The Global Economy Is Forecast to Post ‘Sturdy’ Growth of 2.8% in 2026

- Goldman Sachs Research’s forecasts for growth in most major economies in 2026 are at or above consensus estimates. It is most optimistic (relative to consensus) about the US because of tax cuts, easier financial conditions, and reduced drag from tariffs.

- In China, our economists expect robust growth in manufacturing but continued weakness in parts of the domestic economy.

- Despite longer-term challenges and competition from China, the euro area economy is forecast to increase 1.3% next year, owing to fiscal stimulus in Germany and strong growth in Spain.

- Our economists expect core inflation to moderate and policy rates to decline in developed markets in 2026.

The global economy is forecast to generate “sturdy” growth in 2026, according to Goldman Sachs Research. In fact, our economists’ projections for most major countries are at or above consensus estimates.

What is the global economic outlook for 2026?

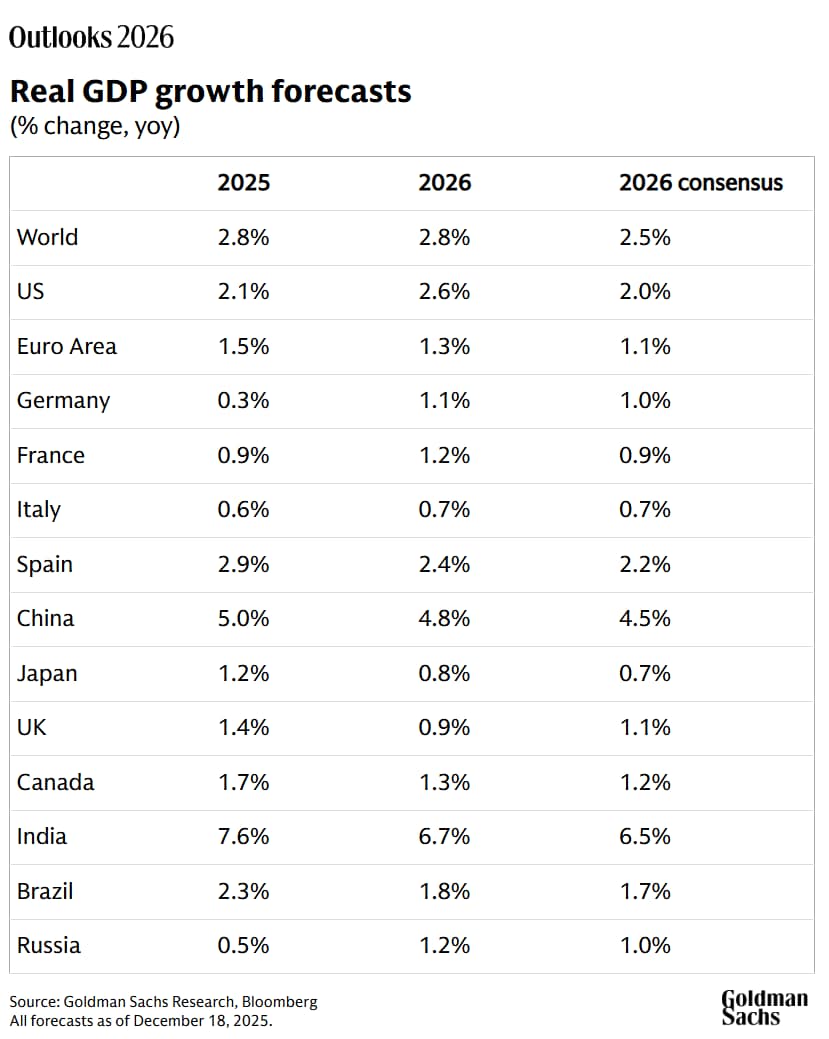

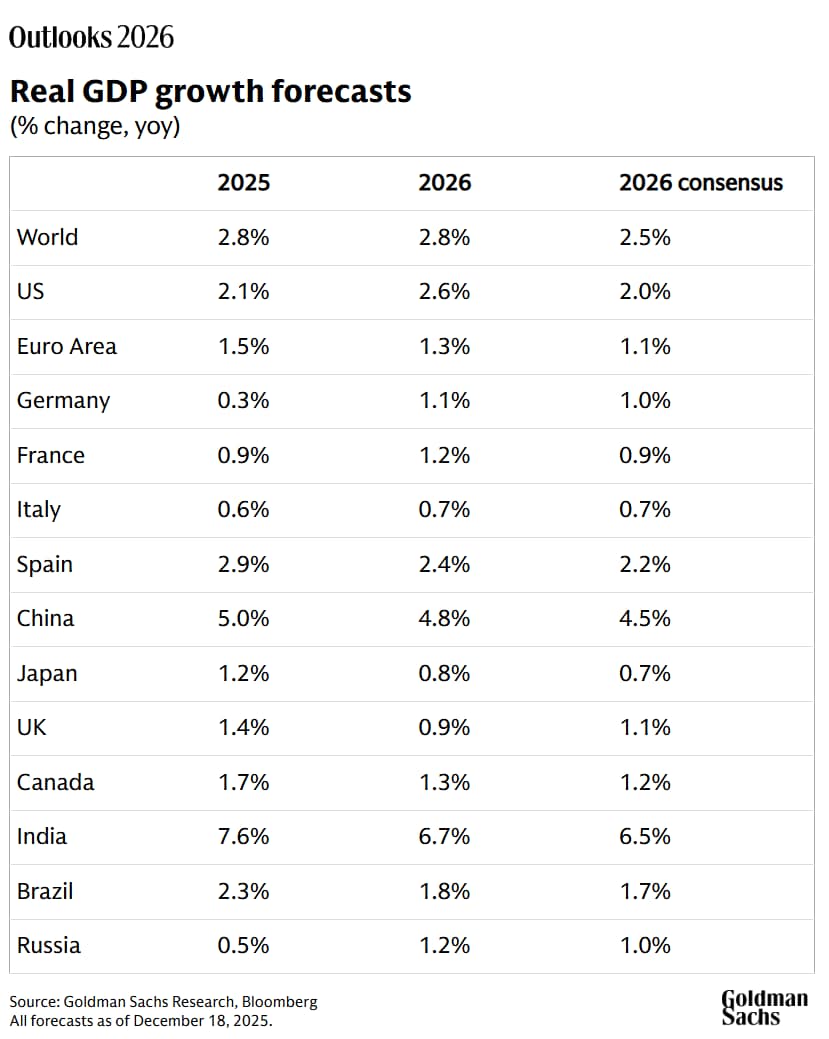

Global GDP is projected by Goldman Sachs Research to increase 2.8% in 2026 (versus the consensus forecast of 2.5%). US economic growth is expected to accelerate to 2.6%, while China’s GDP expands 4.8% as strong exports outweigh sluggish domestic demand. Despite longer-term challenges, our economists predict the euro area economy will increase 1.3%, owing to fiscal stimulus in Germany and strong growth in Spain.

“As has typically been the case since the pandemic, we are most optimistic (relative to consensus) in the US,” writes Jan Hatzius, chief economist and head of Goldman Sachs Research, in the team’s report titled “Macro Outlook 2026: Sturdy Growth, Stagnant Jobs, Stable Prices.”

What is the forecast for US GDP growth in 2026?

