Welcome to the ‘Postmodern’ Cycle of Higher Inflation and Lower Stock Returns

The economy based on physical stuff is getting its revenge.

Not so long ago, investors were enamored with fast-growing companies that used software to send a ride or groceries to your door at the push of button, even if the firm’s profits were far off in the horizon. But these days, healthy margins and companies that make real, physical stuff are back in focus, according to Peter Oppenheimer, chief global equity strategist at Goldman Sachs.

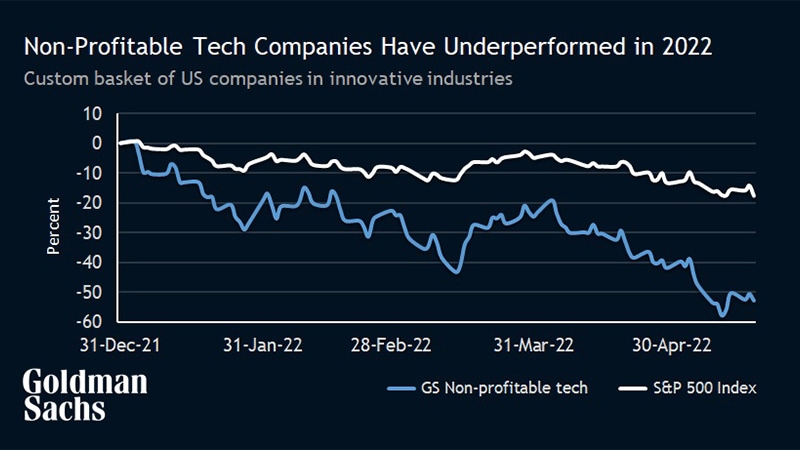

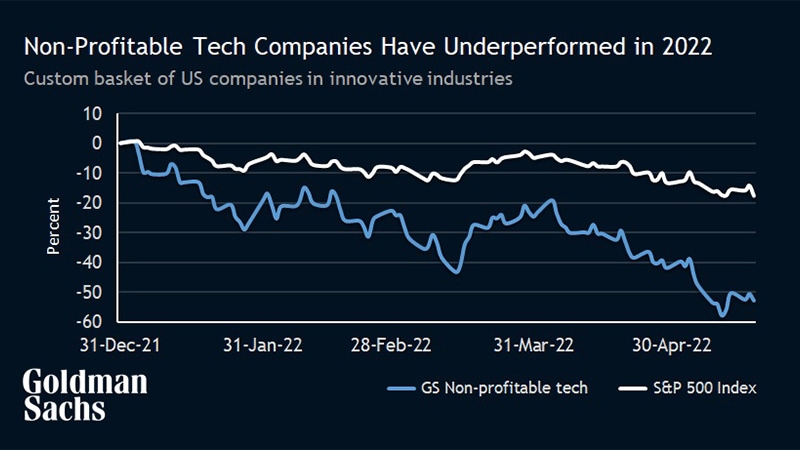

“We are seeing it quite quickly,” Oppenheimer says of the shift, which is filtering through equity markets. The tech-heavy Nasdaq Composite has fallen nearly 30% this year, whereas the U.K.’s FTSE 100 Index, a benchmark tilted toward heavy industry and commodities, is roughly unchanged. Unprofitable tech companies have fallen about 50%, according to a custom Goldman Sachs index.

“It’s a reminder that we’re still living in a very human, physical world,” Oppenheimer says. “The value of those physical things, including human capital, is actually going up.”

That shift is part of what Oppenheimer, who is also the head of Macro Research in Europe, calls the “postmodern cycle.” In this phase, interest rates are climbing from subterranean levels; instead of tepid price increases, inflation is a renewed risk; executives are grappling with a jump in commodity prices and workers with bargaining power as some aspects of globalization are reset; and governments are likely to grow larger and flex their muscles more often.

