With Merck & Co. Offering, Goldman Sachs Emerges from the Shadow of World War I

In the aftermath of World War I, Goldman Sachs forges a relationship with pharmaceutical manufacturer Merck & Co.— one that thrives well into the twenty-first century.

Clients

Deepening a Commitment to Sustainability, GSAM Acquires a Leading Impact Investing Firm

Goldman Sachs Asset Management (GSAM) acquires ESG and impact investing innovator Imprint Capital Advisors in 2015, underscoring its commitment to ESG investing and further broadening the investment opportunities and advice it can offer clients.

Leadership

,

Clients

GSAM Makes a Commitment to Responsible and Sustainable Living

In 2011, Goldman Sachs Asset Management (GSAM) becomes a signatory to the UN Principles for Responsible Investment (UNPRI), a global collaborative of investors established in 2006 in recognition of the increasing relevance of environmental, social and governance issues to the practice of investment management.

Leadership

,

Clients

Firm Opens Salt Lake City Office to Support New Online Venture

In 2000, Goldman Sachs opens an office in Salt Lake City, Utah. The office is initially staffed to provide service and technology support for the firm’s newly launched online platform for private wealth clients, GS.com. In the ensuing decades, the office grows and diversifies to become one of the firm’s largest and strategically important locations and one of the largest private employers in Salt Lake City.

Clients

With Commodities Corp. Acquisition, Goldman Sachs Asset Management Ups its Alternatives Game

In 1997, Goldman Sachs Asset Management (GSAM) acquires Commodities Corp., a pioneer of alternative investing founded in 1969 by Helmut Weymar with backing from investor Amos Hostetter and Nobel-prize-winning economist Paul Samuelson. The acquisition provides GSAM with an additional US$2 billion in assets under management and an established fund-of-hedge-funds platform.

Clients

Goldman Sachs Broadens Client Offerings to Include Asset Management

Formed in 1988, Goldman Sachs Asset Management (GSAM) initially specializes in fixed income separate account management for pension funds and institutions before expanding to offer a wide range of portfolio and mutual fund management services to a growing roster of global clients.

Clients

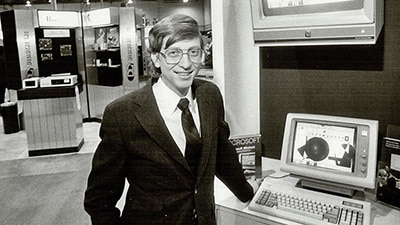

IPO of the Year Puts Goldman Sachs on the Map With Tech Companies

Goldman Sachs acts as book running manager of the initial public offering for software company Microsoft Corporation. Generating US$61 million for Microsoft, it is dubbed by many analysts “the IPO of the year” in 1986.

Clients

Building on a Strong Foundation, Realty Management Division Grows Out of Archon Acquisition

In 2012, Goldman Sachs’ Realty Management Division (RMD) is created as a new, standalone division from former subsidiary Archon Group, offering a fully integrated real estate services platform.

Clients

Vodafone Acquires Mannesmann in the Largest Acquisition in History

On February 4, 2000, Britain’s Vodafone AirTouch PLC acquires Mannesmann AG in a historic deal that will reshape the mobile telecom marketplace.

Globalization

,

Clients

Goldman Sachs’ Hong Kong Relationships Pave the Way for Largest Asia Media Merger

In 1993, Goldman Sachs serves as exclusive advisor to Hutchison Whampoa Limited and the Li family in the largest merger to date in the Asian media industry: Hong Kong-based Star TV and Rupert Murdoch’s News Corporation Limited.

Globalization

,

Clients

Innovative Black-Litterman Global Asset Allocation Model Is Developed at Goldman Sachs

Fischer Black and Robert Litterman revolutionize portfolio management in 1990 with the creation of the Black-Litterman Global Asset Allocation Model – quickly adopted for optimal portfolio allocation across international equity, fixed income and currency markets.

Clients

,

Innovation

Privatization of Spain's Telefónica is World's Largest ADS Offering

In 1987, Goldman Sachs serves as lead manager on Telefónica of Spain’s IPO on the New York Stock Exchange in the first public offering of equity by a Spanish issuer in the United States and the largest-ever ADS offering.

