Does the Old Retirement Math Still Work for Employees?

The latest Retirement Survey & Insights Report: The New Economics of Retirement¹ from Goldman Sachs Asset Management shines a light on what many employers already suspect: simply advising employees to “save more” doesn’t account for the complex and evolving realities of today. A tailored plan helps individuals address both near- and long-term financial priorities by balancing the needs of their current life stage with more distant goals like retirement.

- The new economics of retirement reflects a structural financial shift.Rising costs and competing financial priorities are making affordability a central concern for employees.

- Optimism is palpable thanks to financial markets and the economy.Employees are optimistic, but financial planning remains essential as many expect to outlive savings.

- There is a ray of hope.While 64% of workers said they lived paycheck to paycheck at least some of the time in 2023, impacting their ability to save, new employer solutions have the potential to transform retirement outcomes.

The “new economics of retirement” is shaped by a structural shift in how Americans earn, spend, and save. Costs are increasing at a rate faster than wages, creating a Financial Vortex. There is, however, a ray of hope. The retirement survey points to a growing body of solutions that employers can use to help workers regain their footing and rebuild confidence in their financial futures.

Workers are facing competing priorities, but fragile optimism remains

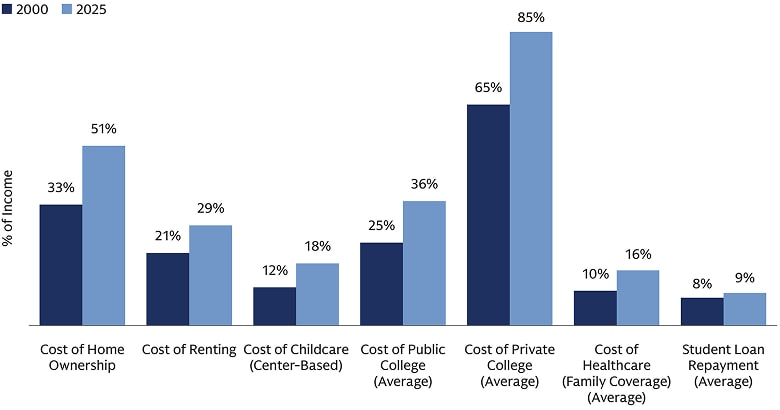

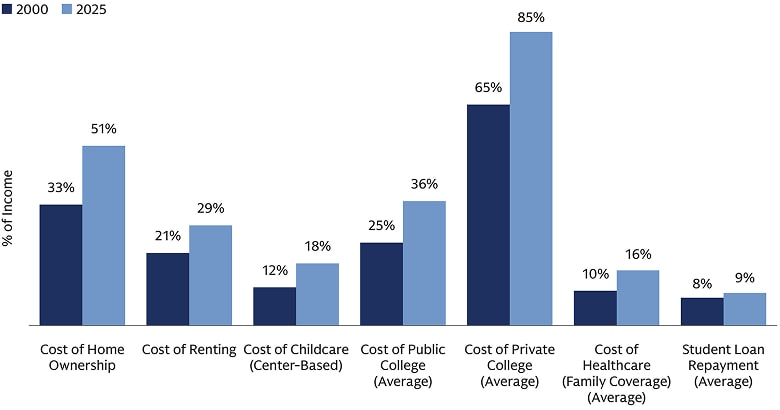

The cost of essentials, like housing, healthcare, childcare, and education, has surged since 2000, outpacing median wage growth. As this gap narrows, saving for retirement becomes increasingly difficult, especially for Gen Z, Millennials, and Gen X. Roughly 40% of working Americans report living paycheck to paycheck; another 40% say they’re making moderate financial progress but still can’t balance needs with goals.

And yet, optimism about saving for retirement is rising, creating an “optimism gap”—the space between how people feel about their readiness and what the numbers actually show. Many survey respondents say they feel better about their long-term prospects, buoyed by market performance and a seemingly solid economy. But optimism can be fragile. Nearly 60% of workers still fear they’ll outlive their savings.

Is ‘retirement affordability’ declining?

