Copper Prices Are Forecast to Decline Somewhat from Record Highs in 2026

Goldman Sachs Research expects copper prices to decline somewhat in 2026 from their recent record highs, even as demand for the metal from the grid and power infrastructure gradually drives up prices again in the longer term.

Prices for copper and other industrial metals like aluminium and lithium rallied this year as interest rates declined, the US dollar weakened, and expectations for Chinese economic growth improved, Goldman Sachs Research analyst Eoin Dinsmore writes in his team's report. Supply disruptions, policy changes, and massive spending on artificial intelligence (AI) gave prices an extra boost.

While copper reached a record $11,771 per tonne on December 8, Goldman Sachs Research expects a continued global surplus of supply to prevent copper prices from exceeding $11,000 for a sustained period in 2026. Chinese demand for refined copper is estimated to have fallen to -8% year-on-year in the fourth quarter of 2025, as the boost from stimulus policies and tariff-related front-loading at the beginning of the year has waned.

What’s the forecast for copper prices in 2026?

Next year, Goldman Sachs Research expects the London Metals Exchange (LME) copper price to remain in a range of $10,000-$11,000 “as strong global demand growth from the grid and power infrastructure, backed by investment in strategic sectors such as AI and defence” keep prices from falling below $10,000. The LME copper price is forecast to average $10,710 in the first half of 2026.

While the global copper market has been in surplus this year, a combination of limited growth in the supply from mines and rising structural demand from power infrastructure should create more of a balance between supply and demand next year, and lift prices beyond 2026. The team now expects the global copper market to end 2025 in a 500kt surplus (revised up from 215kt previously). “While our much smaller 2026 surplus of 160kt moves the market closer to balanced, it means that we do not expect the global copper market to enter a shortage any time soon,” Dinsmore writes

In the longer term, the team forecasts the LME copper price in 2035 at $15,000 per tonne—above the consensus of industry analysts.

What could boost copper prices next year?

One factor that could lead to higher demand on the London copper market next year is the potential for the US to place tariffs on refined copper imports. The US commerce secretary is expected to make a recommendation on copper tariffs to the White House by June 2026 (and possibly sooner), Goldman Sachs Research’s base case is that a refined copper tariff of at least 25% will be implemented shortly after.

Flows of copper to the US may accelerate in this scenario as importers build up their stock before the tax comes into effect. “This will likely allow for a steady flow of metal into the US next year,” Dinsmore writes.

Goldman Sachs Research expects copper prices to decline slightly after the tariff is implemented, then resume its upward trajectory.

When will copper prices rise again?

Beyond 2026, Goldman Sachs Research is bullish on copper prices. The team expects demand for the metal to overtake supply from 2029 onwards, pushing prices higher—which is expected to incentivize the development of new copper supply (mainly by extending the life of mines, but also through more scrap use) and also to curtail demand.

