Goldman Sachs Takes an Equity Stake in Sanyo Electric and Sanyo Electric Credit

In December 2005, the firm becomes the largest shareholder in Sanyo Electric Credit, the finance unit of the Japanese conglomerate Sanyo. One month later, the firm invests in Sanyo Electric.

On December 9, 2005, Goldman Sachs agreed to acquire a 33.2 percent stake in Sanyo Electric Credit, the finance unit of the Japanese conglomerate Sanyo. With the transaction, the firm became the largest shareholder in Sanyo Electric Credit.

One month later, on January 27, 2006, a consortium led by Goldman Sachs, Sumitomo Mitsui Banking Corporation and Daiwa Securities SMBC agreed to invest US$2.6 billion in Sanyo Electric (Japan’s third-largest consumer electronics maker), securing a fully-diluted stake of 70.5 percent in the company. Goldman Sachs and Daiwa Securities SMBC invested US$1.07 billion each and Sumitomo Mitsui Banking Corporation invested US$431 million in the form of convertible preferred shares. Goldman Sachs and Daiwa Securities SMBC advised the consortium on the transaction.

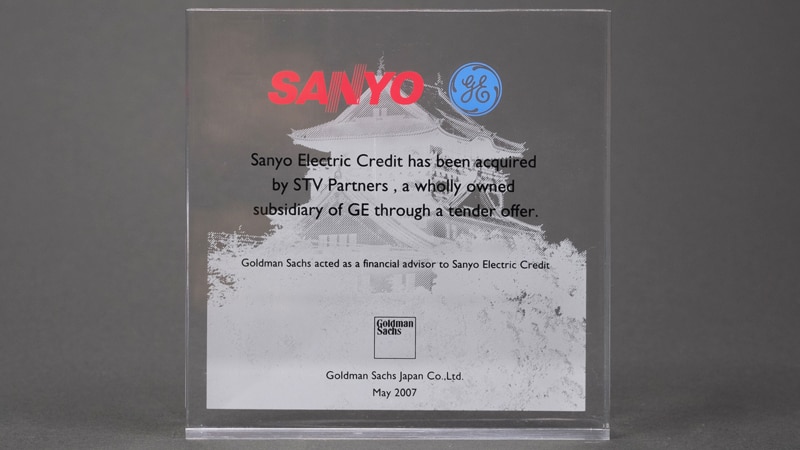

In March 2007, GE Capital agreed to launch a tender offer for all outstanding Sanyo Electric Credit shares in an acquisition valued at US$1.1 billion, a 58 percent premium over the average price during the prior month. Sanyo Electric Credit supported the GE tender offer as did Goldman Sachs Capital Partners and other GS affiliates, which owned approximately 33 percent of the targeted company. Goldman Sachs and Daiwa Securities SMBC advised Sanyo Electric Credit on the deal.

The firm would continue its strategic relationship with the Sanyo conglomerate, serving as advisor along with Daiwa Securities SMBC as Sanyo agreed to sell its wireless handset business to Kyocera Corporation for US$486 million in January 2008.

On December 19, 2008, Panasonic Corporation announced the launch of a tender offer to acquire the entire share capital of Sanyo Electric Co., Ltd, representing an equity value of US$9.0 billion. The offer required more than 50 percent of Sanyo Electric shares to be tendered. Oceans Holdings (owning approximately 29 percent), Evolution Investments (owning approximately 29 percent), and Sumitomo Mitsui Banking Corporation (owning approximately 12 percent) agreed to the tender offer, with Goldman Sachs serving as financial advisor to Oceans Holdings and Evolution Investments. In 2010, Panasonic worked to acquire Sanyo’s remaining stock, ultimately making Sanyo a wholly-owned subsidiary. The acquisition positioned Panasonic as a global leader in rechargeable batteries and solar panels, environmentally-friendly technologies developed by Sanyo.