Is retirement becoming unaffordable? The answer, increasingly, is "yes" for many employees.

Among those living paycheck to paycheck, nearly three-quarters say competing priorities limit their ability to save. If this group continues to expand, the implications could be profound.

Ray of hope

However, there are solutions employers can offer that provide real hope, like early saving, tailored advice, enhanced investment strategies, and protected income. These initiatives, when taken together, can meaningfully strengthen the retirement plans available to all employees.

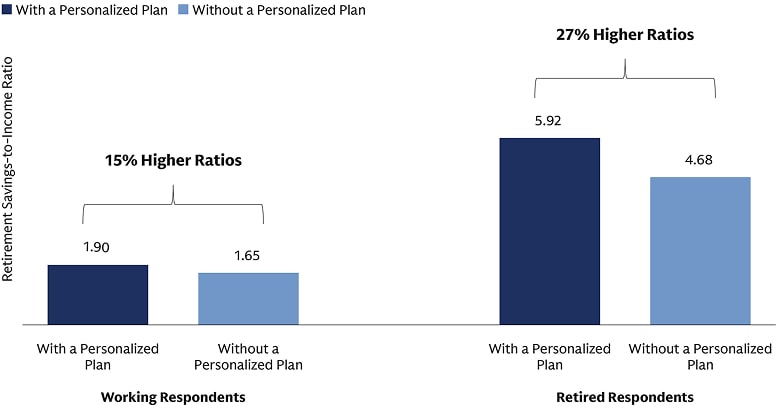

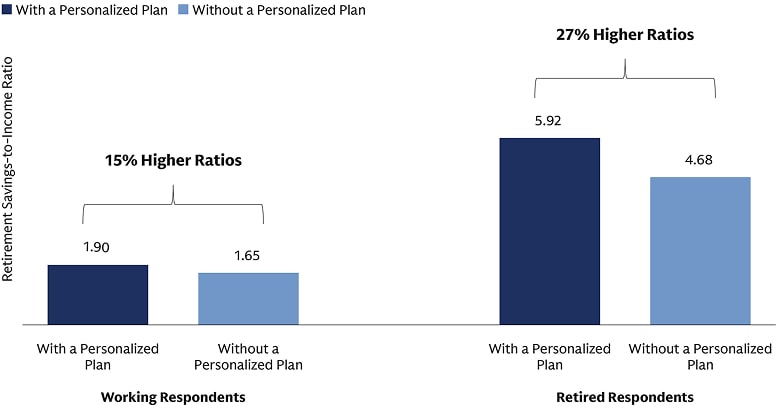

Tailoring strategies to each employee’s unique goals and circumstances significantly increases the likelihood of retirement success.

1. Early-start saving

Early saving remains a critical driver of long-term financial security. One possible way to achieve early saving is by implementing auto-enrollment and auto-escalation features to employer-sponsored retirement plans. Our 2025 Benefits and Compensation Trends report finds 80% of our corporate partners have an auto-enrollment feature for new hires. This feature has grown substantially over the last decade, as it has been shown to increase employee participation rates. Additionally, just over 60% of companies provide an auto-escalation feature².