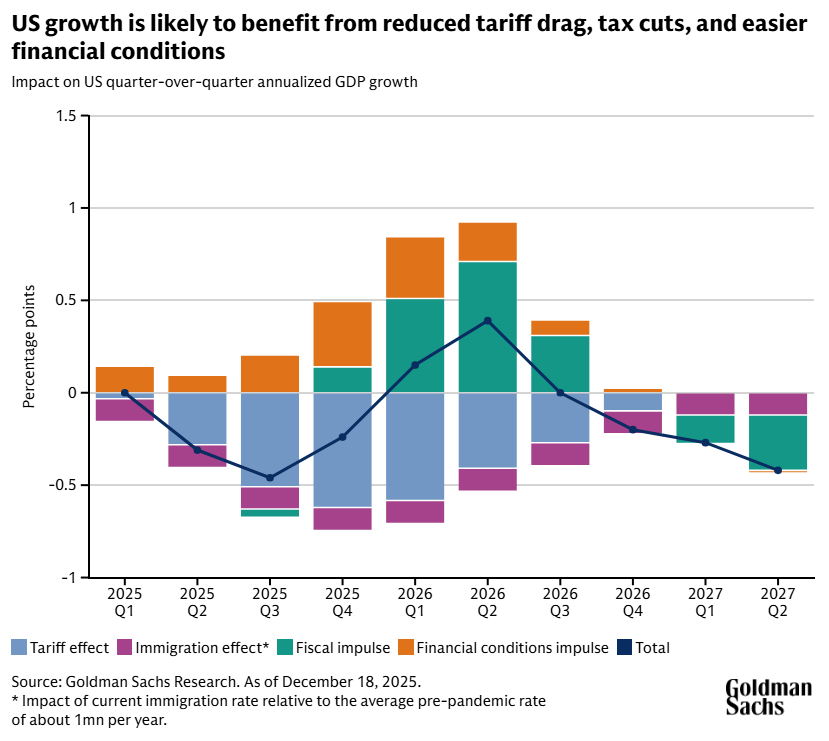

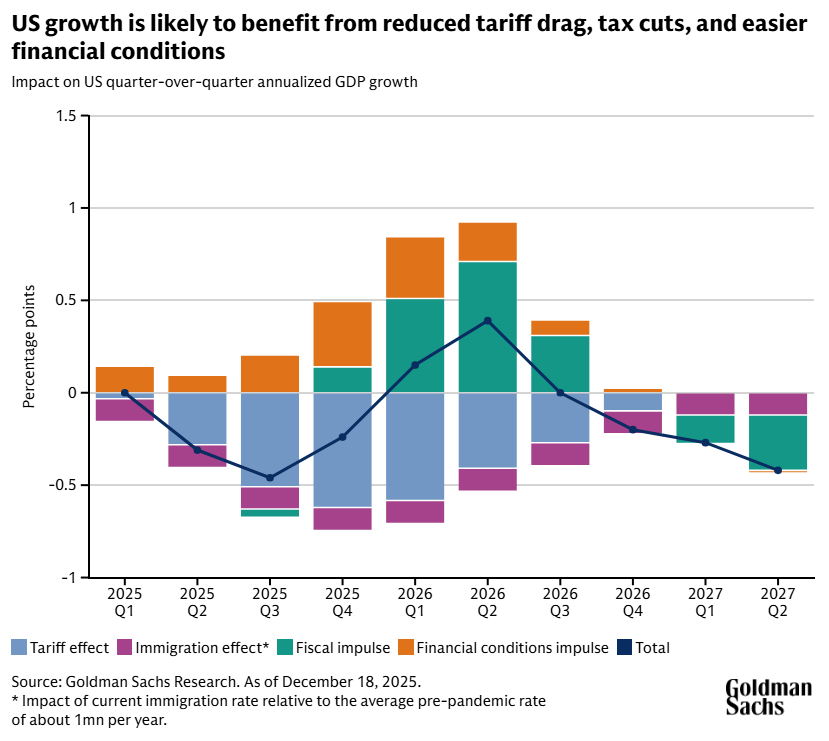

The US is expected to substantially outperform consensus estimates because of tax cuts, easier financial conditions, and a reduced drag on the economy from tariffs. As a result of tax cuts, for example, consumers will receive around an extra $100 billion (0.4% of annual disposable income) in tax refunds in the first half of next year.

The impulse from these forces is expected to be front-loaded in the first half of 2026, and the rebound from the US government shutdown will also provide a boost. “We expect especially strong GDP growth in the first half of next year,” Hatzius writes.

