Why AI Companies May Invest More than $500 Billion in 2026

- The consensus estimate for 2025 capital expenditure by AI hyperscalers is climbing. However, analyst estimates have consistently underestimated capex spending related to AI.

- The recent divergence in the performance of AI-related stocks shows investors aren’t willing to reward all AI big spenders the same.

- Investors have rotated away from AI infrastructure companies where growth in operating earnings is under pressure and capex spending is debt-funded.

- Goldman Sachs Research expects the next phases of the AI trade to involve AI platform stocks and productivity beneficiaries.

Companies’ capital spending on artificial intelligence (AI) is expected to climb still higher in the coming year, according to analyst estimates. But investors are being more selective about AI stocks, according to Goldman Sachs Research.

Third-quarter earnings triggered another increase in capex projections for the hyperscaler AI companies that have the size and resources to deploy AI infrastructure at scale. The consensus estimate among Wall Street analysts for the group’s 2026 capital spending is now $527 billion, up from $465 billion at the start of the third-quarter earnings season, continuing a trend of upward revisions.

What happens next in the AI trade?

The past few months have seen the stock prices of AI hyperscalers diverge: Investors have rotated away from AI infrastructure companies where operating earnings growth is under pressure and where capex is being funded via debt. At the same time, investors have rewarded companies demonstrating a clear link between capex and revenues, such as some of the world’s biggest cloud platform operators.

For example, earlier this year, the biggest AI stocks rose as a group on the continued strength of AI investment spending. But since June, the average stock price correlation across the large public AI hyperscalers has declined from 80% to just 20%. Goldman Sachs Research says some of the dispersion has been driven by the degree of investor confidence that AI investments are generating revenue benefits.

“The combination of continued corporate AI adoption and growing concerns about the AI infrastructure complex has increased recent investor focus on the next beneficiaries of the ever-expanding AI trade,” Goldman Sachs Research analyst Ryan Hammond writes in the team’s report.

Which stocks are likely to benefit from AI?

Many investors believe that AI adoption will eventually boost economic productivity growth and benefit an expanding universe of companies. But the practical focus of most investors has primarily been on the near-term earnings beneficiaries of the current boom in AI investment spending, according to the report.