Clients

Goldman Sachs Defends a Global Bank From Hostile Takeover Bid

In 1986, Goldman Sachs advises Standard Chartered Bank when it is the target of a hostile bid from Lloyds Bank.

Clients

Launch With GS Commits US$500 Million to Narrow Investing Gaps

The firm deploys more than US$100 million through Launch With GS, funding historically underserved entrepreneurs and emerging business leaders.

Clients

,

Innovation

GS Accelerate Taps Firm’s Entrepreneurial Spirit to Drive Innovation From Within

Hundreds of ideas are submitted within the firm in the first year of the program designed to spark new initiatives worthy of investment and further development.

Clients

,

Innovation

Goldman Sachs Is Added to the Dow Jones Industrial Average

In September 2013, Goldman Sachs is added to the Dow, one of the most widely quoted and recognized stock market indices worldwide.

Clients

Firm Helps Build Landmark European Aerospace Consortium

Series of mergers creates European Aeronautic Defense and Space Company (EADS), later renamed Airbus Group.

Globalization

,

Clients

Goldman Sachs Partners with Apple on a Game-Changing Credit Card

Launched in 2019, Apple Card delivers greater control, transparency and privacy to consumers.

Clients

,

Innovation

With Marquee, Institutions Access Data, Cutting-Edge Ideas From Goldman Sachs

In 2014, Goldman Sachs makes a wealth of proprietary insights and analytics available to its institutional clients with the launch of Marquee. With the ability to integrate directly with clients’ own technology platforms via APIs, Marquee offers access to the firm’s market insights, analytics tools, execution capabilities, and data and developer services.

Clients

,

Innovation

The Business Standards Committee Is Formed

In 2010, Goldman Sachs initiates a comprehensive review of business principles and practices via the newly-formed Business Standards Committee.

Culture

,

Clients

Berkshire Hathaway Invests US$5 Billion in Goldman Sachs Amid Global Financial Crisis

At the height of the global financial crisis, Warren Buffett’s Berkshire Hathaway invests US$5 billion in Goldman Sachs, further strengthening the firm’s capitalization and liquidity in turbulent times.

Clients

With Environmental Policy Framework, the Firm Establishes its Commitment to Sustainable Economic Growth

Goldman Sachs establishes its Environmental Policy Framework in 2005, serving as a leading voice in the financial services industry addressing climate change and other critical environmental challenges.

Clients

,

Innovation

Goldman Sachs Announces Launch of Global Markets Institute

The Global Markets Institute (GMI) is formed in 2004 to provide thought leadership on the economic impact of capital markets and their intersection with public policy.

Clients

Urban Investment Group Is Formed to Lead the Firm's Impact Investing Efforts

Innovative financing solutions developed by the Urban Investment Group since 2001 help fuel growth in underserved communities.

Clients

,

Innovation

Goldman Sachs Takes an Equity Stake in Sanyo Electric and Sanyo Electric Credit

In December 2005, the firm becomes the largest shareholder in Sanyo Electric Credit, the finance unit of the Japanese conglomerate Sanyo. One month later, the firm invests in Sanyo Electric.

Clients

Goldman Sachs Blazes New Trail With Debt Restructuring of Over US$5 Billion for Provincial Investment Trust in China

The 2000 completion of US$5.59 billion in debt restructuring of Guangdong Enterprises is the first for a Chinese state-owned enterprise. Goldman Sachs is the first foreign investment bank to be hired by one of China’s provincial governments.

Clients

China Issues US$1 billion in Sovereign Bonds

Despite turbulence in Asian markets, China issues US$1 billion in a 1998 sovereign bond offering.

Clients

Goldman Sachs Acquires Spear, Leeds & Kellogg, a Leader in Securities Clearing and Execution

Building on its own leadership in market making and clearing, Goldman Sachs acquires Spear, Leeds & Kellogg in 2000 to become one of the leading market makers of equities and options in the US marketplace.

