Discover the cost of reaching net-zero and the themes that are shaping progress towards a low-carbon global economy.

Latest

Goldman Sachs Research finds decarbonization is at a turning point

Efforts to decarbonize the global economy are reaching a turning point. Last year’s cost inflation is starting to reverse for some key clean-energy technologies such as solar and batteries, which is improving the affordability of lower carbon energy, according to Goldman Sachs Research.

GCC Capex Wave Series: The rise in low-carbon capex

Continuing on from their recently launched GCC Capex Wave Series, our Goldman Sachs Research analysts have released the second report in the series. In this report, they identify the projects being implemented by GCC countries on the path to achieving their decarbonization targets.

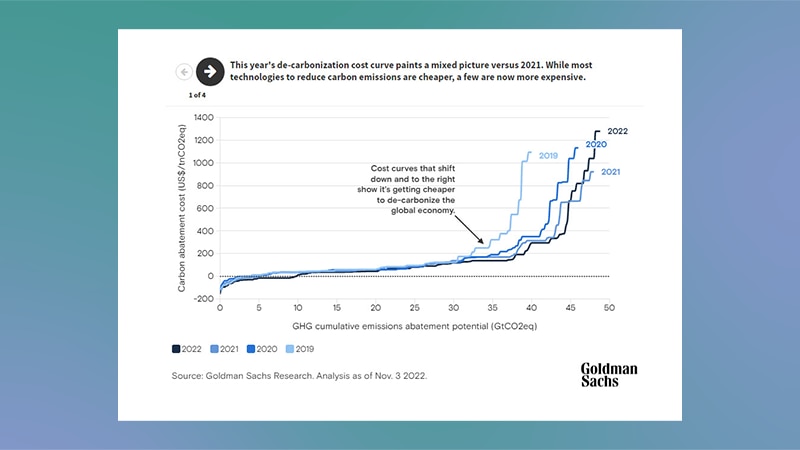

Carbonomics: Updated cost curve shows diverging trends between power and transport

Our Goldman Sachs Research analysts have updated their de-carbonization cost curve for the fifth consecutive year. Their findings show the continued evolution of the cost curve with the lower end more expensive as it is impacted by lower commodity prices, inflation and interest rates. While technologies at the high cost end of the cost curve, dominated by transportation benefit from lower battery prices.

How quantifying Avoided Emissions can broaden the decarbonization investment universe

In this report, GS Research discusses why they believe quantifying avoided emissions can broaden the decarbonization investment universe.

Carbonomics: The third American energy revolution

The US Shale revolution is entering its age of maturity and eventual decline. Goldman Sachs Research analysts estimate that renewable technologies can deliver twice the scale of energy produced by shale, unlocking $3 trn of infrastructure investment over the coming decade.

Balancing Growth with Decarbonisation

India's electricity sector is undergoing a generational shift as the country attempts to grow and decarbonize simultaneously, according to Goldman Sachs Research. The analysts foresee the beginning of a peak power deficit cycle, increasing the importance of storage-backed round-the-clock renewable energy (RTC RE). The viability of RTC RE in certain use cases will provide an economic incentive for transition, and unlock a superior business model for utilities.

Is the Inflation Reduction Act a Game Changer for Reaching Net Zero?

The sweeping climate, healthcare and tax bill is estimated to provide more than $390 billion of energy and climate spending over a 10-year period, according to the US Congressional Budget Office, with about $270 billion of that coming in the form of incremental tax incentives for businesses and individuals to pursue and invest in cleaner and more efficient energy sources.

Carbonomics: The Economics of Net Zero

As a cornerstone of their Carbonomics analysis, our Goldman Sachs Research analysts have updated their de-carbonization cost curve for 2022.

