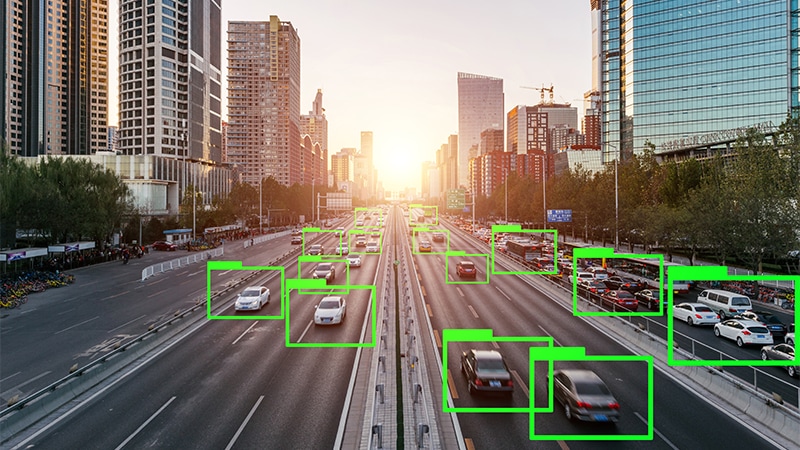

Software Is Taking Over the Auto Industry

Fully self-driving vehicles may still be years away but Goldman Sachs Research analysts believe auto industry profits could rise meaningfully this decade as software becomes increasingly important even at lower levels of automation.

In a new report, the analysts estimate that cars with Level 3 and higher autonomous technologies will account for about 15% of sales in 2030, up from 0% in 2020, with the bulk of that penetration coming from semi-automated vehicles that can control safety-critical functions but prompt the driver to take over in certain circumstances.

Those emerging capabilities will significantly increase the industry’s reliance on software, which is already changing the nature of auto production. The average lines of software code per vehicle doubled from 100 million in 2015 to 200 million in 2020, driven by wider adoption of electrified vehicle control and autonomous driving. GS Research believes that growth could accelerate in the next few years, with each car requiring as much as 650 million lines of code by 2025. This represents a different order of complexity compared with a typical smartphone operating system or fighter aircraft, with an average of around 20-40 million lines of code.

Software’s growing importance to new vehicles will mean higher complexity and costs but could generate new revenue opportunities. “The automobile industry is on the cusp of a major inflection point with vehicles that are increasingly connected and software-defined, including electric and autonomous vehicles,” writes GS Research in its report. “If automakers can successfully monetize the new value provided by these cars, they should be able to deliver profits beyond the reach of their prior business models.”

- LEVEL ODrivers are always responsible for operating the vehicle.

- LEVEL 1Driver assistance systems can help a driver control a vehicle in forward and lateral directions, but drivers are fully responsible for driving and must take over control in an instant when necessary.

- LEVEL 2Under certain conditions, drivers can let systems control forward and lateral directions of the vehicle, but they must always be aware of their surroundings, and be prepared to control the vehicle at any time. The driver is always responsible for driving.

- LEVEL 3Under certain conditions, the driver does not always have to be monitoring driving conditions. When driving conditions exceed preset parameters, the vehicle hands control back over to the driver with a few seconds warning.

- LEVEL 4No help from the driver is required in certain areas, such as parking lots, and enables advanced autonomous driving on highways. Under these conditions, drivers can relinquish full control of the vehicle to the system.

- LEVEL 5Fully autonomous vehicles can be in complete control of driving and do not require any help from drivers under any circumstances.

Source: SAF International, Godman Sachs Global Investment Research

Added up, GS Research forecasts the industry’s profit pool will expand from $315 billion in 2020 to $405 billion by 2030. The base case for that growth comes from two sources: One, automakers will be able to increase sticker prices by roughly $3,000 per vehicle, given benefits new technologies will offer to drivers. The second source of profit growth potential comes from an additional $3,800 automakers can receive from monthly subscription income tied to autonomous safety and convenience enhancements.

If automakers are able to fully capture these earnings opportunities, the researchers estimate they could generate income of $3,750 per vehicle, up from today’s $1,750. If achieved, that level of improvement would boost average operating margins from 7% to 12%.

Of course, not every manufacturer will benefit equally. While GS Research believes industry realignment will become a key theme in vehicle operating systems and EV batteries, some automakers will be better positioned than others. The report predicts that those companies with scalable products – such as common EV architectures – will be able to ramp up more quickly than automakers that operate in multiple regions and handle a wide range of models and powertrains. The report also cautions that traditional OEMs will need to stave off competition from new entrants that might enjoy advantages from having dedicated businesses with no legacy assets.

As electric and automated vehicles take a larger slice of the pie – capturing $149 billion in new business by 2030 – profits from the traditional vehicle business will decline by $59 billion, GS Research estimates. And with regular software updates becoming possible using over-the-air downloads, traditional, unconnected cars built on a four-to-five-year model cycle will likely be rendered obsolete.

“We are entering a new era where software-defined vehicles (software-centric automotive development) will determine who has the competitive edge in the auto industry,” the report concludes.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.