2. Personalized plan

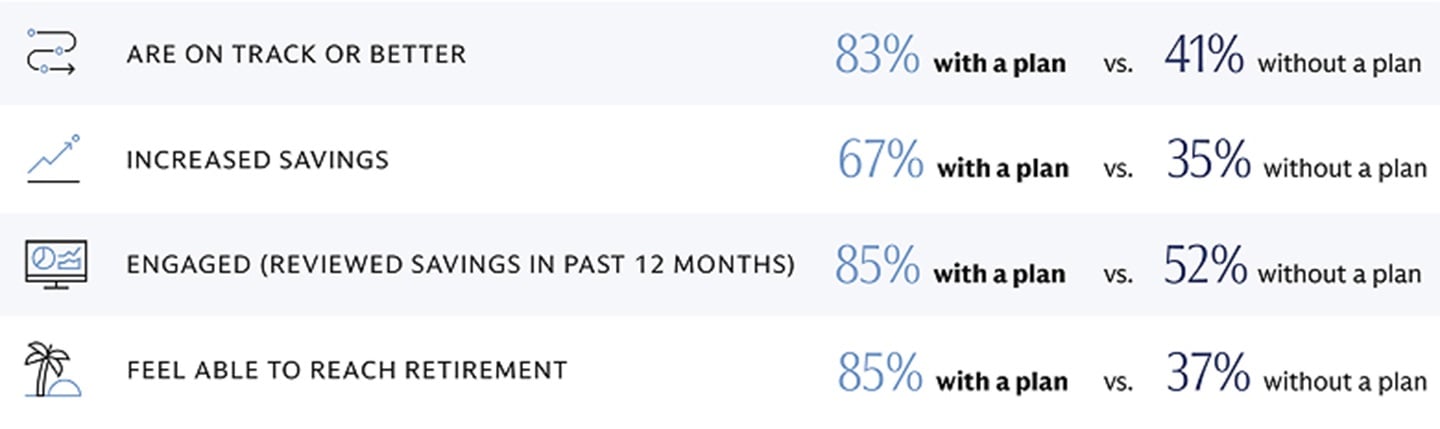

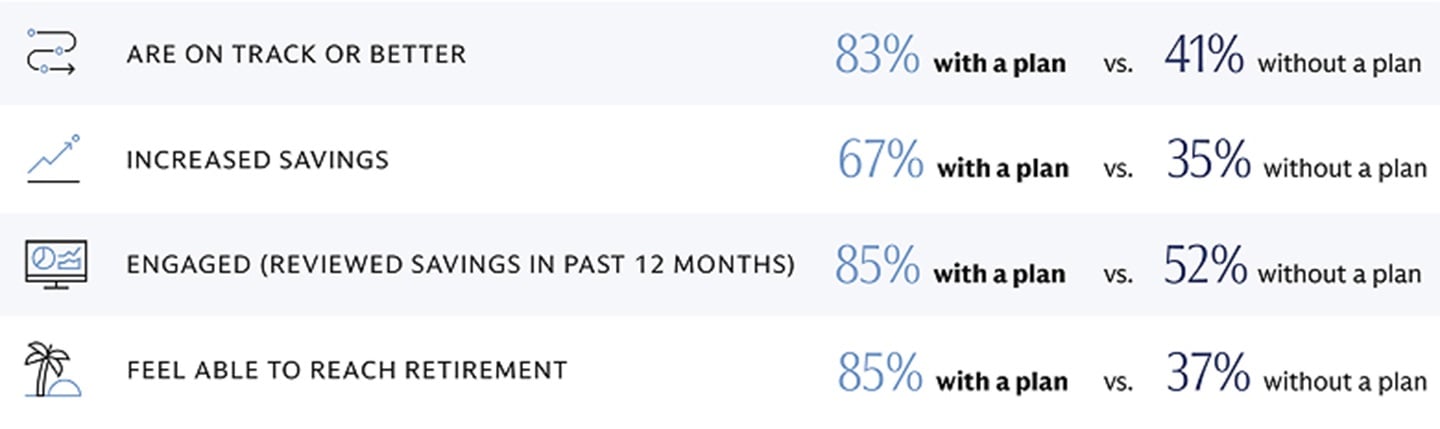

Employers can help employees create innovative, personalized approaches for achieving retirement readiness by fostering an environment where every employee—regardless of financial acumen, level of savings, or engagement—has the opportunity to plan effectively. Tailoring strategies to each employee’s unique goals and circumstances significantly increases the likelihood of retirement success: 83% of working respondents with a plan believe they are on track for retirement, compared with just 41% of those without a plan. By coupling planning with targeted education and easy-to-use planning tools, employers can ensure that portfolio management is aligned with each saver’s unique goals and circumstances, further increasing the likelihood of success. Early savings remain a critical driver of long-term financial security, and fostering behavioral factors—such as developing financial grit—empowers individuals to make consistent, informed decisions.