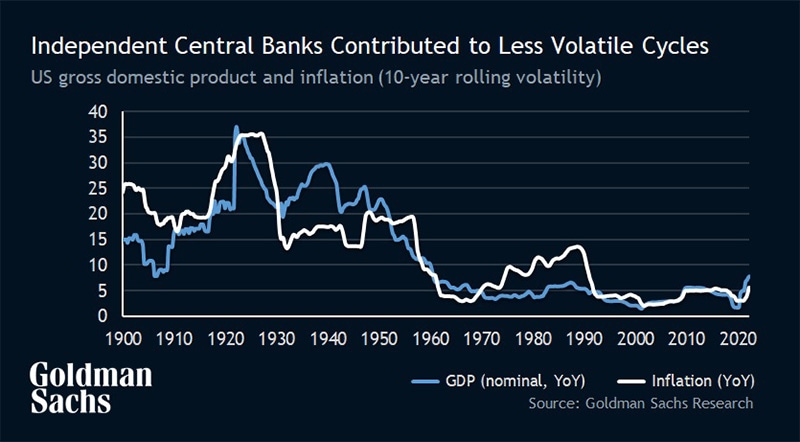

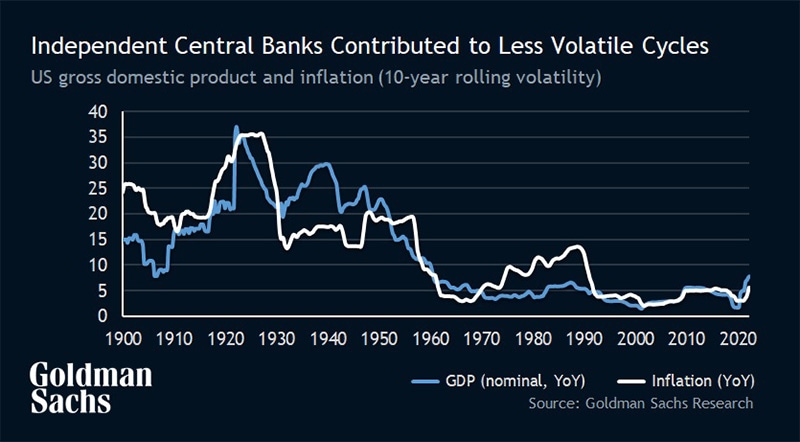

The cost of labor, capital and energy are rising as forces that had been in place since the end of the Cold War are changing, according to Goldman Sachs Research. The geopolitics of that period were relatively stable, and globalization was on the rise as India and China joined the World Trade Organization. Federal Reserve Chairman Paul Volcker snapped a wage-price spiral in the 1970s and independent central banks made inflation targeting a core mission — giving way to a long period of declining rates and lower inflation. Taxes fell in many places and some governments set about deregulating various industries.

“All of these things resulted in longer and more stable, less volatile, economic and financial cycles,” Oppenheimer says. But those drivers may not persist in a world where it’s estimated that $6 trillion of annual investment is needed for green energy to reduce climate change. Smaller government, lower taxes and less regulation are “being challenged for all kinds of reasons,” he says.

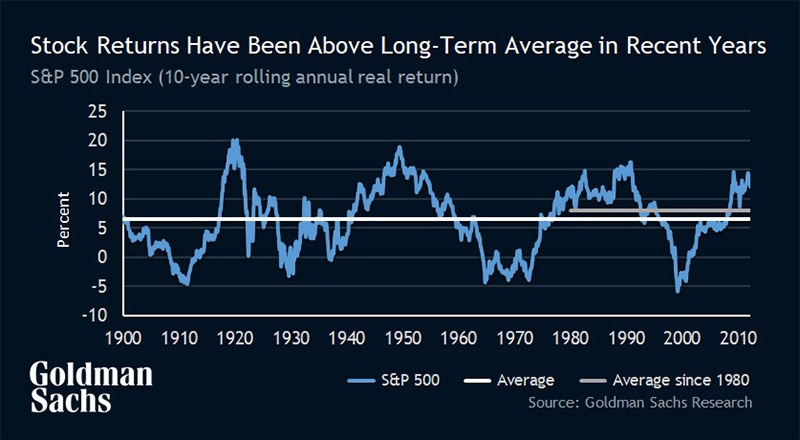

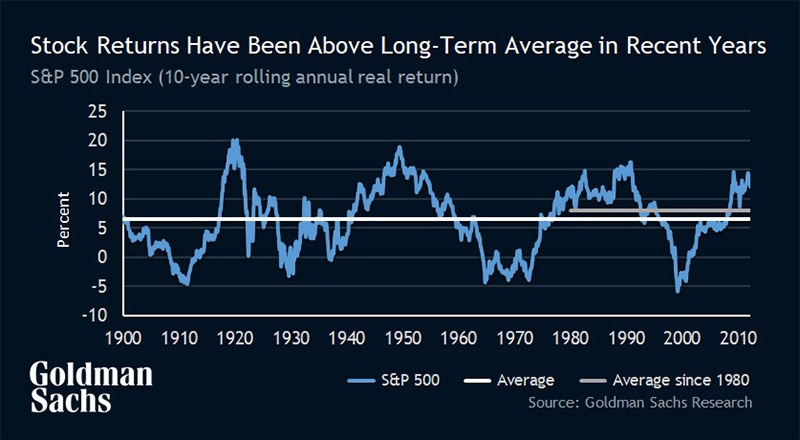

As inflation — and, subsequently, borrowing costs — rises, Oppenheimer expects shorter and more volatile economic and financial cycles. Financial assets (bonds as well as stocks) rose as rates over the decades fell — but returns are likely to be lower now that the reverse is happening, Oppenheimer says. One upshot is that stock pickers may have a better chance against index funds.