Clients

Universal Studios Japan Sold to Comcast NBCUniversal

In 2005, Goldman Sachs invests in Osaka theme park, selling its stake to Comcast NBCUniversal ten years later.

Clients

Goldman Sachs Announces It Will Become a Bank Holding Company

In September 2008, days after the dawn of the global financial crisis, the firm transitions to a bank holding company, regulated primarily by the Federal Reserve, strengthening its capital, liquidity and competitive position.

Clients

Third Leg of Australian Telco Privatization is a Success

In 2006, Goldman Sachs is one of four global joint coordinators in the third leg of the Australian government’s privatization of national telecommunications company Telstra in a challenging market environment.

Clients

Reshaping Research: SEC Settlement Seeks to Eliminate Conflicts; Goldman Sachs is Ahead of the Curve

A US$1.4 billion settlement is reached in 2003 between the Securities and Exchange Commission and ten of the nation’s largest investment firms, including Goldman Sachs, compelling them to address conflicts of interest between the firms’ securities and investment banking businesses. At Goldman Sachs, efforts to ensure research independence are already underway.

Clients

Goldman Sachs Pairs Debt Underwriting for Japanese Telco with First Dollar/Yen Swap

The firm lead-manages a US$150 million Yankee bond issuance on behalf of Japan’s Nippon Telephone and Telegraph in 1984. The issuance is coupled with the first-ever yen/US dollar swap deal, representing an innovative approach to blending two corporate finance disciplines to best serve a client's interests.

Clients

,

Innovation

Firm Aids Chinese Bank's Globalization Efforts with Investment in South Africa

Goldman Sachs advises Industrial and Commercial Bank of China (ICBC) in its 2007 purchase of a 20 percent stake in South Africa’s Standard Bank, the biggest foreign investment yet by a Chinese bank and the largest foreign investment in South Africa since the fall of apartheid.

Clients

Playing Defense in London: BTR Acquisition of Thomas Tilling

Goldman Sachs makes its mark in London with takeover defense of Thomas Tilling in 1983.

Clients

Goldman Sachs Leads Third Consecutive Offering for Japan's NTT

In 2000, Goldman Sachs assists Japan’s Ministry of Finance in its US$11.3 billion offering of Nippon Telegraph and Telephone shares (NTT-6), making the firm co-lead manager of three consecutive offerings for the Japanese telecommunications giant.

Clients

Goldman Sachs Sets (Another) Block Trade Record

In May 1997, Goldman Sachs is selected as sole handler of the Kuwait Investment Office’s block sale of British Petroleum shares valued at US$2 billion, the largest-ever executed by a single firm.

Clients

With Gao Hua Joint Venture, the Firm Establishes a Foothold in China's Domestic Financial Markets

Goldman Sachs announces a joint venture with Beijing Gao Hua Securities in 2004, strengthening its position in China’s domestic financial markets.

Globalization

,

Clients

Firm Helps Retailer Ito-Yokado Tap into the US Bond Market

Goldman Sachs helps facilitate Japanese retailer Ito-Yokado’s participation in the Yankee bond market in 1977.

Globalization

,

Clients

Goldman Sachs, One of the First International Banks to Open a Subsidiary in Japan

Goldman Sachs becomes one of the first international securities companies permitted to open a banking subsidiary in Japan in 1991.

Globalization

,

Clients

Goldman Sachs Joins The Frankfurt Stock Exchange

In 1991, the firm becomes a member of the Frankfurt Stock Exchange, signifying its commitment to the German marketplace.

Globalization

,

Clients

GS Financial WorkbenchSM Breaks New Ground in Firm’s Digital Offerings to Clients

The launch of GS Financial WorkbenchSM in 1995 marks the firm’s first significant effort to share some of its internal technologies, including tools, data, and analytics, with institutional clients.

Clients

,

Innovation

How Innovative Thinking Helped Toshiba Stay Afloat

Goldman Sachs is the sole agent of a private placement of JPY600 billion (US$5.35 billion) for Toshiba Corporation in 2017, raising capital Toshiba needs to avoid being delisted from the Tokyo Stock Exchange at a time when a public listing would be challenging for the beleaguered tech company.