However, while global GDP is rising, it hasn’t resulted in stronger performance from the labor market. Job growth across all major developed-market economies has now fallen well below the rates prevailing in 2019, just prior to the pandemic.

Although it doesn’t provide the full explanation, the job-market weakness mirrors the sharp downturn in immigration and, in turn, labor force growth, Hatzius writes. The disconnect in employment is most pronounced in the US, where job growth may well have been negative over the summer.

The impact of artificial intelligence (AI) on jobs and productivity, meanwhile, has so far mainly been confined to the technology sector, according to Goldman Sachs Research. Our economists expect that the largest productivity benefits from AI are still a few years off.

The outlook for China’s economy in 2026

The narrative for China’s economy is much more mixed. China’s ability to produce increasingly higher quality goods at lower prices remains unmatched, Hatzius writes. The world’s second-largest economy has demonstrated that it has the capability to deter high tariffs on its exports, as seen in recent trade negotiations with the US.

“All this suggests that the Chinese manufacturing sector should continue to grow robustly,” Hatzius writes.

At the same time, large parts of China’s domestic economy remain weak. While the largest drag on GDP growth from the property downturn has probably already taken place (property sales are down 60% and property starts are down 80% from the peak), our economists estimate that the property sector will produce a 1.5 percentage point drag on GDP growth next year.

