Should Stock Investors Look Beyond the Tech Giants?

- Elevated valuations, higher interest rates and inflation, and slower expansion of world trade are among the reasons why absolute market returns are likely to be lower than in past structural bull markets.

- While the technology sector is likely to continue to be a key driver of positive returns, Goldman Sachs Research expects the array of investment opportunities to broaden.

- New opportunities to outperform the broader equity market will emerge as AI demands upgraded digital and physical infrastructure and leads to improved productivity across both the services and manufacturing sectors.

- In this “pick and mix” market, investors may need to be more open to undervalued opportunities around the globe to supplement and diversify away from concentrated positions in the US.

Investors will likely need to look beyond the concentrated group of stocks that drove the market higher in recent years as benchmark returns become more modest and stock-picking opportunities emerge across a more diverse set of regions, sectors, and styles, according to Peter Oppenheimer, chief global equity strategist in Goldman Sachs Research.

Equity markets face headwinds that weren’t present during past structural bull markets. These include elevated valuations, higher interest rates and inflation, slower expansion of world trade, sluggish economic growth, and rising demands on government spending. Taken together, these factors mean that absolute returns are likely to be lower than during other sustained market rallies.

What’s the outlook for global stock market returns?

Structural bull markets typically start with low valuations. But valuations across credit and bond markets are already elevated, and US equity valuations particularly so. While that doesn’t necessarily mean US stocks are in a bubble—high valuations mostly reflect strong fundamentals, including higher margins and returns on equity (ROE)—investors should expect more moderate annual returns.

“The issue for investors is whether the US can maintain its premium ROE relative to other markets,” Oppenheimer writes in a report.

