US assets will benefit from steady growth and persistent advantages

S&P 500 annual returns have exceeded 20% over the past two years, continuing their long run of outperformance since the trough of the global financial crisis (GFC). Inevitably, investors may now wonder: Is it time to trim back exposure to US equities? Goldman Sachs’ Wealth Management Investment Strategy Group (ISG) says the answer is a “resounding no.”

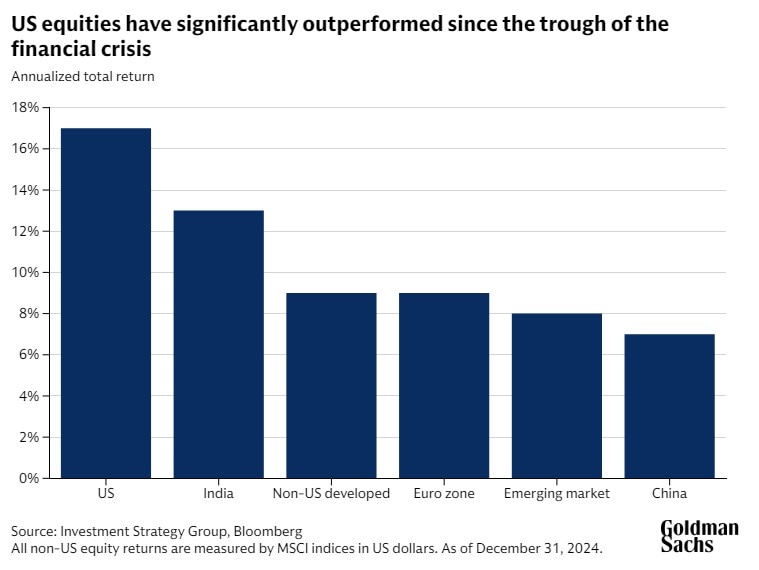

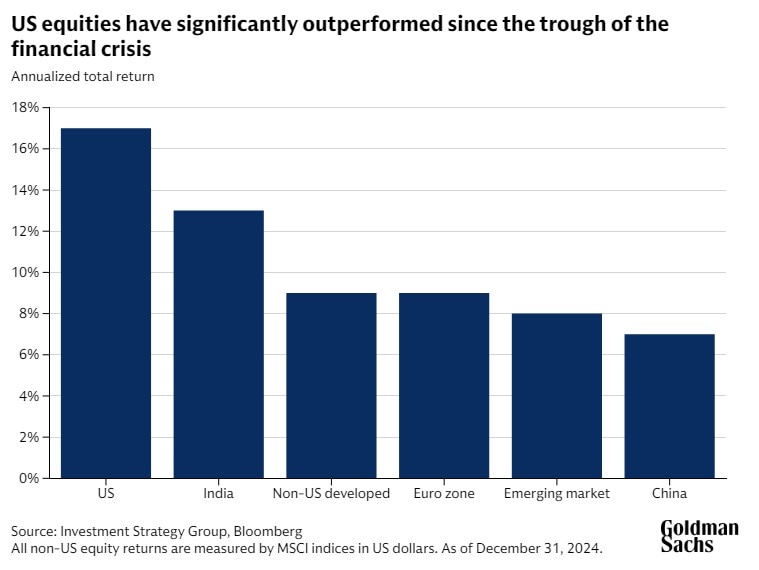

ISG has recommended overweighting US stocks since the trough of the GFC, based on the group’s investment theme of “US Preeminence.” This view is underpinned by the fact that the US enjoys economic and structural advantages — such as higher productivity, top ranked education institutions and innovation, and dynamic capital markets — that make it the most attractive place to invest. Over this 15-year period, ISG has also recommended clients stay invested in US equities. Clients who followed this advice were positioned for strong performance: US equities have outperformed non-US developed markets by 8 percentage points on an annualized basis and emerging market equities by 9 percentage points since the trough of the GFC.

In their 2025 Outlook — Keep on Truckin’ — ISG reiterates that its “US Preeminence” and “Stay Invested” themes remain intact.

That said, ISG doesn’t expect US equities to meaningfully outperform non-US equities over the next five years — and most definitely not by the magnitude seen over the last 15 years. ISG’s base case is for the S&P 500 index to deliver an 8% return in 2025 and 5% annualized over the next 5 years. ISG’s forecasts may differ from those of other groups at Goldman Sachs.

Why investor portfolios should be overweight US assets

ISG’s view of “US Preeminence” is predicated on several factors that have helped create the largest and most diverse, innovative, and resilient economy in the world. Some of the factors are economic, like the size of the economy and the country’s wealth, and some are structural, like good governance and a system of checks and balances.

The US has been the world’s largest economy since the 1890s and will remain so for the foreseeable future, “as the gap between the US and the rest of the world continues to widen — just as it did in 2024,” says Sharmin Mossavar-Rahmani, head of ISG and chief investment officer of Wealth Management. Last year, the US added $1.4 trillion to its GDP, whereas China added $937 billion, and the entire euro zone added $619 billion. The increase in US GDP per capita in 2024 dwarfed those of other countries, while US labor productivity surged.

The economic wealth of the US and its continued growth is significant as it allows for a much greater allocation of resources to research and development (R&D), innovation, healthcare, education, the military, and other areas. In addition, it also affords the country its unique status as the issuer of the world’s reserve currency.

This unique combination of economic, cultural, and structural factors — and the widening of the gap between the US and other countries across most of these metrics for the foreseeable future — underlines ISG’s strategic overweight to US assets.

Why investors should stay invested in US equities

The 2025 Outlook highlights several reasons why investors should favor US stocks over shifting to other allocations:

- Non-US equities: While non-US developed market equities are trading at a historic discount of 54% to US equities, and emerging market equities are at an even deeper discount, ISG believes the lower valuations are justified. “While we acknowledge that US equities are expensive, we also show that high valuations alone are not an effective market-timing signal, and that the record cheapness of most non-US equity markets is warranted by their inferior corporate fundamentals and structural economic weaknesses,” says Brett Nelson, head of tactical asset allocation for ISG.

- Bonds and cash: ISG expects US equities to outperform both intermediate-duration US bonds and cash in 2025, based on its economic growth forecast of 2.3%.

- Gold and bitcoin: Despite the 27% increase in the spot price of gold and the 123% increase in the price of bitcoin in 2024, ISG doesn’t believe that either gold or bitcoin have a strategic role in clients’ portfolios. Gold doesn’t generate income, and — contrary to popular belief — it’s not an inflation hedge. Bitcoin doesn’t meet ISG’s criteria of an investable asset. For example, it doesn’t dampen volatility, provide consistent and reliable diversification benefits to a portfolio, generate steady reliable cash flow on a contractual basis (like bonds), nor does it generate earnings through exposure to economic growth (like equities).

Pullbacks of 5-10% reflect normal equity volatility

ISG’s recommendation to stay invested doesn’t preclude occasional market pullbacks which can happen at any time. Pullbacks of approximately 5-10% represent normal equity volatility and aren’t a compelling reason to underweight stocks. In fact, there’s an 80% probability that the S&P 500 pulls back 10% from its high during a one-year period when valuations are elevated.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.