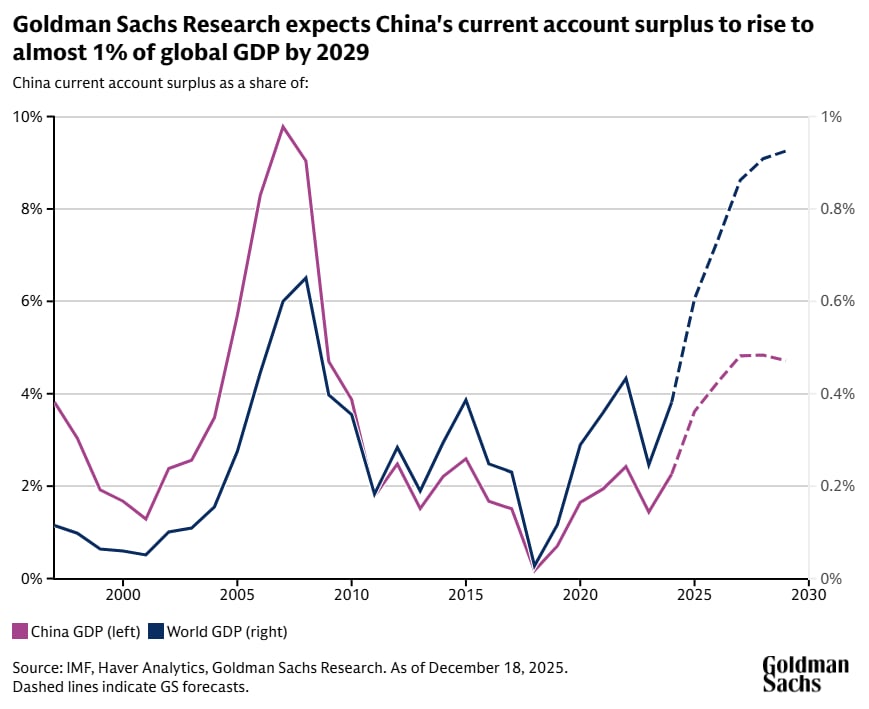

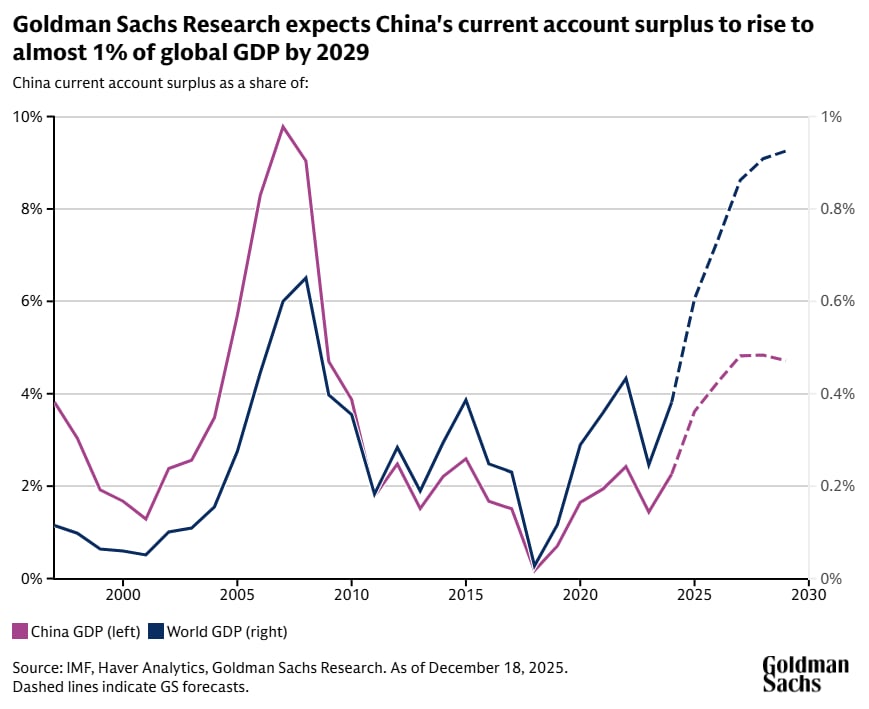

“The combination of a strong manufacturing sector and weak domestic demand is pushing China’s current account surplus ever higher,” Hatzius writes.

Our economists expect its current account surplus to increase to almost 1% of global GDP over the next 3-5 years, the biggest surplus of any country in recorded history. “This is likely to weigh heavily on growth in economies that compete intensively with China such as the euro area, and particularly Germany,” Hatzius adds.

What is the forecast for the euro area’s economy in 2026?

Increased competition from China reinforces the structural weaknesses of the euro area economy, including demographic decline, overregulation, and high energy costs, according to Goldman Sachs Research.

Despite these challenges, the euro area should grow at a “decent” 1.3% pace in 2026, Hatzius writes. GDP growth in Germany is expected to benefit from the sharp increase in federal government spending that is underway. And our economists expect growth in Southern Europe to remain solid, especially in Spain where real consumer spending has continued to grow at around 3% and the economy’s diversification into higher value-added services continues apace.

Inflation is forecast to moderate in 2026

Core inflation in developed markets is expected to fall to levels that are broadly consistent with policy targets in 2026.

In the US, the main reason why core Personal Consumption Expenditures (PCE) inflation has remained elevated in 2025 is because of tariff pass-through. Excluding tariffs, our economists estimate that inflation has continued to fall and now stands at 2.3%. And although tariff pass-through will likely rise modestly further (assuming tariffs stay around their current levels), the impact on year-on-year inflation will diminish sharply in the second half of 2026 because of favorable so-called base effects.

An important factor weighing on inflation in the US and UK is the notable recent slowdown in wage growth in both economies. In the US, nominal wages are now growing below the 4% “sustainable” rate that our economists estimate is consistent with 2% inflation. In the UK, the most recent pace of wage growth is close to our economists’ estimate of the sustainable rate of 3%.

What is the outlook for central bank rate cuts in 2026?

