We see unprecedented opportunity for our clients to apply sustainable finance to make a global impact.

Explore the Latest

Explore the Latest

At Goldman Sachs

We see unprecedented opportunity for our clients to apply sustainable finance to make a global impact.

Renewable energy now accounts for a third of global power capacity.

Millennials will inherit more than $50 trillion in the coming decades.

Total issuance of sustainable debt including green, social and sustainability bonds has surpassed $1 trillion.

Our Approach

Sustainable Finance Group

Our Sustainability Journey

Our Sustainability Journey

Our Sustainability Journey

Our Capabilities

In November 2005, Goldman Sachs established our Environmental Policy Framework, which articulated our belief in the importance of a healthy environment and our commitment to addressing critical environmental issues. At that time, we were one of the first financial institutions to acknowledge the scale and urgency of challenges posed by climate change. In the decade since, we have continued to build upon our commitment to the environment across each of our businesses.

Learn More

We approach the management of environmental and social risks with the same care and discipline as any other business risk, and undertake a robust review process to take the environmental and social impacts and practices of our clients and potential clients into consideration in our business selection decisions.

Learn More

Minimizing our operational impact is a prerequisite of sound environmental policy and a necessary complement to our core business activities.

Learn More

At Goldman Sachs, we believe that strong communities are the foundation of a prosperous society. Through our Impact Investing initiatives, we find innovative commercial solutions that address social and civic challenges in communities across the United States.

Learn More

Goldman Sachs 10,000 Small Businesses is an investment to help entrepreneurs create jobs and economic opportunity by providing access to education, capital and business support services.

Learn More

Goldman Sachs 10,000 Women is a global initiative that fosters economic growth by providing women entrepreneurs around the world with a business and management education, mentoring and networking, and access to capital.

Learn More

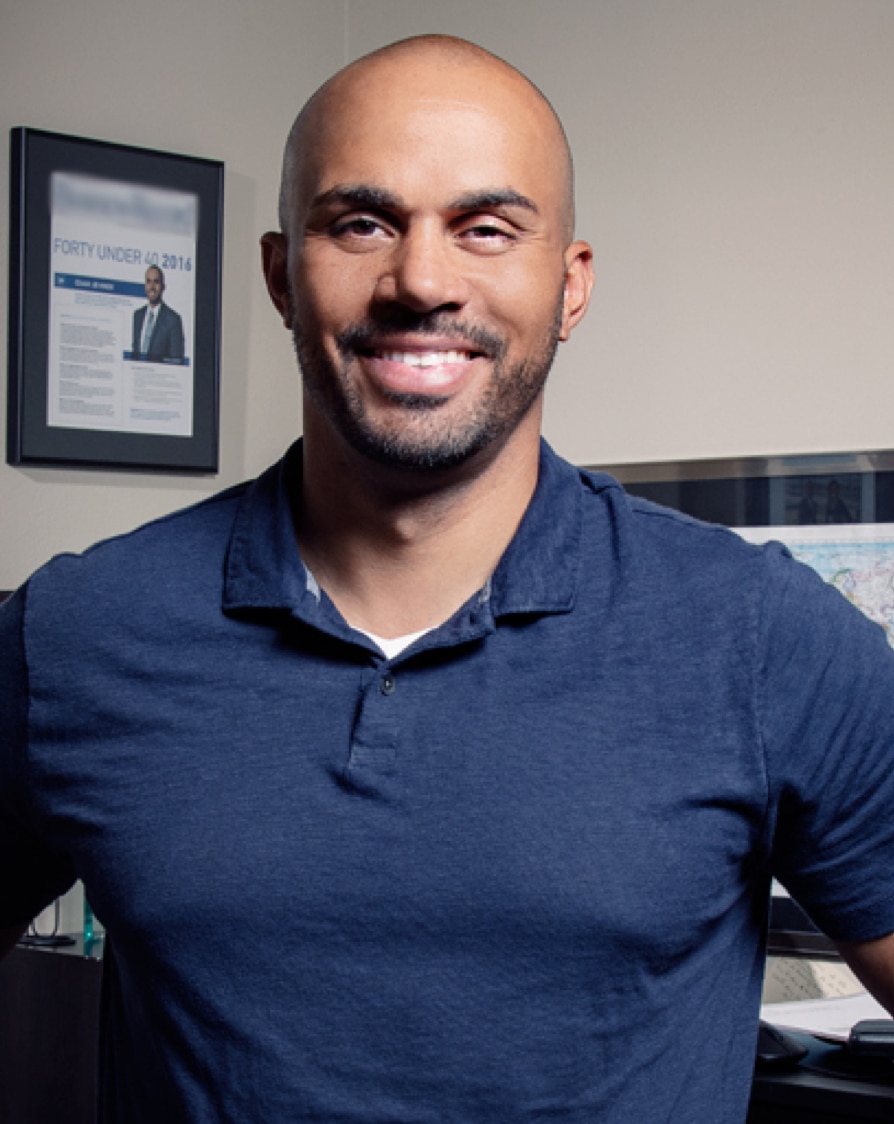

David M. Solomon

David M. Solomon Sustainable Future