In 2019, we launched the Sustainable Finance Framework and announced a firmwide 10-year, $750 billion sustainable finance goal to track our support of our clients’ sustainability priorities across our financing, investing, and advisory activities.

- Finance: Originate, structure, and execute transactions and risk management solutions to facilitate access to capital

- Invest: Allocate Goldman Sachs capital or client capital into public and private investments

- Advise: Provide expertise and strategic recommendations to clients on mergers and acquisitions, divestitures, and spin-offs

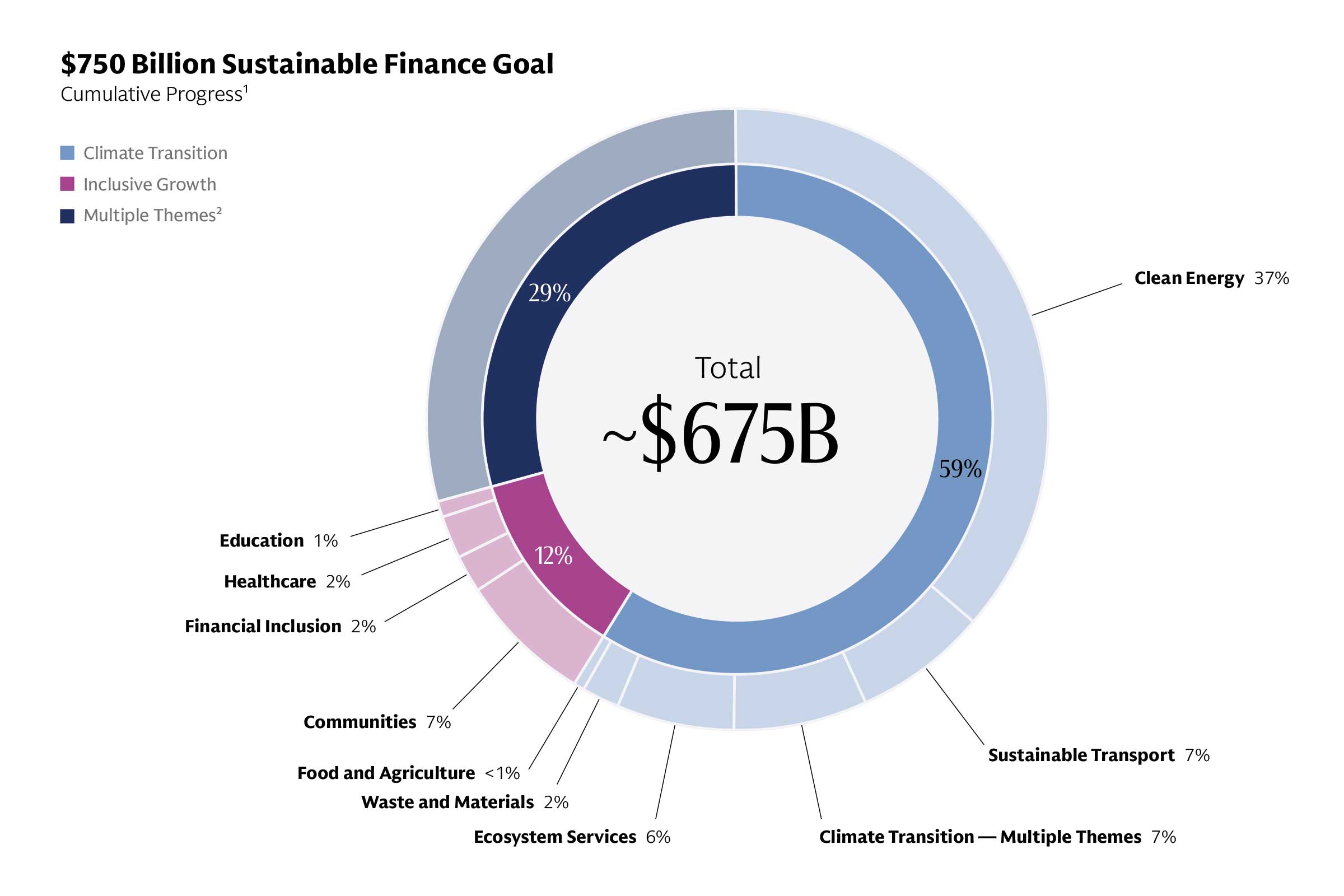

Since 2020, we have mobilized approximately $675 billion1 of commercial activity, including $401 billion in Climate Transition, $82 billion in Inclusive Growth, and the remainder in multiple themes.2 The most significant sub-theme contributor to Climate Transition is from Clean Energy, followed by Sustainable Transport, which together drive the majority of the Climate Transition contribution.

Reaching approximately 90% of our sustainable finance goal in just over five years reflects our ability to meet our clients’ needs across a wide range of sustainable finance capabilities.