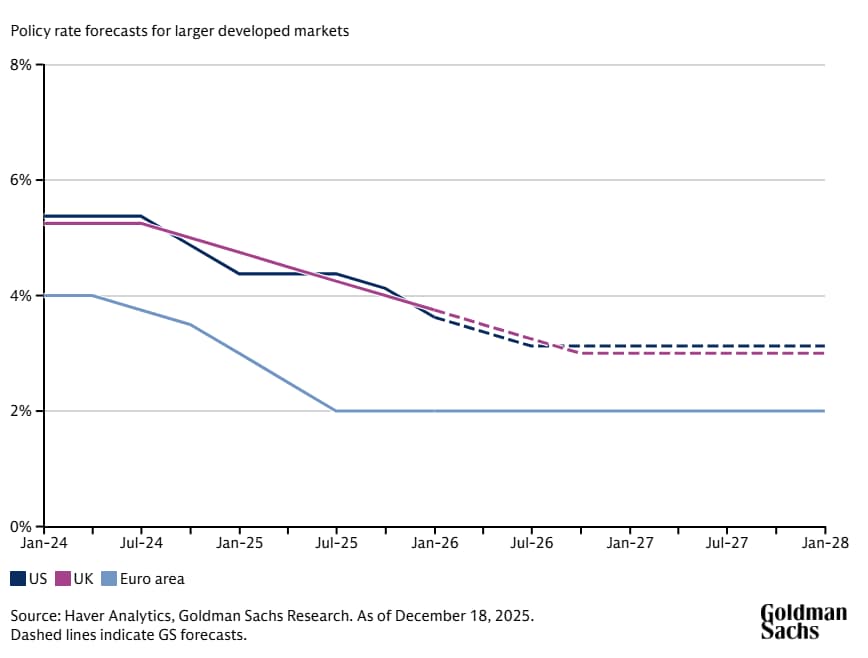

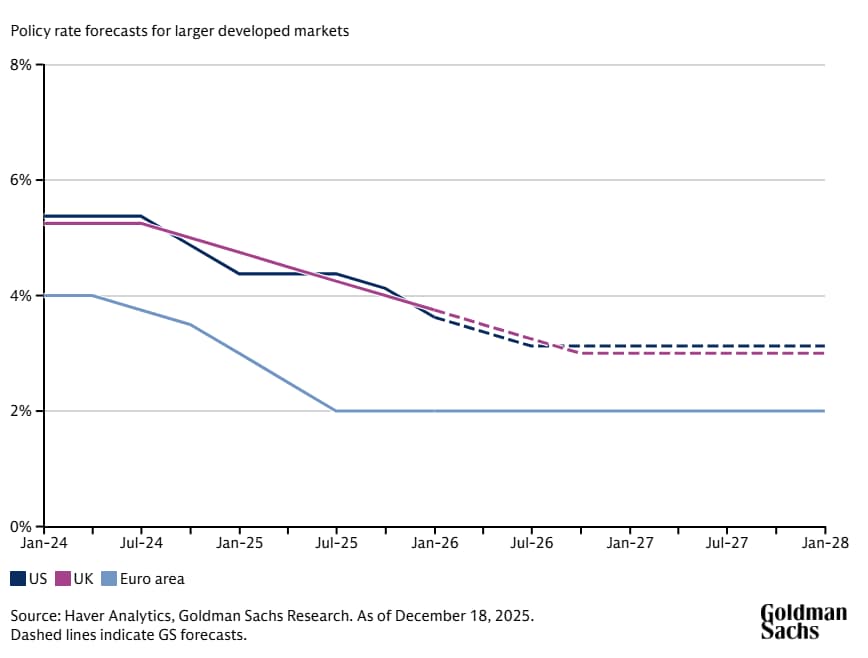

As with inflation, Goldman Sachs Research expects developed-market policy rates to converge lower in 2026. Three of the countries with higher policy rates—the US, UK, and Norway—are forecast to make further cuts.

The US Federal Reserve is projected to reduce its policy rate by 50 basis points to 3-3.25% in 2026. Goldman Sachs Research’s view is that the US inflation issue has been resolved, and there’s potential for the Fed to cut rates more than expected.

Our economists’ baseline forecast for the UK is a sequence of quarterly rate cuts to 3% by the third quarter of 2026. Meanwhile Norway’s central bank is expected to cut rates by 50 basis points to 3.5% in 2026. The European Central Bank, by contrast, is expected to hold policy rates steady as inflation falls.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.