from Australian laws. Any financial services given to any person by GSCo, GSI, and/or GSSP in Australia are provided pursuant to ASIC Class Orders 03/1100; 03/1099; and 03/1102 respectively.

Brazil. These materials are provided at your request and solely for your information, and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, any securities, funds, or products by any of Goldman Sachs affiliates in Brazil or in any jurisdiction in which such activity is unlawful or unauthorized, or to any person to whom it is unlawful or unauthorized. This document has not been delivered for registration to the relevant regulators or financial supervisory bodies in Brazil, such as the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários – CVM) nor has its content been reviewed or approved by any such regulators or financial supervisory bodies. The securities, funds, or products described in this document have not been registered with the relevant regulators or financial supervisory bodies in Brazil, such as the CVM, nor have been submitted for approval by any such regulators or financial supervisory bodies. The recipient undertakes to keep these materials as well as the information contained herein as confidential and not to circulate them to any third party.

Chile: Fecha de inicio de la oferta: (i) La presente oferta se acoge a la Norma de Carácter General N° 336 de la Superintendencia de Valores y Seguros de Chile; (ii) La presente oferta versa sobre valores no inscritos en el Registro de Valores o en el Registro de Valores Extranjeros que lleva la Superintendencia de Valores y Seguros, por lo que los valores sobre los cuales ésta versa, no están sujetos a su fiscalización; (iii) Que por tratarse de valores no inscritos, no existe la obligación por parte del emisor de entregar en Chile información pública respecto de estos alores; y (iv) Estos valores no podrán ser objeto de oferta pública mientras no sean inscritos en el Registro de Valores correspondiente.

Dubai: Goldman Sachs International (“GSI”) is authorised and regulated by the Dubai Financial Services Authority (“DFSA”) in the DIFC and the Financial Services Authority (“FSA”) authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority in the UK. Registered address of the DIFC branch is Level 5, Gate Precinct Building 1, Dubai International Financial Centre, PO Box 506588, Dubai, UAE and registered office of GSI in the UK is Peterborough Court, 133 Fleet Street, London EC4A 2BB, United Kingdom. This material is only intended for use by market counterparties and professional clients, and not retail clients, as defined by the DFSA Rulebook. Any products that are referred to in this material will only be made available to those clients falling within the definition of market counterparties and professional clients.

Israel: Goldman Sachs is not licensed to provide investment advice or investment management services under Israeli law.

Singapore: This document has not been delivered for registration to the relevant regulators or financial supervisory bodies in Hong Kong or Singapore, nor has its content been reviewed or approved by any financial supervisory body or regulatory authority. The information contained in this document is provided at your request and for your information only. It does not constitute an offer or invitation to subscribe for securities or interests of any kind. Accordingly, unless permitted by the securities laws of Hong Kong or Singapore, (i) no person may issue or cause to be issued this document, directly or indirectly, other than to persons who are professional investors, institutional investors, accredited investors or other approved recipients under the relevant laws or regulations (ii) no person may issue or have in its possession for the purposes of issue, this document, or any advertisement, invitation or document relating to it, whether in Hong Kong, Singapore or elsewhere, which is directed at, or the contents of which are likely to be accessed by, the public in Hong Kong or Singapore and (iii) the placement of securities or interests to the public in Hong Kong and Singapore is prohibited. Before investing in securities or interests of any kind, you should consider whether the products are suitable for you.

United Arab Emirates: The information contained in this document does not constitute, and is not intended to constitute, a public offer of securities in the United Arab Emirates in accordance with the Commercial Companies Law (Federal Law No. 8 of 1984, as amended) or otherwise under the laws of the United Arab Emirates. This document has not been approved by, or filed with the Central Bank of the United Arab Emirates or the Securities and Commodities Authority. If you do not understand the contents of this document, you should consult with a financial advisor. This document is provided to the recipient only and should not be provided to or relied on by any other person.

United Kingdom: This material has been approved for issue in the United Kingdom solely for the purposes of Section 21 of the Financial Services and Markets Act 2000 by GSI, Peterborough Court, 133 Fleet Street, London EC4A 2BB. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

© 2020 Goldman Sachs. All rights reserved.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.