Clients

Goldman Sachs Operates Briefly as a Joint Stock Association

In 1922, the Goldman Sachs partnership transitions to a new entity, Goldman, Sachs & Co., a joint stock association. By 1927, the firm would reconstitute itself as a partnership.

Clients

China Telecom Privatization Shines through the Shadow of the Asian Financial Crisis

In 1997, Goldman Sachs acts as advisor, joint global coordinator and joint lead manager on the US$4.04 billion partial privatization of China Telecom (now China Mobile), the largest privatization of a Chinese company to date.

Clients

Triple-Header: Goldman Sachs Manages the Concurrent IPOs of Japan Post Holdings, Japan Post Bank, and Japan Post Insurance

Goldman Sachs acts as a joint global coordinator and joint book runner for the three-pronged initial public offering of Japan Post Holdings, Japan Post Bank, and Japan Post Insurance in the largest IPO of 2015, totaling nearly US$12 billion.

Clients

Firm Facilitates First US Offering of Commercial Paper Issued by a Japanese Company

To bring Japanese commercial paper to a skeptical US market in 1971, Goldman Sachs arranges a US bank letter of credit to back up the offering from Mitsui & Co., Ltd., a centuries-old Japanese trading company.

Clients

Seven Insurers Buy US$225 Million Stake in Goldman Sachs

In 1989, Goldman Sachs forms a ten-year consortium with seven insurance companies that collectively contribute US$225 million for a non-voting stake in the firm.

Clients

The Glass-Steagall Act Separates US Commercial and Investment Banking Activities

As part of financial reforms instituted during the Great Depression in the United States, the Glass-Steagall Banking Act of 1933 mandates the separation of commercial and investment banking, and the Securities Acts of 1933 and 1934 improve disclosure practices in the offering of securities to investors.

Globalization

,

Clients

GS SUSTAIN Targets Sustainable Corporate Performance

In 2007, Goldman Sachs launches GS SUSTAIN, a global, long-term investment research strategy designed to generate sustainable alpha by integrating analysis of financial strength, strategic positioning, and environmental, social and governance performance.

Clients

,

Innovation

International Advisory Board Formed to Provide Global Insight

In 1982, Goldman Sachs establishes a board of international advisors with wide ranging experience in government, diplomacy and multinational business.

Globalization

,

Clients

Black-Derman-Toy Model Developed by Team at Goldman Sachs

The Black-Derman-Toy model for pricing fixed income derivatives is developed at Goldman Sachs in 1986 and used extensively in-house prior to its publication several years later.

Clients

,

Innovation

Goldman Sachs Begins Joint Venture with JBWere, Australia

Goldman Sachs and JBWere announce the merger of their Australian operations in 2003, forming a new venture branded as Goldman Sachs JBWere.

Clients

Firm Helps Warner Brothers Pictures Play a Starring Role in an Emerging Industry

In the mid-1920s, Goldman Sachs identifies the promise of the nascent film industry and provides Warner Brothers Pictures with critical strategic advice and access to financing in the film studio's early years.

Clients

Goldman Sachs Helps a French Utility Tap the US Commercial Paper Market

Just over a century after Goldman Sachs began dealing in commercial paper, the firm leads a commercial paper issuance for state-owned electric utility Électricité de France in 1974, the first ever in the United States on behalf of a foreign government entity.

Clients

,

Innovation

Daimler-Benz Becomes First German Company to List on NYSE

In post-unification Germany, Daimler-Benz looks to the international investment community for funding with its historic 1993 listing on the New York Stock Exchange.

Clients

Goldman Sachs' First Public Utility IPO Helps Keep the Lights On in San Antonio

In 1921, the firm co-lead manages its first utility company offering, approximately US$3.8 million in bonds for San Antonio Public Service Company. At the time, San Antonio is the largest city in Texas.

Clients

Telmex Privatization is First International Equity Offering from a Mexican Corporation

As Mexico pursues a program of economic liberalization and modernization, Goldman Sachs serves as advisor and global coordinator in the 1990 privatization of the country’s telephone service provider, Teléfonos de Mexico.