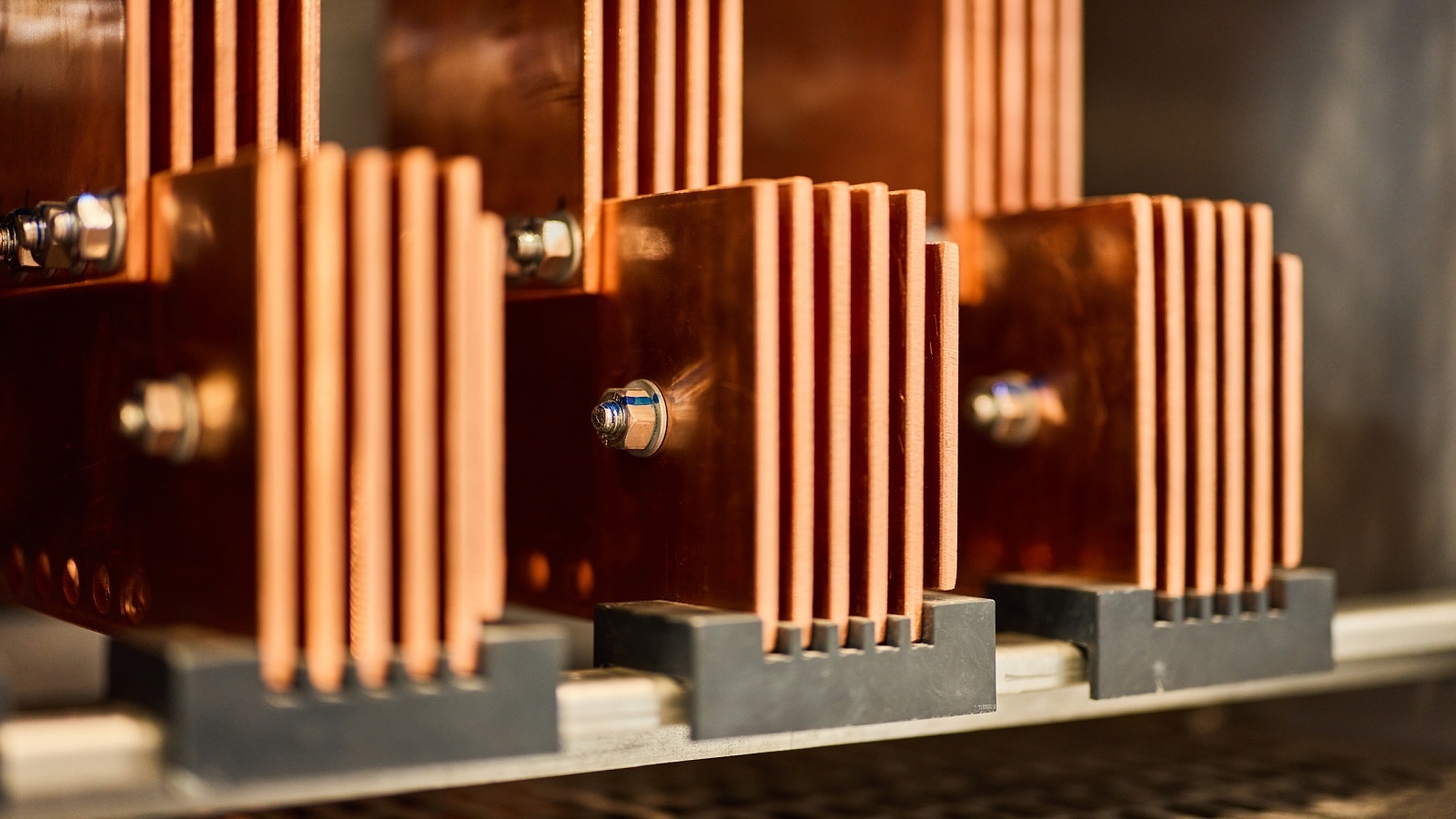

Copper is often seen as an economic barometer—rising copper prices can indicate strong industrial demand and an accelerating global economy. In particular, Dinsmore writes, the metal is “a major beneficiary of investments in grid and power infrastructure globally, as AI and defence heighten the need for robust and secure energy networks.”

The grid and other power infrastructure are projected to drive more than 60% of copper demand growth in the team’s forecast until 2030—adding the equivalent of another US in copper demand.

Goldman Sachs Research expects China to remain the single largest driver, accounting for roughly half of this demand growth to 2030. But the US and Europe are increasing their share of copper demand growth.

“However, we expect this structural demand growth to be partly offset by switching from copper to aluminium” in other sectors such as consumer and industrials, Dinsmore adds. The ratio of copper prices to aluminium prices is set to reach a new high of 4.5:1 next year, from an average of 3.8:1 in recent years.

Goldman Sachs Research forecasts the LME copper price to reach $15,000 per tonne by 2035 (equivalent to $11,500 in 2025 US dollar terms).

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.