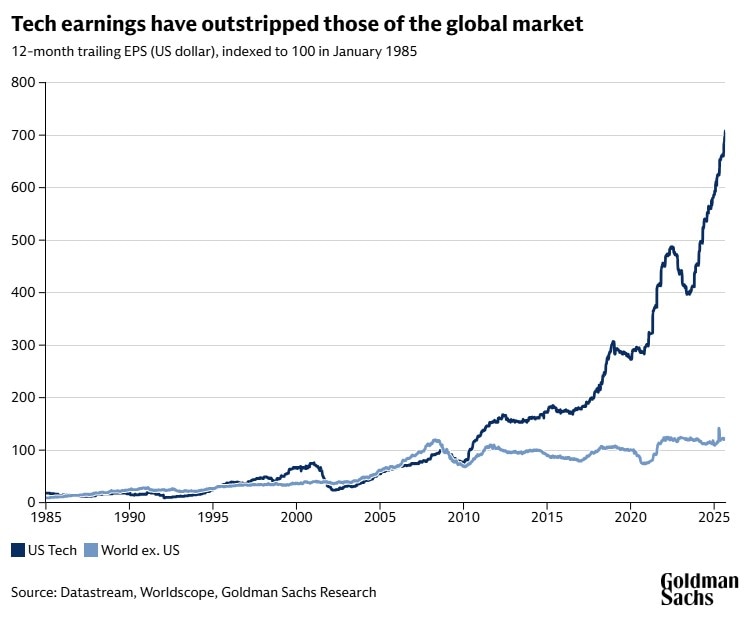

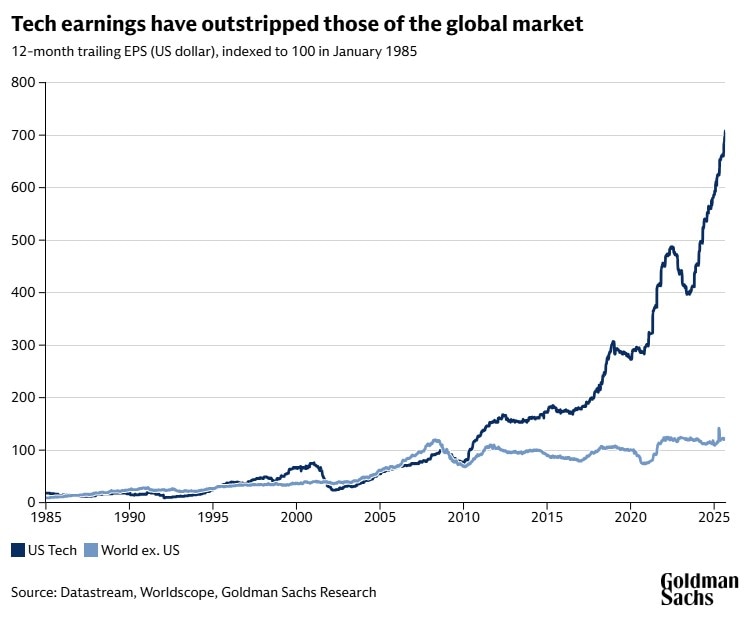

At the same time, the stock market, especially in the US, has been unusually concentrated around a handful of large technology companies. That “can be due to the success of a few large companies that manage to dominate specific sectors, as we have seen in recent years in the US technology industry,” Oppenheimer writes. Even so, higher concentration may be a risk for investors.

“Faced with more limited opportunities to diversify through bond exposure, we think equity investors should focus on diversification both within the technology sector and across industries.”

How will higher interest rates affect the stock market?

During recent major bull markets, interest rates and the cost of capital were declining. But in this cycle, longer-term bond yields have been rising as their fixed income becomes less valuable in a world of potentially higher inflation. Rising government debt levels are also increasing the return that investors are demanding to fund government deficits.

“Even in Japan yields are rising after decades of deflationary pressures, while the shift in fiscal spending is also resulting in a rise in interest rates in Germany,” Oppenheimer writes.

Declining bond yields have helped fuel other major bull markets, again suggesting lower equity returns going forward amid elevated interest rates.

How reduced globalization will impact financial markets

Global trade, meanwhile, is under pressure. That’s a reversal from the period since the late 1980s, when globalization was increasing. Now, a trend towards less global economic integration and higher tariffs is slowing world trade growth.

As a consequence, specialization may become more important. While higher US tariffs might slow demand, China is likely to remain a formidable competitor, as its factories boast large economies of scale and have huge cost advantages. This combination will make it harder to compete for emerging markets with a high share of exports to GDP, as well as for many economies in Europe.

“Investors should focus on countries and companies that can specialize and dominate in their export markets, particularly in services, to offset the impact of more high-end Chinese manufacturing competition,” Oppenheimer writes. He points out that higher tariffs and a weaker dollar, coupled with more fiscal support and localization, also point to investment opportunities in domestic-focused companies that have a dominant position in their respective markets.

Will AI cause stock returns to rise?

As companies race to develop AI, the technology is likely to disrupt the labor market and the internet. This will challenge existing business models while also boosting productivity and the development of new products and services, according to Goldman Sachs Research.

“The success of the technology sector as a driver of positive returns for investors is likely to continue, albeit with a broadening in investment opportunities,” Oppenheimer writes. Software as a service (Saas) companies may be able to use AI tools to create productivity gains for enterprises, for example. And a sharp increase in AI infrastructure may lower the barrier to entry for new companies, cannibalize some existing business models, or lower prospective returns on their increased capital expenditures.

There are also likely to be some beneficiaries of rising technology investment outside of the US. Europe, in particular, has lagged the US significantly in terms of investment spending over the past decade, making a ramp-up in investment in technology to substitute for labor more important. “With a new focus on strategic industry and self-reliance, we should see rising investment that, in specific areas, could boost margins and returns from a low base,” Oppenheimer writes.

Physical assets and infrastructure are increasingly important

For much of the past 20 years, technology companies and those with high intangible investments (such as social media companies) have had strikingly strong performance, particularly when compared with those requiring physical capital investments (such as heavy industry). While Goldman Sachs Research still expects technology investment to generate strong growth opportunities, what is changing is the opportunity to supplement this investment in companies in other sectors.

There are signs that the virtual and physical worlds are aligning. Goldman Sachs Research expects there to be opportunities for investors in companies that are poised to benefit from higher capital and investment spending in, for example, AI and data centers. Oppenheimer points out that this can improve the diversification of portfolios: Investors can employ a “barbell” approach, with investments in fast-growing technology companies as well as in the companies that will help facilitate this growth.

“For AI to fulfil its potential we need a rapid and meaningful upgrade to physical infrastructure,” Oppenheimer writes. “Coupled with a trend of increased defense spending, decarbonization, and electrification, we are seeing a new super cycle of capex spend.”

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.