Clients

Firm Breaks New Ground With Japan Tobacco Global Equity Offering

Goldman Sachs serves as joint global coordinator of the first Japan Tobacco global equity offering in 1996, becoming the first non-Japanese company to underwrite shares for Japan’s Ministry of Finance.

Clients

Goldman Sachs Advises British Candymaker Facing Historic Takeover Bid

In 1988, Goldman Sachs advises UK confectioner Rowntree when it is the target of the largest takeover battle in British corporate history.

Clients

With SecDB, a Groundbreaking Risk Management Platform is Born

Securities Database, known as SecDB, is developed in 1993 and becomes the backbone of Goldman Sachs’ risk analytics platform for securities.

Clients

,

Innovation

NTT DoCoMo IPO Cements Goldman Sachs' Leadership Position in Japan

Goldman Sachs jointly lead manages the 1998 initial public offering of NTT Mobile Communication Network, Inc., (NTT DoCoMo), the largest IPO in history at the time. Coming in the midst of Japan's worst recession since World War II, the offering restores confidence in global capital markets at a time when it is critically needed.

Clients

Goldman Sachs Partners With Kleinwort, Sons & Co. of London

Goldman Sachs partners with Kleinwort, Sons & Co. of London in 1897, beginning a joint undertaking in international finance.

Globalization

,

Clients

Penn Central Bankruptcy Sends Shock Waves Through Commercial Paper Market

When Penn Central, the largest railroad in the country, declares bankruptcy in 1970, liquidity vanishes in the commercial paper market, roiling the market and threatening the very existence of Goldman Sachs, the market leader with nearly 300 other commercial paper-issuing clients.

Clients

Goldman Sachs Sets Block Trading Record With Alcan Aluminum Trade

In 1967, Gus Levy executes a record-breaking block trade of over one million shares of Alcan Aluminum worth more than US$26.5 million.

Clients

Goldman Sachs Completes British Petroleum Privatization Under Challenging Circumstances

Goldman Sachs is retained as US advisor in the privatization of the UK government’s remaining interest in British Petroleum Company PLC, the largest sale ever by HM Treasury. When it coincides with the 1987 "Black Monday” stock market crash, Goldman Sachs absorbs the largest loss the firm has ever taken.

Clients

Goldman Sachs Trading Corporation Bears Full Brunt of 1929 Crash

In December 1928, Waddill Catchings leads the firm’s formation of an investment trust, Goldman Sachs Trading Corporation (GSTC). By mid-1932, GSTC stock will plummet to virtually nothing.

Clients

Commercial Paper Trading Enters the Digital Age

In 1985, Goldman Sachs introduces the first-ever computerized commercial paper dealer system, replacing the telephone and increasing the speed and accuracy of commercial paper transactions.

Clients

,

Innovation

Goldman Sachs Joins the Tokyo Stock Exchange

In 1985, Goldman Sachs is selected as one of the first six non-Japanese firms to join the Tokyo Stock Exchange, allowing the firm to compete on equal footing in the Pacific Basin with some of Japan's largest banks.

Globalization

,

Clients

Ping An Insurance Becomes Goldman Sachs' First Principal Investment in China

Goldman Sachs makes its first principal investment in China in 1994 with the US$35 million investment in Ping An Insurance Company. The deal makes Ping An the first Chinese insurer to have foreign shareholders.

Clients

Goldman Sachs Adds Iconic NYC Property to Its Real Estate Portfolio

Leading an investment group in partnership with David Rockefeller, Goldman Sachs purchases Rockefeller Center in 1995, paving the way for the firm’s growing involvement in real estate investment.

Clients

Goldman Sachs Advises Mittal Steel on Historic Acquisition of Arcelor SA

The firm’s strategic outreach to shareholders helps Mittal Steel secure the EUR26.9 billion acquisition of European steel giant Arcelor in 2006.

Clients

IPO of AIG's Asian Unit is the Largest Ever of an Insurance Company

In 2010, Goldman Sachs serves as joint global coordinator and joint book runner for the US$20.5 billion initial public offering and effective privatization of publicly controlled AIG’s AIA Group unit, one of the largest and oldest life insurers in Asia.