3. Protected lifetime income

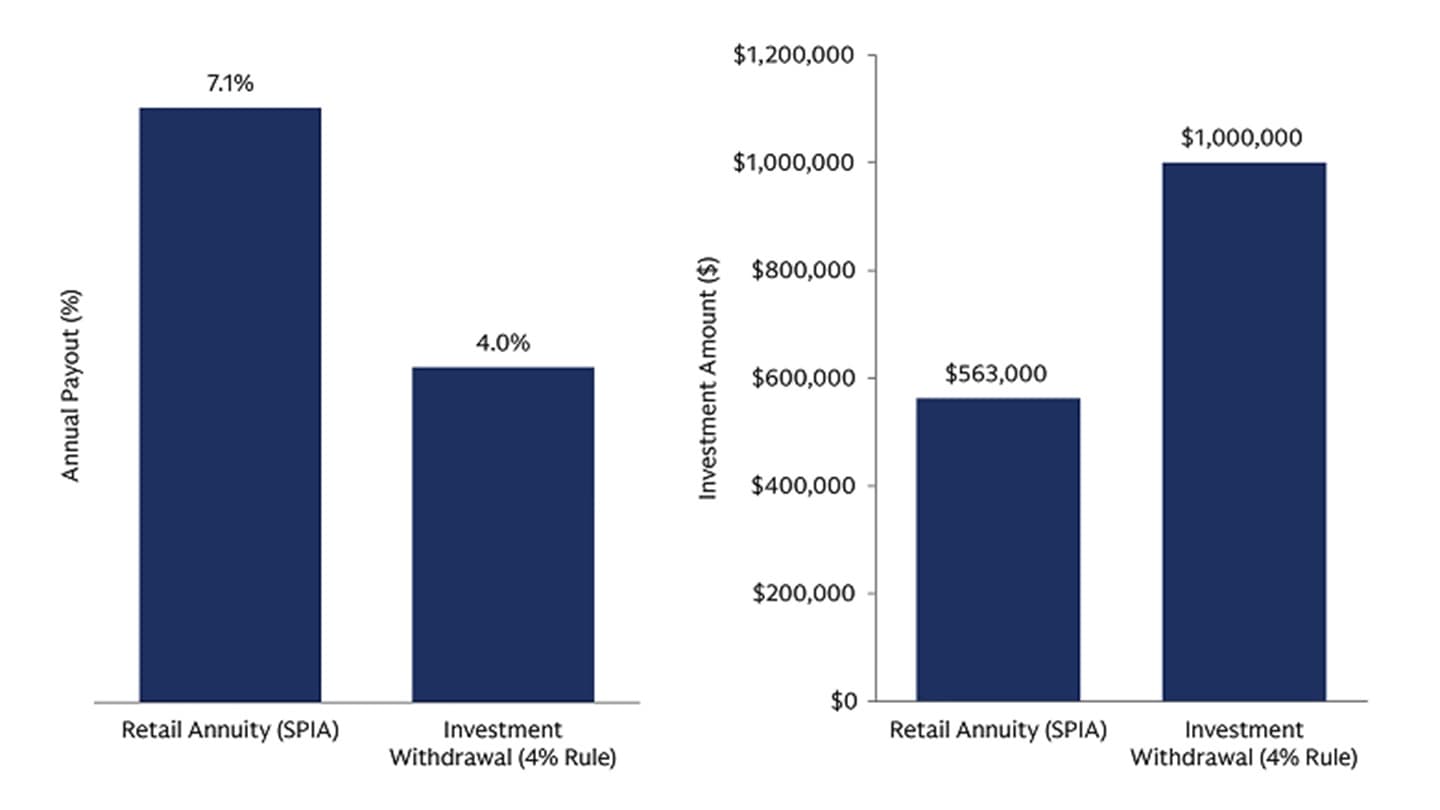

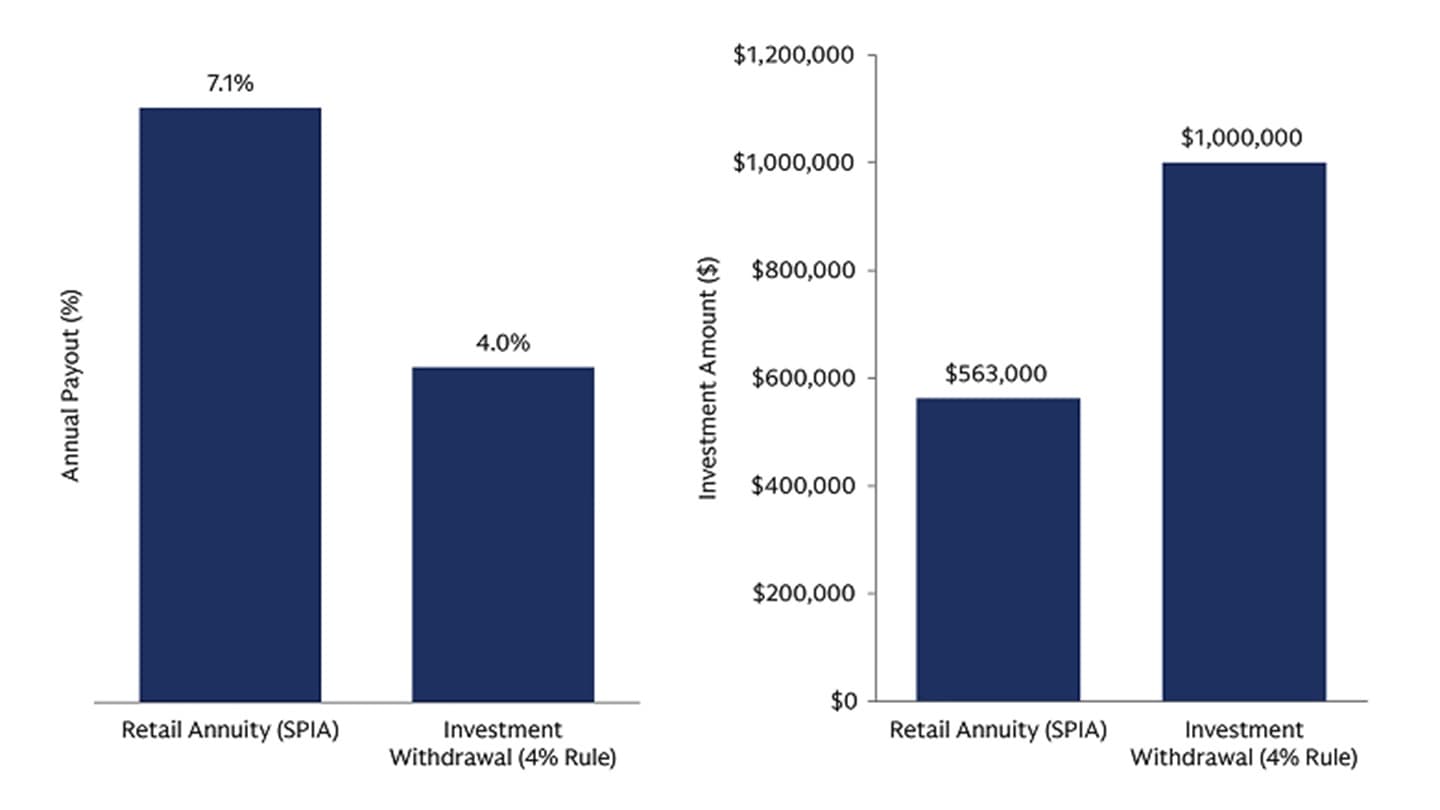

Helping employees build a portfolio that considers different sources, such as annuities or rollovers to pension plans, could provide extra stability for retirement savings. A solution noted in the survey includes the purchase of a single premium immediate annuity³, with a possible annual payout of around 7.1% (as shown below)⁴.