The Path to Net Zero: Managing the Transition

Rising concerns over climate change are spurring investments into clean energy to help bring the world closer to net zero. But where are we in that transition? And how is that path to decarbonization affecting investments in traditional oil and gas projects? In this episode of Exchanges at Goldman Sachs, Michele Della Vigna, head of natural resources research for Goldman Sachs in EMEA, explains the impact of higher fossil fuel prices on the low-carbon transition and the investment that is required to get to net zero.

Europe’s Path to a Sustainable, Reliable, and Affordable Energy Future

Russia’s invasion of Ukraine has upended the European energy playbook. To better understand the current situation and future possibilities for the continent’s energy needs, we asked senior leaders throughout Goldman Sachs for their analysis.

GS SUSTAIN: Green Capex - Accelerating the Energy Transition - Stimulating Capital and Return on Capital

In this report, Goldman Sachs Research highlights where capital is needed, what investors are rewarding and strategies/vehicles to stimulate investment with a case study on China decarbonization strategies. To stimulate greater capital towards the Energy Transition and broader sustainable development goals, GS Research analysts believe stakeholders such as investors, managements and policymakers should deploy the three Cs: collaboration, comprehensive focus, and corporate returns clarity.

GS SUSTAIN: Green Capex - US Inflation Reduction Act - What's Transformational, What's Supportive, What's Underappreciated

The Inflation Reduction Act (IRA) — signed into law by President Biden on August 16 — provides about $386 billion in energy and climate spending over 10 years, with related tax incentives up about $265 billion from the prior run rate. With annual investment needed globally this decade to be on path for Net Zero by 2050 +$1.8 trillion vs. the annual run rate in 2016-20, the IRA is helpful but not an immediate panacea to put the world on track. Goldman Sachs Research Analysts see the IRA as a catalyst to accelerate investment in longer-term carbon capture utilization and storage projects. GS Research Analysts also see the IRA as supportive for solar, electric vehicles, residential clean energy and nuclear energy.

Carbonomics: Affordability, Security and Innovation

Goldman Sachs Research analysts update their Carbonomics cost curve and arrive at three key conclusions. Overall, ‘the revenge of the old carbon economy’ keeps driving a disjointed de-carbonization process that is both inflationary and inefficient. However, GS Research analysts see some clean tech green shoots, with clean hydrogen at the cusp of a regulatory and economic breakthrough.

GS Sustain: Telecoms - The Fibre & 5G Decarbonisation Debate

Goldman Sachs Research analysts see fibre and 5G as critical technologies necessary to reducing the Information and Communications Technology (ICT) sector's overall carbon footprint and enabling low-carbon technologies across the broader economy.

How Europe Can Replace Russian Gas and Still Achieve Its Net-Zero Emissions Goals

The tensions between Russia and the rest of Europe over natural gas flows have underscored the unsustainability of the continent’s energy system. But with the right mix of infrastructure investment, Europe can emerge from the upheaval with a system that is cheaper, achieves the continent’s net-zero carbon emissions goals and is more secure.

Carbonomics: Re-Imagining Europe's Energy System

Can Europe strengthen its energy independence in the face of the Russia-Ukraine crisis without compromising its climate change goals? Goldman Sachs Research uses its Carbonomics framework to model the evolution of Europe’s energy system towards a lower cost, lower imports, lower carbon system.

Green Capex: Greenflation, Returns and Opportunity

Green Capex will be the dominant driver of global infrastructure over the next decade and will be critical for achieving Net Zero, Infrastructure and Clean Water goals. In this report, Goldman Sachs Research analysts explore rising capex and R&D expectations, and consider government commitments to increase or stimulate Green Capex.

Batteries: The Greenflation Challenge II

In this report, Goldman Sachs Research analysts discuss six key topics about greenflation that are relevant to investors and increase their battery pack price forecasts.

How Ukraine Changes the Future of Energy Investing

After years of declining investment in fossil fuels, capital expenditures in the energy industry are set to climb as the war between Ukraine and Russia causes a global reset in how the world produces energy. “We believe that the recent focus on energy security, resilience and diversification will drive a new era for energy investments,” according to the Carbonomics team in Goldman Sachs Research.