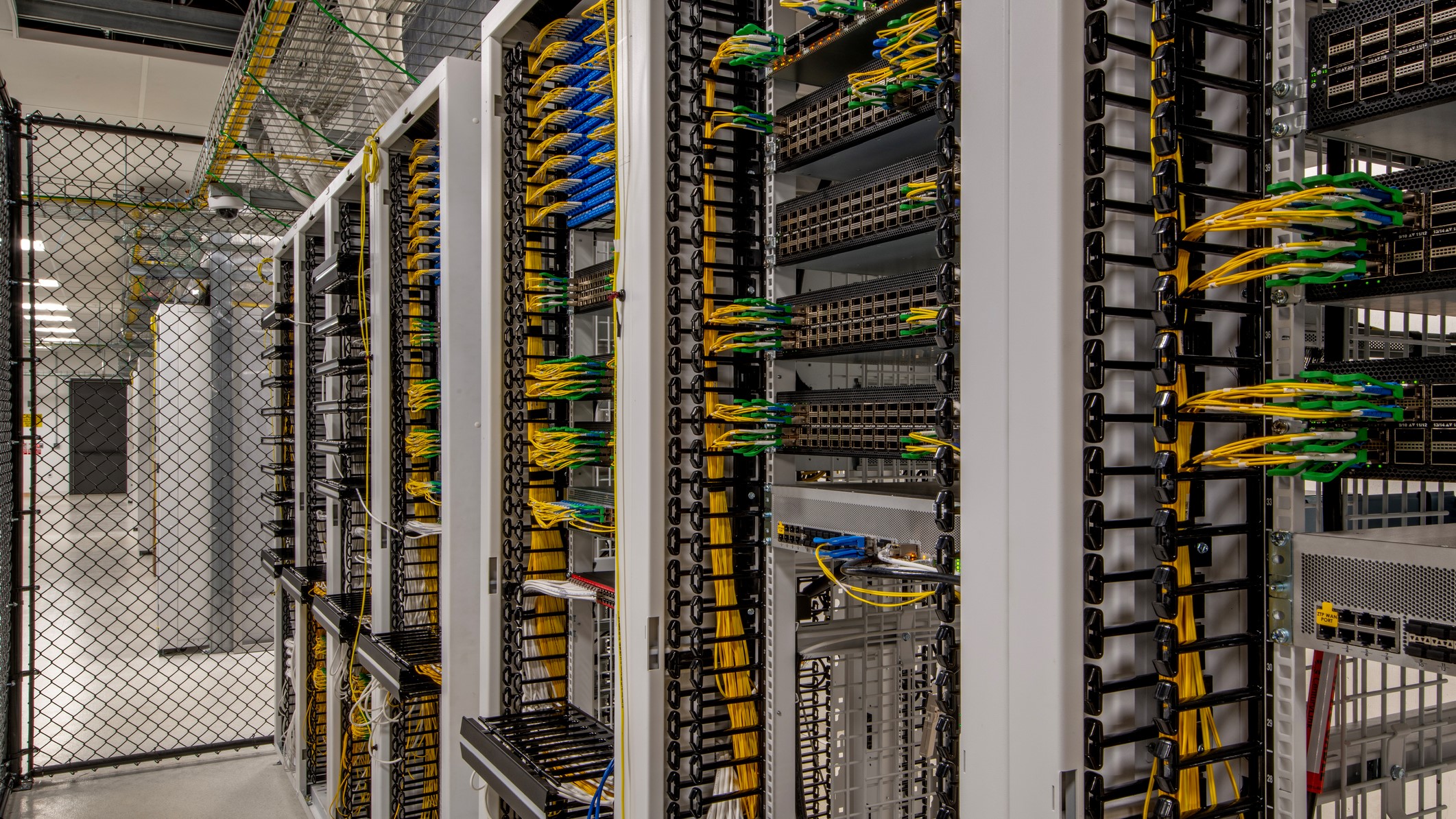

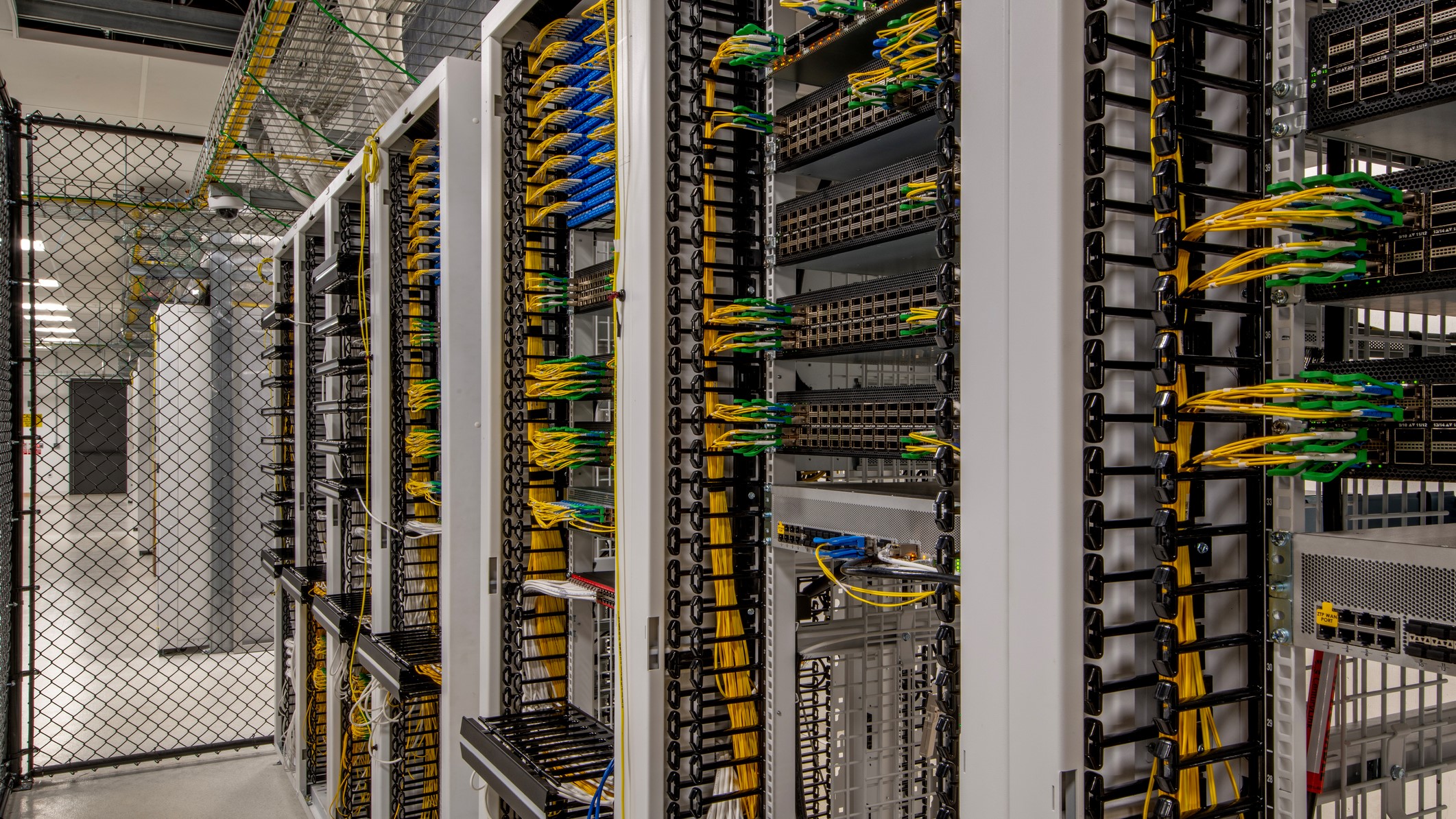

In turn, equity gains have been concentrated in AI infrastructure companies, according to Goldman Sachs Research. These include semiconductors, hyperscalers and other data center operators, technology hardware providers, and power companies. The average stock in Goldman Sachs Research’s basket of infrastructure companies returned 44% year-to-date, compared with a 9% increase in the consensus two-year forward earnings-per-share estimate for the group. “The timing of an eventual slowdown in capex growth poses a risk to these companies’ valuations,” Hammond writes.

Our researchers say attention is starting to shift to companies in other phases of the AI trade, such as companies with the potential for AI-enabled revenues. Some of those firms—primarily members of the software and services industry group—have struggled in recent months because they have yet to realize AI-enabled revenue growth. But a group of “AI Platform” stocks, which include the providers of database and development tools, have proved an exception. Their stocks have recently outperformed, and our analysts expect them to continue to benefit as corporate AI adoption increases.

The performance of stocks in another phase—AI Productivity Beneficiaries—has similarly underwhelmed as investors have struggled with the uncertainty surrounding the timing and magnitude of future earnings benefits.

Our analysts’ framework for companies that could benefit from an AI productivity uplift focuses on labor costs as a share of sales and exposure to AI automation as two key inputs. The group of potential AI Productivity Beneficiaries stocks has lagged the recent trajectory of their earnings (and their stock gains have lagged behind the broader S&P 500 index), suggesting an “attractive risk-reward for investors seeking to expand their exposure to AI beyond the infrastructure layer,” they write.