Clients

Celebrating Most Influential Entrepreneurs at Inaugural Builders + Innovators Summit

2012 marks Goldman Sachs’ first annual Builders + Innovators Summit, a gathering of a select group of up-and-coming US entrepreneurs and seasoned business leaders designed to foster dialogue, idea sharing, and economic progress.

Clients

,

Innovation

Goldman Sachs Joins the New York Stock Exchange

Harry Sachs (Samuel Sachs' brother) becomes partner in 1894 and the firm's first stock exchange member two years later.

Clients

F.W. Woolworth IPO Fuels Rapid Growth of a Retail Empire

After being turned down by other underwriters, Frank Woolworth seeks out Goldman Sachs in 1912 to help finance his company’s rapid expansion, forging a decades-long relationship between the companies.

Clients

Firm Advises, Helps Fund Amazon’s Stunning US$13.7 Billion Acquisition of Whole Foods

In 2017, Goldman Sachs advises Amazon.com on the US$13.7 billion acquisition of Whole Foods as the grocery chain becomes part of the world’s largest online retailer. The firm also provides bridge funding for the acquisition.

Clients

NYSE Debut of PetroChina Ltd. Caps Massive Reorganization of Chinese Oil Industry

In 2000, the firm works to privatize a huge state-owned enterprise into PetroChina, an effort that involves reorganizing the oil industry in China.

Clients

Goldman Sachs Advises the British Government in the Country's Largest Privatization Yet

In 1986, Goldman Sachs advises the UK government and British Gas on selling shares in the United States of what is, at the time, the largest-ever privatization in the United Kingdom, at £5.6 billion.

Clients

Goldman Sachs and IFC Introduce Landmark Credit Facility for Women Entrepreneurs

The Goldman Sachs Foundation and the International Finance Corporation create the Women Entrepreneurs Opportunity Facility in 2014 to provide much-needed financing to female entrepreneurs around the globe.

Service

,

Clients

Firm Helps a U.S. Thrift Sell Yen-Based Notes in Europe

In 1987, Goldman Sachs co-manages the first-ever collateralized Euroyen notes totaling JPY15 billion for California-based Great American First Savings Bank.

Clients

,

Innovation

Goldman Sachs Leads Historic Conrail IPO, the Largest Public Offering to Date

Goldman Sachs leads the Conrail IPO in 1987, the largest ever public offering in the United States and an important chapter in the history of American railroads.

Clients

US$13 Billion Privatization of Deutsche Telekom is Largest IPO Ever

In 1996, Goldman Sachs serves as joint global coordinator on the US$13 billion privatization of Deutsche Telekom AG, Europe’s largest telecommunications service provider. It is the largest equity offering to date.

Clients

Investing in a Stronger Japanese Banking System

Goldman Sachs invests US$1.27 billion (JPY150 billion) in Sumitomo Mitsui Financial Group (SMFG) in 2003 and assists SMFG with the disposition of some of its non-performing assets.

Clients

In a Paradigm Shift, Goldman Sachs Decides to Go Public

After decades of impassioned debate, the partners of Goldman Sachs vote in 1998 to take the firm public the following year. The firm is among the last large financial institutions to do so.

Culture

,

Clients

Landmark Investment in Goldman Sachs by Sumitomo Bank

In 1986, Goldman Sachs accepts a US$500 million investment and limited partnership interest by Sumitomo Bank in order to meet capital requirements.

Globalization

,

Clients

Goldman Sachs Broadens Wealth Management Offerings with Ayco Acquisition

In 2003, Goldman Sachs acquires the Ayco Company, L.P. (Ayco), a leading provider of fee-based financial counseling. Ayco will operate as part of the firm’s Private Wealth Management business.

Clients

With Hathaway & Co. Acquisition, Goldman Sachs Doubles Down on Commercial Paper

In the depths of the Great Depression, Goldman Sachs announces its first-ever acquisition. Taking advantage of a depressed commercial paper market, the firm purchases Chicago-based Hathaway & Co. in 1932 to become one of the largest commercial paper dealers in the US.