Carbonomics: Security of Supply and the Return of Energy Capex

The Russia-Ukraine conflict is a turning point for the energy sector, according to analysis from Goldman Sachs Research. One that is similar to, and potentially greater than, the Fukushima nuclear accident and Libyan civil war concurrence in 2011. In this report, analysts examine this Return of Energy Capex and draw five key conclusions.

Batteries: The Greenflation Challenge

Ever-increasing demand, component shortages and rising raw material prices are now challenging the long-standing consensus that battery prices will continue to decline in the coming decade. To assess the impact of this “Greenflation” and potential supply chain bottlenecks ahead, Goldman Sachs Research introduces a proprietary battery pack price and cost curve model, supply-demand models across battery components and a bear case battery TAM scenario.

Electric Vehicles: What's Next VII: Confronting Greenflation

In this report, the seventh installment of our Electric Vehicles: What’s Next series, analysts from Goldman Sachs Research outline their new forecast for a slower pace of decline for automotive battery prices through 2025, and they consider the outlook for the EV and automotive battery markets under three scenarios (bear, base, and hyper-adoption).

Carbonomics: The Clean Hydrogen Revolution

Clean hydrogen has emerged as a critical pillar to any aspiring net zero path. Policy, affordability, and scalability are converging to create unprecedented momentum for the clean hydrogen economy.

John Doerr, Chairman of Kleiner Perkins

With his new book, Speed & Scale: An Action Plan for Solving Our Climate Crisis Now, venture capitalist John Doerr talks to John Goldstein, head of the Sustainable Finance Group, about his plan to arrest climate change sooner rather than later.

Electrification and Europe’s Path to Net Zero

The European Union is aiming to slash greenhouse gas emissions by 55% by the end of this decade compared to 1990 levels, a goal that GS Research says requires a major – and urgent – push to electrify industries from transport to manufacturing. We sat down with Alberto Gandolfi, head of European Utilities Research, to discuss the steps European economies need to take now on their path to net zero.

EU Taxonomy - Progress on the Journey to Alignment

The EU Taxonomy is ramping up to become the “common green standard” used to credentialize companies’ green revenue and capex as well as investors’ green investments. With the initial climate phase having taken effect, Goldman Sachs Research sees 2022 becoming a critical period of experimentation and engagement between investors and corporates around disclosures and alignment-estimation models leading up to full Taxonomy application from January 1, 2023.

Electrify Now: The rise of Power in European Economies

While previous Goldman Sachs Research has focused on the 2050 net zero end game, here they explore a more immediate, more tangible topic; one that is poised to revolutionize European economies and our everyday lives: the urgency of electrification.

Why Oil Prices Are Surging but Investment is Drying Up

Even as oil prices climb higher, the flow of money into new oil and gas projects has stalled as investors increasingly avoid industries that produce fossil fuels and heavy carbon emissions. That breakdown between energy prices and capital expenditures is likely to prop up the cost of a barrel of oil, but it could also help support the transition to low-carbon energy. We spoke with Michele Della Vigna, head of natural resources research in EMEA at Goldman Sachs, to discuss the firm’s outlook for commodity prices as investors increase their focus on climate change.

Accelerating Transition: Market Tools for ESG

In part 5 of our special miniseries, host Kara Mangone talks to Sarah Lawlor, Chief Operating Officer of the Sustainable Solutions Council in the Global Markets Division about the tools available to ESG investors and how they can find and access opportunities in a Net Zero future.

Accelerating Transition: Public-Private Partnerships

In part 4 of our special miniseries, host Kara Mangone talks to John Greenwood of our Investment Banking Division and Ahmed Saeed of the Asian Development Bank on the role public-private partnerships will play in the drive to Net Zero.

