Global Stocks Are Projected to Return 11% in the Next 12 Months

- After strong gains last year, global equities are likely to continue climbing in 2026, as Goldman Sachs Research forecasts 11% returns over the next 12 months (including dividends, in US dollars).

- Stocks are expected to be supported by earnings and economic growth around the globe, though last year’s gains have left valuations historically high.

- Investors benefited last year if they diversified across regions, and that trend may continue—with diversification among styles and sectors also potentially boosting returns.

The global bull market likely will continue this year, helped by earnings and continued economic growth, although equities’ gains are not forecast to match 2025’s dramatic advance, according to Goldman Sachs Research. The world economy is poised for continued expansion across all regions in 2026, and the US Federal Reserve is forecast to provide further modest easing.

“Given this macro backdrop, it would be unusual to see a significant equity setback/bear market without a recession, even from elevated valuations,” Peter Oppenheimer, Goldman Sachs Research’s chief global equity strategist, writes in a report titled “Global Equity Strategy 2026 Outlook: Tech Tonic—a Broadening Bull Market.”

Diversification was a core theme for Goldman Sachs Research last year. Investors who diversified across regions in 2025 were rewarded for the first time in many years, and our analysts expect diversification to continue as a theme in 2026, extending across investment factors such as growth and value and across sectors. (Investment factors are asset traits like size, value, or momentum that tend to affect risk and returns.)

What is the outlook for global stocks in 2026?

While stocks performed strongly in 2025, outpacing commodities and bonds, the gains didn’t happen in a straight line. Equities underperformed early in the year, with the S&P 500 undergoing a correction of almost 20% between the middle of February and April, before rebounding. The strong rally in global equities has left valuations at historically high levels across all regions—not just in the US but also in Japan, Europe, and emerging markets, Oppenheimer writes.

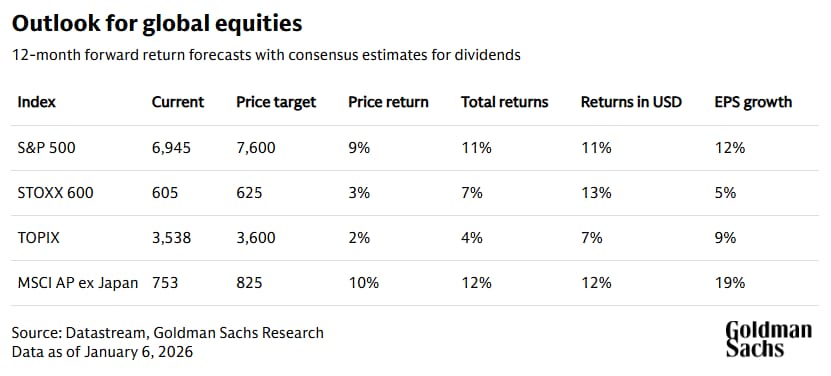

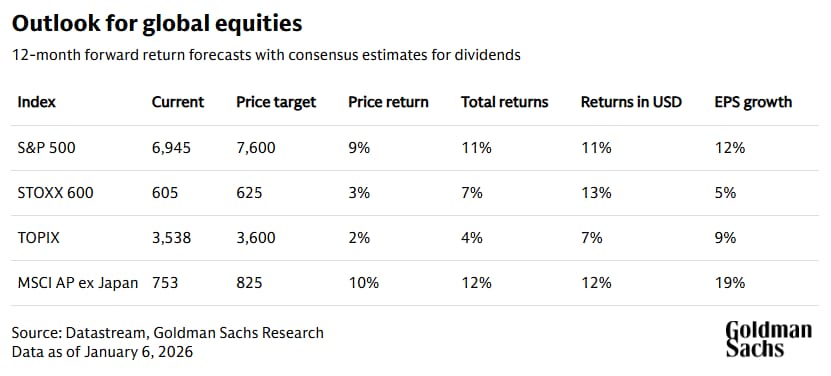

“Consequently, we think that returns in 2026 are likely to be driven more by fundamental profit growth rather than by rising valuations,” Oppenheimer writes. Our analysts’ 12-month global forecasts indicate equity prices, weighted by regional market cap, are expected to climb 9% and return 11% with dividends, in US dollars (as of January 6, 2026). “Most of these returns are earnings-driven,” he adds.

Commodity indexes are also expected to advance this year, with gains in precious metals again offsetting declines in energy, as occurred in 2025, according to a separate Goldman Sachs forecast.

Oppenheimer’s team examines what typically happens as markets move through cycles: despair as stocks fall in a bear market; a short hope phase as the market rebounds; a longer growth period when earnings increases drive returns; and finally optimism, as investors become confident and perhaps even complacent.

Their analysis suggests stocks now are in the optimism phase of a cycle that began with the bear market in 2020 during the Covid pandemic. “The late-cycle optimism phase typically sees rising valuations, suggesting some upside risks to our central forecasts,” our team writes.

Should investors diversify their stock portfolios in 2026?

Geographic diversification benefited investors in 2025, which is unusual; the US underperformed some other major markets for the first time in nearly 15 years. Equity returns in Europe, China, and Asia generated almost double the total returns for the S&P 500 in dollar terms as the US currency declined.

While US equities were driven by earnings growth, particularly for large technology companies, outside the US there was a more even balance between improving earnings and rising valuations. The gap in growth-adjusted valuations between US equities and the rest of the world narrowed last year.

“We expect these growth-adjusted valuation ratios to continue to converge in 2026, even as absolute valuations in the US remain higher,” Oppenheimer’s team writes.

Diversification should continue to offer potential for better risk-adjusted returns in 2026, Oppenheimer writes. Investors should look for opportunities for broad geographic exposure, including an increased focus on emerging markets. They should seek a mix of growth and value stocks and look across sectors. And they may watch for the possibility that stocks move less in lockstep, creating a good opportunity for picking individual names.

“We also focus on increased alpha, as stock correlations have fallen and are likely to remain low,” Oppenheimer writes. Alpha compares an asset’s performance to a broader market index.

Non-tech sectors may perform strongly this year, Oppenheimer adds, and investors may benefit from stocks that see positive spillover from technology companies’ capital expenditures. There’s likely to be a rising focus on companies outside of the technology sector that will benefit as new artificial intelligence (AI) capabilities come to fruition.

Are AI stocks in a bubble?

Overall, the market’s focus on AI “remains intense,” our analysts write. That does not mean, however, that there is an AI bubble. “The tech sector’s dominance of markets has not been triggered by the emergence of AI,” Oppenheimer writes. “It began after the financial crisis and has been supported by superior profit growth.”

While the share prices of large technology companies have soared, valuations are not as extreme as in past bubbles. In one measure of that, a comparison of the valuation of the five largest companies in the S&P 500 to that of the other 495 stocks shows a much smaller difference than in prior cycles, such as the peak of the tech bubble in 2000.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Our signature newsletter with insights and analysis from across the firm

By submitting this information, you agree that the information you are providing is subject to Goldman Sachs’ privacy policy and Terms of Use. You consent to receive our newsletter via email.