Clients

Firm Announces Formation of Merchant Banking Division

The formation of the Merchant Banking Division in 1998 reflects the firm’s expanding role in principal investing activities.

Clients

Firm Makes Historic Investment in Industrial and Commercial Bank of China (ICBC)

In 2006, Goldman Sachs purchases a 7 percent stake in ICBC worth more than $2.5 billion—its largest-ever principal investment—reinforcing a deep strategic collaboration between the two banks.

Clients

Firm Participates in Postwar Bond Offering for French Railroad

In 1924, Goldman Sachs participates in a US$20 million bond offering for Paris-Lyons Mediterranean Railroad Company amid postwar reconstruction in France.

Clients

Landmark IPO Helps an American Retailing Icon Achieve the Next Level of Growth

In 1906, Sears, Roebuck and Co. was a burgeoning catalog business in need of capital to finance its robust growth. Goldman Sachs led an initial public offering for Sears that year, the success of which signaled the rise of the consumer/retail sector in the U.S. economy.

Clients

Disney Magic Comes to NYSE in IPO

Goldman Sachs leads Disney's initial public offering at a share price of US$13.88 on the New York Stock Exchange in 1957.

Clients

Firm's First IPO Uses New Earnings-Based Approach to Valuation

Henry Goldman leads the firm’s first IPO in 1906, utilizing the innovative strategy of earnings, rather than solely assets, to attract long-term investment in United Cigar Manufacturers.

Clients

,

Innovation

The Power of Relationships Fuels Historic Ford Motor Company IPO

Goldman Sachs leads the Ford Motor Company’s US$657 million IPO in 1956, the largest common stock offering to date in the United States. Sidney Weinberg, a long-time friend and informal advisor to the Ford family, becomes one of Ford Motor's first outside directors.

Clients

John Whitehead Memo Revolutionizes Investment Banking, Establishing Investment Banking Services

In one of the firm's most important industry innovations, John Whitehead submits a memo to Sidney Weinberg in 1956 outlining the establishment of Wall Street's first marketing arm for investment banking, later known as Investment Banking Services (IBS).

Clients

,

Innovation

Revolutionary Black-Scholes Option Pricing Model is Published by Fischer Black, Later a Partner at Goldman Sachs

Published in 1973, the Black-Scholes Option Pricing model brings a new quantitative approach to pricing options, helping fuel the growth of derivative investing.

Clients

,

Innovation

Goldman Sachs Adds Strength in Commodities and Foreign Exchange With J. Aron Acquisition

In 1981, Goldman Sachs acquires a client, J. Aron & Company, in a strategic move to extend the firm’s international presence in the commodity and foreign exchange markets.

Clients

Amid London's "Big Bang" Deregulation, Goldman Sachs Joins Newly Formed International Stock Exchange

In 1986, Goldman Sachs joins the International Stock Exchange in London and becomes a primary dealer in UK government securities, cementing the firm's position as a leading participant in the evolving global capital markets.

Globalization

,

Clients

Firm Helps a State-Owned Company in India Tap Global Markets

Goldman Sachs is the lead manager of Indian Petrochemicals Corporation Limited (IPCL)’s US$85 million 1994 offering of global depositary receipts — the first international offering for an Indian government-owned company.

Globalization

,

Clients

“Womenomics” Reveals The Power of the Purse in Japan

The Japanese portfolio team within the Global Investment Research Division publishes “Womenomics: Buy the Female Economy” in 1999, launching a multiyear series of reports that cement “Womenomics” as part of the Japanese vernacular and a pillar of the country’s efforts to revive economic growth.

Clients

,

Innovation

With GS Research Report, "BRICs" Are Born

In 2001, Goldman Sachs’ Global Investment Research Division publishes the report, "Build Better Global Economic BRICs," coining the acronym for the four countries that would reshape the world economy– Brazil, Russia, India and China.

Clients

,

Innovation

Marcus by Goldman Sachs Leverages Technology and Legacy of Financial Expertise in Dynamic Consumer Finance Platform

In 2016, Goldman Sachs launches Marcus by Goldman Sachs, an online platform offering personal loans and savings accounts to retail clients.

Clients

,

Innovation