But capital is also becoming more expensive as interest rates rise. There’s more demand for capital relative to the amount of savings, and risk premiums are likely to climb because there are more uncertainties and the risk-free rate (Treasury yields) has risen.

“Very, very cheap capital has been one of the drivers of the growth of newer companies, which have managed to fund themselves at extremely cheap rates for a long time,” Oppenheimer says. The rising cost of capital can be painful when it causes valuations to adjust, but it can also result in healthier, more sustainable companies.

That isn’t to suggest that none of these tech and software firms are good companies, Oppenheimer says. “Some of them will no doubt recover and be some of the great growth leaders of the future,” he says. “It’s just that they couldn’t justify the valuations.”

And whereas the modern economy featured rapidly growing world trade that resulted in better profits for companies but pressure on wages for workers in wealthy countries, the postmodern cycle may see the reverse, Oppenheimer says. The pandemic and the war in Ukraine have exposed the frailties of just-in-time inventories, which is likely to result in some manufacturing and supply chains moving back from abroad, a trend that Oppenheimer says supports a tighter labor market and higher prices for goods and commodities.

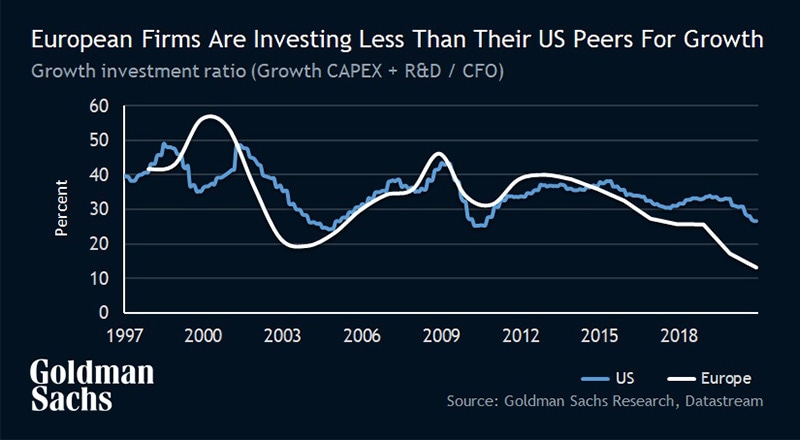

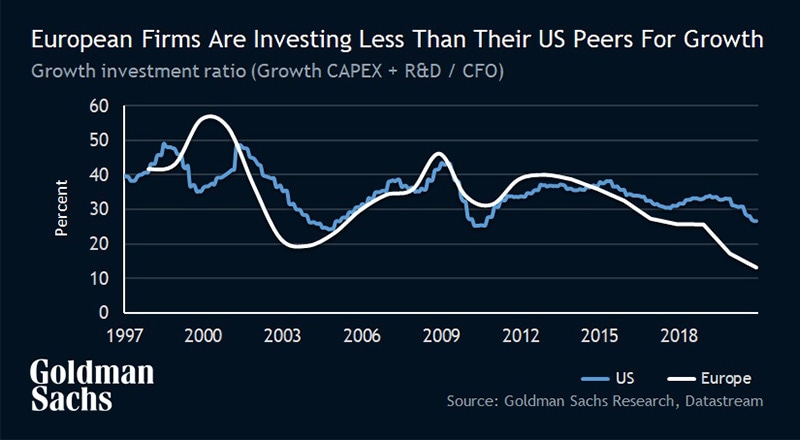

A scarcity of labor and commodities, meanwhile, is poised to spur investment in efficiency and productivity. “One of the conundrums of the last decade or so is that’s there’s been quite poor productivity growth despite a lot of technological innovation,” Oppenheimer says. “Higher income costs should encourage much more investment and innovation in efficiencies: becoming more energy efficient, for example, and the substitution of technology for labor — things like robotics.”

And that fits in with Goldman Sachs Research’s expectation for higher capital expenditures. In the past decade or so, traditional capital spending was in decline as economic growth was weak and many industries had lots of extra capacity. “The growing demand for spending on decarbonization and defense budgets as well as an incentive for investment in energy- and labor-savings technologies will trigger more capital spending,” Oppenheimer says.

There’s a risk, of course, that the world tips back into the old paradigm of slow growth and feeble inflation and interest rates — what some have called “secular stagnation.” “If that were to happen, you might go back to the patterns we were seeing before the pandemic,” Oppenheimer says. “But even so I think that other things are shifting: the geopolitics, the move to decarbonization. These are all longer-term developments that are distinct to what we were seeing pre-pandemic.

“Even if inflation starts to come down and interest rates peak soon,” he adds, “I don’t think we’re going back into a world where we’re getting continued declines in interest rates.”

Read the full report here.

- The Postmodern Cycle09 MAY 2022

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.