How much are hyperscaler tech companies expected to invest in AI?

If recent history holds, analyst estimates for technology capex may be revised higher still. The hyperscalers spent $106 billion in capex in the third quarter this year (including AI and non-AI expenditures), representing a year-over-year growth rate of 75%. Analysts expect this growth rate will slow sharply to 49% in the fourth quarter and to 25% by the end of 2026.

But Goldman Sachs Research notes that consensus capex estimates have proven to be too low for two years running. At the start of both 2024 and 2025, consensus estimates implied capex growth of roughly 20% for the year. In reality, it exceeded 50% in both years.

While capex spending at the large public hyperscalers has surged in the last few years, it remains far below levels indicated by previous technology investment cycles. AI capex has recently equated to 0.8% of GDP, compared with peaks levels reaching 1.5% of GDP or greater during other technology booms of the past 150 years. AI hyperscaler capex would need to reach $700 billion in 2026 to be in line with the peak of spending during the late 1990s telecom investment cycle.

For the hyperscaler companies, supply bottlenecks or investor appetite are more likely to constrain capex than cash flows or balance sheet capacity.

In fact, the magnitude of spending in historical technology investment cycles suggests as much as $200 billion upside to current hyperscaler 2026 capex estimates, Hammond and the team write. “The strong balance sheets of the largest hyperscalers—and their recent willingness to employ those balance sheets—support the outlook for continued capex spending growth.”

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Subscribe to Briefings

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.