4. Enhanced investment portfolios

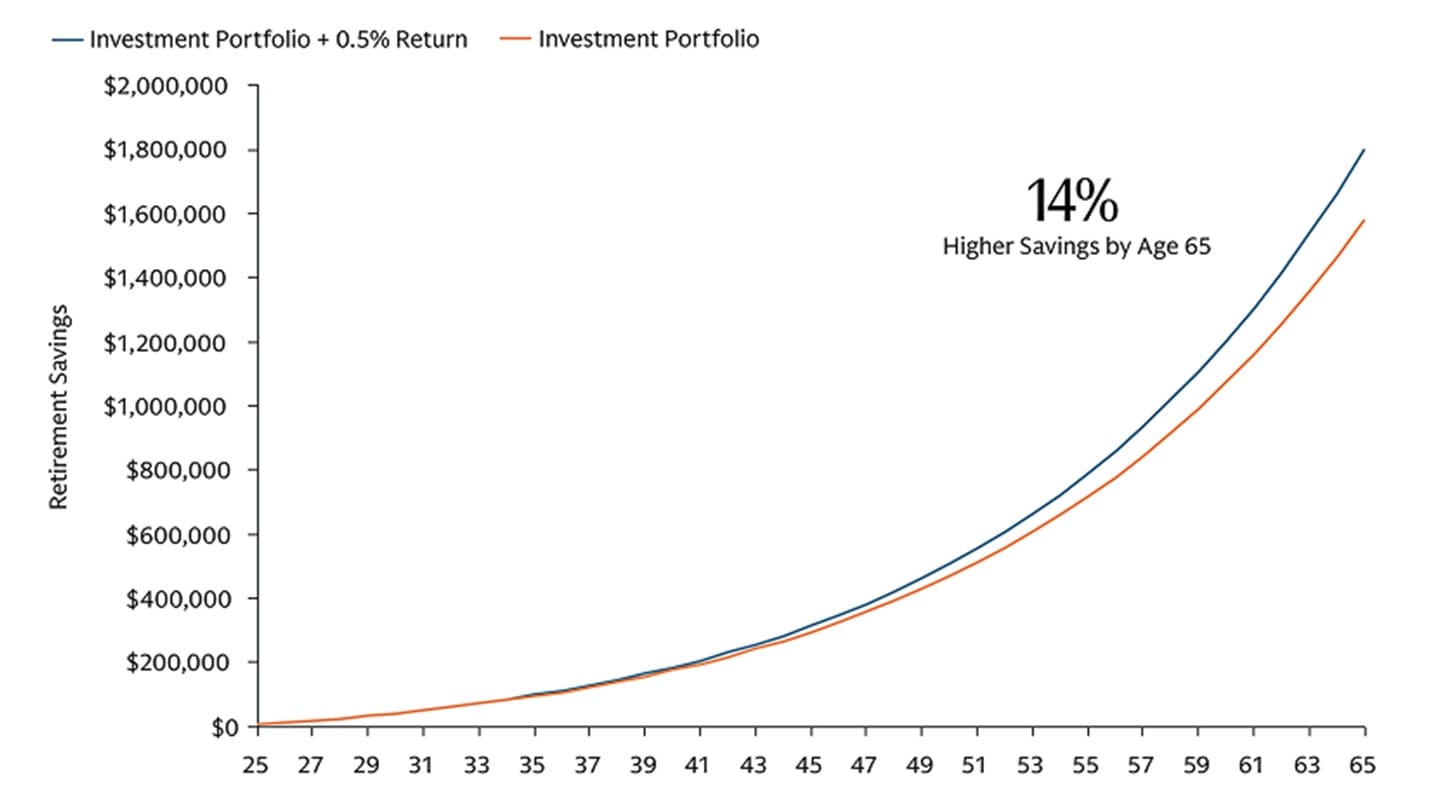

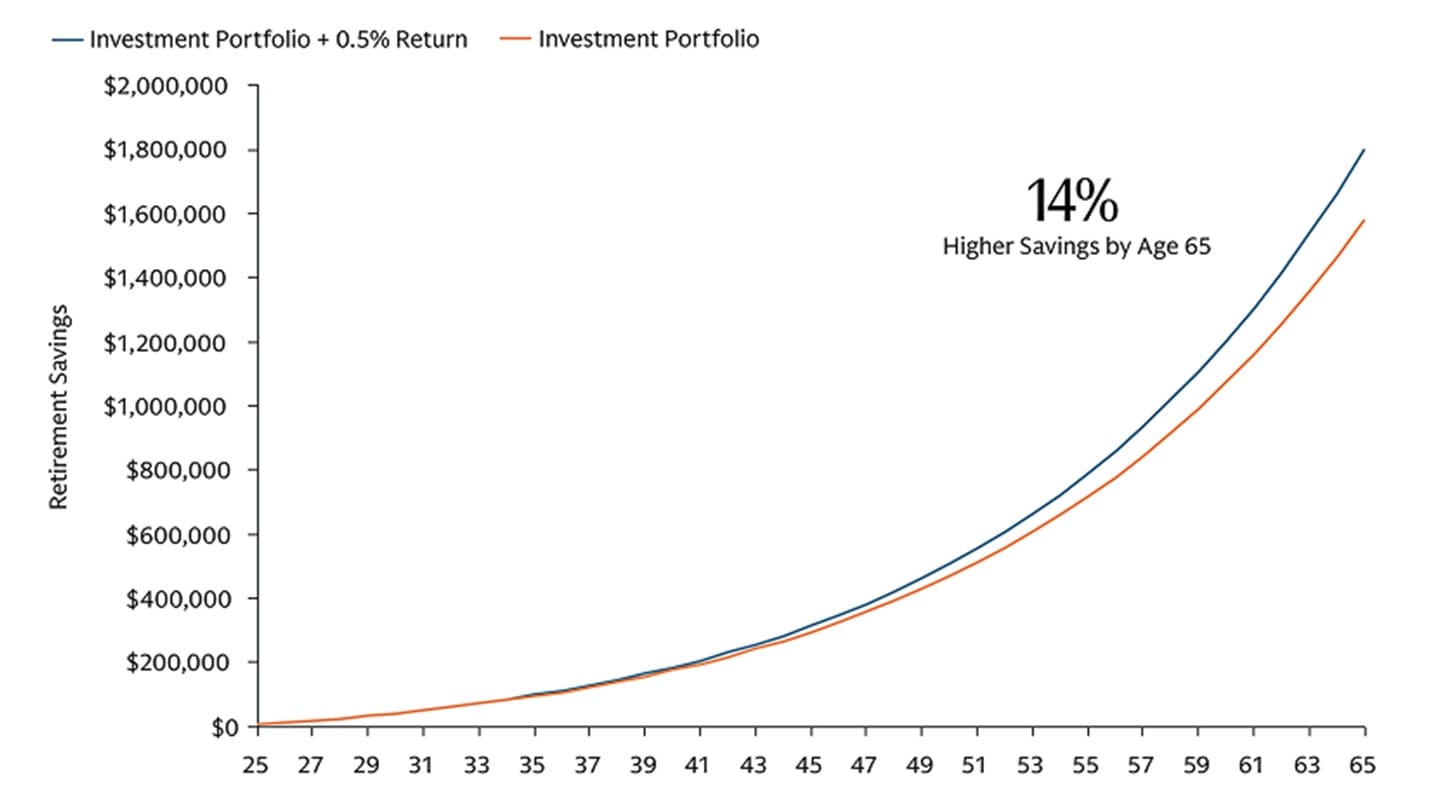

Given the headwinds facing savers, stronger portfolio performance can make existing savings work harder—helping compound balances faster without relying solely on higher contribution rates. By elevating expected returns within prudent risk bounds, employees may reduce the pressure to save more each year to reach on-track targets, creating more flexibility for households facing competing financial priorities.

A persistent half-percent advantage over a full career can translate into a meaningful increase in a retirement balance at age 65, all else being equal.

Employers’ role in this new reality

The New Economics of Retirement calls for a shift in mindset—from reactive to proactive, from individual responsibility to shared partnership—and strategies that recognize income volatility, rising costs, and competing financial priorities. Employers can help rewrite the narrative through thoughtful plan design, modern financial tools, and a renewed focus on employee resilience. HR leaders can foster this through education, year-round communication, and access to financial counseling. These tactics can help transform the "Financial Vortex" from a source of anxiety for employees into an opportunity that can be met with confidence.