Accelerating Transition: Nature Based Solutions

Part 3 of our special miniseries: Host Kara Mangone talks to Peter Kelly and Lisa Williams from the AIMS Imprint investment vertical in Goldman Sachs Asset Management about nature based solutions in the world of sustainable finance.

Accelerating Transition: Carbonomics

Part 2 of our special miniseries: Host Kara Mangone and Michele Della Vigna, head of Natural Resources Research in EMEA, discuss the role capital markets, public policy, and technology will play in moving toward a sustainable future.

Accelerating Transition

In the kickoff episode of our new sustainability miniseries, Accelerating Transition, John Goldstein and Kara Mangone of Goldman Sachs’ Sustainable Finance Group discuss what it will take from both the private and public sectors to achieve the climate goals necessary for a sustainable future.

Carbonomics: The Dual Action of Capital Markets Transforms the Net Zero Cost Curve

In this report Goldman Sachs Research examines how capital markets' deep engagement in sustainability is driving de-carbonization through a divergence in the cost of capital of high carbon vs. low carbon investments.

Carbonomics: Taking the Temperature of European Corporates - An Implied Temperature Rise (ITR) Toolkit

In this report Goldman Sachs Research leverages their Carbonomics Net Zero Paths to gauge the implied temperature rise of corporate de-carbonization through the lenses of >110 corporates in the 15 most carbon intensive sectors of the European market.

Carbonomics: Five Themes of Progress for COP26

COP26 is a historical opportunity to accelerate the de-carbonization pledges laid out by COP21 (the Paris Agreement) in 2015. In this report Goldman Sachs Research analyzes five key themes of change they believe can drive progress.

Carbonomics: Introducing the GS Net Zero Carbon Models and Sector Frameworks

Goldman Sachs Research presents modelling for two paths to net zero carbon, with two global models of de-carbonization by sector and technology, leveraging the team’s proprietary Carbonomics cost curve.

Carbonomics: China Net Zero - The Clean Tech Revolution

China’s pledge to achieve net zero carbon by 2060 represents two-thirds of the c.48% of global emissions from countries that have pledged net zero, and could transform China's economy, starting with the 14th Five-Year Plan.

Carbonomics: 10 Key Themes From the Inaugural Conference

Goldman Sachs Research hosted its first Carbonomics conference in London on November 12, focused on the de-carbonization trends and technologies currently transforming all major industries. The virtual conference convened approximately 5,000 investors, company managers, regulators and industry experts, with speakers and panelists including 30 CEOs of leading corporates and key policymakers.

Carbonomics: Innovation, Deflation, and Affordable De-carbonization

Net zero is becoming more affordable as technological and financial innovation, supported by policy, are flattening the de-carbonization cost curve. Goldman Sachs Research updates its 2019 Carbonomics cost curve to reflect innovation across c.100 different technologies to de-carbonize power, mobility, buildings, agriculture and industry, and draw three key conclusions.

Green Hydrogen: The Next Transformational Driver of the Utilities Industry

Green hydrogen looks poised to become a once-in-a-generation opportunity: Goldman Sachs Research estimates it could give rise to a €10 trillion addressable market globally by 2050 for the Utilities industry alone.

Carbonomics: The Rise of Clean Hydrogen

Clean hydrogen has a major role to play in the path towards net zero carbon, providing de-carbonization solutions in the most challenging parts of the Carbonomics cost curve - including long-haul transport, steel, chemicals, heating and long-term power storage.

Carbonomics: The Green Engine of Economic Recovery

Clean tech has a major role to play in the upcoming economic recovery. Leveraging our Carbonomics cost curve, we estimate that clean tech has the potential to drive US$1-2 tn pa of green infrastructure investments and create 15-20 mn jobs worldwide, through public-private collaboration.

Carbonomics: The Future of Energy in the Age of Climate Change

Climate change is re-shaping the energy industry through technological innovation and capital markets’ pressure.