1 Source: Goldman Sachs Asset Management’s Retirement Survey & Insights Report 2025; Refer to the report for full disclosures. The survey was conducted by Goldman Sachs Asset Management and Qualtrics Experience Management between June 27, 2025–July 21, 2025. Views expressed are those of survey respondents. Findings are from 5,102 individuals surveyed in July 2025 and provide insights from a diverse set of perspectives, including (i) working individuals (3,588 working individuals across generations), and (ii) retired individuals (1,514 retired individuals ages 45-75). This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

2 Goldman Sachs Ayco 2025 Benefits and Compensation Trends. Data based on 411 Goldman Sachs Ayco corporate partners as of December 2024.

3 An insurance product designed to provide a guaranteed stream of income in retirement.

4 Retail annuity payout is calculated by using major retail annuity providers’ offerings at May 2025 rates. The payout percentage of 7.1% is the average of the top 5 highest paying single premiums immediate annuity starting at age 65. This is also the average between male and female rates.

* Median Household Income (after-tax): 2000: Median household income is $42,148 and assume effective tax rate is 18%; 2025: Median household income is $83,730 and assume effective tax rate is 18%; Source; US Census Bureau Median Household Income, Goldman Sachs Asset Management.

Cost of Home Ownership: 2000: Median home price: $119,600, 8% mortgage rate, 20% down payment, Insurance estimate - $500, annual maintenance cost 1% of home value, taxes 1.1% of home value; 2025: Median home price: $410,800, 6.5% mortgage rate, 20% down payment, Insurance estimate - $1500, annual maintenance cost 1% of home value, taxes 1.1% of home value: Sources: Federal Reserve Bank of St. Louis, US Census Bureau, Goldman Sachs Asset Management.

Cost of Renting: 2000: Median gross rent: $602 monthly; 2025: Median gross rent: $1638 monthly: Source: US Census data, Goldman Sachs Asset Management.

Cost of Child Care (Center-based): 2000: Median cost center-based childcare: $4,000 annually; 2025: Median cost center-based childcare: $12,500 annually; Source: Child Care Aware, Goldman Sachs Asset Management.

Cost of Public College: 2000: Average tuition $3,510; average room and board $4,960. 2025: Average tuition $11,610; average room and board $13,300; Source: College Board, Goldman Sachs Asset Management.

Cost of Private College: 2000: Average tuition $16,332; average room and board $6,209. 2025: Average tuition $43,350; average room and board $15,250; Source: College Board, Goldman Sachs Asset Management.

Cost of Student Loan: 2000: Average federal loan balance $16,530; Interest rate assumption 6.9%, loan term assumption 10 years. 2025: Average federal loan balance $39,075; Interest rate assumption 6.4%, loan term assumption 10 years. Source: National Association of Colleges and Employers, Goldman Sachs Asset Management.

Cost of Healthcare: 2000: average employee paid healthcare premiums $1,715; estimated out of pocket expense $1,776 (assume three family members). 2025: average employee paid healthcare premiums $6,269; estimated out of pocket expense $4,542 (assumes three family members). Source: Kaiser Family Foundation, Goldman Sachs Asset Management.

Disclosures

Advisory services offered by Goldman Sachs Wealth Services, L.P. (the “Adviser”), a registered investment adviser, affiliate of Goldman Sachs & Co. LLC ("GS&Co."), and a subsidiary of The Goldman Sachs Group, Inc., a worldwide, full-service investment banking, broker-dealer, asset management, and financial services organization. Goldman Sachs Ayco is a brand of Goldman Sachs Wealth Services, L.P. Brokerage services are offered through GS&Co. and Mercer Allied Company, L.P. (a limited purpose broker-dealer), both affiliates of the Adviser and members FINRA/SIPC.

© 2025 Goldman Sachs Asset Management. All rights reserved.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.